Last updated: December 28th, 2018 1:38 AM

Last updated: December 28th, 2018 1:38 AM

Chandigarh Property Registration

All transactions that involve the sale of the immovable property must be registered to ensure transfer of clean title to the owner. In India, it is mandatory to register all property transactions as per the provisions of the Registration Act, 1908. The registration of property or land requires preparation of certificates and paying the applicable stamp duty registration fees for the sale deed to be recorded legally at the Sub-Registrar’s office. Department of Stamps and Registration regulates the registration and transfer of property in Chandigarh. In this article, we look at the procedure for Chandigarh property registration with stamp duty charges.Purpose of Property Registration (Deed Registration)

Transfer of immovable land/ property can only be effected by way of registration. Registration of a certificate of transfer of immovable property/ land provides the following benefits:- The document of transfer of a property will be a permanent record once if it is registered in the concerned office of Sub-Registrar.

- Anyone can inspect a public record of the transfer of land/ property, and a proof of the document can be obtained from the relevant Sub–Registrar office.

- Listing of the property is providing the details to the general public that the owner has transferred to the buyer by the owner.

- If any person intends to buy a property, they can check or verify the records available in the sub-Registrar office. Such a person can review in whose name the last transfer deed has been registered.

- If the land is an agriculture land, you can verify the revenue record as khata, khatoni/ khasra of that land and title deed.

Eligibility Criteria

To complete Chandigarh property registration, the parties to the transaction must be the residents of Chandigarh. The rural inhabitants of the state must be in custody of Certificates of Identification (COI).Documents Required

Documents required for registering deeds in Chandigarh is explained in detail here.- Original and Duplicate copy of the certificates is mandatory for the registration.

- 2 passport size photographs of all parties, each of the seller, buyer, and all the witnesses.

- Photo Identity Proof (voter’s ID card and passport of the buyer, the seller and all the witnesses).

- Certified copies of documents of Incorporation of both buyer and seller, in case of a company and not an individual buyer

- Proof of the land register card to indicate that the land/ property does not belong to the Government (It can be received from the City Survey Department)

- Proof of municipal tax bill to mention the year in which the land was built/ constructed.

- Proof of the PAN Cards of all the parties are obligatory (It has to be annexed with the Sale Deed)

- Photographs and signatures of all parties are mandatory.

Rates of Stamp Duty

The Stamp Duty is chargeable in the following documents in the Chandigarh are given below:| S. No. | Documents | Stamp Duty |

| 1. | Sale Deed/ Gift Deed | 6% |

| 2. | Transfer of Lease Right Deed | 3% |

| 3. | Exchange Deed on the higher value/ rate of the property | 3% |

| 4. | Lease Deed 1 to 5 years Lease Deed 1 to 10 years Lease Deed 1 to 15 years Lease Deed 1 to 20 years Lease Deed above 20 years On Security or Advance amount (if any) | 1.5% 3% 6% 6% 6% 3% |

| 5. | Mortgage Deed Without Possession Mortgage Deed With Possession | 1.5% 3% |

| 6. | Trust Deed | Rs. 50/- |

| 7. | Family Settlement | Rs. 50/- |

| 8. | Amendment Deed | Rs. 5/- |

| 9. | Relinquishment Deed | Rs. 50/- |

| 10. | Redemption Deed | Rs. 30/- |

| 11. | Award/ Decree | 1.5% |

| 12. | Partnership Deed | Rs. 25/- |

| 13. | General Power of Attorney Cancellation of GPA | Rs. 15/- Rs. 15/- |

| 14. | Special Power of Attorney Cancellation of SPA | Rs. 5/- Rs. 5/- |

| 15. | Adoption Deed | Rs. 40/- |

| 16. | Sub General Power of Attorney Cancellation of Sub GPA | Rs. 15/- Rs. 15/- |

| 17. | WILL/ Cancellation of WILL | Nil |

- Such fee in case of duplicates, if presented with the original document, shall be Rs. 2/-, Duplicates, if not presented along with the original documents must be treated as the original records.

- The registration charge to be paid on partition deeds must be calculated on the amount of the share or shares on which stamp duty has been assessed under Schedule 1-A to the Indian Stamp Act, 1899.

Registration Fees

The following is the registration fees leviable on the registration of documents:| S. No. | Registration of Documents | Registration Fees |

| 1. | For all optionally registrable documents except lease deeds | Rs. 50 |

| 2. | For all compulsorily registrable documents (other than leases of immovable property) | 1 per cent of the value of the document, subject to a minimum of Rs. 50 and maximum of Rs. 10,000 |

| 3. | If the value or consideration be only partly expressed (in addition to the ad valorem fee as above on the value or consideration money expressed) If the value or consideration be not at all expressed | Rs. 100 |

| 4. | For a lease of immovable property and surrender of leases. | At the rates given on the amount of rent of which stamp duty has been assessed under the Schedule 1-A to the Indian Stamp Act, 1899 and it the lease be exempt from stamp duty four rupees. |

| 5. | When the value exceeds Rs. 1,000 When the value of the property/ land bequeathed is not expressed. | Rs. 200 |

Time Frame

After the presentation of the deed/ property, registration proceedings be settled on the same day.Concerned Authority

The parties can approach submit the application forms relating to property registration services at the Sub-Registrar’s Offices of Stamps & the Registration Department, Government of Chandigarh.Application Procedure for Chandigarh Property Registration

Follow the below-provided guidelines examined here to register immovable property in Chandigarh. Step 1: The applicant must register their land/ property transaction record in the Office of the Sub-Registrar. Step 2: Then the applicant must acquire the property registration document, which is called “Dalil” (Gift Deed Registration/ Sale Deed Registration/ or any Registration Deed arising from the above process of owning land). Step 3: Then the applicant must visit the Tehsil office (TK) and apply for a mutation in Form No.21 of TRLR ACT (Application form for Mutation). Step 4: Tehsildar will acknowledge the receipt of the application form 21 by making a counter-foil, duly filled in, dated and signed. Then he would enter the details in his Mutation register (form 20 of TRLR Act.) Step 5: A notice will be generated and served to all landholders with a date fixed for the hearing. If any objection to the mutation is received either in writing or orally to the Tehsil office before the date of hearing, will be recorded in the disputed mutation case register (Form 22 of TRLR ACT). The acknowledgement of the objection will be given in Form 23 TRLR Act. Step 6: Entries in the mutation register will be tested by the Circle officer (DCM or RI) and shall order for field enquiry to the Tehsil office before the date of hearing. An Amin will conduct field enquiry. Step 6: After hearing, the applicant will be asked to submit Form B (Form for getting new RoR (Record of Rights). Simultaneously, the Tehsil office will be preparing the Touzi mill Register, Badar Register, Jama Bandi Register and will send the case record to DCM’s office. After verifying all the documents, DCM will pass an order of mutation over Form B. Step 7: When handing over of Khatian( Record of Rights), the charges are collected from the concerned applicant at Rs 15/- per page of Khatian and Rs 4/- per extra page of the concerned Khatian. Then an acknowledgement receipt will be issued to the concerned applicant as proof of collection of charge.Check/ Verify Property Details

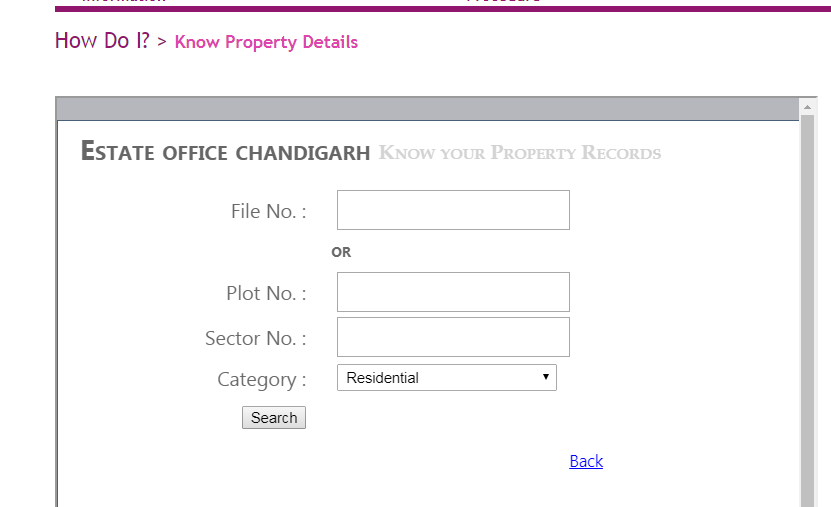

Applicants can check/verify the details of any land that has been registered in Chandigarh using the District Name, Tehsil Name, Village Name and Khata Number or Khasra Number or Name in the official website. [caption id="attachment_70936" align="aligncenter" width="831"] Verify Land Records

You need to enter the registration office details, registration number, and registration year and captcha code. Then click on the see details button to verify your property/ land details.

Verify Land Records

You need to enter the registration office details, registration number, and registration year and captcha code. Then click on the see details button to verify your property/ land details.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...