Last updated: February 3rd, 2020 6:45 PM

Last updated: February 3rd, 2020 6:45 PM

Calculating GST Payment Due - Electronic Liability Register

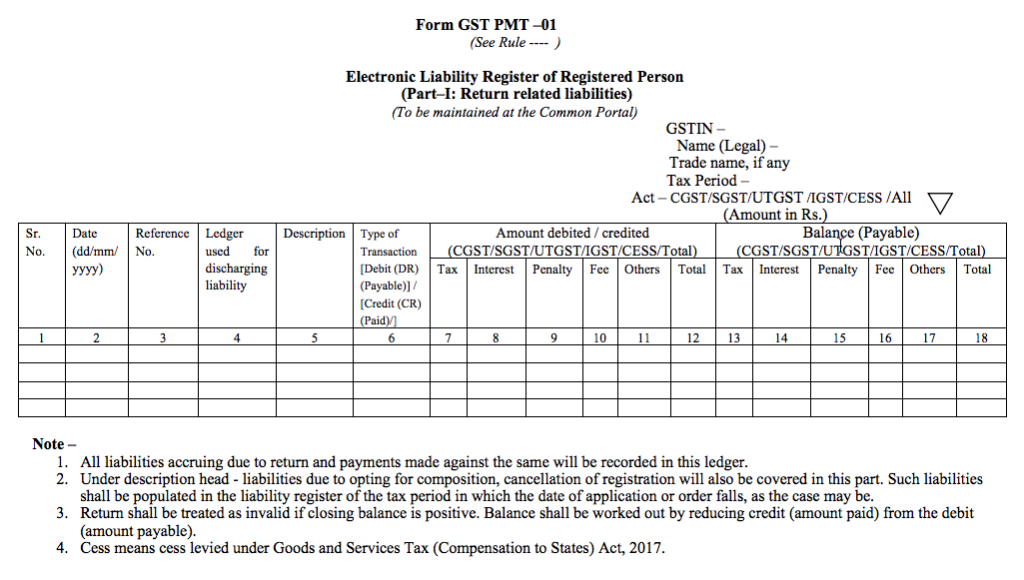

The GST platform in India uses a system of three ledgers, namely Electronic Liability Register, Electronic Credit Ledger, and Electronic Cash Ledger. These ledgers provide support to manage the GST liability, credit, payment due, deposits, interest, penalty and late fee or any other debit/credit amount of each of the taxpayers. The electronic liability register maintained in FORM GST PMT-01 provide support to manage the GST payment due, interest, penalty, late fee as well as any other amount of a taxpayer. In this article, let us look at the procedure for calculating GST payment due to the Common Portal.Electronic Liability Register

The taxpayer shall access the electronic liability register or GST PMT-01 through the GST Common Portal for any reference. The electronic liability register accounts for:- The amount payable towards tax, interest, late fee or any other amount payable as per the return furnished by the taxpayer;

- Amount related to tax, interest, penalty or any other amount payable as determined by a proper officer in pursuance of any proceedings under the Act or as ascertained by the taxpayer;

- Amount of tax and interest payable as a result of mismatch under section 42 or section 43 or section 50; or

- Amount of interest that may accrue from time to time.

GST Form PMT-01 - Part A

[caption id="attachment_30935" align="aligncenter" width="730"]

GST Form PMT-01 - Part A

[caption id="attachment_30935" align="aligncenter" width="730"] GST Form PMT-01 - Part B

The liability of a registered person as per his return is recorded by debiting the electronic credit ledger or the electronic cash ledger and the electronic liability register is credited accordingly.

The electronic cash ledger pays any amount deducted under section 51, or the amount collected under section 52, or the amount payable on a reverse charge basis, or the amount payable under section 10 any amount payable towards interest, penalty, fee or any other amount under the Act. Therefore the electronic liability registers credits accordingly.

For any amount of demand debited in the electronic liability, the register reduceds to the extent of relief given by the appellate authority or Appellate Tribunal or court and the electronic tax liability register would be credited accordingly. In case of an amount of penalty imposed or liable to be imposed would stand reduced partly or fully, as the case may be, if the taxpayer makes the payment of tax, interest and penalty specified in the show cause notice or demand order and the electronic liability register would be credited accordingly.

GST Form PMT-01 - Part B

The liability of a registered person as per his return is recorded by debiting the electronic credit ledger or the electronic cash ledger and the electronic liability register is credited accordingly.

The electronic cash ledger pays any amount deducted under section 51, or the amount collected under section 52, or the amount payable on a reverse charge basis, or the amount payable under section 10 any amount payable towards interest, penalty, fee or any other amount under the Act. Therefore the electronic liability registers credits accordingly.

For any amount of demand debited in the electronic liability, the register reduceds to the extent of relief given by the appellate authority or Appellate Tribunal or court and the electronic tax liability register would be credited accordingly. In case of an amount of penalty imposed or liable to be imposed would stand reduced partly or fully, as the case may be, if the taxpayer makes the payment of tax, interest and penalty specified in the show cause notice or demand order and the electronic liability register would be credited accordingly.

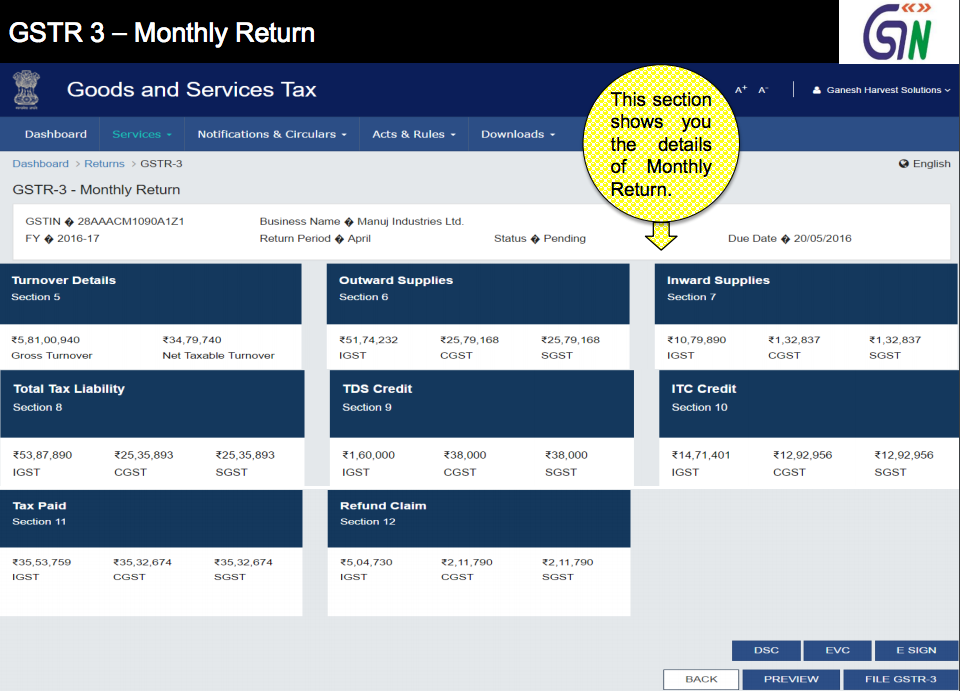

Calculating GST Payment Due

The GST payment due in any month can be readily viewed on the GST Common Platform dashboard after filing of GSTR-3, the GST Monthly Return. GSTR-3 or Monthly Return is due on the 20th of each month. Prior to filing GSTR-3, the taxpayer must have filed GSTR-1 and GSTR-2 on the 10th and 15th of each month, respectively. Step 1: Access the GST Monthly Return or GSTR-3 Summary Page [caption id="attachment_30931" align="aligncenter" width="713"] Access GSTR-3 Dashboard

Step 2: The GSTR-3 Outward Supplies summary page displays all the outward supplies

[caption id="attachment_30933" align="aligncenter" width="699"]

Access GSTR-3 Dashboard

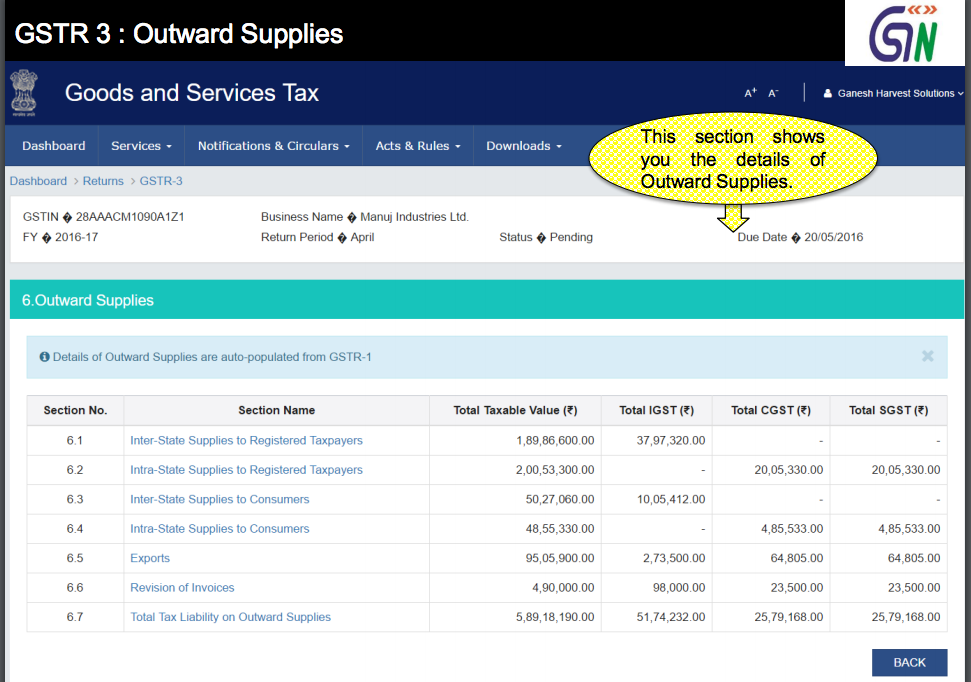

Step 2: The GSTR-3 Outward Supplies summary page displays all the outward supplies

[caption id="attachment_30933" align="aligncenter" width="699"] GST Outward Supplies Summary

Step 3: The total tax credit or details or inward supplies can be viewed by accessing the GSTR-3 Inward Supplies Summary

[caption id="attachment_30930" align="aligncenter" width="735"]

GST Outward Supplies Summary

Step 3: The total tax credit or details or inward supplies can be viewed by accessing the GSTR-3 Inward Supplies Summary

[caption id="attachment_30930" align="aligncenter" width="735"] GST Input Tax Credit Summary

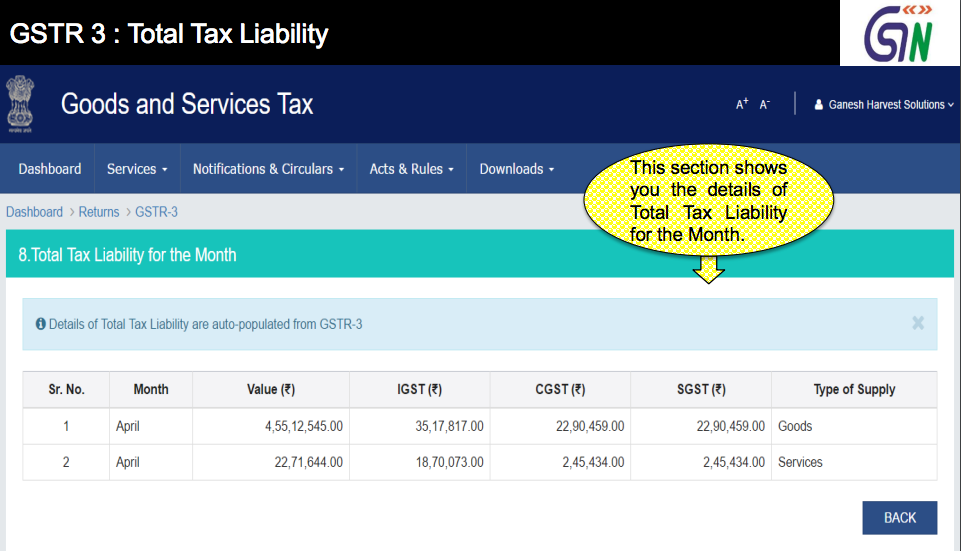

Step 4: View the total GST tax payment due

[caption id="attachment_30932" align="aligncenter" width="778"]

GST Input Tax Credit Summary

Step 4: View the total GST tax payment due

[caption id="attachment_30932" align="aligncenter" width="778"] GST Total Liability

For GST, trademark and logo registration, click here

GST Total Liability

For GST, trademark and logo registration, click here

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...