Last updated: December 17th, 2024 2:28 PM

Last updated: December 17th, 2024 2:28 PM

Casual Taxable Person - GST Registration

All Casual taxable persons have been provided special treatment under GST. The GST Act defines as a casual taxable person as a person who occasionally undertakes transactions involving the supply of goods or services or both in the course or furtherance of business, whether as principal, agent or in any other capacity, in a State or a Union territory where the entity has no fixed place of business. Hence, persons running temporary businesses in fairs or exhibitions or seasonal businesses would fall under casual taxable person under GST. In this article, we look at GST registration for the casual taxable person.Regular Taxable Persons vs Casual Taxable Persons

Persons classified as the regular taxable person must obtain for GST registration as regular taxable person. These individuals shall come under the regular person’s tax and not in the category of casual taxable person or non-resident taxable person. Hence, regular taxable persons would be someone with a fixed place of business located within India. Unless a regular taxpayer is enrolled under the GST composition scheme, the taxpayer would be required to file monthly GST returns, maintain accounts as per GST Act, maintain a fixed place of business and comply with GST regulations. Casual taxable persons would find it hard to maintain a fixed place of business or file monthly GST returns continuously, as their business would be seasonal in nature with no fixed place of business. To accommodate the unique requirements of such taxpayers, special provisions have been provided under the GST Act for registration of casual taxable person.GST Registration for Casual Taxable Person

All persons classified as casual taxable persons should mandatorily obtain GST registration, irrespective of the annual aggregate turnover. Further, the casual taxable person shall apply for GST registration at least 5 days prior to the commencement of business. For GST registration the casual taxable persons can use FORM GST REG-01.Deposit for GST Registration

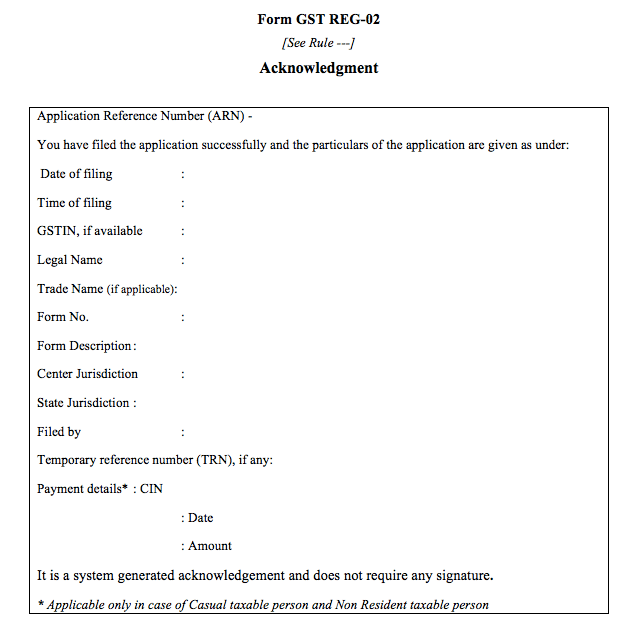

The casual taxable persons shall deposit the advance tax equal to the expected tax liability during the validity period of GST registration. After applying for GST registration, the portal generates a temporary number for the said GST deposit. The portal then credits the electronic cash ledger of the taxpayer and provides the GST registration certificate. The taxpayer may download, if necessary. (Know more about the amount of deposit required for GST registration) Document Provided for Payment of GST Deposit

Document Provided for Payment of GST Deposit

Validity of GST Registration

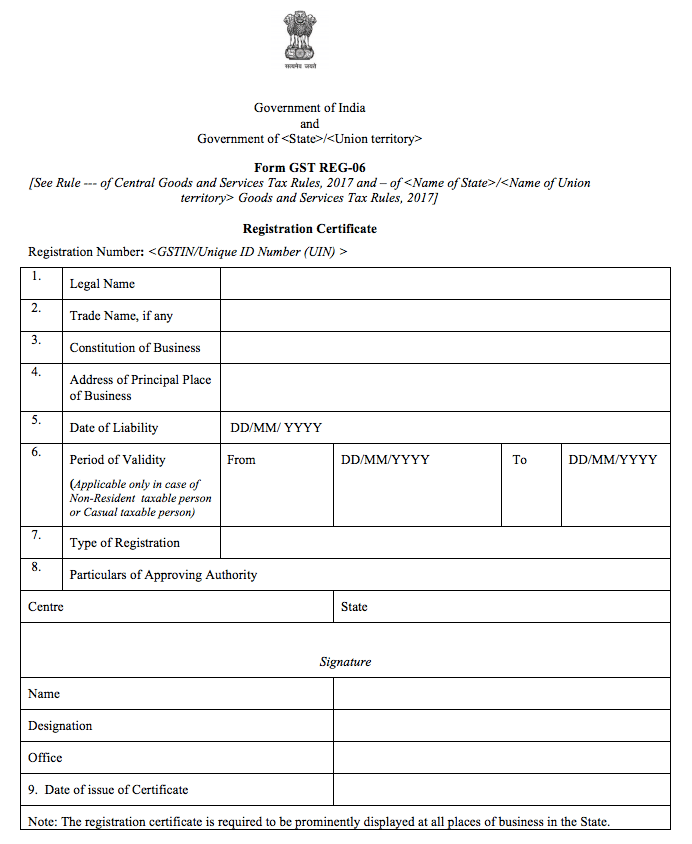

The validity of GST registration is the validity period as mentioned in the GST registration application or 90 days from the date of registration, whichever is earlier. The sample GST registration certificate below shows validity period being specified only for casual taxable persons and non-resident taxable persons under GST.

Extension of GST Registration

In case if the concerned individual needs to extend beyond the date mentioned in the GST registration certificate, then the concerned individual shall apply through FORM GST REG-11. Along with the request for extension of validity period, advance GST deposit must also be made by the taxpayer based on the expected tax liability. If the officer verifying the application is satisfied and advance GST deposit is made, the GST registration can be extended by up to another 90 days. Simplify the GST registration & GST return filing process with IndiaFilings experts!Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...