Updated on: August 10th, 2018 1:48 AM

Updated on: August 10th, 2018 1:48 AM

Deen Dayal Upadhyaya Bunkar Yojana

The Government of Arunachal Pradesh has launched the Deen Dayal Upadhyaya Bunkar Yojana for all the women weavers in the state, under Finance Department. This scheme aims to provide easy access to an affordable loan facility through bank channel for working women. Under the scheme, all women weavers will get the loan at the low rate for the working capital needs. In this article, we look at the Deen Dayal Upadhyaya Bunkar Yojana in detail.Key Features

The following are the features of the Deen Dayal Upadhyaya Bunkar Yojana scheme:- The beneficiary of the scheme will get a loan on 7% interest subvention.

- The government will provide a loan facility as a short-term credit / Cash Credit limit / Working capital limit / Weavers Credit Card / Swarojgar Credit card availed by the women weavers of the state.

- Under this scheme, the limit of working capital loan is up to Rs 2 lakh for each applicant women weaver.

- The district administration will cover all the women weavers with no limit on the unit size/number of looms.

Interest Rate in the Scheme

- Under this scheme, the loan will be given at the lowest interest rate by the government in comparison to bank interest rate.

- The interest rate will be at 8% maximum.

- The NABARD will give the short-term loan under the scheme.

- One year duration will be given to repaying this loan.

- The interest assistance will be given up to 2 lakh working capital loan amount.

Eligibility Criteria

In Arunachal Pradesh, all women wavers of the state will be eligible for the scheme who requires capital for their working purpose. This scheme is only applicable to the individual women weaver or Group of Women Weavers, not to any company or any partnership firms.Online Application procedures

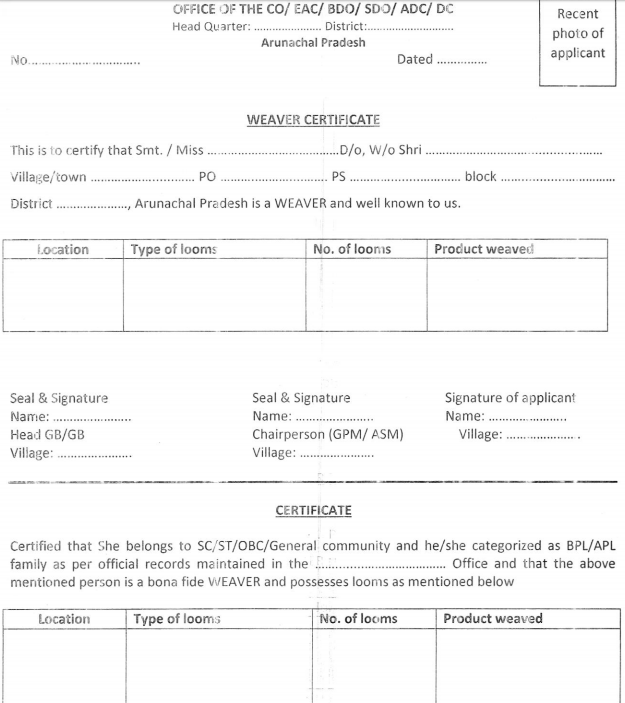

Let us examine the procedure to apply for the Deen Dayal Upadhyaya Bunkar Yojana: Step 1: The interested women applicants will have to visit the official website of Arunachal Pradesh. Step 2: You have to click on “To Download Form” link on the homepage. An application form will appear as shown below : [caption id="attachment_55266" align="aligncenter" width="625"] Application Form

Step 3: After that, download the application form and fill all the required information in the given application form.

Step 4: After filling the application form, the applicants have to submit the completed form to the circle officer.

Step 5: The Circle Officer will inspect and certify that the applicants are in possession of working looms.

Step 6: After the inspection, you can apply in any bank and can avail the benefits of a loan from any bank.

Note: The women weavers applicants can also obtain the application form from the office of CO / EAC / BDO / SDO / ADC / DC.

Application Form

Step 3: After that, download the application form and fill all the required information in the given application form.

Step 4: After filling the application form, the applicants have to submit the completed form to the circle officer.

Step 5: The Circle Officer will inspect and certify that the applicants are in possession of working looms.

Step 6: After the inspection, you can apply in any bank and can avail the benefits of a loan from any bank.

Note: The women weavers applicants can also obtain the application form from the office of CO / EAC / BDO / SDO / ADC / DC.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...