Last updated: December 16th, 2024 3:26 PM

Last updated: December 16th, 2024 3:26 PM

Credit Note Format under GST

Credit notes are a type of business document issued by a seller usually when the customer returns the goods. The Ministry of Finance provided specific rules under GST to issue credit note along with credit note format. In this article, let us look at credit notes under GST in detail.Issuing Credit Note

A taxpayer can issue a credit note when the taxable value and tax charged in the invoice exceeded than the taxable value or tax chargeable for the supply. Hence, the following instances shall apply when a taxpayer can issue a credit note to the customer:- When the tax invoice exceeds the value of supply

- When customer returns the goods

- Defective goods

Credit Note vs Debit Note

A taxpayer can issue a debit note after the supplier providing a tax invoice when the taxable value or tax charged in the invoice is found to be less than the value payable by the customer. On the other hand, a credit note is issued when the taxable value in the invoice is more than the taxable value chargeable for the supply. In simple terms:If Invoice Value > Amount Due from Customer - Issue Credit Note

If Amount Due from Customer > Invoice Value - Issue Debit Note

Procedure for Issuing a Credit Note under GST

The GST Rules provide a specific format for credit notes as under:- Name, address and Goods and Services Tax Identification Number of the taxpayer.

- Nature of the document. (Credit or Debit Note)

- Consecutive serial number not exceeding sixteen characters, in one or multiple series.

- Date of issue of the credit note.

- Name, address and GSTIN or UIN of the customer, if registered.

- Name and address of the recipient and the address of delivery, along with the name of State and its code, for un-registered recipients.

- Serial number and date of the related tax invoice or bill of supply.

- Value of taxable supply of goods or services, rate of tax and the amount of the tax credited.

- Signature or digital signature of the supplier or his authorised representative.

Details of Credit Note to be Filed in GST Returns

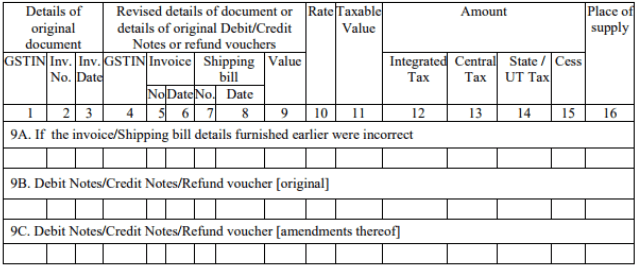

In GSTR 1 Filing, all taxpayers are required to provide details of all credit notes or debit notes issued by them during the previous month in the following format [caption id="attachment_33386" align="aligncenter" width="637"] GSTR 1 Amendments to taxable supplies

The details of credit notes issued and credit notes amended during the previous month must be provided along with the details of the original invoice number, invoice date and GSTIN of the customer. All credit notes pertaining to a financial year must be issued and filed no later than September following the end of financial year or the date of filing of GST annual return, whichever is earlier. The tax liability shall adjust based on the credit notes issued by the taxpayer, Based on the credit notes issued by the taxpayer, the tax liability would be adjusted. However, no reduction in the output tax liability of the taxpayer shall apply, if the incidence of tax and interest on such supply passed onto any other person.

Get expert help from IndiaFilings to register for a Private Limited Company, Public Limited Company or One Person Company!

GSTR 1 Amendments to taxable supplies

The details of credit notes issued and credit notes amended during the previous month must be provided along with the details of the original invoice number, invoice date and GSTIN of the customer. All credit notes pertaining to a financial year must be issued and filed no later than September following the end of financial year or the date of filing of GST annual return, whichever is earlier. The tax liability shall adjust based on the credit notes issued by the taxpayer, Based on the credit notes issued by the taxpayer, the tax liability would be adjusted. However, no reduction in the output tax liability of the taxpayer shall apply, if the incidence of tax and interest on such supply passed onto any other person.

Get expert help from IndiaFilings to register for a Private Limited Company, Public Limited Company or One Person Company!

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...