Updated on: May 21st, 2019 11:33 AM

Updated on: May 21st, 2019 11:33 AM

Business Loan - Jana Small Finance Bank

Securing funds for a startup is one of the toughest challenges an Entrepreneur's faces while starting a new business. A bank loan is a perfect option for entrepreneurs starting a business in the traditional business like service/manufacturing/trading sectors. Jana Small Finance Bank offers business loan at attractive interest rates and has secure repayment options of equated daily/weekly/monthly instalment, along with user-friendly features specially designed to help businesses fulfil their existing needs, as well as achieve their business goals and future expansions. In this article, we will look at the Jana Small Finance Bank's Business Loan in detail.About Jana Small Finance Bank

Jana Small Finance Bank, erstwhile Janalakshmi Financial Services, is headquartered in Bangalore. It is one of the ten financial institutions which had received in-principle approval from Reserve Bank of India in 2015, to set up a Small Finance Bank. The bank also received the final banking license in April 2017 and started banking operations by March 2018. It has a range of 500 branches across 19 states of India.Loan Amount

- The loan amount provided under Business Loan by Jana Small Finance Bank ranges between INR 1 Lakh and INR 3 Lakhs (without collateral security) based on the performance of the firm.

- The Bank also offers business loan in the range between INR 3 Lakhs and INR 10 Lakhs with collateral security.

Tenure Details

The repayment period fixed for the borrower is up to 36 months (Unsecured). Also, Jana Small Finance Bank offers 12 to 60 months under the secured condition.Features of Loan Account

- Zero balance Current account is provided

- Credit Life Insurance for applicant and co-applicant can be availed

Interest Rates

The entrepreneur can get the Jana Small Finance Bank business loan at a highly competitive interest rate of 24% per annum.Doorstep banking facility

The Jana Small Finance Bank provides following doorstep banking facility:- Onboarding of customer

- Doorstep daily collection

Eligibility Criteria

The following persons are eligible to get the business loan for the entity from the Jana Small Finance Bank:- Existing customers of Jana Small Finance Bank

- Customers new to Jana Small Finance Bank with a current business venture having a minimum of 3 years vintage is eligible for a business loan

- All business units and entities covered under MSME category are eligible to apply for a loan.

Documents Required

The supporting documents required for the Jana Small Finance Bank business loan for an entity is listed as follows:- Aadhaar and PAN card are the mandatory documents

- Business Entity Proof - Any one document (Bank Statement / Sales Tax Challans / IT Returns / Shops & Est. Certificate / Certificate of Incorporation / Partnership Deed)

- Business Address Proof - Any one document such as Voter ID / Driving License / Passport / Telephone Bill / Electricity Bill / Registered Lease Deed or Sale Agreement / Bank Statement)

- Signature Proof

- Other documents as per the policy of the Bank

- A letter certifying end use of the business loan funds on Business Letterhead

- Passport Size Photographs of all applicants and co-applicants

Service Charges and Fees

The service charges and fees details for the Jana Small Finance Bank Business Loan for Entity are tabulated here:|

Sl.No |

Particulars |

Business Loan for Entity |

| 1 | Loan Processing Charges | 3% + GST |

| 2 | Documentation charges | Nil |

| 3 | Prepayment charges | 5% of the amount Pre-Paid |

| 4 | Late payment charges | 24% per annum |

| 5 | Foreclosure charges | 5% on the amount prepaid prior to completion of 75% of sanctioned tenure |

| 6 | Cheque/AD/ECS bounce charges | Rs.500 + GST |

Application Process

- The entrepreneur needs to visit the nearest branch of Jana Small Finance Bank, and the Relationship Manager will guide the application process.

- You can also contact the Jana Small Finance Bank Limited and the bank Customer Care Executive will fix a service appointment with the Relationship Manager to help the entrepreneur with the application process.

- The entrepreneur can also apply for Business Loan for entity through the official website of Jana Small Finance Bank.

Image 1 Jana Small Finance Bank Business Loan for Entity

Image 1 Jana Small Finance Bank Business Loan for Entity

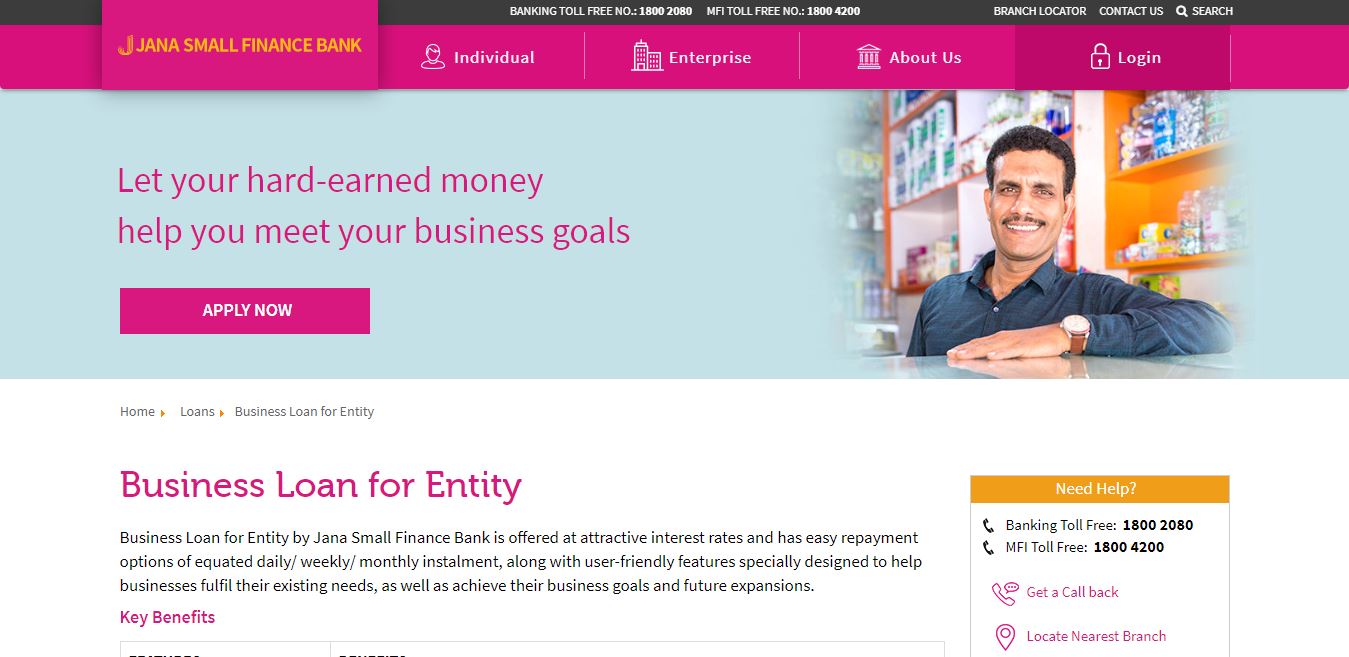

Image 2 Jana Small Finance Bank Business Loan for Entity

By clicking on Apply now option, the application form for the loan will be displayed. Provide the personal details and click on submit.

Image 2 Jana Small Finance Bank Business Loan for Entity

By clicking on Apply now option, the application form for the loan will be displayed. Provide the personal details and click on submit.

Image 1 Jana Small Finance Bank Business Loan for Entity

On submission of the application form, the customer care executive will call you to assist the application process.

Image 1 Jana Small Finance Bank Business Loan for Entity

On submission of the application form, the customer care executive will call you to assist the application process.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...