Last updated: December 19th, 2019 5:06 PM

Last updated: December 19th, 2019 5:06 PM

Chhattisgarh Property Tax

In Chhattisgarh, property tax is levied by the state Municipal Corporation on the value of the property or real estate. Property owners are liable to remit property tax to the Department of the Urban Administration and Development of Chhattisgarh. The property tax imposed on property differs from state to state. In this article, we view the various aspects of Chhattisgarh property tax.Importance of Property Tax

In India, property tax is one of the primary revenue sources for Municipal Corporations. All residential, commercial, industrial situated within the limits of the Municipal Corporation are assessed for tax and are expected to pay property tax. Property tax is imposed on every financial year of the same month, and a citizen is liable is file return on the same day.Types of Property Tax

The following are the kinds of property that are liable to be taxed in Chhattisgarh.- Residential

- Commercial

- Industrial

Eligibility Criteria

The person is eligible to pay property tax under the following conditions is explained below:- A person whose age is above 18 years of age.

- An individual who is a permanent resident in the state of Chhattisgarh.

- Any person who owns a property in Chhattisgarh is entitled to pay a property tax.

Exemption on Property Tax

An individual who is exempted from paying property tax under section 136 are listed below:- The land or property maintained by the Devasthan Department of the State Government.

- Any land or property used for public worship or public purpose.

- Land hold for the purposes connected with the disposal of dead bodies.

- Land utilised by an educational institution solely for purposes of education.

- Land for the cause of public parks public libraries or public museums.

Property Registration

Before making payment for property tax, the taxable person is responsible for registering their property by filing the application form for property registration and furnish the same application along with the required documents to the concerned authority of the Municipal Corporation.Required Document

The applicant will be expected to submit the property tax invoice details at the time of making payment for property tax.Online Payment Procedure for Property Tax

To make payment for property tax online in Chhattisgarh, follow the steps specified here.Visit the Official Website

Step 1: Kindly visit the official website of Chhattisgarh Municipal. Step 2: Select your particular corporation from the home screen of the portal and click on the “Go” button. [caption id="attachment_65724" align="aligncenter" width="739"] Chhattisgarh Property Tax - Image 1

Chhattisgarh Property Tax - Image 1

Self Assessment of Property Tax

Step 3: On the next screen, click on “Self-assessment” tab and enter your property ID and press “Submit” button. [caption id="attachment_65726" align="aligncenter" width="711"] Chhattisgarh Property Tax - Image 2

Chhattisgarh Property Tax - Image 2

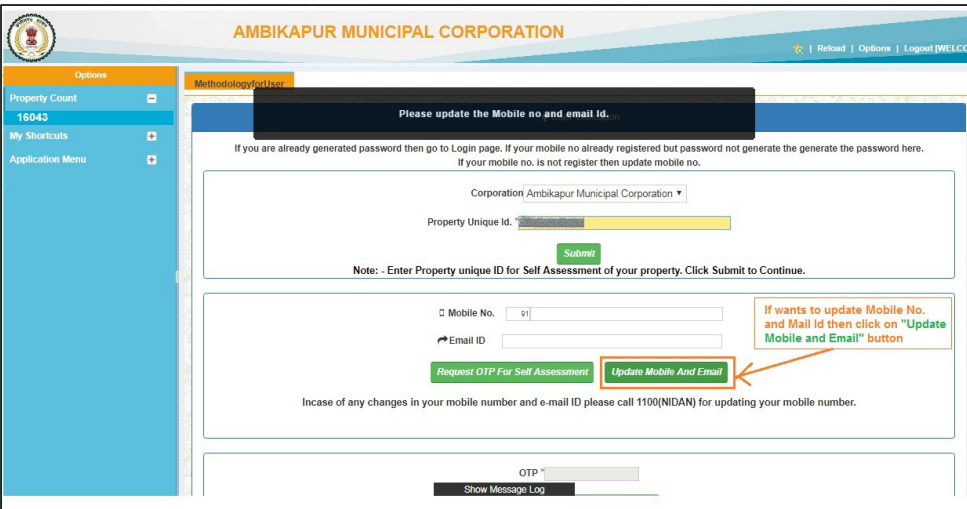

Update your Mobile Number

Step 4: If needed the user can now update their mobile number and email id by clicking on “Updating mobile and email” or else click on “Request OTP for self-assessment” link. [caption id="attachment_65727" align="aligncenter" width="791"] Chhattisgarh Property Tax - Image 3

Step 5: Enter your mobile number and email id for which you want to change and click on “Request OTP for update” button.

[caption id="attachment_65728" align="aligncenter" width="713"]

Chhattisgarh Property Tax - Image 3

Step 5: Enter your mobile number and email id for which you want to change and click on “Request OTP for update” button.

[caption id="attachment_65728" align="aligncenter" width="713"] Chhattisgarh Property Tax - Image 4

Chhattisgarh Property Tax - Image 4

Request for OTP

Step 6: After clicking on Request OTP for Update button, the user will be got OTP in registered Mobile Number, enter OTP in the text box and click on “Verify and Update” button. [caption id="attachment_65729" align="aligncenter" width="758"] Chhattisgarh Property Tax - Image 5

Step 7: Click on “Request OTP for Self Assessment” tab.

Step 8: After clicking on Request OTP for Self Assessment button, again user will get OTP in registered Mobile Number, enter OTP in the text box and click on “Submit OTP for Self Assessment” Button.

[caption id="attachment_65733" align="aligncenter" width="622"]

Chhattisgarh Property Tax - Image 5

Step 7: Click on “Request OTP for Self Assessment” tab.

Step 8: After clicking on Request OTP for Self Assessment button, again user will get OTP in registered Mobile Number, enter OTP in the text box and click on “Submit OTP for Self Assessment” Button.

[caption id="attachment_65733" align="aligncenter" width="622"] Chhattisgarh Property Tax - Image 6

Chhattisgarh Property Tax - Image 6

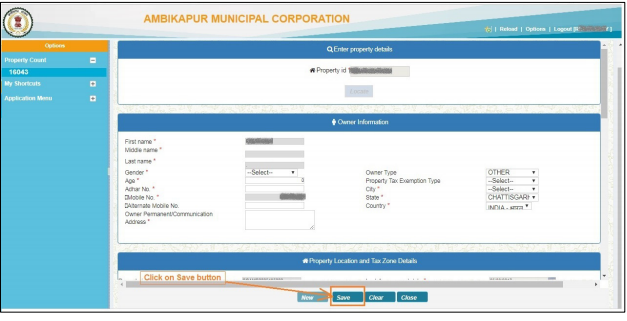

View Self Assessment for Property

Step 9: By Clicking on “Submit OTP for self-assessment” tab the current page will be redirected to the self-assessment page, where the user can make self-assessment for his/her property and click on ”Save” button. [caption id="attachment_65735" align="aligncenter" width="627"] Chhattisgarh Property Tax - Image 7

Step 10: Now press ” Yes” button to proceed further.

[caption id="attachment_65736" align="aligncenter" width="626"]

Chhattisgarh Property Tax - Image 7

Step 10: Now press ” Yes” button to proceed further.

[caption id="attachment_65736" align="aligncenter" width="626"] Chhattisgarh Property Tax - Image 8

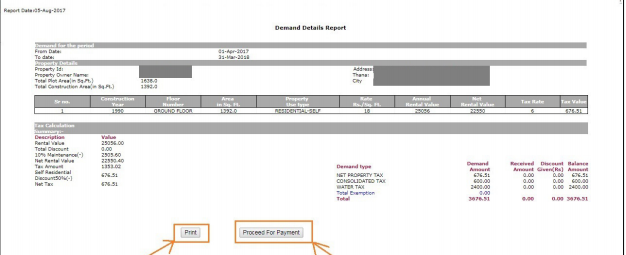

Step 11: The demand report will be generated the user can save and print the report.

[caption id="attachment_65739" align="aligncenter" width="626"]

Chhattisgarh Property Tax - Image 8

Step 11: The demand report will be generated the user can save and print the report.

[caption id="attachment_65739" align="aligncenter" width="626"] Chhattisgarh Property Tax - Image 9

Chhattisgarh Property Tax - Image 9

Proceed for Payment

Step 12: Click on “Proceed for payment” button for paying the property tax. Step 13: After completing the self-assessment of property. Click on “Pay now” for online payment. [caption id="attachment_65741" align="aligncenter" width="625"] Chhattisgarh Property Tax - Image 10

Step 14: Then the page will be redirected to the tax Payment page, select “Payment Gateway” in the mode of payment and click “Save” button.

Chhattisgarh Property Tax - Image 10

Step 14: Then the page will be redirected to the tax Payment page, select “Payment Gateway” in the mode of payment and click “Save” button.

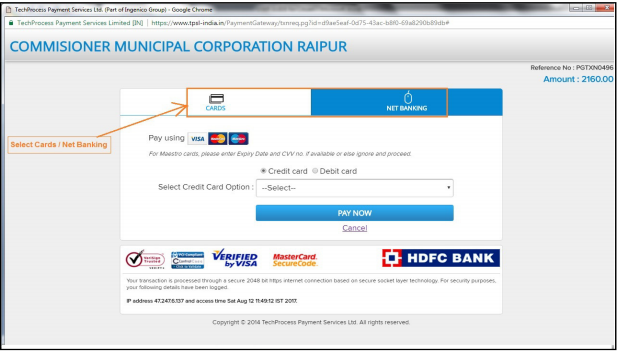

Choose Mode of Payment

Step 15: Select the payment method either payment is done by card or net banking and click on “Pay now” button. [caption id="attachment_65745" align="aligncenter" width="617"] Chhattisgarh Property Tax - Image 11

Step 16: If you want to make payment through card enter your card details.

Chhattisgarh Property Tax - Image 11

Step 16: If you want to make payment through card enter your card details.

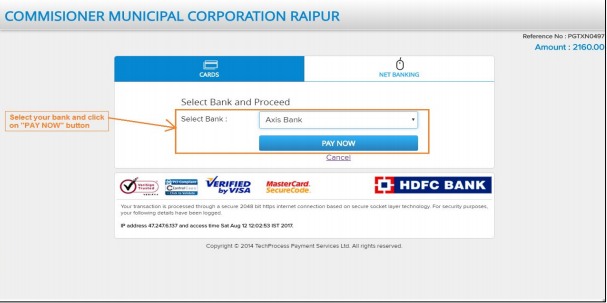

Select the Appropriate Bank

Step 17: If you want to make payment through net banking select your respective bank. [caption id="attachment_65750" align="aligncenter" width="607"] Chhattisgarh Property Tax - Image 12

Step 18: Enter your login id and password of net banking and make payment for your amount displayed on the screen.

Step 19: After making payment online, the receipt will be generated for further reference, and that can be taken printout.

Chhattisgarh Property Tax - Image 12

Step 18: Enter your login id and password of net banking and make payment for your amount displayed on the screen.

Step 19: After making payment online, the receipt will be generated for further reference, and that can be taken printout.

Offline Payment Procedure for Property Tax

To make an offline payment for property tax in the state of Chhattisgarh, follow the steps mentioned below:Generate Challan

Step 1: The user has to generate the challan from the portal to make offline payment for property tax. Step 2: To generate challan follow the same steps which are mentioned above for performing self-assessment. Step 3: Then click on “Pay later” tab for paying offline property tax. Step 4: The challan will be generated, the user can take the printout of the challan.Approach Municipal Corporation Office

Step 5: The user has to visit the respective municipal corporation office within seven days from the date of challan generated.Make Payment

Step 6: Then make payment in the cash counter as per the evaluated amount of your property type.Receive Acknowledgement Receipt

Step 7: The user will be provided with acknowledgement receipt as the confirmation of payment.Collect Property Tax Bill

Step 8: The user with the help of receipt can collect his/her property tax bill from the same municipal corporation office.Validity of Property Tax

The property tax documents are valid for one year. Therefore it has to be renewed every year.Penalty for Not Paying Tax

If a taxpayer refuses to pay the tax within the specified time limit, the assessing authority may impose a penalty which will be equal to five times of the rate of property tax imposed.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...