Last updated: September 30th, 2021 4:52 PM

Last updated: September 30th, 2021 4:52 PM

Clarification on PLI Scheme for White Goods

The Department for Promotion of Industry and Internal Trade (DPIIT) has issued further Clarification on provisions of the PLI Scheme for White Goods vide a Circular dated 11.02.2021. The Circular contains clarifications on various issues of the PLI Scheme for White Goods in the form of frequently asked questions (FAQs). The Production Linked Incentive (PLI) Scheme for White Goods (PLIWG) provides financial incentives to boost domestic manufacturing and attract large investments in the White Goods manufacturing value chain. In the present article, we are covering the Clarifications issued by the DPIIT in respect of the QRMP Scheme.The objective of the PLI Scheme for White Goods

The objective of the scheme is to boost domestic manufacturing and facilitate the development of a robust ecosystem for component manufacturing across the value chain in the country for Air conditioners (ACs) and LED Lights.- The primary objective of the scheme is to remove sectoral disabilities

- The scheme also aims to create economies of scale and to enhance exports

- PLI Scheme for White Goods' objective is to create a robust component ecosystem and employment generation.

Incentive Offered

The PLI Scheme for White Goods shall extend an incentive of 4% to 6% on net incremental sales (net of taxes) over the base year (FY 2019-2020) of goods manufactured in India or net incremental sales of eligible products over the base year or FY 2020-21, whichever is higher.Eligible Applicant for PLI Scheme

The eligible applicant under the Production Linked Incentive Scheme for White Goods is as follows:- Any company incorporated in India and as defined under the provisions of the Companies Act 2013 and Companies Act, 1956, to manufacture one or more eligible products under the specified target segments are eligible for the scheme.

- Any company incorporated in India and as defined in the Companies Act 2013, proposing to manufacture one or more eligible products under the specified target segment can be an applicant.

Pre-Qualification Criteria under PLI Scheme

- The applicant should be a company incorporated in India under the provisions of the Companies Act, 2013

- Foreign (non-resident) investment in the Applicant Company shall comply with the FDI Policy 2020, as amended from time to time

- An applicant must propose setting up of greenfield or brownfield project for manufacturing of one or more eligible products under any investment category in the respective target segment as defined in the scheme guideline

- An applicant should commit to setting up manufacturing facilities to manufacture eligible products along with appropriate quality and testing facilities conforming to prescribed Standards commensurate with committed incremental sales

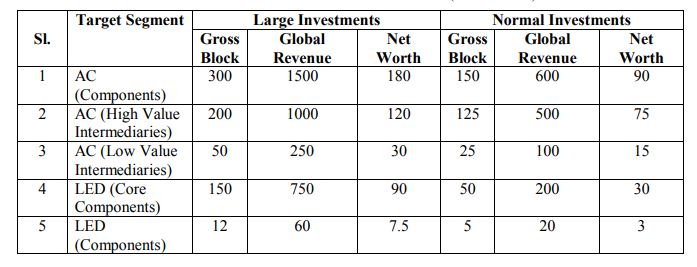

- The minimum amount of (i) Gross Block (ii) Global Revenue (iii) Net Worth of the applicant and its group companies (Indian or overseas) as of 31 March 2020 or 31 March 2021 shall be as under:

Clarification on PLI Scheme for White Goods - Initial Investment Period

Clarification on PLI Scheme for White Goods - Initial Investment Period

- Value-Added Resellers shall not qualify under the scheme

- The applicant and its group company should neither have been declared as bankrupt or willful defaulter or defaulter nor reported as fraud by any bank or financial institution or non-banking financial company

- An applicant availing benefits under any other PLI scheme of the Government of India for the same product shall not be eligible under this PLI scheme

Eligible Products under PLI Scheme

Support under the PLI Scheme will be provided to companies engaged in manufacturing components of Air Conditioners and LED Lights in India. The list of Target segments and Eligible products are as under:Target Segment and Eligible Products – Air Conditioners

ACS (Components)- High-value Intermediaries of ACs

- Low-Value Intermediaries of ACs

- A combination of High-value Intermediaries of ACs and Low-Value Intermediaries of ACs

- Compressors including oil-free and high capacity

- Copper Tube (plain and/or grooved)

- Aluminum Stock for Foils or Fins for heat exchangers

- Control Assemblies for IDU or ODU or Remotes

- Display Panels (LCD/LED)

- Motors

- Cross Flow Fan (CFF)

- Valves & Brass components

- Heat exchangers

- Sheet Metal components

- Plastic Moulding components

Target Segment and Eligible Products – LED Lights

LED (Core Components)- LED Chip Packaging

- Integrated Circuits (ICs)

- Resistor

- Fuses

- Large-scale investments in LED components

- LED Chips

- LED Drivers

- LED Engines

- LED Modules

- Printed Circuit Boards (PCB) including Metal clad PCBs

- Mechanicals- Housing

- Wire Wound Inductors

- Drum Corps

- Heat Sinks

- Diffusers

- Ferrite Cores

- LED Light Management Systems (LMS)

- Resistors

- Fuses

- Capacitors

- LED Transformers

- Laminates for Printed Circuit Boards and Metal Clad PCBs

- Metalized film capacitors

Investment categories

There are two investment categories under each Target segment as given below. An applicant can apply under any one of the following investment categories for anyone target segment:- Large Investment

- Normal Investment

Initial Investment Period (Gestation Period)

The initial Investment period (Gestation period) is the gestation time given for setting up manufacturing facilities to manufacture the eligible products. An applicant may opt for any one of the following initial investment periods- 1st April 2021 to 31st March 2022

- 1st April 2021 to 31st March 2023

Tenure of the Scheme

The tenure of the Scheme shall be from Financial Year 2021- 2022 to Financial Year 2028- 2029.Application Fee

An application fee of Rs.100000 needs to be paid electronically to DGFT for applying the Production Linked Incentive (PLI) Scheme for White Goods. The details of bank account fee payment will be provided on the application portal.Documents Required for PLIWG Application

The following documents are mandatory to apply for Production Linked Incentive (PLI) Scheme for White Goods- Certificate of Incorporation and Corporate Identification Number

- Memorandum of Association

- Article of Association

- IEM/IL

- MSME Registration Certificate

- Importer Exporter Code (IEC) Registration Certificate

- Audited Financial Statement of FY 2019-2020

- Audited Balance Sheet and Profit and Loss Statement of FY2019-2020

- Chartered Accountant Certificate for existing investment in plant and machinery (Gross Block) Net Sales Revenue and Net worth as on 31.03.2020

- Shareholder Structure

- Top 10 Shareholders list as on 31.03.2020

- Resolution from Board of Directors

- Letter authorizing the signing authority

- Technology Transfer Agreement

- Detailed Manufacturing Process note

- Detailed Manufacturing Flow Chart with inputs required in each stage in the process flow chart and the output at each stage of Manufacturing

- Other Business Agreement

Application Procedure for PLI Scheme for White Goods

The application window for the scheme shall be open for a period from 15th June 2021 to 15th September 2021 on the official website of the PLI Scheme for White Goods. The prescribed application form for PLI Scheme for White Goods is as follows: Note: Application may also be invited anytime during the tenure of scheme for any particular segment- One entity may apply for one category under one target segment only. However, separate Group companies may apply for different target segments.

- The applicant needs to declare the following details on the application for statically purposes :

- Yearly plan Details

- Domestic Value Addition

- Employment Generation

- Exports during the tenure of the scheme

- Upon successful submission of an application, an acknowledgment with a unique Application ID number shall be communicated to the applicant over email as well as through SMS. This acknowledgment shall be constructed as approval under the scheme.

- In case an application is submitted on the last day of the application window, the PMA shall inform the about the deficiency in the application to the applicant within 15 days of submission. After that applicant needs to submit the application completed in all respect by the last day of the month following the date of application window closure. The acknowledgment will thereafter be issued by the PMA.

- The net incremental sales of the eligible products manufactured in the Financial year following the investment period opted by the applicant shall be considered for incentive.

Application Processing

- The PMA will process the applications and make appropriate recommendations for approvals under the scheme to DPIIT.

- Applicants are recommended by PMA shall be considered for approval by DPIIT. The selection of applicants will be finalized within 60 days from the date of closure of the application window.

- Selected applicants need to submit a bank guarantee along with undertakings of an amount equivalent to 0.5% of the committed investment in favor of DPIIT valid for 18 months from the date of the proposed date of commercial production.

- The bank guarantee will be invoked if the actual commercial production is not achieved within 1 year of the originally proposed date of commercial production.

Disbursement of Incentives

For calming incentives under the PLI scheme, applicants shall be required to submit claims for disbursement of incentives to the PMA online. The prescribed application form claiming Incentives under Production Linked Incentive (PLI) Scheme for White Goods is attached here for reference: The actual disbursement of PLI for a respective year will be after that year. An applicant shall submit a claim for disbursement of incentive on annual basis for the sales made in a financial year along with its audited financial statements. Claim for disbursement of incentive shall be filled by the applicant latest by 31st October in the following financial year to which the claim pertains. The PMA shall process the claim for disbursement of incentive within 45 days from the date of receipt of such claim along with all supporting documents and make appropriate recommendations to DPIIT. Upon approval of claims by DPIIT, the disbursement of incentive will be done by way of Direct Bank Transfer through PFMS.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...