Last updated: February 16th, 2024 1:48 PM

Last updated: February 16th, 2024 1:48 PM

Andhra Pradesh Property Tax

Property tax is a tax that an owner of the property is liable to pay and comprises the single largest source of income to the Urban Local Bodies (ULBs) in India. The local government calculates the tax to be paid based on the value of the property owned including the land. The types of properties taxed and the property tax rates vary by jurisdiction. The Revenue section of the Municipal body is responsible for the administration of property taxation for the concerned urban local bodies. In this article, we look at the varous aspects of Andhra Pradesh property tax in detail.Purpose

Property Tax acts as one of the main sources of revenue for the Urban Local Bodies (ULB) in Andhra Pradesh. The local governing body will assess the property and collects the property tax. The collected taxes are used for the jurisdiction in which the property is situated. Some of the services for which the funds are used include education, sewer improvements, road and highway constructions, fire service and other services that highly benefit the community.Taxable Properties

All residential and commercial (non-residential) properties located within the limits of urban local bodies in Andhra Pradesh are assessed for tax. Based on such assessments, taxes are levied on the property owners. However, the residential buildings for which the Annual Rental Value of the property tax is below Rs.600 are exempted from property tax. The information about all the new constructions, existing construction and improvements to the property must be provided to the Town Planning Department to make necessary changes to tax assessment.Components of Property Tax

As per section 85 of Municipal Corporation Act, the tax determined by the council will be levied on all buildings and lands within the limits of the Municipal that includes the following components.- tax for general purpose

- water and drainage tax

- lighting tax

- scavenging tax.

Assessment of Property Tax

An official appointed by the Government will assess the property. Assessments are made based on the size of the property and other parameters to tax the citizen. When the property tax is levied for the first time, assessment book of records are prepared after sending a notice to the owner of the property. The assessment sheet includes the following.- Serial Number

- Name of the owner

- Door No.

- Locality

- Zone Number

- Type of construction

- Nature of usage

- Plinth area in sq. meters

- As per Form A notification, Monthly rental value fixed per sq. meter. of plinth area

- Monthly rental value fixed on the property

- Half-yearly property tax

- Date of service of special notice

- Date of receipt of revision petition

- Date of hearing

- Orders of the Commissioner in brief

- Property tax fixed after disposal of revision petition

- Initials of the Commissioner

Andhra Pradesh Property Tax Calculation

In Andhra Pradesh, property tax is calculated based on the Annual Rental Value (ARV) and the Tax Rate as may be fixed by the Corporation for each property in the limits of the Urban Local Bodies.Annual Rental Value

Annual rental value of buildings and lands is the basis for levy of property tax in Municipalities. The Annual Rental Value of a property is calculated based on the following parameters.- Zonal location of the property

- Residential/Non-residential status

- Plinth area

- Age of the property

- Type of construction

- Other parameters applicable to specific situations.

Property Tax Rate

| Residential Buildings Range of Annual Rental Value | Rate of Property Tax |

| Up to Rs.600/- | Exempted from payment of Property Tax |

| Rs.601/- to Rs.1200/- | 17% |

| Rs.1201/- to Rs.2400/- | 19% |

| Rs.2401/- to Rs.3600/- | 22% |

| Above Rs.3600/- | 30% |

Online Payment

The Commissioner and the Directorate of Municipal Administration under the State Government of Andhra Pradesh facilitates online payment for various services. The citizen can pay the property tax online by visiting its official website. Step 1: Visit the official website of the Commissioner and the Directorate of Municipal Administration online portal to pay the property tax online. Step 2: Under online Payment tab on the home page, click Property tax. Andhra Pradesh Property Tax - Home Page

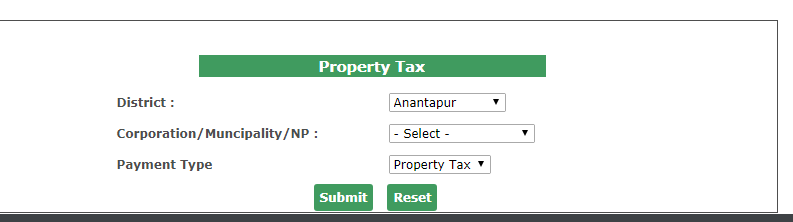

Step 3: The online payment section appears. Select the District, Municipality where the property is located and select the payment type as property tax from the drop-down list.

[caption id="attachment_61886" align="aligncenter" width="793"]

Andhra Pradesh Property Tax - Home Page

Step 3: The online payment section appears. Select the District, Municipality where the property is located and select the payment type as property tax from the drop-down list.

[caption id="attachment_61886" align="aligncenter" width="793"] Andhra Pradesh Property Tax - Online Payment

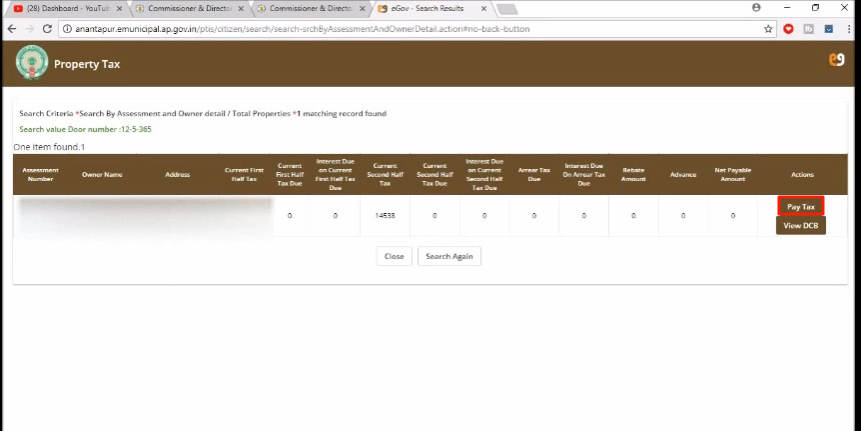

Step 4: On clicking submit, the ‘property search’ dialog box appears. Enter the required details such as owner name, mobile number etc. and click search that redirects to the Payment section.

[caption id="attachment_61887" align="aligncenter" width="860"]

Andhra Pradesh Property Tax - Online Payment

Step 4: On clicking submit, the ‘property search’ dialog box appears. Enter the required details such as owner name, mobile number etc. and click search that redirects to the Payment section.

[caption id="attachment_61887" align="aligncenter" width="860"] Andhra Pradesh Property Tax - Search Property

Step 5: Click ‘Pay Tax’. The amount to be paid will be displayed. Make necessary payment through internet banking or credit/debit card. Check-list the terms and conditions and click submit.

Andhra Pradesh Property Tax - Search Property

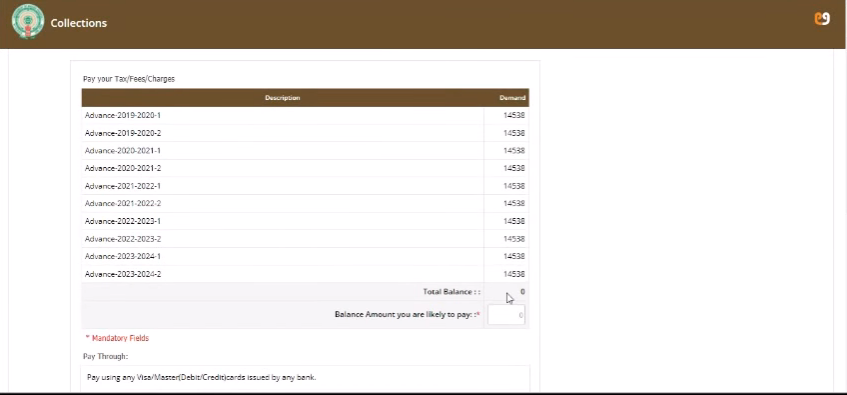

Step 5: Click ‘Pay Tax’. The amount to be paid will be displayed. Make necessary payment through internet banking or credit/debit card. Check-list the terms and conditions and click submit.

Andhra Pradesh Property Tax - Pay Tax

Step 6: The acknowledgement receipt on successful payment will be generated.

Andhra Pradesh Property Tax - Pay Tax

Step 6: The acknowledgement receipt on successful payment will be generated.

Andhra Pradesh Property Tax - Amount

Andhra Pradesh Property Tax - Amount

Rebate on Andhra Pradesh Property Tax

When the tax for the current financial year is paid before 30th April of the year, a rebate of 5% of property tax is given. A rebate of 40% of the Annual Rental Value is allowed to the building in respect of the residential buildings occupied by the owner that includes the deduction allowed towards the age of the building.| Age of the building | Deduction allowed |

| 25 years and below | 10% of ARV |

| Above 25 years and up to 40 years | 20% of ARV |

| Above 40 years | 30% of ARV |

Penalty

The Andhra Pradesh Property tax is calculated and collected semi-annually. month in case of failure to pay property tax by the end of June for the first half-year and by the end of December for the second half-year, simple interest at the rate of two percent per month is levied. A penalty with property tax is levied on unauthorized constructions.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...