Last updated: December 17th, 2019 5:44 PM

Last updated: December 17th, 2019 5:44 PM

Bihar Property Tax

In Bihar, property tax is a tax levied by the Municipal Corporation on the value of a property or real estate. Owners of properties in the state are responsible for paying property tax to the Municipal Corporation which is regulated by the Urban Development and Housing Department of Bihar. The property tax imposed on property varies from state to state. In this article, we look at the various aspects of Bihar property tax in detail.Uses of Property Tax

In India, property tax is one of the primary revenue sources for Municipal Corporations. All residential, commercial, industrial situated within the limits of the Municipal Corporation are assessed for tax and are expected to pay property tax. Property tax is imposed on every financial year of the same month, and a citizen is liable is file return on the same day.Eligibility Criteria

The following are the eligible person to pay property tax in the state of Bihar.- A person whose age is above 18 years of age.

- Any person who is a permanent resident in the state of Bihar.

- Any individual who owns a property in Bihar is entitled to pay a property tax.

Exemption on Property Tax

Any person who is exempted from paying property tax under section 136 are listed below:- The land or property maintained by the Devasthan Department of the State Government.

- Any area or property used for public worship or public purpose.

- Land hold for the purposes connected with the disposal of dead bodies.

- Land utilised by an educational institution solely for purposes of education.

- Property for the cause of public parks public libraries or public museums.

Property Registration

Before making payment for property tax, the taxable person is responsible for registering their property by filing the application form for property registration and furnish the same application along with the required documents to the concerned authority of the Municipal Corporation.Required Document

The applicant is required to submit the property tax invoice details at the time of making payment for property tax.Payment Procedure for Bihar Property Tax

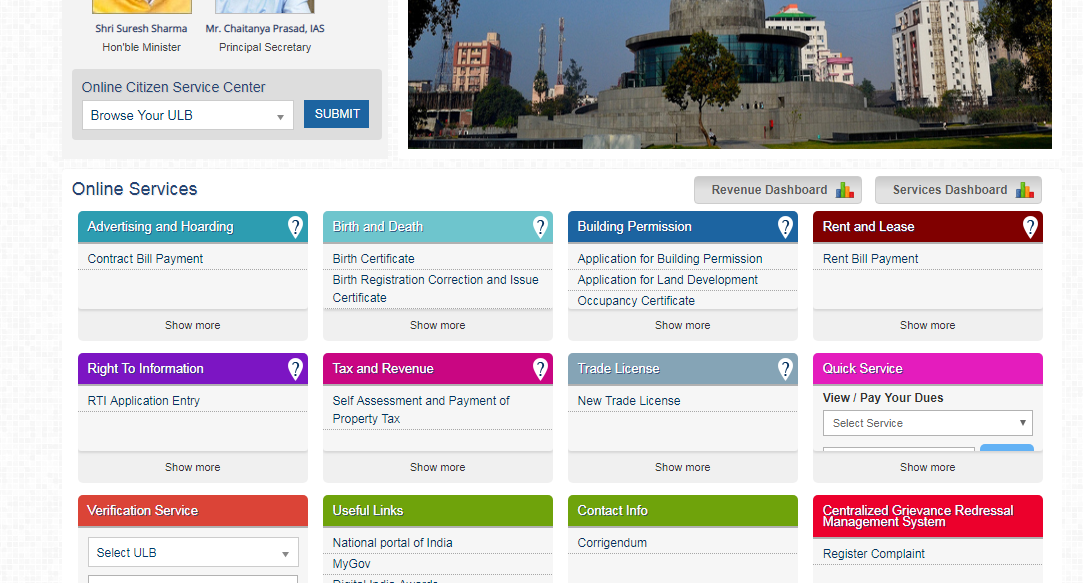

To make payment for property tax online in Bihar, follow the steps specified here. Step 1: Kindly visit the official website of Urban Development and Housing Department Government of Bihar. Step 2: Click on “Self Assessment and Payment of Property tax” block which is under the Tax and Revenue option. [caption id="attachment_67993" align="aligncenter" width="750"] Bihar Property Tax - Image 1

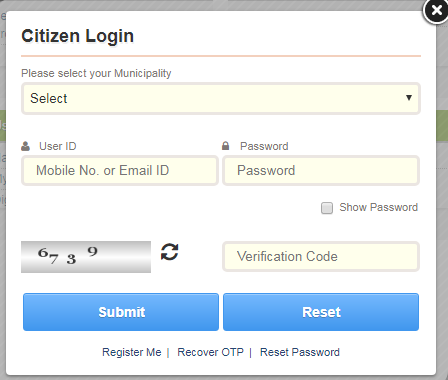

Step 3: The citizen login screen will pop up, where the applicant has to select the municipality and enter your user id and password and click on the “ Submit” button.

[caption id="attachment_68087" align="aligncenter" width="448"]

Bihar Property Tax - Image 1

Step 3: The citizen login screen will pop up, where the applicant has to select the municipality and enter your user id and password and click on the “ Submit” button.

[caption id="attachment_68087" align="aligncenter" width="448"] Bihar Property Tax - Image 2

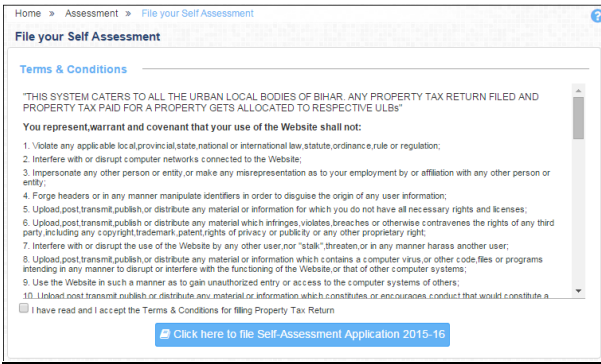

Step 4: Then read the terms and conditions which is displayed and click the checkbox for accepting the terms and conditions for filing the property tax return.

Step 5: Click the “Click here to file self-assessment application” tab.

[caption id="attachment_68088" align="aligncenter" width="601"]

Bihar Property Tax - Image 2

Step 4: Then read the terms and conditions which is displayed and click the checkbox for accepting the terms and conditions for filing the property tax return.

Step 5: Click the “Click here to file self-assessment application” tab.

[caption id="attachment_68088" align="aligncenter" width="601"] Bihar Property Tax - Image 3

Step 6: Choose the option either change in assessment or no change in assessment.

Bihar Property Tax - Image 3

Step 6: Choose the option either change in assessment or no change in assessment.

For change in Assessment

Step 7: Select the Change or Alteration in Assessment option. Step 8: Enter your Property No, Mobile number and also the OTP which is received on your registered mobile number. Step 9: After successful verification, the system will provide you with two options for selection.- Change in Contact Details

- Change in Holding Details.

- Then the applicant is supposed to enter the required details in the fields.

- Enter the property address details in the correspondence address details field.

- Enter the property number in the property number field.

- Enter the address line 1 in the address line 1 field.

- Enter the address line 2 in the address line 2 field.

- Enter the pin code in the area of the pin code.

For change in Holding Details

Step 13: Select the Change in Holding Details option, here three options will be shown like Addition, Alterations, Partial Demolish. You can select any one of the options as per your requirement and click on the “Submit” button. To perform a change in Holding Detail, in case of Addition option chosen, do the following steps: Step 14: You need to check the box in front of additional options which is under the change in holding details menu and click on the “Submit” button. Step 15: Fill the details under land or building details like- Select the property location on which road it resides from given options like the Principal main road, Main road, Other Road.

- Enter Plot/Land area in Sq. Ft. on which the property is constructed.

- Enter the property’s actual Built-up area/Constructed area. Here it is expected that user should enter the property’s built-up area.

- You need to check or uncheck this option as per facility available for Rain Harvesting for the property.

- Select any one option as per facility available for water connection for the property.

- Click on “Add” button, and the system will automatically add the new separate row for capturing the property additional construction information for a current financial year.

- Data present in the system will be automatically calculated by the system depend on the values/information selected by the applicant, but the applicant can edit the same.

- Check the box in front of Partial Demolish options provided under the Change in Holding Details option and click on the Submit button.

- Fill the required details under the land or building details.

- Select the property location on which road it resides from the given options like a Principal main road, Main road, other Road.

- Enter the Plot / Land area in Square Ft. on which the property is constructed.

- Enter the property’s actual Built-up area/Constructed area. Here it is expected that user should enter the property’s built-up area.

- You need to check or uncheck this option as per facility available for Rain Harvesting for the property.

- Select any one option as per facility available for water connection for the property.

- Data present in the system will be automatically calculated by the system depend on the values/information selected by the applicant, but the applicant can edit the same.

Submit No changes in Assessment

Follow the steps mentioned below to perform a change in holding details.- Select the No Change in Assessment option.

- Enter your Property Number and click on Submit button. Hereafter clicking on submit button, the system will show all users’ previous property related data in View mode only. Here the user cannot change any information. The system will show Owner Details, Address Details, Correspondence Address Details, Contact Details of Property Owner, Land Building Details, and Tax Calculations.

- The user can change the Total payable amount by selecting Other Amount option and enter the desired amount in the provided text box.

- The system will ask for Payment, options available are online Payment, Offline Payment, Pay at ULB counter.

- You will be redirected into the payment process as per your selected options.

- After completion of payment process changes will be made to your property data.

Make Online Payment

The following steps have been specified to make property tax payment online: Step 1: Enter the required information on the Change in assessment or No Change in the Assessment Application form. Select Online in the Select the mode of Payment section and click on “Submit “ button. Step 2: Enter the Payee Name and Mobile Number, and Email Id is populated automatically. Select Bank name and click Reset to clear all fields of payment details. Step 3: Click Pay to proceed further and then choose the Payment method [caption id="attachment_68090" align="aligncenter" width="608"] Bihar Property Tax - Image 4

Step 4: Select Card type and enter card number and name as on the card.

Step 5: Enter CVV number (3 digit number back of the card) and select card expiry date.

Step 6: If you want to cancel the Payment process, then Click Cancel to cancel the payment

Step 7: If you're going to make the payment then Click Pay Now to proceed further. 16. If you wish to cancel the payment process at the final stage, Click on Cancel to cancel the payment process.

Note: The applicant will receive a payment related alert on his/her Mobile number and Email ID upon successful transaction.

Bihar Property Tax - Image 4

Step 4: Select Card type and enter card number and name as on the card.

Step 5: Enter CVV number (3 digit number back of the card) and select card expiry date.

Step 6: If you want to cancel the Payment process, then Click Cancel to cancel the payment

Step 7: If you're going to make the payment then Click Pay Now to proceed further. 16. If you wish to cancel the payment process at the final stage, Click on Cancel to cancel the payment process.

Note: The applicant will receive a payment related alert on his/her Mobile number and Email ID upon successful transaction.

Offline Payment Procedure

The following steps have been specified to make property tax payment offline: Enter the required information on the Change in assessment OR No Change in the Assessment Application form. Step 1: Select Offline in the Select the mode of Payment section. Step 2: Select any one of the options from Pay by Challan at ULB, Pay By Challan at Bank, Pay at ULB Counter. If Pay By Challan at Bank option is selected, then select the Bank Name. Note: In drop-down list names of those banks are available where the user can visit and make the payment. (Bank decided by Corporation/Council/Panchayat) Step 3: Click on the Submit button then the payment details screen appears. Step 4: Click on “Print Challan” button to print the Challan. Step 5: Challan will be generated by the system in your browser in a separate tab. Step 6: Print the Challan and visit your respective Corporation/Council/Panchayat or Bank with the Challan to make the payment. Step 7: In case of Payment by Challan at ULB, Applicant needs to pay the Cash or Cheque/DD/PO, and then he/she has to pay or deposit Cheque/DD/PO at specified counters of Corporation/Council/Panchayat Step 8: In case of Payment by Pay at ULB, Applicant needs to pay the Cash or Cheque/DD/PO, and then he/she has to pay, deposit Cheque/DD/PO at specified counters of Corporation/Council/Panchayat. Step 9: The hard copies of the scanned documents should be submitted at the specified counters of Corporation/Council/Panchayat.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...