Last updated: December 20th, 2019 2:46 PM

Last updated: December 20th, 2019 2:46 PM

Bajaj Business Loan for Women

Bajaj Finance Limited is ranked among the leading Non-Banking Financial Companies (NBFCs), which provides personalised business banking solutions. The bank builds a platform for women entrepreneurs in getting small business loans at nominal interest rates. These business loans are meant for most business purposes to meet the requirement of working capital or for business expansion. Let us look in detail about the Business Loan for Women in this article. To know about Bajaj DealershipFeatures and Benefits

The below listed are the key features and benefits of obtaining a small business loan with Bajaj Finance Limited. Loan Limit: It offers with the maximum amount of loans up to the limit of INR 30 Lakhs with the view of financing all the business requirements from getting the latest machinery or equipment to enhance the business to cater to new markets Loan Repayment Tenor: The convenient loan repayment tenure for the investments into EMI that is stated to be 12 months to 96 months. No Collateral Required: It offers without any collateral or guarantors for small business loans for funding to make the faster processing of loan applications. Loan Approval: At fast and easy business funds and approval within 24 hours for the women-owned business loans. Flexi Loan facility: The number of withdrawal requests is unlimited as the beneficiary can withdraw funds, and the interest is charged only for the amount that is withdrawn. The repayment of cash can be made whenever possible to suit applicants the cash flow at no extra pay. It offers the beneficiary with the new Flexi Loan facility that helps for the reduction of EMI up to a maximum of 45%.Other Features

- It provides a loan with the minimal documentation and eligibility criteria on business financing for the women entrepreneurs to apply for the small business loan with the Bajaj Finance Limited

- There are special pre-approved offers, in which the funds can be obtained without the wait time that is required for the processing of a loan.

- The details of the loan can be viewed/accessed at anytime and anywhere on maintaining the online account.

Business Loan Eligibility Criteria

The following are the criteria for availing the Small Business Loan from the Bajaj Finance:- The applicant to be with the age limit ranging from 25 to 55 years old.

- The applicant’s business must have a vintage for the period of at least 3 years.

- The business must have the Income Tax returns filed for at least the previous 1 year.

- Self Employed Professionals (SEP) - Allopathic doctors, chartered accountant (CA), company secretaries and architects those who are practising their profession. Proof of qualification for the same has to be submitted.

- Self Employed Non-Professionals (SENP) - Traders and manufacturers, retailers, Proprietors, and service providers etc

- Entities - Partnerships, Limited Liability Partnership, Private Limited and closely held Limited companies. Other constitution types depending on their profile on a case to case basis

Documents Required

The below listed are the certificates that need to be furnished at the time of applying for business loans in Bajaj Finance.- Passport size photograph

- KYC documents - Identity Proof: Aadhar Card, PAN Card, Driving License, Voter Identity Card, etc.

- Address Proof: Valid Passport, Utility bill, Aadhar Card, Property tax bill, etc.

- Business proof: Certificate of business existence

- Relevant Financial documents

- Bank Account statement of last month

Business Loan Details on Interest Rates

The below following are the details of Bajaj Business Loan Interests, charges, fees and Commissions.|

Type |

Details |

| Rate of interest | 18% per annum onwards |

| Processing fees | Up to 3% of the loan amount |

| Loan Tenure | The minimum repayment tenor is up to 1 Year whereas the maximum tenure is up to 5 Years |

| Document charges include the Statement of Account, Repayment Schedule, No Objection Certificate (NOC), Interest Certificate, Foreclosure Letter and other lists of documents. | Download e-statements/letters/certificates at no extra charge by logging into the Customer Portal. A physical copy of all the statements, certificates, letters and other lists of documents from any Bajaj bank branch at a cost of Rs.50 per letter, statement and certificate (Inclusive of taxes) |

| Outstation collection charges | Rs.65 + applicable taxes per repayment instrument |

| Processing of documents charges | Rs.1449 + applicable taxes |

| The notice period for the exercise of the right of lien/setoff | 7 days |

| Part-prepayment charges | 2% + applicable taxes |

| Penal Interest | 2% + applicable taxes |

| EMI Bounce Charges | Rs.3000 (Inclusive of taxes) |

| Foreclosure Charges | 4% + applicable charges |

| Interest and Principal statement charges | Nil |

Business Loan Application Procedure - Online

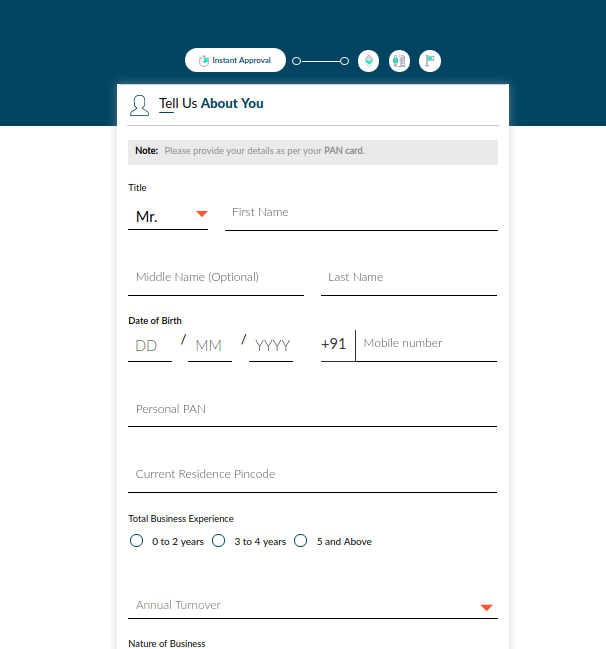

To obtain a small business loan with the Bajaj Finance Limited online, the applicant can apply by filling up a form on its official website. The applicant will have to fill up the online form with the necessary details. After the completion of the post-sanction formalities the fund offered is transferred to the beneficiary at the earliest (within the working hours of the bank). [caption id="attachment_86986" align="aligncenter" width="481"] Application Form - Bajaj Business Loan for Women

Application Form - Bajaj Business Loan for Women

Business Loan Application Procedure - Offline

Approach the Branch Step 1: The applicant has to address the nearest Bajaj Branch for applying for a small business loan. Get Application Form Step 2: Then the applicant needs to get the Loan form from the bank branch and have to fill out the small business loan application in a prescribed format. Fill in the Right Credentials Step 3: Now, fill the small business loan application with appropriate details without any faults. Provide the following details in the application form as below:- Enterprise Name and Address

- E-mail address

- PAN Card/Aadhaar Card

- Constitution (Proprietary/Partnership /Private .Ltd. Co./Limited Co./Co.-op. society)

- Loan details

- Date of establishment

- Name, address and PAN details of partners/proprietors/directors of the company

- Banking and existing credit details

- Details of collateral security offered

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...