Last updated: March 12th, 2020 1:15 PM

Last updated: March 12th, 2020 1:15 PM

Checklist for Due Diligence of Company

Due diligence of a company is usually performed before the business sale, private equity investment, bank loan funding, etc., In the due diligence process, the financial, legal and compliance aspects of the company are usually reviewed and documented. In this article, we review the process for due diligence of a company (Private Limited Company or Limited Company) and provide a checklist for those performing due diligence on a company in India.

Business Due Diligence

A business due diligence is usually performed prior to the purchase of a company or investment in a company by the acquirer or investor ("Buyer"). It is the responsibility of the seller of the business or shares ("Seller") to provide the documents and information necessary for performing a due diligence on the company to the buyer. A due diligence helps the buyer take an informed investment decision and mitigate risks associated with a business purchase transaction. Both parties usually enter into a non-disclosure agreement prior to starting a business due diligence as sensitive financial, operational, legal and regulatory information would be divulged to the buyer during the due diligence process.

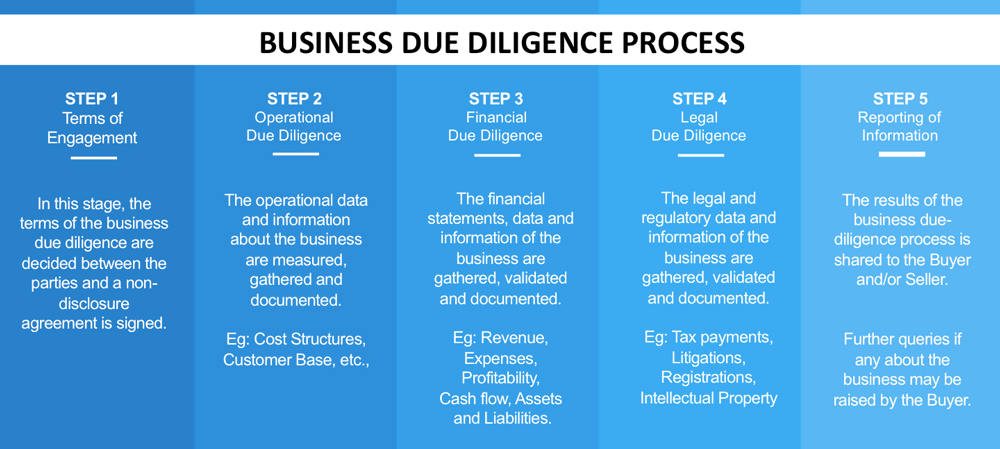

Business Due Diligence Process

Business Due Diligence Process

Documents Required During Company Due Diligence

Usually, the following information and documents pertaining to a private limited company or limited company are required for performing due diligence:

- Memorandum of Association

- Articles of Association

- Certificate of Incorporation

- Shareholding Pattern

- Financial Statements

- Income Tax Returns

- Bank Statements

- Tax Registration Certificates

- Tax Payment Receipts

- Statutory Registers

- Property Documents

- Intellectual Property Registration or Application Documents

- Utility Bills

- Employee Records

- Operational Records

Review of MCA Documents

Most of the due diligence of a company starts with the Ministry of Corporate Affairs. On the Ministry of Corporate Affairs website, the master data about a company is made publicly available. Further, with the payment of a small fee, all documents filed with the Registrar of Companies is made available to anyone. This information from the MCA website is usually verified first. The documents and information gathered in this step include:

- Company Information

- Date of Incorporation

- Authorised Capital

- Paid-up Capital

- Date of Last Annual General Meeting

- Date of Last Balance Sheet

- Status of the Company

- Director Information

- Directors of the Company

- Date of Appointment of Directors

- Charges Registered

- Details of Secured Lenders of the Company

- Quantum of Secured Loans

- Documents

- Certificate of Incorporation

- Memorandum of Association

- Articles of Association

In addition to the above, the financial information of the company and other filings with the MCA pertaining to various aspects of the company can be downloaded and reviewed. The review of MCA documents of the company would provide a good overview of the company to the person performing the due diligence.

Review of Articles of Association

It is very important to review the articles of association of a company during the due diligence process to ascertain the different classes of equity shares and their voting rights. The articles of association of a company can restrict the transfer of shares of a company. Thus, the articles of association should be studied carefully to ascertain the procedure for transfer of shares.

Review of Statutory Registers of Company

Under Companies Act, 2013, a private limited company is required to maintain various statutory registers pertaining to share allotment, share transfer, board meetings, the board of directors, etc., Therefore, the statutory registers of a company must be reviewed to obtain and validate information pertaining to directorship and shareholding.

Review of Book of Accounts and Financial Statements

All companies are required to maintain the book of accounts along with detailed transaction information by the Companies Act, 2013. Hence, detailed financial transaction information must be audited and verified against the financial statements prepared by the company. Some of the matters relevant during the business financial due diligence process are:

- Verification of bank statements

- Verification and valuation of all assets and liabilities

- Verification of cash flow information

- Verification of all financial statements against transactional information

Review of Taxation Aspects

Taxation aspects of a company must be thoroughly checked during the due diligence process to ensure that there are no unforeseen tax liabilities created on the company in a future date. The following aspects relating to the taxation aspect of a company must be checked:

- Income tax return filed

- Income tax paid

- Calculation of income tax liability by the company

- ESI / PF Returns Filed

- ESI / PF Payments

- ESI / PF Payment Calculation

- Service Tax / VAT Returns Filed

- Service Tax / VAT Payments

- Basis for Service Tax / VAT Payment Calculation

- TDS Returns

- TDS Payments

- TDS Calculations

Review of Legal Aspects

A comprehensive legal audit of the company must be performed by a legal practitioner to ascertain if there are any pending legal actions, suits by or against the company and liability in each. Further, the following aspects must be checked during the legal due diligence:

- Legal due diligence for all real estate properties of the company.

- No objection from Secured Creditor for transfer of the company.

- Verification of court documents and court filings, if any.

Review of Operational Aspects

It is important to obtain a thorough understanding of the business model, business operations and operational information during the due diligence process. The review of operational aspects must be extensive including site visits and employee interviews. Following are aspects that must be covered and documented in the operational aspects review:

- Business Model

- Number of Customers

- Number of Employees

- Production Information

- Vendor Information

- Machinery Information

- Utilities

In addition to the above, based on the business and business model, other operational aspects may be important. Those aspects must be thoroughly checked and documented during the due diligence process.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...