Updated on: January 11th, 2024 9:56 AM

Updated on: January 11th, 2024 9:56 AM

Aasara Pension Scheme

Telangana Government, as a part of its welfare measures and social safety net strategy, introduced the Aasara pension scheme with a view of ensuring a secure life with dignity for all the poor people. Aasara pension scheme is meant to protect the most vulnerable sections of society to support their day to day minimum needs to be required to lead a life of dignity and social security. Aasara pensions provide substantial financial benefits to all the below-mentioned categories, particularly those who are most needy.- Old and infirm

- People with HIV-AIDS

- Widows

- Incapacitated weavers

- Toddy tappers

Aasara Pension Amount

Pension amount for Aasara Pensioners in Telangana state is detailed below.| Sl.No |

Category |

Monthly Pension Amount (Rs.) |

|

1 |

Old Age |

1000 |

|

2 |

People with HIV-AIDS |

1000 |

|

3 |

Widows |

1000 |

|

4 |

Incapacitated weavers |

1000 |

|

5 |

Toddy Peppers |

1000 |

|

6 |

Disabled |

1500 |

Eligibility Criteria for Aasara Pension

The following are the eligibility criteria for obtaining Aasara Pension for various categories of applicants:Eligibility Criteria for Old Age

- To get Aasara to pension, the age should be 65 years and above

- Primitive and Vulnerable Tribal Groups

- Only one pension in a family, preferably women

- Landless agriculture labourers, rural artisans or craftsmen slum dwellers, persons earning their livelihood daily in the informal sector like porters, coolies, rickshaw pullers, hand cart pullers, fruit or flower sellers, snake charmers, rag pickers, cobblers, destitute and other similar categories irrespective of rural or urban areas

- Homeless households residing in temporary informal establishments or huts especially in urban areas

- Households headed by widows or terminally ill persons, disabled persons or persons aged 65 years or more with no assured means of subsistence or societal support and able-bodied earning member

Eligibility Criteria for Widows

- If the age of the widow is 18 years and above, she is eligible for Aasara pension.

- Primitive and Vulnerable Tribal Groups

- Women headed households with no able-bodied earning members

- Only the widow is given the pension

- Landless agriculture labourers, rural artisans or craftsmen, slum dwellers, persons earning their livelihood daily in the informal sector like porters, coolies, rickshaw pullers, hand cart pullers, fruit or flower sellers, snake charmers, rag pickers, cobblers, destitute and other similar categories irrespective of rural or urban areas

- Homeless households residing in temporary informal establishments or huts especially in urban areas

- Households headed by widows or terminally ill persons, disabled persons or persons aged 65 years or more with no assured means of subsistence or societal support and able-bodied earning member

Eligibility Criteria for Weavers

- Age criteria for weavers to get Aasara pension are 50 years and above or local post office

- Primitive and Vulnerable Tribal Groups

- Only one pension in a family

- By profession, a person should be in weaving, irrespective of rural or urban areas

- Homeless households residing in temporary informal establishments or huts especially in urban areas

- Households headed by widows or terminally ill persons, disabled persons or persons aged 65 years or more with no assured means of subsistence or societal support and able-bodied earning member

Eligibility Criteria for Toddy Tappers

- 50 years and above-aged Toddy Tappers are eligible for Aasara Pension

- Primitive and Vulnerable Tribal Groups

- Only one pension in a family

- By profession, a person should be in Toddy Tapping, irrespective of rural or urban areas

- Homeless households residing in temporary informal establishments or huts especially in urban areas

- Households headed by widows or terminally ill persons, disabled persons or persons aged 65 years or more with no assured means of subsistence or societal support and able-bodied earning member

- For Toddy tapper pensions the verification should be confirmed whether the beneficiary is a registered member in the Co-Operative Society of Toddy Tappers

Eligibility Criteria for Disabled Person

- Aasara pension is issued to the Disabled Person irrespective of their Age

- Primitive and Vulnerable Tribal Groups

- Women headed households with no able-bodied earning members

- In the case of Hearing Impaired, the minimum disability should be 51%

- Landless agriculture labourers, rural artisans or craftsmen slum dwellers, persons earning their livelihood daily in the informal sector

- Homeless, houseless households residing in temporary, casual establishments or huts especially in urban areas

- Households headed by widows or terminally ill persons, disabled persons or persons aged 65 years or more with no assured means of subsistence or societal support and able-bodied earning member

Documents Required to Apply for Aasara Pension

Each applicant will have to submit the following documents for sanction of an Aasara pension:- Photograph of applicant

- Aadhaar number (Aadhaar number is not available they shall secure one in the next three months)

- Savings Bank account number and IFSC code either from a bank or local post office

- Proof of Age, if no document is available for the confirmation of age in case of old age person, other documents such as age proof of children or grandchildren’s marriage certificate etc. can be submitted

- Photograph Death certificate of the husband in case of widows (where death certificate is not available the Panchayat Secretary shall conduct a detailed enquiry and submit a report). However, the death certificate shall be obtained in the next three months and uploaded in the online system

- Photocopy of registration in Co-operative society of Toddy Tappers

- Weavers should submit a photocopy of registration in Co-operatives society of weavers

- SADAREM Certificate in the case of persons with disabilities 40% or above and 51% in respect of the hearing impaired

Apply for Aasara Pension

Step 1: Download the Aasara pension application form from the Official website of respective Municipal Corporation. The applicant can get the application from the nearby MeeSeva Centre. A copy of Hyderabad Municipal Corporation Aasara Pension Application form is shown here. Step 2: Fill the application form and attach all the documents mentioned above. Step 3: Applicant can give the application to Gram Panchayat Secretary or Village Revenue Officer in the rural area and Bill Collector in Urban area. Step 4: After processing through Aasara online portal by Municipal Commissioner and finally by District Collector, Aasara Pension cards are distributed for the relevant category by affixing the photo of the beneficiary.Search Aasara Pensioner Details

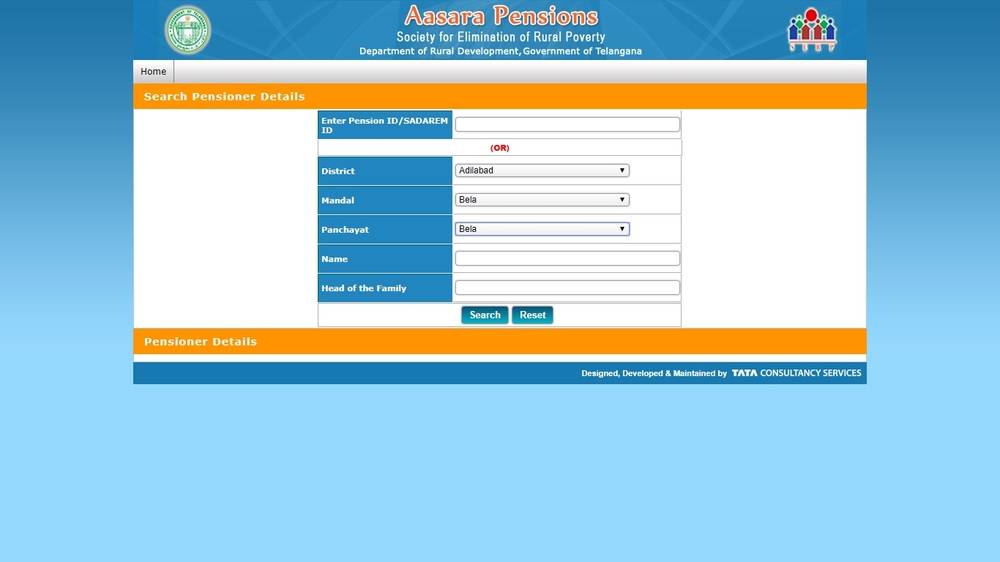

Step 1: Visit the home page of Aasara Pension. Step 2: Go to Quick search menu and select “Search Pensioner details”. Senior Citizen Aasara Pension

Step 3: Link will be redirected to the next page where the applicant needs to enter Pension ID and click on search.

Senior Citizen Aasara Pension

Step 3: Link will be redirected to the next page where the applicant needs to enter Pension ID and click on search.

Image 2 Aasara Pension

Step4: If the applicant does not have the pension ID, they can use the alternate method to get the Pensioner detail.

Step 5: For that, the applicant needs to select the District, Mandal, Panchayat from the drop-down menu.

Step 6: Enter the name and head of the family and click on search.

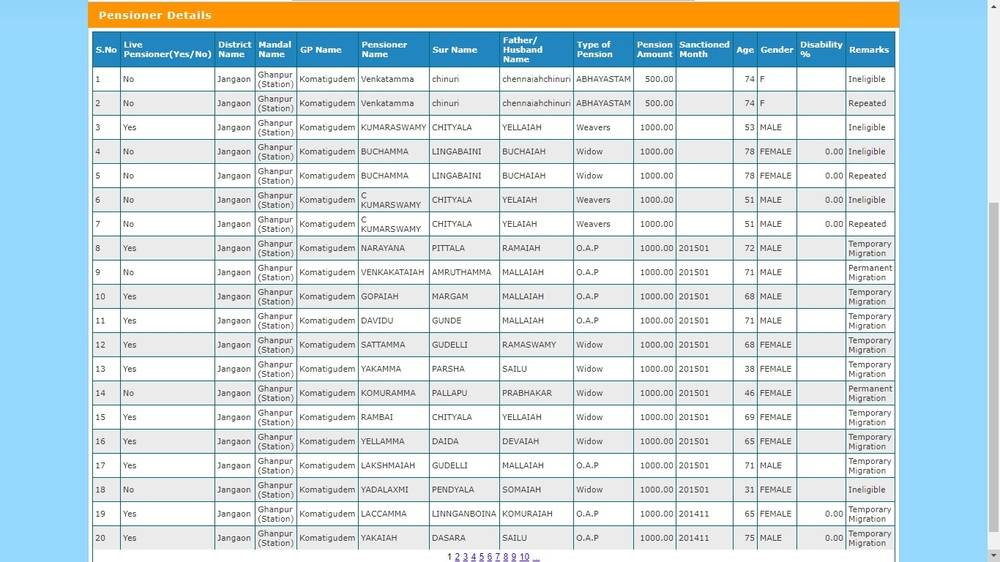

Step 7: The details of the Pensioner will be displayed.

Image 2 Aasara Pension

Step4: If the applicant does not have the pension ID, they can use the alternate method to get the Pensioner detail.

Step 5: For that, the applicant needs to select the District, Mandal, Panchayat from the drop-down menu.

Step 6: Enter the name and head of the family and click on search.

Step 7: The details of the Pensioner will be displayed.

Image 3 Aasara Pension

Image 3 Aasara Pension

Disbursal of Aasara Pensions

Aasara pension disbursement is made between 1st to 7th of every month. In larger municipalities, the pensions may be remitted in the bank accounts of the beneficiaries. In rural areas where banks exist, the pension can be deposited in the local banks or the post offices and shall be disbursed through biometric authentication.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...