Last updated: December 16th, 2024 12:20 PM

Last updated: December 16th, 2024 12:20 PM

How to Change GST Mobile Number

The GST Portal utilises various safeguards to ensure that there is no misuse of the GST account of a taxpayer. Hence, during the GST registration process, a mobile number is requested on the GST Portal and OTP verification is completed. After obtaining GST registration, the GST Portal sends the OTP for various transactions like making GST payment, filing GST returns, allowing GST API access, etc., Hence, its important for the taxpayer to provide a permanent and readily available mobile number during the GST registration process. Due to various reasons, if you would now like to change the GST mobile number, follow the steps below:Step 1: Check your GST Registration Certificate

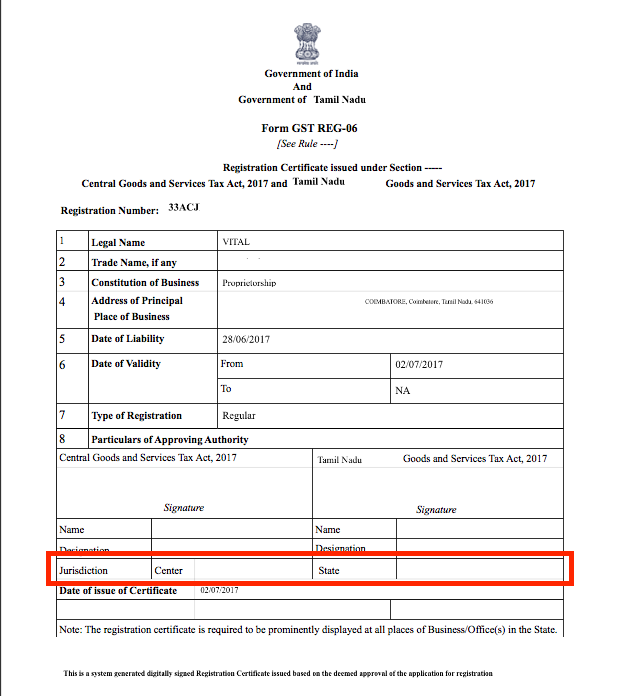

To change GST mobile number, the relevant jurisdictional Tax Officer must be approached. To find GST jurisdiction, see the GST registration certificate issued to you or in the GST Portal under the My Profile section. Choose the jurisdiction under which the GST registration obtained. [caption id="attachment_34062" align="aligncenter" width="623"] Find GST Jurisdiction

Find GST Jurisdiction

Step 2: Approach the Relevant Jurisdictional Tax Officer

Once you have determined the relevant Jurisdictional Tax Officer, approach the Officer or the nearest GST Seva Kendra with the relevant documents. You will have to provide documents like identity proof, address proof, board resolution for change of mobile number and other relevant documents to validate the business details related to your GSTIN. The concerned GST officer verifies the status of the concerned as to whether a Stakeholder or Authorized Signatory for that GSTIN in the GST system. After making a positive identification, the GST officer shall upload sufficient proof in support to authenticate the change of GST mobile number on the GST Portal.Step 3: GST Mobile Number Changed

After resetting or changing the mobile number on the GST portal, username and temporary password reset automatically and the portal sends the details to the registered email address on the GSTIN. After resetting and logging into the portal for the first time, the user shall provide the new user name and password using the link sent to the e-mail address of the Primary Authorized Signatory.Powers of Jurisdictional Officer

The GST Jurisdictional Officer only has powers to change the mobile number linked to an existing Authorised signatory. In case a new Authorised Signatory must be added, then the taxpayer must follow the procedure for GST amendment. Also, a Jurisdictional Officer can mark an existing promoter/ partner as a Primary Authorized Signatory after proper authentication, if the GST amendment process is completed. Learn about GST Registration or GST Return FilingPopular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...