Last updated: December 11th, 2024 10:50 AM

Last updated: December 11th, 2024 10:50 AM

Board Resolution for Opening Bank Account

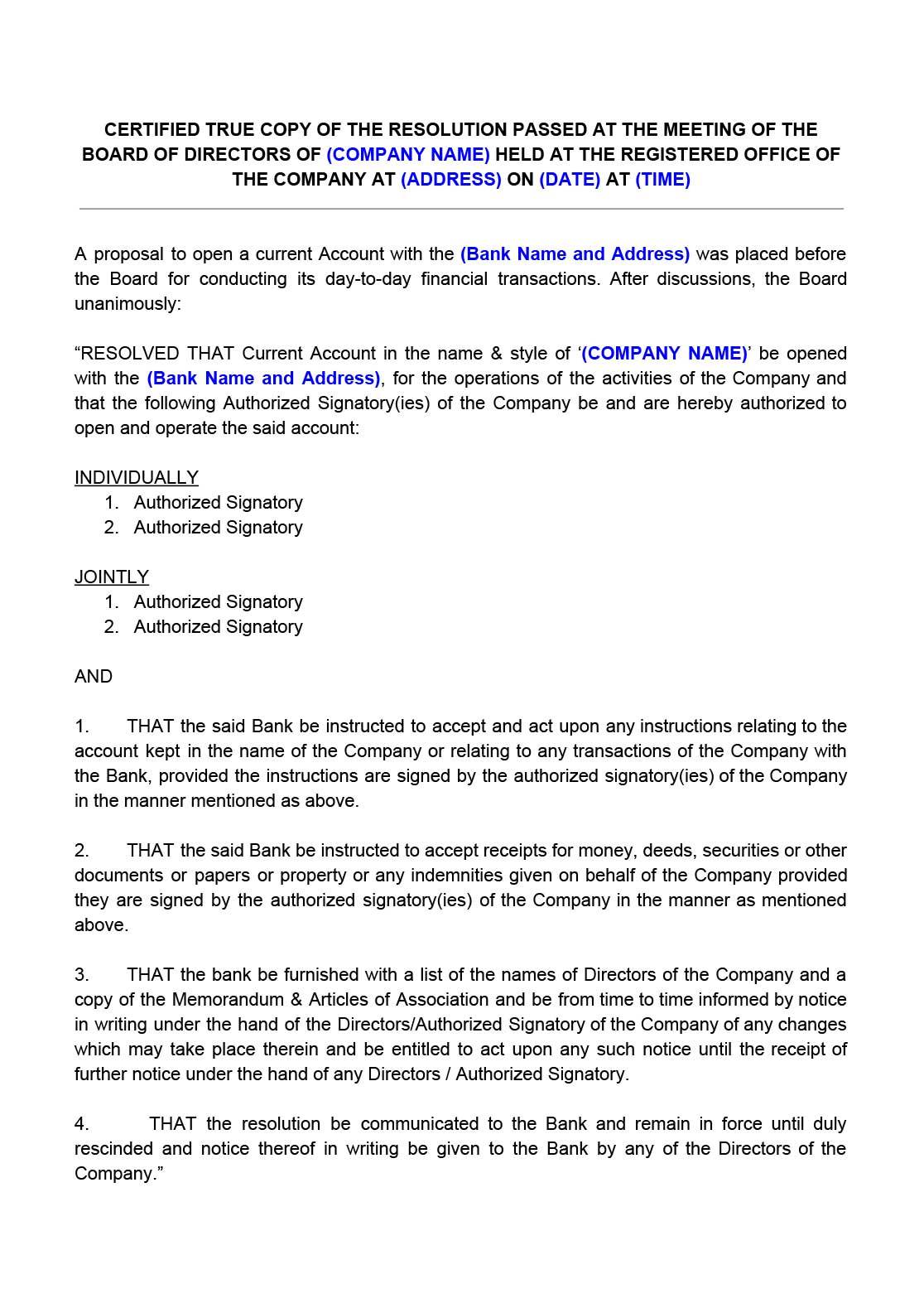

Board resolution for opening bank account is a resolution passed in a Board Meeting authorizing certain persons in a company to open and operate the Bank account of a Company or LLP. As a Company is a separate legal entity, this form of board resoltion is required in addition to the other documents for opening a bank account. In case the Company wishes to have Bank accounts with various banks, then separate Board Resolutions must be executed for each of the banks in which the account is to be opened. It is one of the first resolutions executed after incorporation of company or LLP. Get expert assistance from IndiaFilings to open a bank account for a company!! Get Started!Download Board Resolution for Opening Bank Account format

You can also download the Board Resolution for Opening Bank Account format in the following formats.Using this Board Resolution

General Format for Board Resolution for Various Bank Operations

In the course of business, companies often require board resolutions to authorize specific banking transactions. These transactions include routine actions such as opening or closing bank accounts, modifying authorized signatories, obtaining Internet banking services, and setting up merchant banking facilities. Each of these actions typically requires a formal resolution to grant permission and designate specific individuals to carry out or oversee the transaction.1. Opening a Bank Account

A board resolution for opening a bank account is essential when a company initiates a new banking relationship. This resolution generally authorizes specific individuals within the organization to manage the account and conduct transactions on behalf of the company.2. Change in Signatories

When there is a change in authorized personnel, a resolution is required to update the list of signatories. This ensures that only approved individuals have the authority to access and operate the account, maintaining security and compliance.3. Obtaining Internet Banking Facility

To facilitate online transactions, companies may pass a resolution to obtain internet banking services. This resolution designates authorized individuals who can access and perform online transactions on behalf of the company, ensuring control over digital banking activities.4. Obtaining Merchant Banking Facility

For businesses accepting payments through cards and other digital methods, a resolution to obtain merchant banking services is needed. This authorizes the persons of the company to establish merchant facilities, allowing the collection of payments in various forms.5. Closure of Bank Account

When a account is no longer required, a board resolution for account closure is passed. This action authorizes designated individuals to handle the closure process and transfer any remaining balance to a specified account. These resolutions provide a formal and legal framework for carrying out essential banking operations, ensuring compliance with corporate governance requirements and safeguarding organizational interests.Executing Board Resolution for Opening Bank Account

The board resolution for opening bank account must be printed on the letterhead of the business. It must be signed by two ore more of the Directors of the Company with quorum at a Board Meeting. In case of One Person Company, the document can be signed by the sole Director and shareholders. One or more Director or Officer or Employee of the business can be nominated by the Board of Directors for opening and operating the bank account of the company. One copy of the document can be retained with the Company while the original is provided to the Bank opening the account for the Company. Opening a company bank account is made easier with IndiaFilings!! Let us do all the formalities and begin your bank operations.

Get Started!

Opening a company bank account is made easier with IndiaFilings!! Let us do all the formalities and begin your bank operations.

Get Started!

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...