Last updated: January 11th, 2024 10:49 AM

Last updated: January 11th, 2024 10:49 AM

ACTIVE Form INC-22A Due Date Extension

The Government of India, through the Ministry of Corporate Affairs, has made it mandatory for all companies registered before 1.1.2018 to file ACTIVE eForm or INC-22A. The due date for filing INC-22A is now 15th June 2019. There have been representations made to the MCA for Form INC-22A due date extension. In this article, we look at the requests made by various stakeholders for INC-22A due date extension in detail.Extension to June 15th, 2019

The MCA has extended the due date for filing ACTIVE Form INC-22A to 15th June 2019. The relevant notification is reproduced below for ready reference:MCA VPD Service

The Ministry of Corporate Affairs on 24/04/2019 has announced the following on their homepage “VPD service will be unavailable from 8:00AM to 08:00PM IST on 24th–25th Apr 2019 for system maintenance. Stakeholders are requested to plan accordingly.” VPD Service means View Public Documents Service which can be accessed from http://www.mca.gov.in/mcafoportal/viewPublicDocumentsFilter.do With VPD Service being taken down on the same last date for filing of INC22A ACTIVE eForm, there are more chances for the due date being extended for INC-22A filing.Representation from ICSI

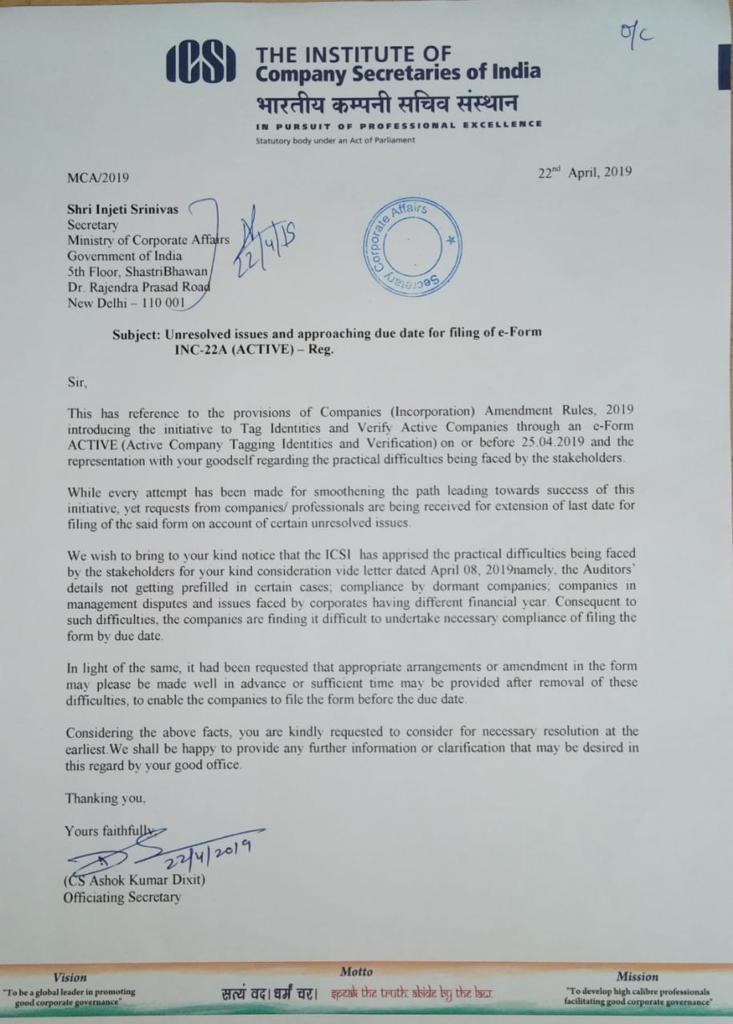

The Institute of Companies Secretaries of India has made a representation to the Ministry of Corporate Affairs on 22nd April 2019. In the letter, the Institute explains the difficulty faced by certain stakeholders while filing Form INC22A-ACTIVE as below:- The Auditors’ details not getting prefilled in certain cases.

- Compliance by dormant companies.

- Companies in management disputes.

- Issues faced by corporates having a different financial year.

ACTIVE Form Due Date Extension Letter

ACTIVE Form Due Date Extension Letter

The Northern India Regional Council Meet

In addition to the ICSI request, in a discussion today in The Northern India Regional Council of The Institute of Chartered Accountants of India (NIRC), the following matters were observed:- Based on the representation from ICSI letter, there is hope for extension/advisory on the submission of Form INC-22A.

- Relief will be given to those who filed Form GNL-2 between 1st April 2014 and 20th October 2014.

- If it is not submitted in the above-mentioned dates, the already filed Form GNL-2 will not be considered and they have to immediately file Form ADT-1 (Information to the Registrar by Company for the appointment of Auditor) without waiting for the clarification from MCA

- If a company filed Form STK-2 (Application by the company to ROC for removing its name from the register of Companies) and the status shows ACTIVE, Form INC22A need to be filed.

- In case of liquidation/amalgamation, there is no need to file Form INC-22A

- If Form ADT-1 is not filed by Government companies which runs under section 139/139(5), the authorities should intimate ROC and file Form ADT-1 with an additional fee as required. There is no exemption for Government Companies.

- No updations can be done through ACTIVE Form (like details of Company) except the E-mail ID

- From-22A-ACTIVE is not required for LLP or Foreign Company having its Branch office in India

- It is advisable to create a separate E-mail ID for the company.

- Two photos of the registered office are needed - One from outside of the premises and another from inside of the premises.

- *One time Compliance* is mandatory for all Companies incorporated on or before 31st December 2017.

- For the purpose of Address of Registered Office, follow the provision of Section 12 of Companies Act 2013.

- If all *STP FORM* (Including ACTIVE FORM) is filled wrongly, new form to be submitted on approval by ROC concerned. Also, the old form must be marked as defective.

- If *Shifting of Registered office* is mentioned as WIP and awaiting for R.D. Approval, then we have to file *ACTIVE FORM*.

Applicability of INC22A Filing

The following companies are required to file INC22A filing:- The company which is incorporated on or before 31 December 2017.

- If companies whose Financial Statements or Annual Return or both are due and will not be able to file ACTIVE form but with the exception for under dispute companies which includes:

- Strike off Companies;

- Companies with the process of Striking off;

- Companies under Amalgamation;

- Companies under Liquidation;

Consequences of Non-Filing

If a company does not file Form 22A or ACTIVE before 15th June 2019, the company would be marked as ACTIVE non-compliant. When a company is marked as ACTIVE non-compliant, it would not be able to effect any of the following changes:- Changes in authorized capital (Form SH-07)

- Changes in paid-up capital (Form PAS-03)

- Changes in Director (Form DIR-12) (cessation would be allowed).

- Changes in Registered Office (Form INC-22)

- Amalgamation or Merger (INC-28)

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...