Updated on: December 16th, 2024 12:40 PM

Updated on: December 16th, 2024 12:40 PM

26th GST Council Meeting

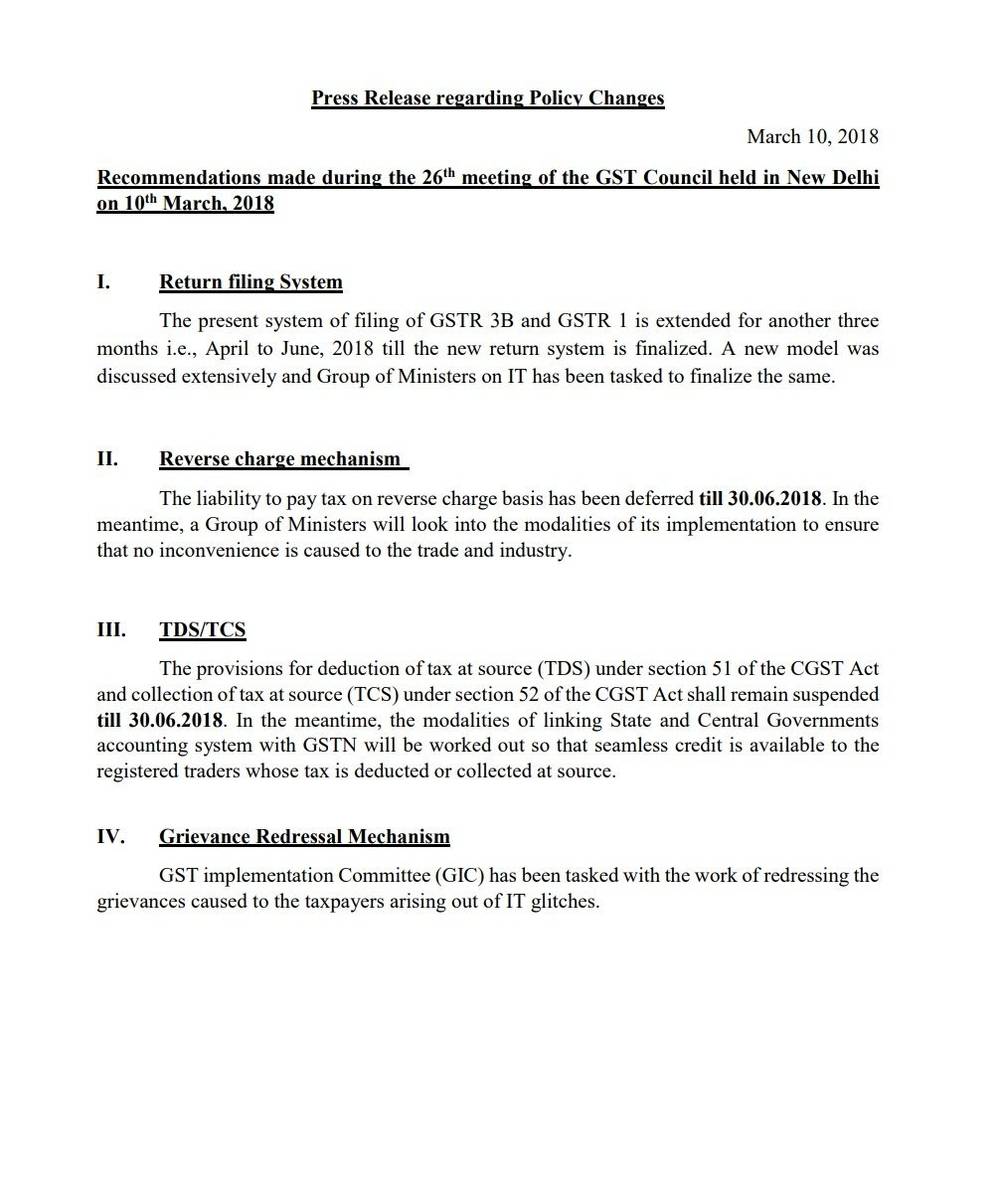

The 26th GST Council Meeting was held on 10th March 2018 at New Delhi, India. The Council discussed and announced various details pertaining to GSTR 3B return filing, e-way bill, reverse charge mechanism, TDS/TCS provisions and grievance redressal mechanism. In this article, we look at the highlights of the 26th GST Council Meeting in detail.GSTR 3B Return Filing - Extended up to June 2018

GSTR 3B return was introduced as a temporary measure until the full-fledged implementation of GSTR 1, GSTR 2 and GSTR 3 returns. All taxpayers having GST registration should file the GSTR 3B returns, up to March 31 2018 every month. However, as GSTR 2 and GSTR 3 returns remains suspended, the GST Council decided to extended GSTR 3B return filing up to June, 2018. Hence, all taxpayers registered under GST should file GSTR 3B return up to the month of June 2018.Reverse Charge Mechanism - Not Applicable up to June 2018

GST reverse charge is applicable on some types of transactions. If reverse charge is applicable, the recipient of the goods or services would be liable for payment of GST instead of the supplier. However, the GST reverse charge mechanism remains suspended up to March 2018. The 26th GST Council Meeting has decided to extend the suspension of reverse charge mechanism upto June 2018.TDS & TCS Provisions - Not Applicable upto June 2018

The GST TDS and TCS provisions are applicable for e-commerce companies and certain types of taxpayers. The GST TDS and GST TCS provisions were also suspended and will not be applicable upto June 2018. 26th GST Council Meeting - GSTR 3B Return Filing

26th GST Council Meeting - GSTR 3B Return Filing

E-Way Bill Mechanism

In the 26th GST Council Meeting, e-way bill rollout has been announced from 1st April 2018 across India. From 1st April 2018, the supplier or the transporter should carry the e-way for all transport of goods from one state to another (inter-state) with a value of more than 50,000. As per the GST Council meeting mandated the E-way bill for all transport of goods (both inter-state and intra-state) with a value of more than Rs.50,000 from 1st June, 2018. The following details some of the major changes announced to the e-way bill mechanism:- The supplier or the transporter shall carry the E-way bill only if the value of the consignment exceeds Rs.50000. However, if the supplier carries smaller value consignments, the concerned individual shall limit not to carry the E-way.

- The value of exempted goods has been excluded from value of the consignment, for the purpose of a-way bill generation.

- The GST Council included the Public conveyance as a mode of transport and the responsibility of generating an e-way bill in case of movement of goods by public transport would be that of the consignor or consignee.

- Goods transport by railways has been exempted from generation and carrying of ea-way bill with the condition that without the production of an e-way bill, railways will not deliver the goods to the recipient. But railways are required to carry invoice or delivery challan etc.

- Time period for the recipient to communicate his acceptance or rejection of the consignment would be the validity period of the concerned a-way bill or 72 hours, whichever is earlier.

- In case of movement of goods on account of job-work, the registered job worker can also generate an e-way bill.

- Consignor can authorize the transporter, courier agency and e-commerce operator to fill PART-A of an e-way bill on his behalf.

- Movement of goods from the place of consignor to the place of transporter up to a distance of 50 Km [increased from 10 km] does not require filling of PART-B of an e-way bill. They have to generate PART-A of an e-way bill.

- Extra validity period has been provided for Over Dimensional Cargo (ODC).

- If the supplier or the transporter unable to transport goods within the validity period of the a-way bill, the transporter may extend the validity period in case of transshipment or in case of circumstances of an exceptional nature.

- Validity of one day will expire at midnight of the day immediately following the date of generation of an e-way bill.

- Once verified by any tax officer, the same conveyance shall become exempted for a second check in any State or Union territory, unless and until the concerned officer receives any specific information for the same.

- In case of movement of goods by railways, airways and waterways, the e-way bill can be generated even after commencement of movement of goods.

- Movement of goods on account of Bill-To-Ship-To supply will be handled through the capturing of place of dispatch in PART-A of an e-way bill.

GST Export & Refund Procedures

The GST Council has decided to extend the available tax exemptions on imported goods for a further 6 months beyond 31.03.2018. Hence, exporters availing various export promotion schemes can continue to avail such exemptions on their imports up to 01.10.2018, by which time an e-wallet scheme is expected to be in place to continue the benefits in future.Fast Processing of GST Refund for Exports

The pace of grant of GST refunds for exports has increased. The Council has also directed GSTN to expeditiously forward the balance refund claims to the Customs/Central GST/State GST authorities, as the case may be, for their immediate sanction and disbursal.Extension of Various Benefits for Exporters

For merchant exporters, a special scheme of payment of GST @ 0.1% on their procured goods was introduced to improve cash-flow for the taxpayers. Also, domestic procurement made under Advance Authorization, EPCG and EOU schemes were recognized as 'deemed exports' with flexibility for either the suppliers or the exporters being able to claim a refund of GST / IGST paid thereon. All these avenues and benefits have been extended upto 1.10.2018.E-Wallets

The e-Wallet scheme acts as the creation of electronic e-Wallets. The amount transferred by the individual shall credit in the registered account with notional or virtual currency by the DGFT. This notional / virtual currency would be used by the exporters to make the payment of GST / IGST on the goods imported / procured by them so their funds are not blocked. The GST Council has decided to implement e-wallets as a permanent solution for easing the GST refunds process and compliance for exporters. As per the GST Council meeting, the Council may implement the GST e-wallets from 1st October 2018.Controlling GST Evasion

The Government has noticed that there are major discrepancies between the amount of IGST & Compensation Cess paid by importers at Customs ports and input tax credit of the same claimed in GSTR 3B return. There are major data gaps between self-declared liability in FORM GSTR-1 and FORM GSTR 3B return. The Government has started analysing such discrepancies and started taking action against tax evaders.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...