Last updated: December 9th, 2024 3:19 PM

Last updated: December 9th, 2024 3:19 PM

Authorised Capital VS Paid up Capital with Illustration

"The main difference between authorized capital and paid-up capital is that authorized capital is the maximum amount of capital a company can raise by issuing shares, while paid-up capital is the actual amount of money the company has received from issuing shares."

A private limited company or one-person company, or limited company will have its share capital classified under various types in the financial statements. Vide the Companies Amendment Act 2015, the requirement for paid-up capital for the company has been removed. However, the requirement for authorized capital still exists. Therefore, to help Entrepreneurs understand the differences, we explain the differences between authorized and paid-up capital in detail. In this guide, you will also understand what is paid up capital and what is authorised capital meaning.

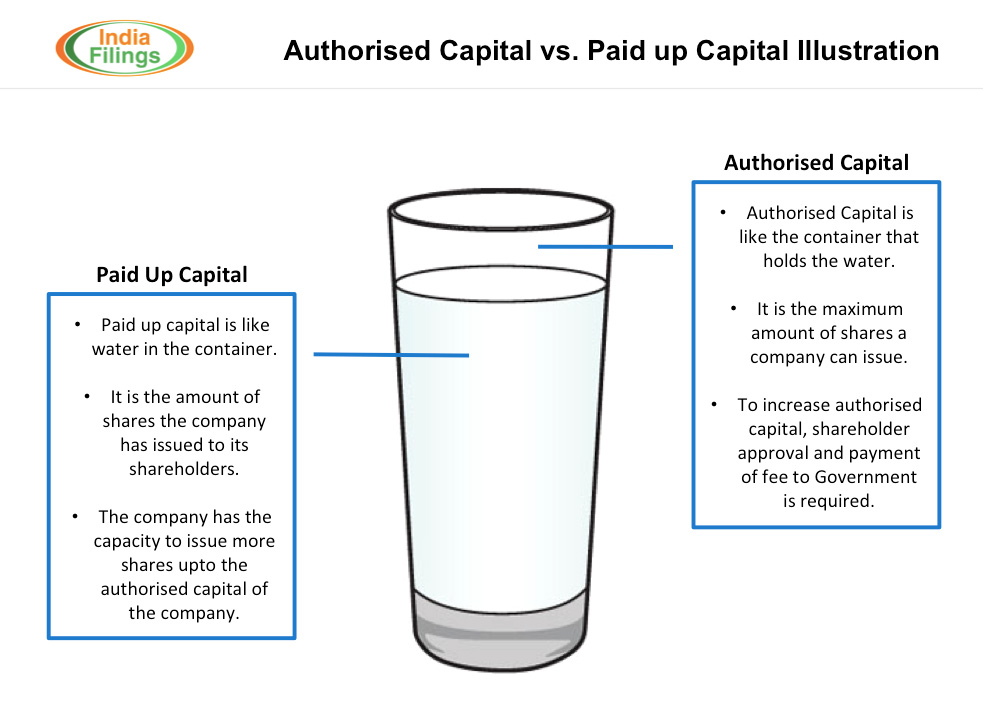

Increase the Authorised Capital for your business with expert help from IndiaFilings!! [shortcode_68] [caption id="attachment_2864" align="aligncenter" width="983"] Authorised Capital vs Paid-Up Capital Illustration

Authorised Capital vs Paid-Up Capital Illustration

What is Authorised capital?

Authorized capital, nominal or registered capital, represents the maximum capital a company's shareholders can invest and own. It's defined in the Company's Memorandum of Association (MOA) under the Capital Clause. Notably, not all authorized capital may be issued; the issued capital is the amount given to investors. The following illustration helps you to understand what is authorised capital meaning, clearly. Illustration: If ABC Private Limited Company has an authorized capital of Rs.10 lakh, it means that ABC Private Limited Company can issue shares worth up to Rs.10 lakhs to its investors. ABC Private Limited Company cannot issue shares worth Rs.11 lakhs to its investors. However, the Company can still issue shares worth only Rs.5 lakh to its investors - as the Company has not issued shares over the authorized capital. A company isn't obligated to issue its entire authorized capital during public subscriptions; it can give based on its needs. Adjustments to the MOA's official capital, whether an increase or decrease, follow the guidelines set in the Companies Act of 2013. Specifically:- The Company's Articles of Association (AoA) must allow for changes to authorized capital. If not, modifications to the AoA are needed, adhering to Section 14 of the Companies Act.

- Upon deciding to change the authorized capital, the Company's Directors, Members, and Auditors must be informed. A meeting with the Board of Directors and a general shareholders' meeting are convened for approval.

- Once the resolution is passed, the Company must inform the government's registrar. This involves submitting a copy of the resolution, the General Meeting notice, and an updated MOA in Form SH-7 within thirty days.

Benefits of Authorised Capital

- Business Expansion: With the revenue generated from the sale of shares, the Company can concentrate on expanding its business without resorting to borrowing or seeking finance from conventional sources.

- Increased Compensation: With a higher cash inflow, the Company can better compensate its stakeholders, including investors, shareholders, partners, senior management, employees under equity ownership schemes, founders, and owners.

- Enhanced Net Worth: The addition of more share capital boosts the overall net worth of the Company. Consequently, this amplifies the Company's borrowing capacity.

What is Paid up capital?

Paid-up Capital means the amount of money a company can gain from shareholders in the exchange of shares of stock. After acquiring the shares, shareholders make their respective payments, contributing to this capital. Essentially, it represents the funds the Company has received from issuing its shares, commonly during an Initial Public Offering (IPO). Consequently, these funds become an integral part of the Company's financial resources. It's worth noting that the paid-up capital of a company will not be the same as its authorized capital. Before the 2015 amendment to the Company Act, a private limited company was required to have a minimum paid-up capital of 1 lakh, while a public company needed at least 5 lakh. However, after the amendment, this stipulation was removed. Now, the amount of a company's paid-up capital is at its discretion and can be as minimal as Rs 5,000.Characteristics of Paid-up Share Capital

You need to know the characteristics as well to fully understand what is paid up capital meaning,- Called-up Capital: Paid-up capital is also called-up capital since it represents the amount that shareholders have been asked to pay and the Company has subsequently received.

- Issuance Post Incorporation: The Company must issue shares amounting to its declared paid-up capital within 60 days of incorporation.

- Relation to Authorized Capital: The paid-up capital can never exceed the authorized capital of the Company.

- Operational Expenses: The funds obtained from paid-up capital can be utilized to meet the Company's operating costs.

- Net Value Assessment: Paid-up capital plays a role in determining the Company's net value.

Difference between Authorised Capital and Paid-up Share Capital

To know clearly about the paid up capital meaning and authorised capital meaning, you need to understand the differences and distinction between them. Below are the differences between authorized capital and Paid up capital,| Criteria | Authorized Capital | Paid-up Share Capital |

| Definition | The maximum value of shares a company can issue. | The actual amount paid by shareholders for the shares they hold. |

| Alteration | Requires amendment to the MoA as per the prescribed procedure. | Increased through private placements or issuing more shares. |

| Net Worth Calculation | Does not factor into the net worth calculation. | Directly factors into the net worth calculation. Only paid-up capital is used to determine the company's net value. |

| Limit for New Companies | Rs 1 lakh for private limited companies and Rs 5 lakh for public limited companies (pre-2015 amendment). | Must be less than or equal to the authorized capital. |

| Issuance Restrictions | Companies cannot issue shares beyond this limit. | It cannot exceed the authorized capital but can be equal to it. |

Seek Expert Assistance for Authorised Capital Increase

If you're considering increasing your Authorised Capital and require guidance through the process, please get in touch with the experts at IndiaFilings. Our professionals are well-versed in navigating the complexities of capital adjustments. We can provide comprehensive assistance to ensure that your needs are met efficiently and in compliance with relevant regulations. Whether you're a budding entrepreneur or an established business, IndiaFilings can support your financial endeavors.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...