Last updated: December 16th, 2024 4:14 PM

Last updated: December 16th, 2024 4:14 PM

Crossed Cheque

The process referred to as Crossing of Cheques specifies a general instruction to a cheque which is about to be deposited to a bank account. According to Section 123 of the Negotiable Instruments Act, 1881 about Crossing of Cheques, the instruction stated above defines that the amount specified in the cheque will be deposited directly unto the account of the Cheque holder and will not be immediately delivered as cash to the holder over the bank counter. In this article, we look at cross cheques in detail.Reasons to Cross Cheque

- Crossing a Cheque provides precise instructions to a financial organisation regarding the handling of funds.

- Crossed cheques are usually identified by drawing either two parallel transverse lines either vertically across the cheque or on the top left-hand corner of the cheque.

- Two or more words like ‘and company’ or ‘not negotiable’ may be placed between the lines. While just drawing the lines with no words also would not alter the purpose of the crossed cheque.

- With Crossed cheques, the cheque writers may protect the amount transferred from being cashed by the unauthorized person or from being stolen.

- This format for Crossed cheques may differ between various countries in the nature of its format or statements.

- Since the Crossed Cheques can only be paid through a bank account, the beneficiaries transaction record may be traced later for further queries and clarifications.

Types of Cross Cheque

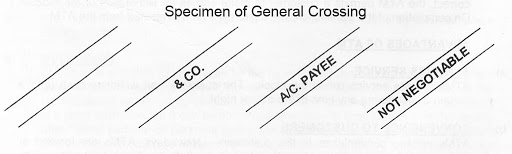

General Crossing (Section 123)

As mentioned earlier, the general crossing of cheques means including some words in between the two lines drawn which symbolizes a crossed cheque. This depicts that the bank on which it is drawn shall not permit the amount of payment in any other banks. Hence, the payment can be made only in the collecting bank. General Crossing

General Crossing

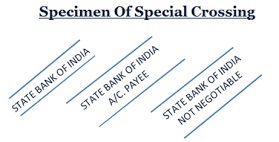

Special or Restricted Crossing (Section 124)

In the case of special crossing, the cheque bears the name of the bank, either with or without the words ‘not negotiable’. This means that the payment can be made only to that specific bank. Special Crossing

Special Crossing

Not negotiable crossing (Section 130)

This type of cheque crossing means that the cheque can be transferred but cannot be negotiated. In such cases, the ‘cheque holder’ will bear the title of a transferor only. Non- Negotiable Crossing

Non- Negotiable Crossing

Amount Payee Crossing

The above term depicts that the amount cannot be paid in any other bank account apart from the one mentioned in the cheque. Practicing Account payee crossing also ensures that, the money is transferred to the bank account only and is not given in the form of liquid cash. Account Payee Crossing

NOTE: In certain payments such as treasury payments and Income Tax refund orders there prevails a requirement of acknowledging for the receipt of the amount and the necessary stamp is also required behind the refund order. Whereas, in the case of Crossing Cheque, no official stamp registered under the Stamp Act is required.

Account Payee Crossing

NOTE: In certain payments such as treasury payments and Income Tax refund orders there prevails a requirement of acknowledging for the receipt of the amount and the necessary stamp is also required behind the refund order. Whereas, in the case of Crossing Cheque, no official stamp registered under the Stamp Act is required.

Cheque Validity

The validity of a cheque is estimated to be within a period of three months from the date on which it is drawn. After this period, it becomes stale, and it may result in the drawee bank refusing to pay the amount. However, if the cheque has become obsolete due to the expiry of the period of validity, then it can be re-validated by the drawer. Know more about Cheque Bounce!Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...