Last updated: December 17th, 2019 4:57 PM

Last updated: December 17th, 2019 4:57 PM

Credit Linked Capital Subsidy Scheme

The Credit Linked Capital Subsidy Scheme was introduced to facilitate technology up-gradation in Micro and Small Enterprises (MSEs). The scheme intends to provide an upfront capital subsidy of 15 per cent, limited to the maximum of Rs 1 crore is offered to the eligible MSEs for upgrading their technology with the well-established and improved technology as approved under the scheme. In this article, we view the features, eligibility, application procedure for the Credit Linked Capital Subsidy Scheme in detail.CLCS Scheme Update

The Indian Government has commended the three-year extension of the CLCS scheme for MSEs with the general expenditure of Rs. 2,900 crores. The scheme has been authorised for continuation from 2017-2018 to 2019-2020. The scheme motivates the technology up-gradation to MSMEs, improvement in the quality of products, enhancement in productivity, reduction in waste and will promote a culture of continuous improvement.Eligibility Criteria for Providing Financial Assistance on Scheme

The incubation support will be provided by Host Institutions are listed out.- Indian Institutes of Technology (IITs)

- National Institutes of Technology ( NITs)

- Engineering Colleges

- Technology Development Centres, Tool Rooms, etc

- Other recognised R&D&/or Technical Institutes/Centres, Development Institutes of DIP&P in the field of Paper, Rubber, Machine Tools, etc.

Loan Amount and Capital Subsidy

The Cabinet Committee on Economic Affairs has confirmed the changes in the ceiling of credit from Rs.40.00 lakhs to Rs 1.00 crore with the rate of subsidy enhanced from 12 per cent to 15 per cent of the investment in eligible plant and machinery, whichever is lower.Industrial Sectors Approved under the Scheme

The following are the industrial sectors which are approved for availing the assistance under the scheme are mentioned below:- Biotech Industry

- Common Effluent Treatment Plant

- Corrugated Boxes

- Drugs and Pharmaceuticals

- Dyes and Intermediates

- Industry based on Medicinal and Aromatic plants

- Plastic Moulded/ Extruded Products and Parts/ Components

- Rubber Processing including Cycle/Rickshaw Tyres

- Food Processing (including Ice cream manufacturing)

- Poultry Hatchery & Cattle Feed Industry

- Dimensional Stone Industry (excluding Quarrying and Mining)

- Glass and Ceramic Items including Tiles

- Leather and Leather products including Footwear and Garments

- Electronic equipment viz tests, measuring and assembly/ manufacturing, industrial process control, analytical, medical, electronic consumer and communication equipment etc.

- Fans and Motors Industry

- General Light Service (GLS) Lamps

- Information Technology (Hardware)

- Mineral-Filled Sheathed Heating Elements

- Transformer/ Electrical Stampings/ Laminations/ Coils/ Chokes including Solenoid Coils

- Wires and Cable Industry

- Auto parts and components

- Bicycle Parts

- Combustion Devices/ Appliances

- Forging and Hand Tools

- Foundries - Steel and Cast Iron

- General Engineering Works

- Gold Plating and Jewellery

- Locks

- Steel Furniture

- Toys

- Non-Ferrous Foundry

- Sport Goods

- Cosmetics

- Ready mate Garments

- Wooden Furniture

- Mineral Water Bottle

- Paints, Varnishes, Alkyds and Alkyd Products

- Agricultural Implements and Post Harvest Equipment

- Beneficiation of Graphite and Phosphate

- Khadi and Village Industries

- Coir and Coir Products

- Steel Furniture

- Toys

- Non-Ferrous Foundry

- Sports Goods

- Cosmetics

- Ready-made Garments

- Wooden Furniture

- Mineral Water Bottle

- Paints, Varnishes, Alkyds and Alkyd Products

- Agricultural Implements and Post Harvest Equipment

- Beneficiation of Graphic and Phosphate

- Khadi and Village Industries

- Coir and Coir Products

- Steel Re-rolling and Pencil Ingot making Industries

- Zinc Sulphate

- Welding Electrodes

- Sewing Machine Industry

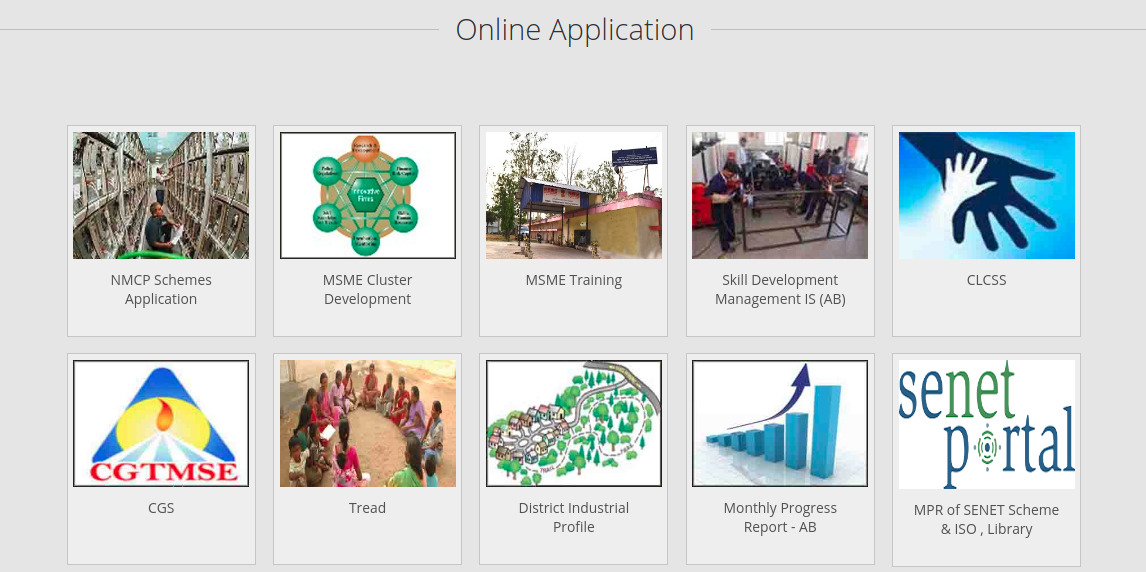

Online Application Procedure

The following are the procedure to register for CLCS Scheme are mentioned below: Step 1: The applicant has to visit the official website of the MSME department. Step 2: Click on “Online Application” tab which is displayed on the homepage of the portal. [caption id="attachment_75212" align="aligncenter" width="576"] Credit Linked Capital Subsidy Scheme - Image 1

Step 3: Select the scheme “CLCSS” under the online application menu.

[caption id="attachment_75213" align="aligncenter" width="589"]

Credit Linked Capital Subsidy Scheme - Image 1

Step 3: Select the scheme “CLCSS” under the online application menu.

[caption id="attachment_75213" align="aligncenter" width="589"] Credit Linked Capital Subsidy Scheme - Image 2

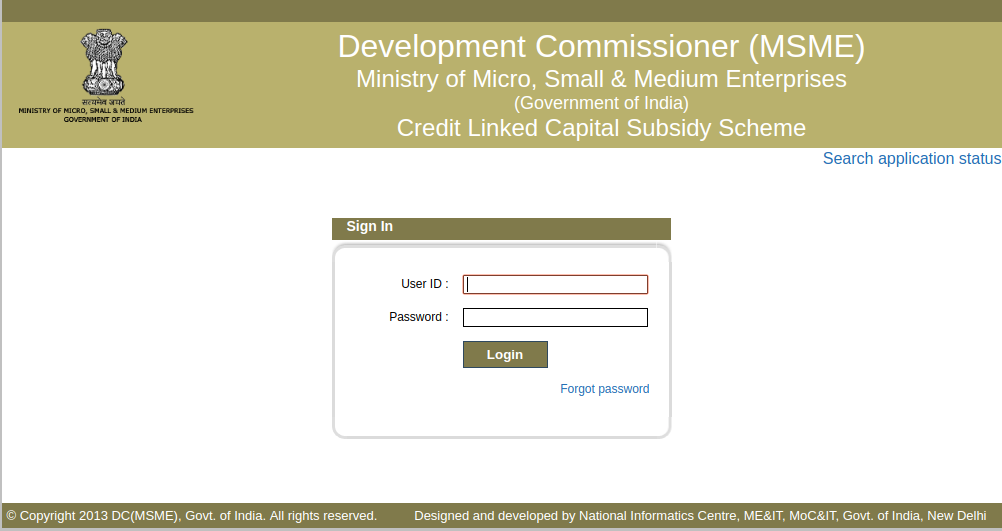

Step 4: The user has to provide the login details such as user id and password and then click on the “Login” button.

[caption id="attachment_75216" align="aligncenter" width="592"]

Credit Linked Capital Subsidy Scheme - Image 2

Step 4: The user has to provide the login details such as user id and password and then click on the “Login” button.

[caption id="attachment_75216" align="aligncenter" width="592"] Credit Linked Capital Subsidy Scheme - Image 3

Step 5: After logging into the portal, the applicant has to apply online by filling the form with the required details.

Step 6: After completing the application procedure the applicant can track the status of the application.

Credit Linked Capital Subsidy Scheme - Image 3

Step 5: After logging into the portal, the applicant has to apply online by filling the form with the required details.

Step 6: After completing the application procedure the applicant can track the status of the application.

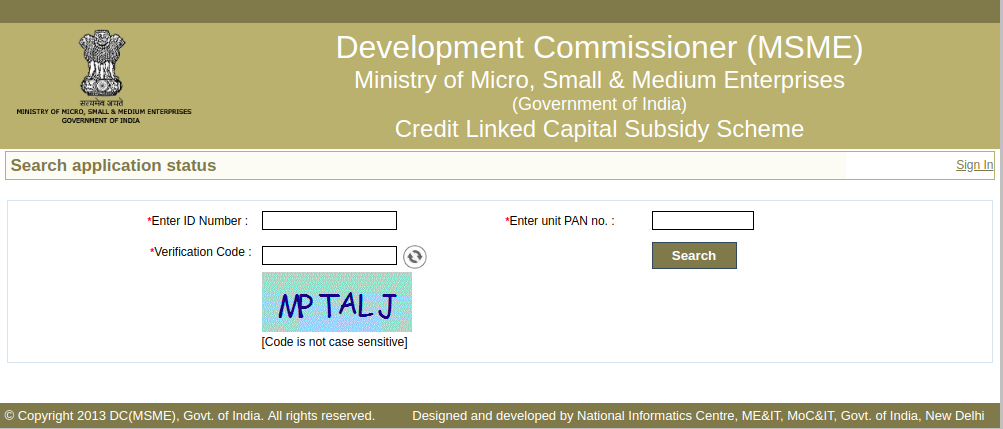

Track Application Status

To track the application status follow the steps mentioned below: Step 1: Click on “Search application status” link is present on the login page. [caption id="attachment_75218" align="aligncenter" width="573"] Credit Linked Capital Subsidy Scheme - Image 4

Step 2: Enter your ID number, Unit PAN number, Verification code and then click on the “Search “ button.

[caption id="attachment_75220" align="aligncenter" width="559"]

Credit Linked Capital Subsidy Scheme - Image 4

Step 2: Enter your ID number, Unit PAN number, Verification code and then click on the “Search “ button.

[caption id="attachment_75220" align="aligncenter" width="559"] Credit Linked Capital Subsidy Scheme - Image 5

Step 3: Now the applicant can able to view the status of the application.

Credit Linked Capital Subsidy Scheme - Image 5

Step 3: Now the applicant can able to view the status of the application.

Implementation Process

The completed application is being loaded by the Primary Lending Institutions (PLIs) through Online Application and Tracking System to the attached Nodal Agency which, in turn, recommends the application online to Office of DC (MSME) for the release of subsidy. After processing of the application and subject to availability of funds, due approval is accorded from the Competent Authority with the concurrence of Internal Finance Wing, after which funds are released to Nodal Agencies. The Nodal Agencies then transfer funds to the PLIs where the account of the MSE is operated. Also, read about Government Schemes for MSMEPopular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...