Last updated: December 17th, 2019 5:04 PM

Last updated: December 17th, 2019 5:04 PM

Cent Kalyani Scheme

Central Bank of India has launched the Cent Kalyani Scheme. The primary objective of this Scheme is to motivate female entrepreneurs to initiate a new project or extend or modernise an existing unit. It is available for women employed in the rural areas and cottage industries, small, agriculture and allied activities, medium and micro enterprises (MSME), self-employed women, Government-sponsored programs and retail trade. Under this scheme, Central bank provides a loan to the women entrepreneurs. In this article, we will look at the Cent Kalyani Scheme in detail. Know more about the Best Time for Women Entrepreneurs to Start BusinessObjective of the Cent Kalyani Scheme

The objective of the cent Kalyani scheme is to generate continuous and sustainable employment opportunities for women entrepreneurs.Eligibility Criteria

The eligibility criteria for Cent Kalyani Scheme is explained in detail below;- Woman entrepreneurs, above 18 years of age

- No income ceiling for assistance

Nature of Facility

The facility offered under the Cent Kalyani Scheme is described in detail below:- Overdraft

- Cash credit working capital limit

- Term loan

- Non-Fund based limit (for Working capital as well as term loan)

Quantum Finance

The quantum finance provided under the Cent Kalyani Scheme is maximum Rs.1000 lakh.Margin

As per the Cent Kalyani Scheme, the term loan is 25 %.Rate of Interest for Cent Kalyani Scheme

The Interest rate for cent Kalyani scheme is explained in detail below:- For Loans Up to ten Lakhs: The concession in rate of interest will be MCLR (Marginal Cost of Funds based on the Lending Rate) with 0.25 % of Loan.

- For Loans above tel Lakhs and Up to Rs. 100 Lakhs: The concession in rate of the interest would Marginal Cost of Funds based on Lending Rate ( MCLR ) with 0.50% of Loan

- Additional Interest concession of 0.25% will provide if the account rated by External Agency.

- 1 year upto three years: 0.20 premiums

- Three years upto 7 years: 0.40 premium

Processing Fee

For Cent Objective of Cent Kalyani Scheme, no need of collateral security or any guarantee of the third party on loan provided under the Cent Kalyani Scheme. Also, there is no fee for processing the loan.Repayment Details

The repayment details of Cent Kalyani Scheme is given here: Working Capital: On demand Term Loan: Maximum seven years including moratorium period of 6 months to 1 year.Security Details

- Hypothecation of stock and receivables and all assets created of Bank’s fund

- No collateral or third party guarantee is needed for this scheme

- Necessarily to be covered under CGTMSE. CGTMSE coverage is applicable to units except for Retail trade (categorised as small services), educational/training Institutions and SHGs.

Documents Required

The documents required for the Cent Kalyani Scheme is listed as follows:- KYC norms have to be ensured, name changed after marriage will have to be kept in record

- Balance sheet for the past two years along with estimated and projected balance sheets and other financial statements

- Standard application form approved by IBA

- Letter of hypothecation

- Letter of interest

- Letter of Continuity and Letter of Understanding by Borrower

- DP Note

- Disclosure of names of the borrower in case of default to be obtained

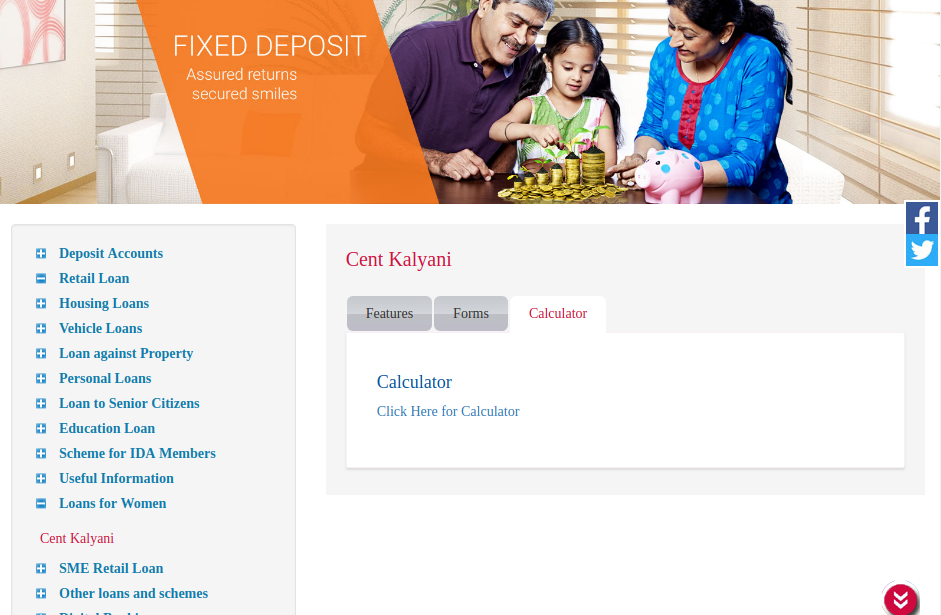

Quarterly Interest Deposit Calculator

Access the home page of Central Bank of India. Click on the Calculator option. Select ‘click here for calculator’ option. Image 1 Cent Kalyani Scheme

Image 1 Cent Kalyani Scheme

- Deposit Amount

- Deposit Amount Option

- Period of Deposit

- Interest Rate

- Quarterly Interest

Image 2 Cent Kalyani Scheme

After providing the details, click on deposit amount or Quarterly income option. The details of the quarterly interest deposit will be displayed.

Image 2 Cent Kalyani Scheme

After providing the details, click on deposit amount or Quarterly income option. The details of the quarterly interest deposit will be displayed.

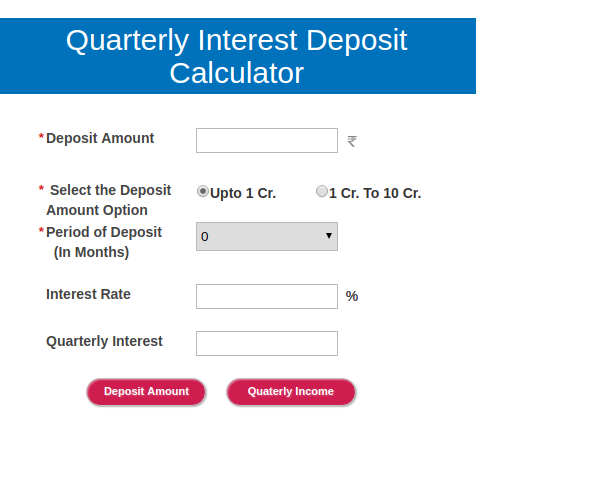

Image 3 Cent Kalyani Scheme

Image 3 Cent Kalyani Scheme

Cent Kalyani Scheme Application procedure

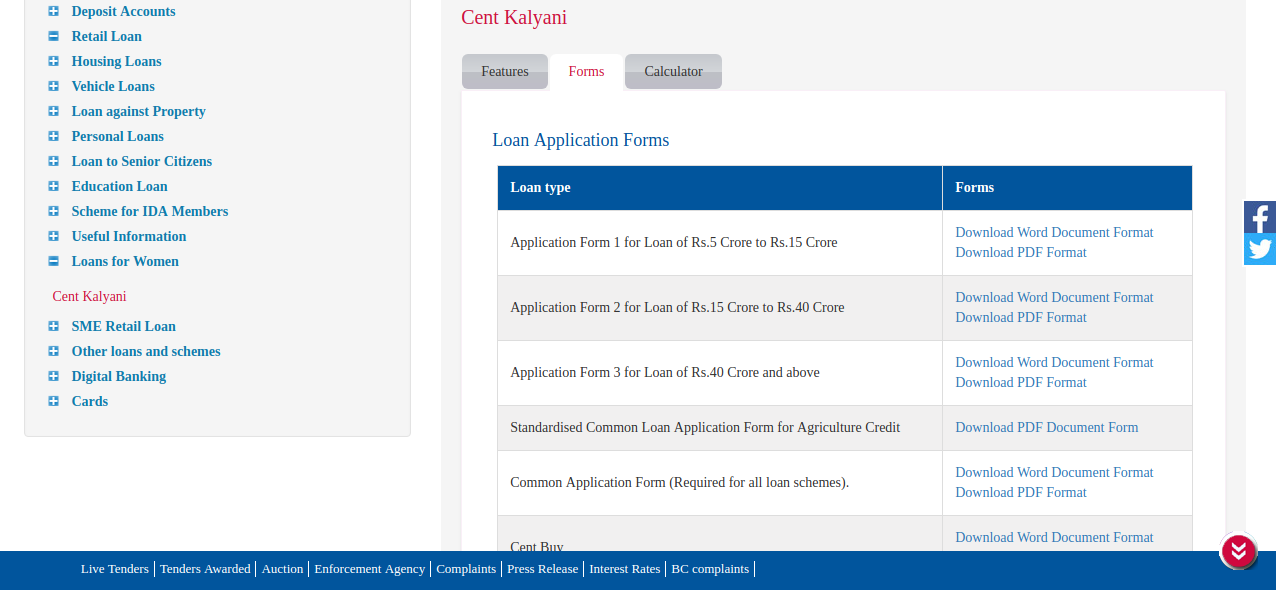

The entrepreneur needs to access the concerned branch of Central Bank of India. Submit an application for Cent Kalyani Scheme. Separate forms are available for startups depending on the loan type. We have here with attached an application for Cent Kalyani Scheme. You can obtain the Cent Kalyani Application from the official website of Central Bank of India. From the home page of Central Bank of India, Click on the application forms. Image 4 Cent Kalyani SchemeImage

Select the application forms according to the loan type. You can download word pdf format of application.

Image 4 Cent Kalyani SchemeImage

Select the application forms according to the loan type. You can download word pdf format of application.

Image 5 Cent Kalyani Scheme

Provide all details in the hard copy of the application. Submit the application along with all documents to the concerned branch of Central Bank of India.

On successful verification, the loan will be credited to the entrepreneur’s account.

Image 5 Cent Kalyani Scheme

Provide all details in the hard copy of the application. Submit the application along with all documents to the concerned branch of Central Bank of India.

On successful verification, the loan will be credited to the entrepreneur’s account.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...