Last updated: October 19th, 2024 4:37 PM

Last updated: October 19th, 2024 4:37 PM

Assam eStamp Paper

To register property in India, the buyer is required to pay charges in the form of stamp duty for registration. Previously, stamp duties were paid by purchasing stamp papers from authorised stamp vendors or treasury at the time of property registration. The Department of Revenue and Disaster Management, Government of Assam, has now facilitated the payment of Stamp Duty through the purchase of e-Stamp paper. In this article, we look at the procedure for purchasing Assam eStamp paper in detail. Know more about TDS on Property PurchaseStamp Duty

As explained above, the stamp duty is a kind of tax that requires to be paid at the time of Assam property registration. This legal tax needs to be paid as proof for any purchase of immovable property or land registration of deed in Assam. Stamp Duty is calculated by market value or consideration amount of the land, whichever is higher. You can refer the below-attached document to verify the stamp duty for Assam Property registration. Note: Consideration amount is a total value of funds involved in any sale or purchase transaction entered between two or more parties.Stamp Paper

Stamp paper is one of the traditional ways of paying property registration charges and stamp duty. The owner of land has to purchase a non-judicial stamp paper from an authorised vendor or Treasury in Assam. Once the non-judicial stamp paper is obtained, the property transaction details will be noted on that paper.Assam e-Stamp Paper

Assam e-Stamp Paper is a computer-generated alternative for conventional stamp papers. To avoid counterfeit stamp papers and to make Assam property registration easy, the Government of Assam introduced e- stamping procedure. As per The Indian Stamp (Assam Amendment) Act, 1989, transaction above Rs. 1 lakh should be paid only with Assam e-stamp.Benefits of Assam e-Stamp paper

Assam e-Stamp paper can be used for all transaction on which stamp duty is payable. Such instrument includes all transfer of documents such as lease deeds, mortgage deed, exchange deed, gift deed, conveyance deed, sale deed, deed of partition, agreement of tenancy, leave, license agreement and power of attorney. The benefits of using Assam e-Stamp Paper is explained in detail below:- Assam e-stamp paper is a convenient method for tax at the time of property registration

- Usage of Assam e-stamp paper eliminates the need of non-judicial stamp papers for deed registration

- All details of property registration charges and rate of stamp duty can be obtained from a single online portal

- Assam e-stamp paper online purchase makes the property registration process quick

- Assam e-stamp paper is tamper proof

- Validation is very easy with Assam e-stamp paper

Attribute in Assam e-Stamp Paper

The Assam e-Stamp certificate will contain below-mentioned details.- Name of payee

- Nature of property or land

- Amount of stamp duty paid

- Government Receipt Number (GRN)

- Value of immovable property or land

- Payment Date and Time

- e-Stamp paper Serial number

- Department Reference Numbers

Licensing Authority

The Stock Holding Corporation of India Limited (SHCIL) is designated as the Central Record Keeping Agency for issuing Assam e-Stamp paper.Calculating Stamp Duty

To generate e-stamp paper in Assam, you have to ascertain stamp duty and registration charges at first. Following documents are important to be furnished with the application form.- Assessment Patta of land

- Permission for Transfer of Property by Mortgage, Lease, Gift and Sale

- NOC on the transfer of land for registration

- Other land related document

Ascertain Assam Stamp Duty

You have to ascertain the Assam property registration and the amount of stamp duty payable from the concerned sub-registrar’s office. Step 1: Visit the sub-registrar’s office where the property/land is located. Step 2: You need to submit an application form for assessment Of Stamp Duty and Registration Fees. Provide following details Applicant’s Details, Address Details, and Land Details in the Application form: The application form for Assessment of Stamp Duty and Registration Fees in Assam is given here: Step 3: After processing the detail, the concerned authority will provide details of Assam stamp duty rate and property registration charge details.Procedure to Purchase Assam e-Stamp Paper

Once the assessment of the stamp duty to be paid for property registration is done, you can purchase Assam e-Stamp Paper. Procedure to purchase e-Stamp Paper is explained in step-by-step guidelines here:Submit an Application

Step 1: Approach the nearest counter of CRA in Sub-registration office or CRA branch office or Authorized collection centres (ACC) and fill up the Assam e-Stamp Paper application form. We have here with attached an application form for Assam e-Stamp Paper: Step 2: After entering details in e-stamp paper such as property/land details, first party information, second party information, and the rate of stamp duty payable, furnish the application form at the counter.Make Payment

Step 3: Applicant can make the payment through any of the following ways to get Assam e-stamp paper:- Cash

- Cheque

- Demand Draft

- Pay Order

- RTGS

- NEFT

- Account to Account transfer

Get Assam e-Stamp Paper

Step 4: Once the payment for stamp duty is made, the Assam e-Stamp Paper will be generated and issued to the applicant. Step 5: In the case of payment made through Cheque/DD, the applicant will get a receipt from the counter. Upon crediting the amount to the CRA account, the applicant can get the Assam e-Stamp Paper from the concerned counter. Step 6: After obtaining the debit confirmation from the concerned bank, access the nearest concern counter; submit the transaction reference provided by the bank along with duly filled the e-Stamp Application Form to get the e-Stamp paper. For registering property in Assam, visit the concerned registration office with the Assam e-Stamp Paper along with the deed.Verify Assam e-Stamp Paper

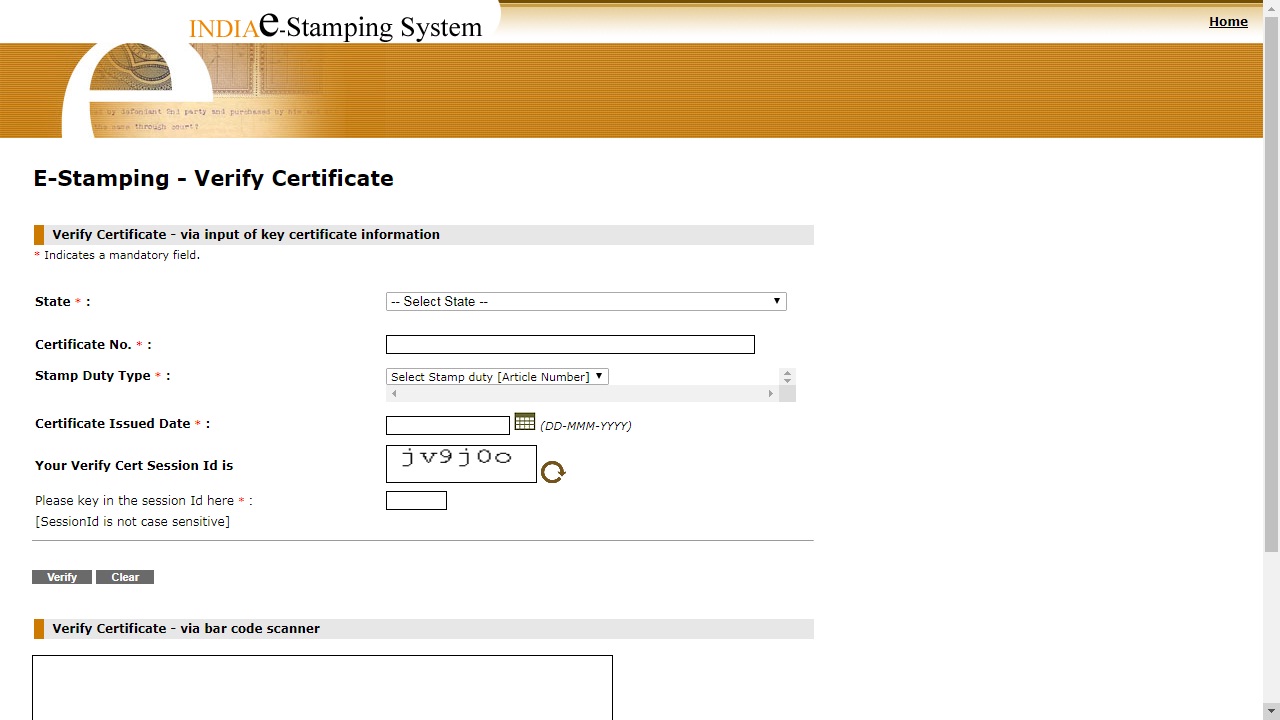

For verifying Assam e-Stamp Paper, you need to access the home page of the SHCIL web page. From the main page click on verify e-Stamp certificate option. The link will move to the new page.

- Certificate Number

- Stamp Duty Type

- Certificate Issued Date

- Certificate Number

- Stamp Duty Type

- Certificate Issued Date

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...