Last updated: July 1st, 2024 5:34 PM

Last updated: July 1st, 2024 5:34 PM

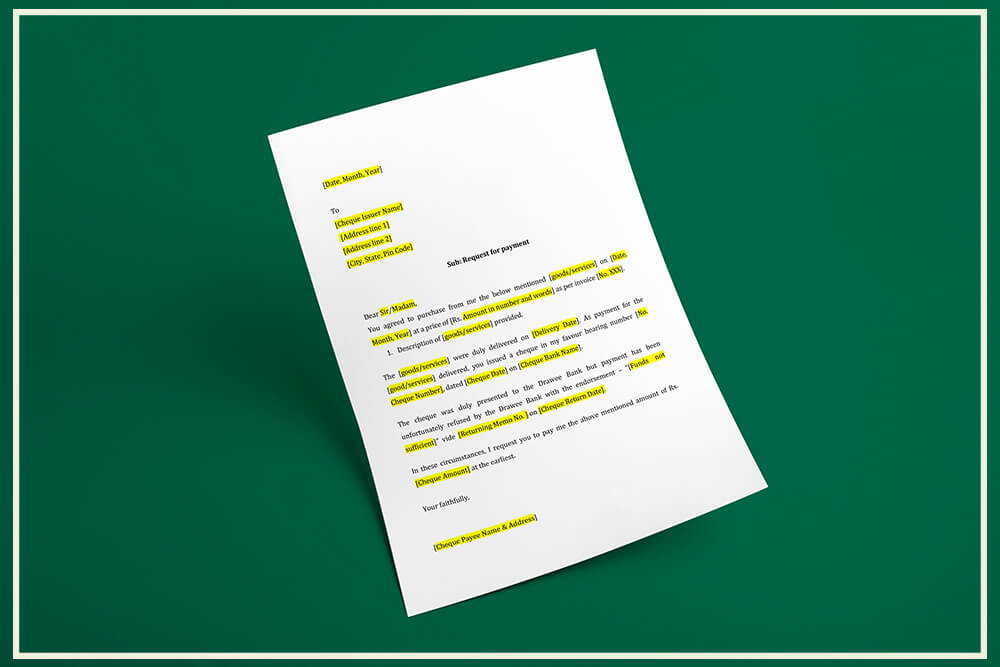

Cheque Bounce Notice Format

Cheque bounce or cheque non-payment in a serious offence in India punishable with imprisonment or fine under Section 138 of the Negotiable Instruments Act. In case of cheque bounce, a cheque beneficiary must present the cheque issuer with a cheque bounce notice under section 138 within 30 days of return of the cheque to protect his/her rights under Section 138 of the Negotiable Instruments Act. Cheque bounce notice is a firm and serious intimation to the cheque issuer that the cheque beneficiary will proceed with legal action if payment for the cheque is not made immediately. For a cheque bounce notice to be valid, it must contain reference to Section 138 of the Negotiable Instruments Act, information about when the cheque was presented, the reason for non-realization of payment and a request to the cheque issuer to arrange for payment immediately through alternate means. A Section 138 Notice must be presented to the cheque issuer within 30 days of return of cheque due to be valid.Download Cheque Bounce Notice Letter Format

You can also download the Cheque Bounce Notice letter format in the following formats.How to Issue Cheque Bounce Notice

Cheque bounce notice or Section 138 notice can be easily created using the IndiaFilings Live Edit feature. Once the document is created, it can be printed on a plain white paper or letterhead of the business and delivered to the cheque issuer. The cheque bounce notice must contain the name of the cheque beneficiary, check issuer name and address, date of return of cheque, reason for return of cheque, request to make arrangement for alternate payment immediate and the words that the notice is issued under Section 138 of the Negotiable Instrument Act. Its important to send the Cheque Bounce notice through registered post, so that the date of issuing notice can be recorded formally. One copy of the letter can be retained by the cheque's beneficiary while the other copy is delivered to the cheque issuer through registered post.When Cheque Bounce Notice Can Be Issued

To issue a cheque bounce notice and get legal recourse, the following conditions must be satisfied:- The cheque must have been provided towards a liability.

- The cheque should have been presented by the beneficiary within a period of 6 months of its validity.

- The cheque must have been returned by the bank due to insufficient funds.

- The payee makes a demand for the payment by giving a cheque bounce notice in writing, within 30 days of the receipt of information by him from the bank that funds are insufficient.

- The cheque drawer fails to make payment of the said amount of money within 15 days of the receipt of the cheque bounce notice.

- Legal action is initiated within one month of the date on which the cause-of-action arises.

Initiating Legal Action for Cheque Bounce

The following steps must be followed to issue a cheque bounce notice and take legal action:- Cheque bounce notice must be issued by the payee to the defaulter, within 30 days of dishonor of cheque, by registered post (or Speed Post) acknowledgement due. The cheque bounce notice must be proper format, with information like nature of transaction, amount, date of cheque deposit, date of cheque bounce, reason for cheque bounce and request to make payment within 15 days.

- If the cheque defaulter fails to make payment within 15 days of cheque bounce notice, the payee should file a criminal case in a court within 30 days from the expiry of notice period of 15 days. Cheque bounce complaints must be filed in a court in the city where the cheque was presented.

- Once the case is filed, the court will hear the case and issue summons under Section 138 of the Negotiable Instruments Act.

- The cheque defaulter would then have to submit surety and appear before the Court for resolution of the matter.

Section 138 of Negotiable Instruments Act

138. Dishonour of cheque for insufficiency, etc., of funds in the account. Where any cheque drawn by a person on an account maintained by him with a banker for payment of any amount of money to another person from out of that account for the discharge, in whole or in part, of any debt or other liability, is returned by the bank unpaid. either because of the amount of money standing to the credit of that account is insufficient to honour the cheque or that it exceeds the amount arranged to be paid from that account by an agreement made with that bank, such person shall be deemed to have committed an offence and shall, without prejudice. to any other provision of this Act, be punished with imprisonment for a term which may extend to one year, or with fine which may extend to twice the amount of the cheque, or with both: Provided that nothing contained in this section shall apply unless:- The cheque has been, presented to the bank within a period of six months from the date on which it is drawn or within the period of its validity, whichever is earlier;

- The payee or the holder in due course of the cheque as the case may be, makes a demand for the payment of the said amount of money by giving a notice, in writing, to the drawer of the cheque, within fifteen days of the receipt of information by him from the bank regarding the return of the cheque as unpaid; and

- The drawer of such cheque fails to make the payment of the said amount of money to the payee or, as the case may be, to the holder in due course of the cheque, within fifteen days of the receipt of the said notice. Explanation.-For the purposes of this section, "debt or other liability" means a legally enforceable debt or other liability.

Section 141 of Negotiable Instruments Act - For Companies

242. Offences by companies. If the person committing an offence under section 138 is a company, every person who, at the time the offence was committed, was in charge of, and was responsible to, the company for the conduct of the business of the company, as well as the company, shall be deemed to be guilty of the offence and shall be liable to be proceeded against and punished accordingly: Provided that nothing contained in this sub-section shall render any person liable to punishment if he proves that the offence was committed without his knowledge, or that he had exercised all due diligence to prevent the commission of such offence. Where any offence under this Act has been committed by a company and it is proved that the offence has been committed with the consent or connivance of, or is attributable to, any neglect on the part of, any director, manager, secretary or other officer of the company, such director, manager, secretary or other officer shall also be deemed to be guilty of that offence and shall be liable to be proceeded against and punished accordingly.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...