Last updated: December 17th, 2024 2:26 PM

Last updated: December 17th, 2024 2:26 PM

Cardless Withdrawal - YONO App

The State Bank of India (SBI) initiated a digital banking platform YONO (You Only Need One) to withdraw cash from ATMs without ATM cards. It also provides other services like cash service, business transactions, and purchasing products through e-commerce platforms for SBI customers. The YONO is built on Android and iOS platform to provide a simple solution for a variety of financial services.

Objectives of YONO

- The primary goal of YONO is to provide cardless transactions at ATM centres

- To encourage users towards digital transaction platform

- Eliminate the possible risks associated with withdrawals from ATM

- To reduce time and acts as a primary source during emergencies if ATM card is not available

- To reduces the risk of fraudulent activities like cloning and skimming

Features of YONO

- Any savings account holder can withdraw cash at the ATMs of the bank without using a debit card

- It is a digital banking platform for SBI customers and can be used on smartphones to make transactions and payments

- The cashless withdrawal service is available across 16,500 SBI ATMs across the country

- It is also possible to perform banking transactions like opening Fixed Deposit, applying for credit cards, insurance, investments and loans

- Provides option to purchase products through other e-commerce web portals

- Increase investments and manage funds from other SBI accounts

- Provision to book air, train and bus tickets

Steps to Withdraw Cash from an ATM Without a Debit Card using Phone

To use the YONO application, the SBI user should have registered with the SBI internet web portal.

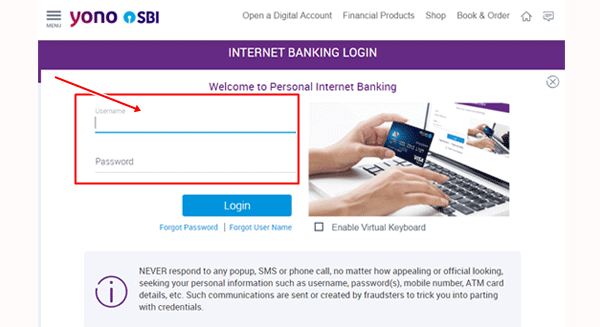

Step 1: At the first step, log into the Yono app using the login ID and password of the bank

YONO login page

YONO login page

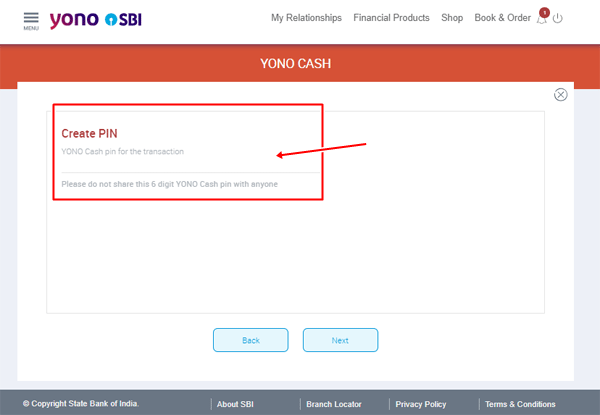

Step 2: Set up a six-digit MPIN for future logins

Create 6 digit pin

Create 6 digit pin

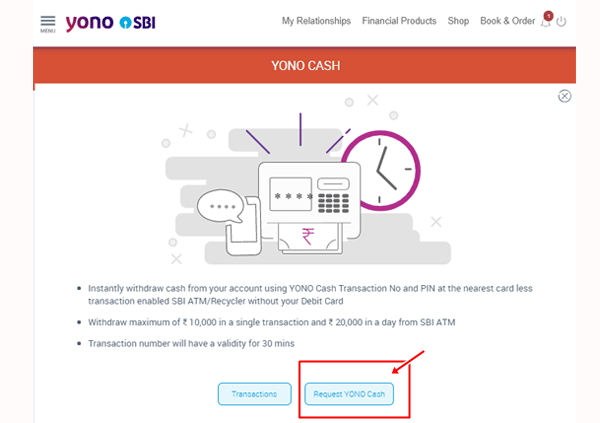

Step 3: To withdraw cash from ATM centres without ATM cards, Click on Yono cash

Yono Cash

Yono Cash

Step 4: Click on the ATM section and enter the amount to be withdrawn. There is a minimum withdrawal limit of Rs.500 and maximum withdrawal limit of Rs. 10,000 per transaction.

Step 5: A cash transaction number will be sent to the registered mobile number. The transaction number and PIN can be used at Yono Cash points (cardless transaction enabled ATMs) for withdrawal.

Note: The number will remain valid for four hours. Partial withdrawals cannot be made using the same reference number.

Step 6: Choose the option Card less transaction at the Yono cash point and enter the details. The app also gives an option to account holders to locate the nearest card-less transaction enabled ATMs.

For more information on loans for startups, check IndiaFilings guides

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...