Last updated: August 30th, 2021 1:01 PM

Last updated: August 30th, 2021 1:01 PM

Company Share Certificate

A share certificate is a document issued by a company evidencing ownership of shares of the company, as per the details specified in the document. Companies Act requires the company to issue share certificates post-incorporation of the company and in the article, we look at the procedure for issuing company share certificate and other relevant regulations.

Face Value of Share Certificate

The face value or nominal value of shares mentioned on the share certificate must be as per the Memorandum of Association and Articles of Association of the Company. Shares of a company not listed on any stock exchange can have a nominal value of Rs.1, or Rs.10, or Rs.100 or Rs.1000 as per the requirements of the promoters.

Shares listed on any stock exchange but not in DEMAT form should have a face value of Rs.10. Debentures listed in any stock exchange but not in DEMAT form should have a face value of Rs.100/-

Issuing Share Certificates

Post incorporation of a company, the company is required to issue share certificates within a period of two months from the date of incorporation. In case of allotment of additional shares to new or existing shareholders, share certificates must be issued within a period of two months from the date of allotment of shares. In case of transfer of shares, share certificates must be issued to the Transferee within one month of the date of receipt of the instrument of transfer by the Company.

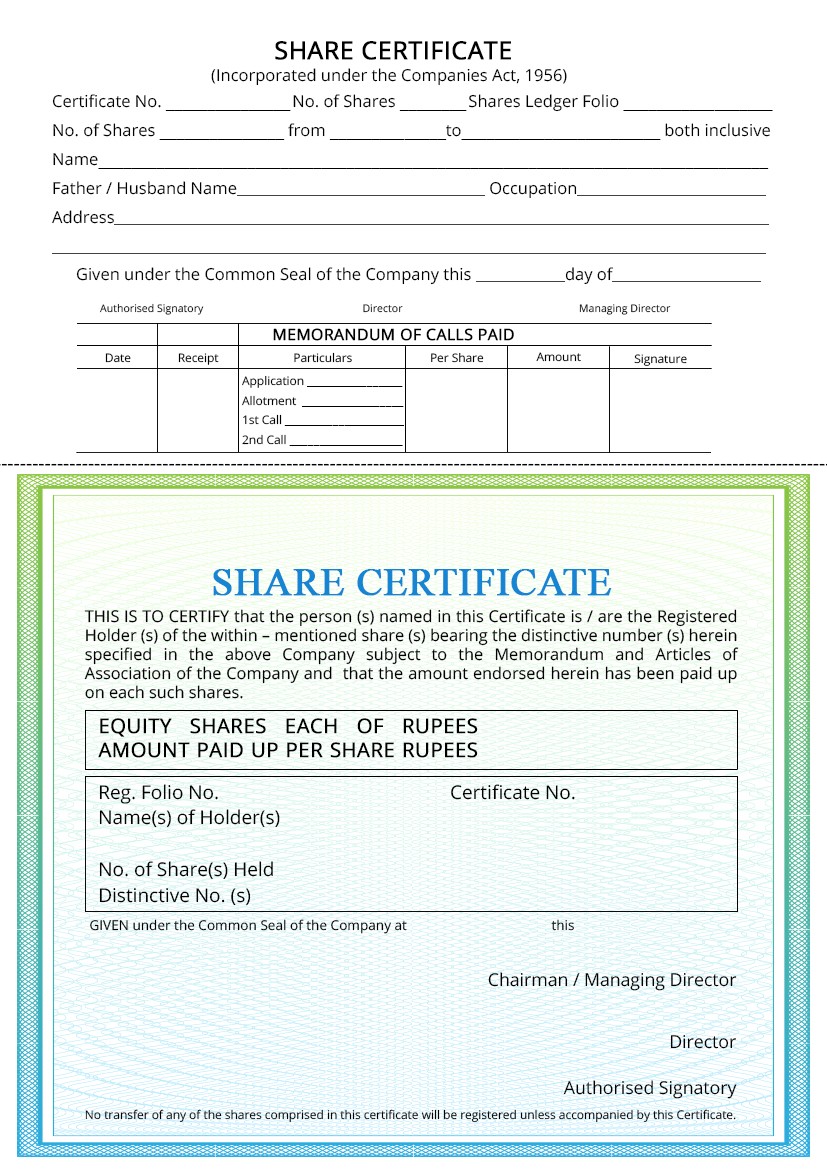

[caption id="attachment_44301" align="aligncenter" width="827"] Share Certificate Format

Share Certificate Format

Details Mentioned in Share Certificate

All share certificate of a company-issued in India must have the following information mentioned on the share certificate.

- The share certificate should be issued in Form SH-1 or any document that resembles Form SH-1

- Name of the Company

- CIN Number of the Company

- Registered Office of the Company

- Name of the owners of the shares

- Folio number of the member

- Number of shares represented by the share certificate

- Amount paid on the shares

- Distinctive number of shares

- Number of share certificate

Procedure for Issuing Share Certificates

The company requires to provide one certificate to a member for all his shares without payment of any charges. If a shareholder requests more than one certificate, then the company can issue additional shares for payment of Rs.20 per each share certificate.

Must issue share certificate at allotment or subscription or at the time of Incorporation. A Board resolution should be passed in the Board Meeting for the issue of Certificate. The prepared share certificates must conform to the standards mentioned above and should be issued under the signature of two Directors or Company Secretary or any other person authorized by the Board of Directors.

The share certificate must be issued from the registered office of the Company and payment of stamp duty on the issue of share certificate must be made as per the Stamp Act of the State. After issuing the share certificate, must enter the details of share certificates into to Register of members maintained under Section 88 of the Companies Act, 2013. Along with Name to who issued and date of issue.

Download Share Certificate Format

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...