Updated on: June 5th, 2019 2:26 AM

Updated on: June 5th, 2019 2:26 AM

TIIC Contractor Credit Scheme

Tamilnadu Industrial Investment Corporation Limited (TIIC) has proposed the contractor credit scheme, which provides financial assistance for government contractors. The contractor credit scheme provides fund for the working capital requirements of civil contractors, general contractors, mining contractors, engineering contractors, etc. In this article, we look at the procedure for availing finance under Contractors Credit Scheme in detail.Objectives of the Scheme

The primary objective of the contractor credit scheme is to facilitate the contractors to undertake timely execution of work orders by providing adequate and need-based credit facility.Eligibility Criteria

The following are the eligible conditions to avail loan under the Contractors Credit Scheme:- The contractors should have been registered under MSME, and large enterprise are eligible for contractor credit scheme.

- The unit must be in existence and operation for the past two financial years to apply for the contractor loan scheme.

- The government provides loan under contractors credit scheme for units who earned a net profit for the last two financial years.

- To obtain a contractor loan, the net worth of the units should be positive and no cumulative losses.

- The units should be in the standard assets category continuously of TIIC/Banks for the last two financial years.

Quantum of Loan

The minimum quantum of assistance under contractor credit scheme will be Rs.20 lakhs, and the maximum quantum of assistance will be Rs.5 crores for limited companies and Rs.2 crores for proprietary or partnership firm.Promoter Contribution

The Promoter Contribution under the contractor credit scheme will be at the rate of 25% of the value of the total project cost.Debt Equity Ratio

The debt-equity ratio fixed for the contractors will be 2:1, including assistance under the scheme.Collateral Security

The collateral security to the extent of 150% of the credit limit sanctioned will be received.Registration Fees

The applicant has to pay the registration fee at the time registration of the application.- The Registration Fee of Rs. 5,000 has to be remitted if the loan is processed by the Branch Sanction Committee (BSC).

- The Registration Fee of Rs. 25,000 has to be remitted if the loan is processed by the Head Office.

Investigation Fees

The investigation fees are inclusive of the registration fees, and the applicant is requested to make an investigation fee before the loan proposal is sanctioned in the prescribed sanction committee.| Loan Amount | Investigation Fee |

| Loans up to Rs.10.00 lakhs | Rs.5000/- |

| Loans above Rs.10 lakhs and up to Rs.50 lakhs | Rs.10000/- |

| Loans above Rs.50 lakhs and up to Rs.100 lakhs | Rs.30,000/- |

| Loans above Rs.100 lakhs and up to Rs.200 lakhs | Rs.40,000/- |

| Loans above Rs.200 lakhs and up to Rs.300 lakhs | Rs.50,000/- |

| Loans above Rs.300 lakhs and up to Rs.2000 lakhs | 0.20% up to a maximum of Rs.2.00 lakhs |

| Loans above Rs.2000 lakhs | Rs.5,00,000/ |

Rate of Interest

The proposed rate of interest charged for the loan amount will be at the rate of 13.20%. For more details about the rate of interest, kindly refer the below-attached pdf.Documents Required

The documents required for applying the contractor loan scheme is explained in detail below:- Audited Balance Sheet

- Trading and Profit Loss account of the applicant

- Associate concern for the last three years

- Bio-data of Promoter, Director, Guarantors as per prescribed format

- Details regarding the assets of the existing unit viz. Building, Land and Machinery

- Copy of Collateral documents with supporting records

- IT Returns for the promoters, Company for the last three years

- Copy of work orders

- Copy of Contract Agreements

- Copy of Registration Certificates

Application Procedure for the Contractor Credit Scheme

To apply for the Contractor Credit Scheme, follow the procedure specified here. Step 1: Kindly approach the official portal of TIIC, Tamilnadu Government. [caption id="attachment_82958" align="aligncenter" width="475"] Contractor Credit Scheme - Image 1

Step 2: Click on “Application form download” under the scheme option, which is displayed on the home screen of the portal.

[caption id="attachment_82959" align="aligncenter" width="637"]

Contractor Credit Scheme - Image 1

Step 2: Click on “Application form download” under the scheme option, which is displayed on the home screen of the portal.

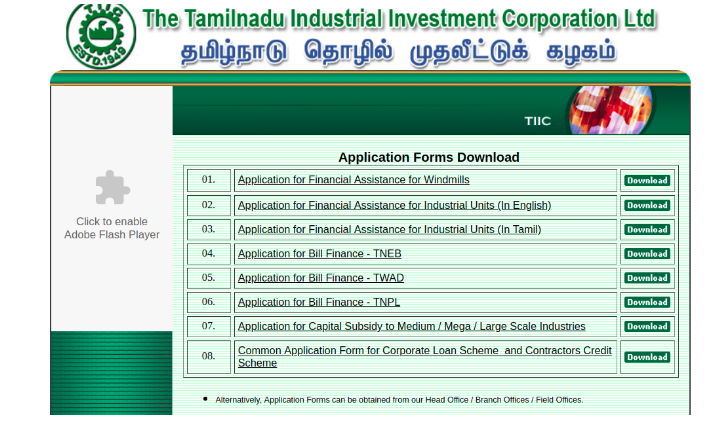

[caption id="attachment_82959" align="aligncenter" width="637"] Contractor Credit Scheme - Image 2

Step 3: Select the particular application form from the list of options shown below.

[caption id="attachment_82960" align="aligncenter" width="597"]

Contractor Credit Scheme - Image 2

Step 3: Select the particular application form from the list of options shown below.

[caption id="attachment_82960" align="aligncenter" width="597"] Contractor Credit Scheme - Image 3

Step 4: Now, the form for the Contractors Credit Scheme will be downloaded.

The application form for the contractor credit scheme is reproduced below in the pdf format for your reference.

Step 5: Fill the application form with the following details and submit to the Head Office or Branch Office of Tamilnadu Industrial Investment Corporation Limited.

Contractor Credit Scheme - Image 3

Step 4: Now, the form for the Contractors Credit Scheme will be downloaded.

The application form for the contractor credit scheme is reproduced below in the pdf format for your reference.

Step 5: Fill the application form with the following details and submit to the Head Office or Branch Office of Tamilnadu Industrial Investment Corporation Limited.

- Name of the unit

- Address of the unit

- Size of the unit

- Constitution

- Amount of Loan Applied

- Type of Industry and Product

- Details of all promoters

- Details of work orders

Repayment Period

The maximum repayment period for the contractor loan is 5 years, including a moratorium of 6 to 18 months for principal repayment, and the repayment can be done in equated monthly instalments. Note: The loan has to be repaid within 1 year from the completion of the project.Refund for rejection of loan application

In case of rejection of loan application, the prescribed fee will be refunded as given below:- The investigation fee paid as the second instalment will be considered for refund at the rate of 50% on fees paid if the applicant withdraws the proposal before sanction. However, the initial registration fees will not be refunded.

- If the corporation or the applicant rejects the loan application withdraws the application after the sanction of loan, no reimbursement will be entertained.

- No refund of investigation fee will be allowed if the contractor availed for 50% concession already.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...