Appointment of Auditor

Appointment of Auditor

All the companies registered, like a private limited company or one-person company or limited company are required to maintain a proper book of accounts and get the book of accounts audited. Therefore, after the incorporation of a company, an auditor must be appointed by the Board of Directors of the Company. First auditors of the company must be appointed within 30 days of the date of registration of the company by the Directors if not the shareholders can appoint first auditors within 90 days of incorporation. In this article, we look at the requirement and procedure for the appointment of an auditor.

Documents Required

The below following documents to be filed by the company when it appoints a new auditor.

- Form MGT-14 along with a proof of the resolution in the board meeting.

- Form ADT-1 to be filed with the Registrar of Companies (ROC).

Besides the above forms, the following information to be provided to the ROC.

- Name of the new auditor firm.

- Address of the new auditor firm.

- Email address and PAN number.

- A number of years for which the firm is appointed.

- Details of the resigning auditor firm.

- Appointment date of the new auditor firm.

- Digitally signed Form ADT-1 (along with the signature of the director of the company).

Procedure for Appointment of Auditor

Only a practising Chartered Accountant can be an Auditor of a Company. Before the auditor is appointed, the written consent of the auditor must first be obtained, along with a certificate from the Auditor that the appointment, if made, shall be in accordance with the conditions as prescribed by the Auditor and that the Auditor satisfies the criteria provided in Section 141 of the Companies Act, 2013 (Provision relating to audit and auditor).

It is optional file ADT-1 for the appointment process of the first auditor. Once the consent of an Auditor is obtained, then the Board of Directors of the Company can execute a resolution to appoint the Auditor. The appointment of the auditor must be conveyed to the Registrar of Companies within fifteen days of appointment. The first auditor can hold office from the conclusion of that meeting until the conclusion of its sixth annual general meeting. However, the company should place the matter relating to the appointment of an auditor for ratification by members at every annual general meeting.

First Auditor Appointment

The Board of Directors consider the recommendation of the Audit Committee, if any, and recommend the appointment of auditor to the members of the company, it would send the recommendation back for reconsideration. If the audit committee decided not to reconsider its recommendations, the Board would record the reasons of disagreement and send its own recommendation to the members of the company.

In case of Government Companies, the first auditor would be appointed by the Auditor-General of India and Comptroller within 60 days from the date of registration of the company and in case the Auditor-General of India and Comptroller does not appoint such auditor within the said term period, the Board of Directors of the company would appoint such auditor within the next 30 days. The first auditor may hold office till the conclusion of the 1st Annual General Meeting.

Other Auditors

The appointment of auditors (other than the first auditors) is required to be done by the members of the company in the general meeting. The auditor appointed at the general meeting holds office from the conclusion of that meeting, with the meeting wherein such appointment being counted as the first meeting.

However, where a casual vacancy is created in the office of auditor due to registration, the approval of members is required to be obtained within a period of 3 months from the recommendation date of the Board. Such an auditor may hold office until the conclusion of the next annual general meeting. For the appointment of the subsequent auditor, the Company must file ADT-1 within 15 days of appointing the auditor.

Failure to Appoint Auditor

If the Board of Directors fails to appoint an Auditor within 30 days of the company’s incorporation, the Board should inform the company’s members. The members can then appoint an auditor within 90 days at an extraordinary general meeting, and the auditor would hold office until the conclusion of the first annual general meeting.

If, at any annual general meeting, no auditor is appointed or re-appointed, then the company’s existing auditor would continue to be the company’s auditor.

Auditor Appointment for Listed Company

The provisions relating to the appointment of an auditor for a listed company are more stringent than those for a private company. For instance, a listed company cannot appoint an individual as an auditor for more than one term of five consecutive years, and an audit firm cannot be appointed as an Auditor for more than two terms of five consecutive years.

Power and Duties of Auditor of the Company

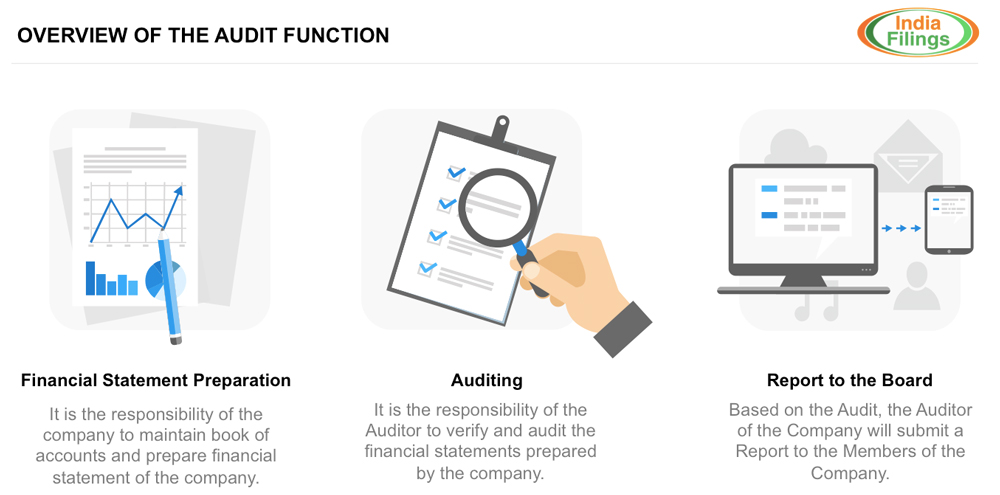

An Auditor of the Company must be an independent person engaged by the Company to express an opinion on whether the financial statements prepared by the company are free of material misstatements, fraud or error and in line with the Accounting Standards. It is important to note that it is the responsibility of the Company to maintain a book of accounts and prepare financial statements of the Company. The Auditor of the Company cannot maintain the Company’s Book of Accounts or prepare its financial statements, as it would impair his/her independence. (Know more).

Resignation of Auditor

Firstly, the auditor must provide notice of resignation to the company and would file a statement in the form of ADT-3 form. This statement would be sent to the RoC within 30 days from the resignation date.