Last updated: August 8th, 2019 10:33 AM

Last updated: August 8th, 2019 10:33 AM

Corp SME Suvidha Scheme

The Corporation Bank has recently launched Corp SME Suvidha Scheme for the GST registered Micro, Small and Medium Enterprises (MSME) units. The primary objective of the Corp SME Suvidha scheme is to provide adequate funding to the units engaged in the manufacturing and services sector, thereby enabling them in meeting the working capital requirements. In this article, Corp SME Suvidha Scheme in detail. To know the procedure for online GST registration click here.Salient Features of the Scheme

The salient features of the Corp SME Suvidha Scheme are given below:- Corp SME Suvidha Scheme provides a competitive interest rate structure in the industry and also has various concessions beneficial for a developing entrepreneur.

- Corporation Bank offers timely, hassle-free and adequate credit delivery to MSME clients for working capital requirements.

Purpose

The Purpose of the Corp SME Suvidha Scheme is to meet Working capital requirements of the borrower entity.Eligibility Criteria

The following are the eligibility criteria for availing loans from the Corporation Bank.- Any units engaged in the manufacturing and services sector including traders are classified as MSME under the MSMED Act, 2006 are eligible to apply for Corp SME Suvidha Scheme.

- The unit should be registered with GST Authority.

- The unit must have completed at least a year of operation.

- The applicant should not have any working capital limit with any other Banks or Financial Institutions (FIs).

Nature of Assistance

The nature of assistance will be in the form of Working Capital limit (Fund based cash credit and Non-Fund based credit).Quantum of Loan

The maximum quantum of the assistance of up to Rs. 5 crores can be obtained to meet the working capital requirements.Security

The securities acquired by the Corporation bank for lending the loan amount are specified here: Primary Security The chargeable current assets, inventory, receivables etc. is considered as the primary security. Collateral Security- The mortgage of residential properties in the personal name of the proprietor, partners, directors and their close relatives, Spouse, parents and children are accepted.

- The property must be self-occupied and should not be leased or tenancy occupied.

- The self-occupied immovable commercial properties including factory land and building owned by the firm or in the personal name of the proprietor, partners and directors can be accepted.

- The property under lease or tenancy will not be considered as collateral security. However, the properties on long term lease from the Industrial Development Corporations which are fully paid and have clear mortgageable rights may be accepted as security.

- The Third Party Property will be accepted as collateral security.

- The Vacant Land, Agricultural Property, property on which educational institutions and religious institutions are operated should not be taken as security.

- The residual age of the property should not be less than 25 years.

- The property needs to be free from all encumbrances and should be exclusive security to the facilities proposed.

Margin

The security coverage based on the market value of the immovable properties should not be less than 75% of the exposure sanctioned. Note: In the case of the collateral security coverage in the means of immovable property less than 100% of the exposure should be covered under CGTSME guarantee “Hybrid Product” scheme for improvement in security coverage. However, the applicable fee for the CGTSME coverage has to be borne by the borrower.Repayment of Loan

The repayment period will depend upon the amount of loan borrowed, and it has to be renewed every year.Rate of Interest

The interest rate linked with the collateral security coverage in the form of immovable properties are given below:| Collateral Security Coverage | Rate of Interest |

| 125% and above | One Year MCLR + 0.10% |

| From 100% to less than 125% | One Year MCLR + 0.60% |

| From 75% to less than 100% | One Year MCLR + 1.10% |

Guarantee

In the case of the partnership firm, LLP and companies, the personal guarantees of the partners, designated partners, promoter directors and owner of the property in all cases are compulsory.Documents Required

The below following documents are to be furnished along with the application form.- Proof of Identity – Voter’s ID, Passport, Driving License, PAN Card, Aadhaar signature identification from present bankers of the proprietor, partner or director

- Proof of residence – report telephone bills, electricity bills, Property tax receipt, Aadhaar /passport/voter’s ID Card of the proprietor, partner or Director (if a company)

- Proof of business address

- Proof of minority

- The entrepreneur should not be a defaulter in any Corporation Bank/F.I

- Last three years balance sheets of the SME units along with the Income-tax/sales tax returns

- Applicable for all cases from Rs.2 lakhs and above. However, for cases below the fund based limits of Rs. 25 lakhs if audited balance sheets are not available, then unaudited balance sheets have to be enclosed.

- Memorandum and Articles of association (MOA) of the Company or Partnership Deed of partners

- Assets and liabilities statement of the promoters and guarantors along with latest income tax returns

- Rent Agreement (In case business premises on rent) and clearance from the pollution control board

- SSI/MSME registration if applicable

- Projected balance sheets of two years if the working capital limits and the period of the corporation bank loan in case of the term loan

- In case of takeover of advances, the sanction letters of facilities being availed from existing bankers or financial Institutions along with detailed terms and conditions need to be furnished

- Profile of the unit, It should include names of promoters, other directors in the company, the activity being undertaken, address of all offices and plants, shareholding pattern)

- Last three years balance sheets for the associate and Group Companies (If applicable)

- Project reports for the proposed project if term funding is required. The report should include the details of the machinery to be obtained such as price, names of suppliers, and financial information consists of the capacity of machines, capacity utilisation assumed, production, sales, projected profit and loss.

- Balance sheets for the next seven to eight year until the proposed loan is to be paid.

- Review of account containing the month wise sales (quantity and value both), production, imported raw materials and indigenous raw material, the value of stocks in the process, finished goods (quantity and value), creditors, debtors, bank’s outstanding for the working capital limits, term loan limits and bills discounted.

- Photocopies of lease deeds and title deeds of all the proprieties being offered as primary and collateral securities.

- The position of accounts from the existing bankers and confirmation about the asset being Standard with the banks.

- Manufacturing process if applicable, the primary profile of executives in the company, tie-ups details, the raw material used and suppliers, details about the buyers, details about significant competitors and the organisation strength and weaknesses as compared to their competitors.

Application Procedure for Corp SME Suvidha Scheme

To apply for the Corp SME Suvidha Scheme, the applicant has to follow the below procedure: Visit Corporation Bank Portal Step 1: The applicant will have to approach the nearest branch (Corporation Bank) to apply for the scheme. Application for Corp SME Suvidha Step 2: The applicant must fill out the loan application form with all the requested details and have to attach the specified documents as required. The application form of “ Corp SME Suvidha Scheme” is given here and that can be downloaded for quick reference. Submit the Application Step 3: After completing the application form, submit it to the official concerned. Verification of Application Step 4: Upon submission of the loan application form, the verification process will be done by the official. Receive Acknowledgement Slip Step 5: Then, the applicant will be provided with an acknowledgement slip for further proceedings. Note: If the application is approved after verification of details, the Corporation bank will sanction the loan amount, and that will be credited to the beneficiary’s accounts.Track Application Status

The applicant can monitor the status of the application online by following the steps given below: Step 1: You need to visit the official portal of Corporation bank. [caption id="attachment_84663" align="aligncenter" width="611"] Corp SME Suvidha Scheme - Home Page

Step 2: Click on Priority option and then select MSME on the homepage of the portal.

[caption id="attachment_84665" align="aligncenter" width="620"]

Corp SME Suvidha Scheme - Home Page

Step 2: Click on Priority option and then select MSME on the homepage of the portal.

[caption id="attachment_84665" align="aligncenter" width="620"] Corp SME Suvidha Scheme - Select MSME

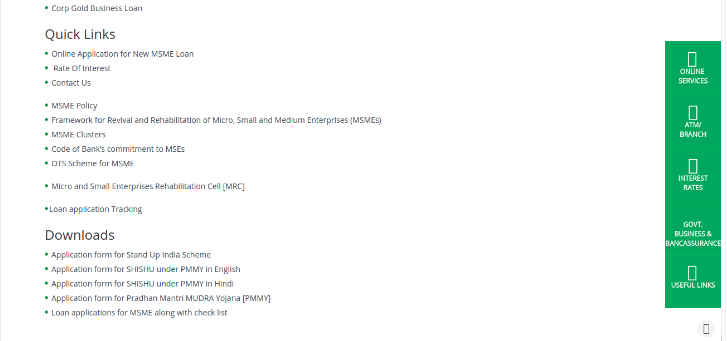

Step 3: On the next page, select loan application Tracking option under the Quick Links.

[caption id="attachment_84666" align="aligncenter" width="624"]

Corp SME Suvidha Scheme - Select MSME

Step 3: On the next page, select loan application Tracking option under the Quick Links.

[caption id="attachment_84666" align="aligncenter" width="624"] Corp SME Suvidha Scheme - Track Application

Step 4: Provide the branch reference number and Date of birth or date of incorporation.

[caption id="attachment_84667" align="aligncenter" width="611"]

Corp SME Suvidha Scheme - Track Application

Step 4: Provide the branch reference number and Date of birth or date of incorporation.

[caption id="attachment_84667" align="aligncenter" width="611"] Corp SME Suvidha Scheme - Provide Details

Step 5: Now, the status of your application will be viewed on your portal.

Corp SME Suvidha Scheme - Provide Details

Step 5: Now, the status of your application will be viewed on your portal.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...