Last updated: December 16th, 2024 12:16 PM

Last updated: December 16th, 2024 12:16 PM

How to Change GST Email

During the GST registration process, an email and mobile number of the authorised signatory is obtained and verified. To ensure that there is sufficient notice for major transactions to the authorised signatory, the GSTN sends the details to the registered email address provided at during the time of registrations. In some cases, the authorised signatory might wish to change the GST email id provided. In such cases, you can follow the steps provided below:Step 1: Find your GST Jurisdiction

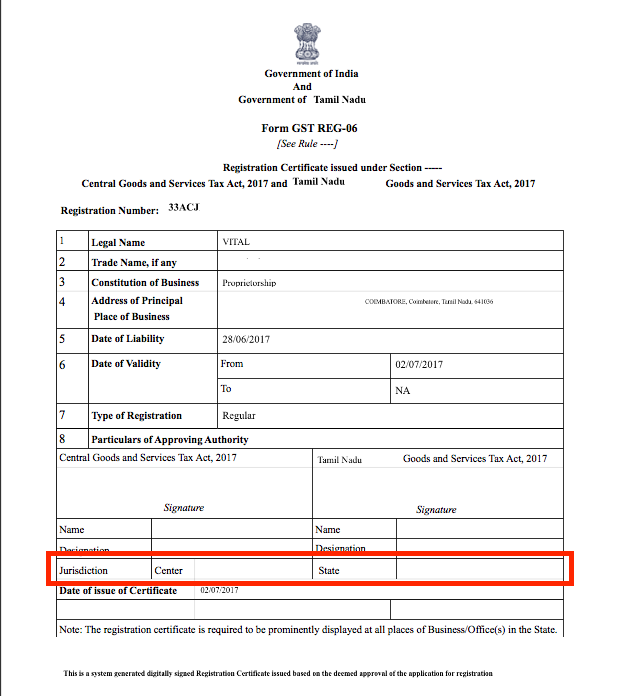

To change GST email of the authorised signatory, the relevant jurisdictional Tax Officer must be approached. You can find GST jurisdiction, in the GST Portal under the My Profile section or on your GST registration certificate. Find the nearest GST Office and the concerned officer based on your Jurisdiction.

Step 2: Visit the GST Office

Once you have determined the relevant Jurisdictional Tax Officer and office, approach the Officer or the nearest GST Seva Kendra with the relevant documents. The taxpayer shall provide documents such as identity proof, address proof, board resolution for change of email id and other relevant documents to validate the change of email id on GST Portal. The concerned GST officer shall verify the status of the person whether the individual belongs to a Stakeholder or Authorized Signatory for that GSTIN in the system. After making a positive identification, the GST officer uploads the sufficient proof in support to authenticate the change of GST email id on the GST Portal and complete the process.Step 3: GST Email ID Changed

After the change of email id on the GST portal, the Portal sends a confirmation message to the new email address as entered by the Tax Officer in your jurisdiction. After the change, you will have to log in to the GST Portal and log in using the First time login link. After logging into the Portal for the first time the taxpayer shall enter the username and password using the data emailed to the updated e-mail address of the Primary Authorized Signatory. After setting the password, the GST Portal registers the new e-mail address.Powers of Jurisdictional Officer

The GST Jurisdictional Officer only has powers to change the email id linked to an existing Authorised signatory. In case a new Authorised Signatory must be added, then the taxpayer must follow the procedure for GST amendment. Also, a Jurisdictional Officer can mark an existing promoter/ partner as a Primary Authorized Signatory after proper authentication, if the GST amendment process is completed. Learn more about GST Registration or GST Return FilingPopular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...