Last updated: February 16th, 2024 1:43 PM

Last updated: February 16th, 2024 1:43 PM

Andhra Pradesh Land Conversion

Land conversion is a process of converting agricultural land to non-agricultural land. As per Andhra Pradesh Agricultural Land (Conversion for non-agricultural purposes) Act, 2006, agricultural land in Andhra Pradesh can be converted for commercial, industrial and residential purposes only by taking prior permission from the competent authorities in the state. In this article, we look at the procedure for completing Andhra Pradesh Land Conversion in detail.AP Agricultural Land (Conversion for Non-Agricultural Purposes) Act

Government of Andhra Pradesh has introduced the Andhra Pradesh Agricultural Land (conversion for non-agricultural purposes) Act in the year 2006. The objective of this act is to regulate the conversion of agriculture land to non-agriculture land in Andhra Pradesh. As per Andhra Pradesh Agricultural Land Act, the following types of land cannot be converted.- Land owned by the Andhra Pradesh Government

- Land used for religious or charitable purposes

- Land owned by the local authority and used for any communal purposes so long as the land is not used for commercial purpose

- Land used by the owner for household industries involving traditional occupation, not exceeding one acre

Documents Required For Land Conversion

Below mentioned documents are necessary for land conversion in Andhra Pradesh:- Land conversion application form

- Copy of Pattadhar passbooks

- Copy of Title Deed

- Basic Value certificate from Sub-Registrar

- Ration Card

- EPIC Card

- Aadhaar Card

Andhra Pradesh Land Conversion Procedure

To convert agriculture land into non- agriculture, follow the procedure given below.Step 1: Calculate Conversion fee

The landowner needs to calculate the conversion fee as One Time Conversion tax (OTC tax) for converting agricultural land into non–agriculture land. OTC tax for proposed lands in Vijayawada and Visakhapatnam Municipality Corporation is 2% of the basic value of the land. All other areas, the OTC tax is 3% of the basic value of the land.Basic Value of Land

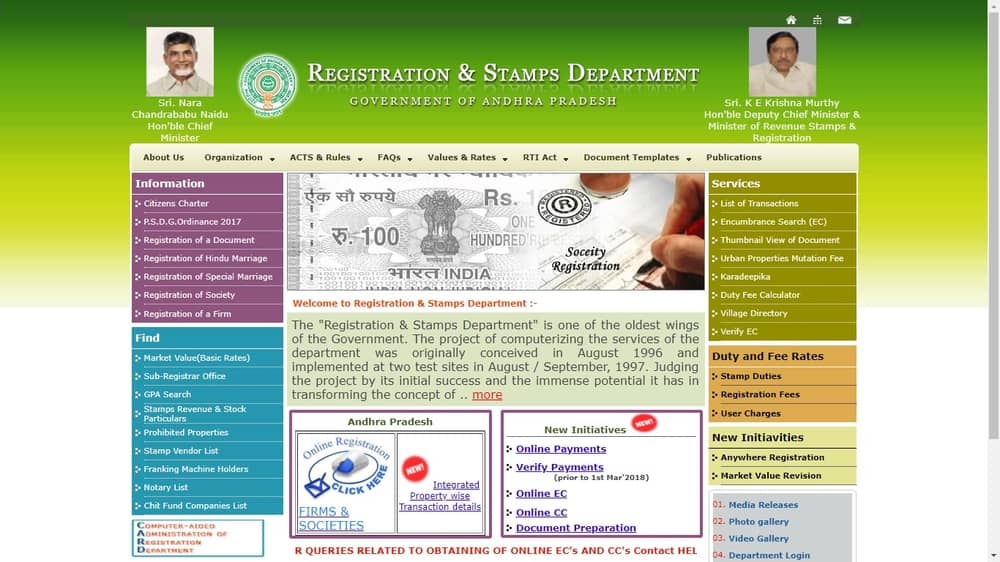

To get the basic value of land, the owner or applicant can follow the procedure described here: Step 1: Visit the home page of the Registration department of Andhra Pradesh. Step 2: Click on Market value option from Find menu. The page will redirect to next page. Image 1 Andhra Pradesh Land Conversion

Step 3: You can check agriculture and non-agriculture rate of land by selecting the appropriate option.

Step 4: Select district, village and Mandal from the drop-down menu and click on submit.

Image 1 Andhra Pradesh Land Conversion

Step 3: You can check agriculture and non-agriculture rate of land by selecting the appropriate option.

Step 4: Select district, village and Mandal from the drop-down menu and click on submit.

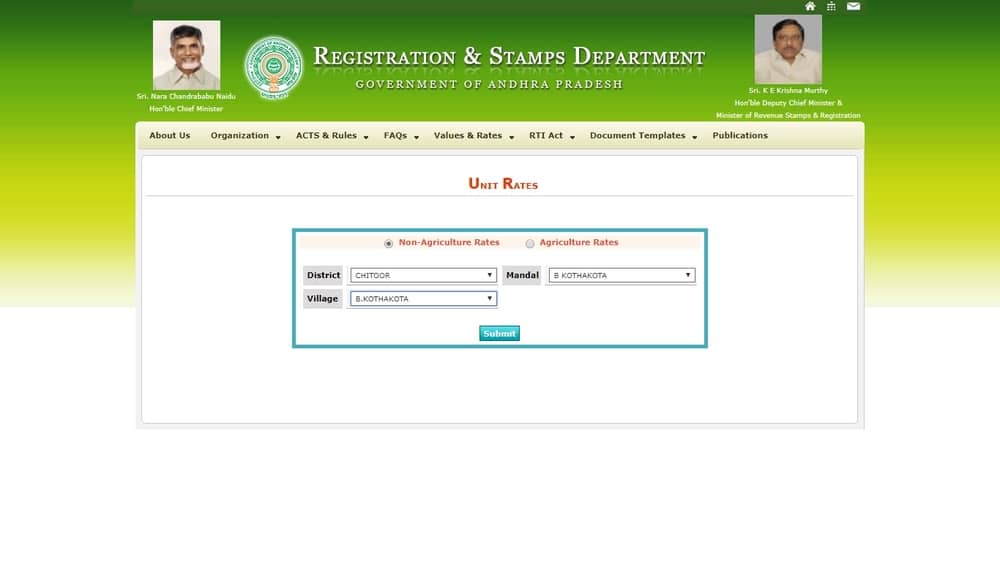

Image 2 Andhra Pradesh Land Conversion

Step 5: Land rate will display on the screen. You can get door number wise details by clicking on the 'Get' button.

Image 2 Andhra Pradesh Land Conversion

Step 5: Land rate will display on the screen. You can get door number wise details by clicking on the 'Get' button.

Image 3 Andhra Pradesh Land Conversion

Image 3 Andhra Pradesh Land Conversion

Step 2: Pay One Time Conversion tax

The landowner can pay one-time conversion tax to Government by challan in the OTC head of account 0035-101-01-001 or by e-payment. After paying the tax to obtain challan copy or e-payment receipt.Step 3: Application for Land conversion

After the payment of one-time conversion tax, the owner of the land has to submit the intimation through OTC application through MeeSeva centre. Fill all details as mentioned below in the conversion form.- Name of the owner

- Aadhaar number

- Survey number

- The village, district or Mandal

- Amount

Step 4: Receipt of Intimation

After approval, competent authority will issue a notice for one-time conversion tax payment. MeeSeva operator will provide you with this Receipt of Intimation of payment for land conversion. The format of e-receipt will be as follows:Step 5: Land conversion

After receiving a receipt of intimation, the Landowner will be entitled to convert agricultural land to non-agriculture land. Converted land can be used for commercial, industrial and residential purposes.Step 6: Inspection by Competent Authority

The competent authority will inspect and measure the converted land. In the case of deceitful conversion, the officer will give notice to the applicant.Step 7: Visit by District collector

The concerned district Collector will review every three months, whether the converted lands are used for intended purposes.Penalty for Deemed Conversion

If any agricultural land in the state has been put to non-agricultural purpose without obtaining the permission from the concerned authority, the land will be deemed to have been converted into non-agricultural purpose. Upon such deemed conversion, the competent authority will impose a fine of 50% over and above the conversion fee for the land. The landowner has to pay the penalty. Any penalty remains unpaid after the date specified for payment; the land would be recoverable as per the provisions of the Andhra Pradesh Revenue Recovery Act, 1864.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...