Last updated: February 16th, 2024 1:45 PM

Last updated: February 16th, 2024 1:45 PM

Andhra Pradesh Liquor License

A liquor license is a legal permit issued by the Andhra Pradesh Prohibition and Excise Department to sell alcoholic beverages for consumption. Andhra Pradesh liquor license is issued as an endorsement of the pursuit of manufacture, sale and sometimes even use of the beverage at particular premises. In this article, we look at the license's purpose, eligibility, required documents and procedure for obtaining Andhra Pradesh liquor license in detail. To know more about Starting a Bar Business in IndiaAndhra Pradesh Excise Act, 1968

An Act to consolidate and amend the law relating to the production, possession, manufacture, transport, sale and purchase of intoxicating liquor and drugs, the levy of duties of excise and countervailing, duties on alcoholic liquors for consumption and opium, Indian hemp and other narcotic drugs and narcotics and to provide for matters connected therewith in the State of Andhra Pradesh. In Andhra Pradesh, the sale and manufacture of liquor are governed by the Andhra Pradesh Excise Act, 1968. The import or export and transport of country spirit are subject to rules and regulations imposed by various sections and prohibition made under Section 10 of the Excise Act. The admin of the Prohibition and Excise Department and the Collector of Excise Revenue are under the charge of the District Collector.Eligibility Criteria

The eligibility of individuals who can apply for an excise license in the state of Andhra Pradesh is listed below:- A person should be age 21 years or above and must be an India citizen or a Person of Indian Origin.

- Any partnership firm having the partners is citizens of India and the change in the partnership firm will not be entertained after the settlement of shop or group of shops except legal permit from the Excise Commissioner required.

- The individual must not be a defaulter/ blacklisted or debarred from holding an excise license under the regulation of Rule 13 of these rules or under the regulation of any law made under the Act.

Documents Required

The below listed are the documents/ records to be submitted by the applicants along with the application for the grant of Liquor License in the state.- Copy of the certificate showing applicant’s title, rights and interest on the proposed property or the land.

- 4 copies of the plan of the building which the person intends to use, construct his plant and layout plan showing the position of vats, stills and other permanent equipments along with the list of the warehouses, storeroom connected in addition to that (prepared any technically competent person, not below the rank of PWD and SEO department)

- Project Report, cost-benefit analysis, estimated production and market feasibility

- A copy of fire license or no-objection certificate in this regard from the appropriate authority.

- A copy of clearance from the appropriate authority in the matter of environmental pollution, if necessary.

- No objection certificate (NOC) from the municipal corporation, municipality, town committee, gaon panchayat concerned.

- Whether a criminal court of non-bailable offence ever convicted the applicant

- if yes full particulars thereof

- if not an affidavit of the effect

- Registration certificate

- Partnership deed

- Beneficial owners list holding more than 15 per cent in the firm.

- ID Proof and Address Proof

- Power of Attorney (POA)

- Declaration of Firm’s Partner that who will present in Excise Department.

- Affidavit relating to no dues of excise or any other Concerned Department.

- Affidavit relating applicant partnership firm or applicant has not punished under N.D.P.S., Molasses Act, Excise Act, I.P.C Affidavit relating firm is not blacklisted in any state.

- Sale tax Clearance Certificate and Sales Tax Registration from the concerned Sales Tax Authority where the firm is presently working.

- 3 copies of Blue Prints of the labelled map of the proposed site and its premises and its inside places. The plan has to be certified by the applicant, District Excise, Enquiry officer, Officer and Deputy Commissioner of the district.

- Enquiry report of Excise Officer.

- No Objection Certificate (NOC) about Law and Order from proposed area’s S.D.O. Certificate from concerned Officer that proposed site is as per tourist rules.

- Any other certificates which required by licensing /Sanctioning Authority.

- Trade license issued by the concerned local authority to serve food.

- Two years Income Tax or VAT returns.

- Copy of plan of the proposed premises and consent letter of the owner in case the premises are rented.

- Payment of Rs. 3 lakhs towards EMD.

- Rs.2 lakhs towards non-refundable and application fee.

- Drawings and Description and for the construction of proposed microbrewery.

- No Objection certificate (NOC) from Andhra Pradesh Pollution Board and local body competent authority.

- Counterpart Agreement.

License Fee Applicable

The below- specified shows the charge/ fees for the applying of a new liquor license.|

S. No. |

Kind of License |

Licence Fee |

|

| 1. | A4 Shops | Non-Refundable application | Rs. 5,000/- |

| Earnest Money Deposit | Rs. 3,00,000/- | ||

| A licence fee for mandal with population up to 5000 | Rs. 7,50,000/- | ||

| Non-Refundable registration (Mandal) | Rs. 50,000/- | ||

| Nagara Panchayat | Rs. 75000/- | ||

| Municipal Corporation | Rs. 1,00,000/- | ||

| Municipality | Rs. 1,00,000/- | ||

| 2. | 2B Bars | Non Refundable application | Rs. 2,00,000/ |

| Earnest Money Deposit | Rs. 3,00,000/ | ||

| The non-refundable registration fee for population up to 50000 | Rs. 8,00,000/- | ||

| A non-refundable Licence fee for population up to 50000 | Rs. 2,00,000/- | ||

| 3. | Micro Brewery | Application for Grant of License | Rs. 1,00,000/- |

| License Fee | Rs. 0.25 per bulk litre | ||

| Approval of labels | Rs. 2000/- per label per year | ||

| 4. | M-I (Molasses) | Does not exceed 5000 MTs | Rs. 1000/- |

| Exceeds 5000 but does not exceed 10000 MTs | Rs. 2000/- | ||

| Exceeds 10000 but does not exceed 15000 MTS | Rs. 3000/- | ||

| Exceeds 15000 but does not exceed 20000 MTs | Rs. 4000/- | ||

| Exceeds 20000 MTs | Rs. 5000/- | ||

| 5. | M-II (Molasses) | Does not exceed 1000 MTs | Rs. 1000/- |

| Exceeds 1000 MTs but not exceed 5000 MTs | Rs. 2000/ | ||

| Exceeds 5000 MTs but does not exceed 10000 MTs | Rs. 3000/- | ||

| Exceeds 10000 MTs but does not exceed 15000 MTs | Rs. 4000/- | ||

| Exceeds 20000 MTs | Rs. 6000/- | ||

| 6. | M-III | Molasses | Rs. 100000/- |

| 7. | M-IV | Import of Molasses | Rs. 100/- |

| 8. | M-V | Export of molasses | Rs. 100000/- per annum |

| 9. | L-1 | - | Rs. 400/- |

| 10. | L-2 | - | Rs. 50/- |

| 11. | L-3 | - | Rs. 50/- |

| 12. | L-4 | - | Rs. 50/- |

| 13. | RS-I | Rectified Spirit - 1 | Rs. 10/- |

| 14. | RS-II | - | Rs. 25/- |

| 15. | RS-III | - | Rs. 500/- |

| 16. | DS-XI-A | licences issued to IOCL, HPCL and BPCL | Rs. 100/- |

Excise Duty Rates

|

S. No. |

Type of Licence |

Rate of Levy |

| 1. | IMFL Units( Distilleries)

|

|

| 2. | Brewery Units(Breweries)

|

|

| 3. |

Fruit Wines/ Table Wines

(Manufactured in A.P)

|

|

| 4. |

Wines Manufactured within the state

(other than Fruit wines/ Table wines)

Imported Wines (From Other States)

|

|

Licensing authority

The Commissioner of Prohibition and Excise may be competent to grant prior clearance and the Deputy Commissioner may be competent to grant the privilege of Bar. The Prohibition and Excise Superintendent will issue the Excise License in the prescribed formApplication Procedure for Obtaining Liquor License - Online

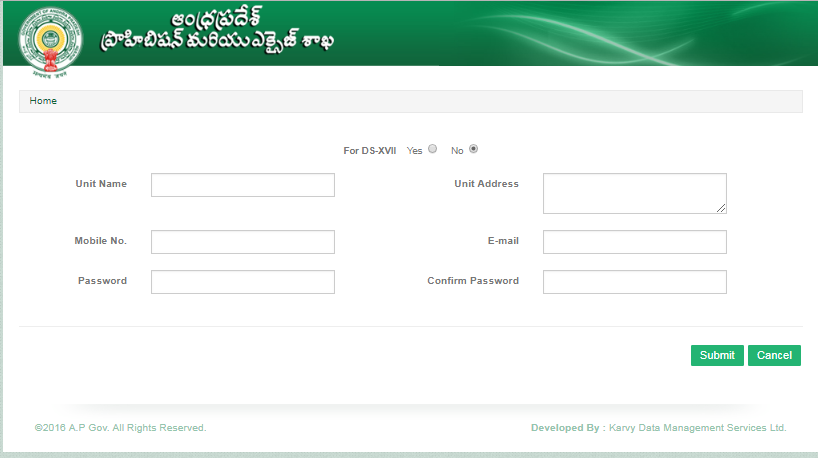

The applicants have to follow the steps below to obtain a Liquor license by submitting the application form online. Visit the Andhra Pradesh Prohibition and Excise Department Step 1: You must visit the Andhra Pradesh Prohibition and Excise Department for the obtaining Excise license online. [caption id="attachment_71231" align="aligncenter" width="1018"] Step 1 - Andhra Pradesh Liquor License

New User Registration

Step 2: You have to click on the “Sign Up” button that is visible on the home page.

Step 3: Now you have to fill all the required information in this registration form.

[caption id="attachment_71232" align="aligncenter" width="818"]

Step 1 - Andhra Pradesh Liquor License

New User Registration

Step 2: You have to click on the “Sign Up” button that is visible on the home page.

Step 3: Now you have to fill all the required information in this registration form.

[caption id="attachment_71232" align="aligncenter" width="818"] Step 3 - Andhra Pradesh Liquor License

Step 4: You have to enter the unit address for which license you’re going to apply. After filling all the information you need to click on the “Submit” button.

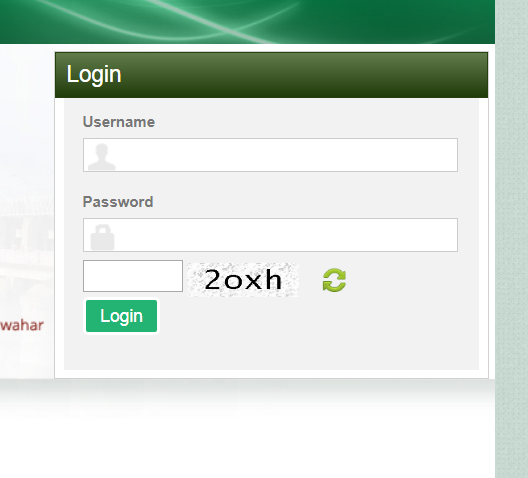

Login to Portal

Step 5: Now you got to log in to the portal using your user id and user password.

[caption id="attachment_71233" align="aligncenter" width="635"]

Step 3 - Andhra Pradesh Liquor License

Step 4: You have to enter the unit address for which license you’re going to apply. After filling all the information you need to click on the “Submit” button.

Login to Portal

Step 5: Now you got to log in to the portal using your user id and user password.

[caption id="attachment_71233" align="aligncenter" width="635"] Step 5 - Andhra Pradesh Liquor License

Step 6: Login into Excise Department Portal by providing the appropriate username and password on the application.

Application of New Liquor License

Step 6: You have to click on the “New Liquor License” tab and have to select the Gazette number of the shop.

Step 7: Then you must select the License type, after selecting the license type, the particular liquor license application page will be displayed on the screen.

Fill in the Right Credentials

Step 8: Now you have to fill all the mandatory details in the license application form.

Upload Documents

Step 9: Once you have completed the license application form, you must upload all the requested documents and click on the Submit button.

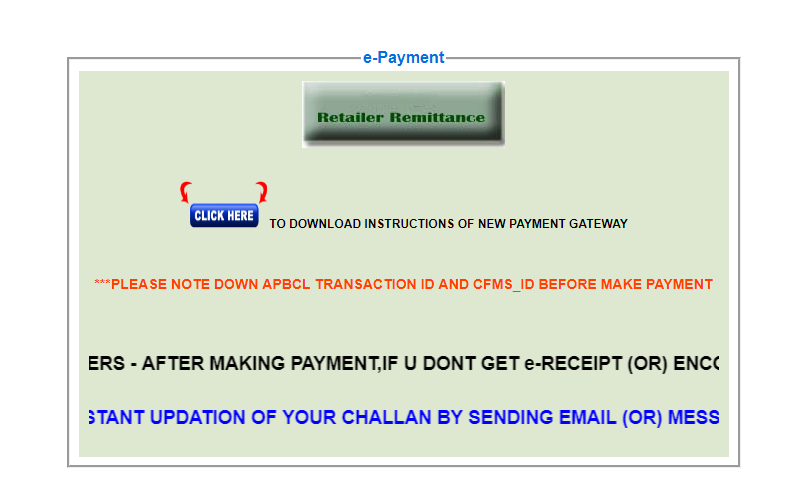

Make Payment

Step 10: Click on “E-payment” option which is present on the homepage of the portal.

Step 11: Click on Make Payment button to get redirected for the E-challan page.

Step 12: Then select the Bank Name for making the online payment and then click on the “Submit” button.

[caption id="attachment_71236" align="aligncenter" width="807"]

Step 5 - Andhra Pradesh Liquor License

Step 6: Login into Excise Department Portal by providing the appropriate username and password on the application.

Application of New Liquor License

Step 6: You have to click on the “New Liquor License” tab and have to select the Gazette number of the shop.

Step 7: Then you must select the License type, after selecting the license type, the particular liquor license application page will be displayed on the screen.

Fill in the Right Credentials

Step 8: Now you have to fill all the mandatory details in the license application form.

Upload Documents

Step 9: Once you have completed the license application form, you must upload all the requested documents and click on the Submit button.

Make Payment

Step 10: Click on “E-payment” option which is present on the homepage of the portal.

Step 11: Click on Make Payment button to get redirected for the E-challan page.

Step 12: Then select the Bank Name for making the online payment and then click on the “Submit” button.

[caption id="attachment_71236" align="aligncenter" width="807"] Step 11 -- Andhra Pradesh Liquor License

Step 13: Enter the particular details of your license type and select the challan number and click on “Save and Proceed” button to send permit request.

Submit the Application Form

Step 14: For verification and issuance application goes through the Excise Superintendent. You must visit can view/print and download his hall ticket for the lottery process.

Print Acknowledgement Receipt

Step 15: You will receive a message stating “Your application has been registered successfully”. You can also save the receipt and make a print of it by clicking on the ‘Print’ button.

Step 16: The selected applicant shall obtain a licence in Form A-4 after fulfilling the required formalities and satisfying the rules in respect of the premises where the shop will be located.

Step 11 -- Andhra Pradesh Liquor License

Step 13: Enter the particular details of your license type and select the challan number and click on “Save and Proceed” button to send permit request.

Submit the Application Form

Step 14: For verification and issuance application goes through the Excise Superintendent. You must visit can view/print and download his hall ticket for the lottery process.

Print Acknowledgement Receipt

Step 15: You will receive a message stating “Your application has been registered successfully”. You can also save the receipt and make a print of it by clicking on the ‘Print’ button.

Step 16: The selected applicant shall obtain a licence in Form A-4 after fulfilling the required formalities and satisfying the rules in respect of the premises where the shop will be located.

Procedure for Obtaining Liquor License – Offline Method

The applicants have to follow the steps given to obtain a Liquor license by submitting the application form offline. Step 1: Approach the ES Office The applicants will have to visit the ES office for the registration of certain liquor license in the state. Step 2: Type of License Toddy Licence and Neera Licence For the grant of Toddy Licence and Neera Licence, the applicant will have to visit the ES office to register and apply for the license. License for Microbrewery For the grant of License for Microbrewery may be submitted to the Commissioner of Prohibition and Excise, declaration form. Form A3 has been attached below for a quick reference: Step 3: Make Payment Applicant have to fill the application form, makes the payment challan and submits the application. Step 4: Verification For verification and issuance of the license, the application goes through the Excise Superintendent. Step 5: Issuance of License After the verification, if the applicant is selected the license issuance copy will be issued at Excise Superintendent Office.Penalty

Tabulated below are the penalties levied by the government for the late filing and renewing of a liquor license.|

S. No. |

Name of the Approval/ Clearance |

Penalties |

| 1. | Liquor Shop (Form - A4) | A penalty of Rs. 250/- Per day up to a Maximum of Rs. 25,000/- |

| 2. | Bar (Form - 2B, 2BP) | A penalty of Rs. 250/- Per day up to a Maximum of Rs. 25,000/- |

| 3. | In house Licenses - TD1,TD2,C1,CS3,AL1,SW1 | Penalty of Rs. 250/- Per day up to a Maximum of Rs. 25,000/- |

| 4. | In-house Licenses - CS1,CS2 & EP1 | A penalty of Rs. 250/- Per day up to a Maximum of Rs. 25,000/- |

| 5. | Toddy License and Neera License | A penalty of Rs. 250/- Per day up to a Maximum of Rs. 25,000/- |

| 6. | L-1, L-2, L-3, L-4 | A penalty of Rs. 250/- Per day up to a Maximum of Rs. 25,000/- |

| 7. | RS-I, RS-II, RS-III | A penalty of Rs. 250/- Per day up to a Maximum of Rs. 25,000/- |

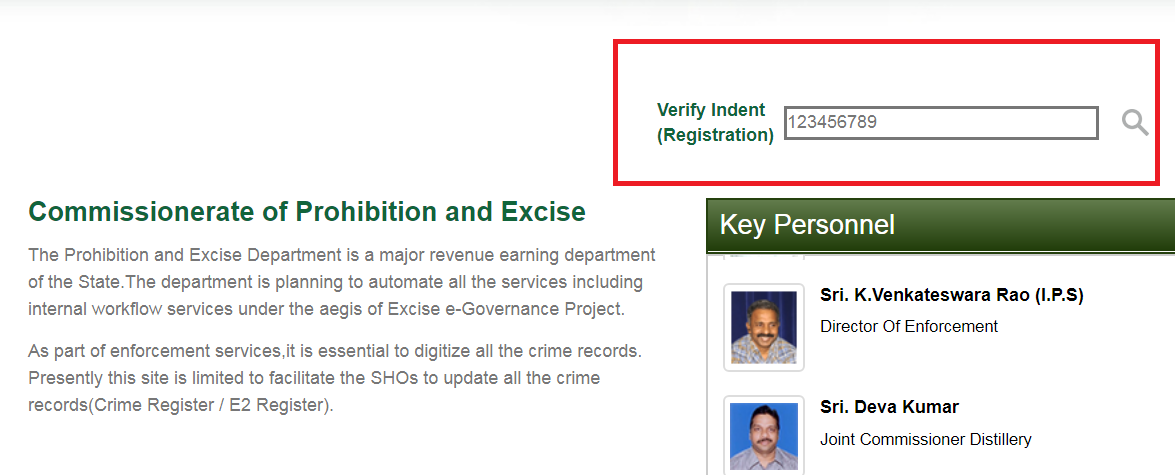

Check/ Verify Status of License Application

Applicants can check/verify the details of any license that has been registered in Andhra Pradesh using the online portal of Andhra Pradesh Prohibition and Excise Department. The applicant has to enter the correct request or reference number to verify the details in the license application form. Then, upon clicking on the search icon, the applicant can verify the license application. [caption id="attachment_71239" align="aligncenter" width="808"] Track or Verify License Application - Andhra Pradesh Liquor License

Track or Verify License Application - Andhra Pradesh Liquor License

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...