Last updated: October 27th, 2022 3:20 PM

Last updated: October 27th, 2022 3:20 PM

Deposit for GST Registration

All individuals involved in businesses and not-for-profits engaged in the supply of goods and services to persons or entities in India. GST registration can be broadly be classified into three different types, namely GST registration for regular taxpayers, GST registration for casual taxable persons and GST registration for non-resident taxable persons. Under the GST Act, casual taxable persons or non-resident taxable persons should mandatorily obtain GST registration, irrespective of aggregate annual turnover. In this article, let us look at the deposit requirement for those registering for GST as a casual taxable person or non-resident taxable person.Amount of Deposit for GST Registration

All casual taxable persons and non-resident taxable persons applying for GST registration are required to make an advance deposit of tax equal to the estimated tax liability of the taxpayer for the period for which the registration is sought. After depositing the GST payment in advance, the taxpayer shall receive the credit in the electronic cash ledger to use against payment of GST liability, fee, penalty or other charges. Further, all temporary GST registration for a casual taxable person shall detail the expiry date of registration. In case the taxpayer needs an extension of temporary GST registration, then additional tax must be deposited as per the amount of tax liability expected to get an extension of the GST registration. For example, if a casual taxable person estimates a GST liability of Rs.18 lakhs for a period of 2 months during the Diwali season, then the concerned individual shall deposit Rs.18 lakhs in advance while applying for GST registration. It is important to note that GST registration for casual taxable persons and non-resident taxable persons are provided for a period of less than 90 days or the period requested in the GST registration application. To lighten the process of GST registration for casual taxable persons and non-residents taxable persons, the authorized officer can extend the registration period for 90 days. Paying Deposit for GST Registration

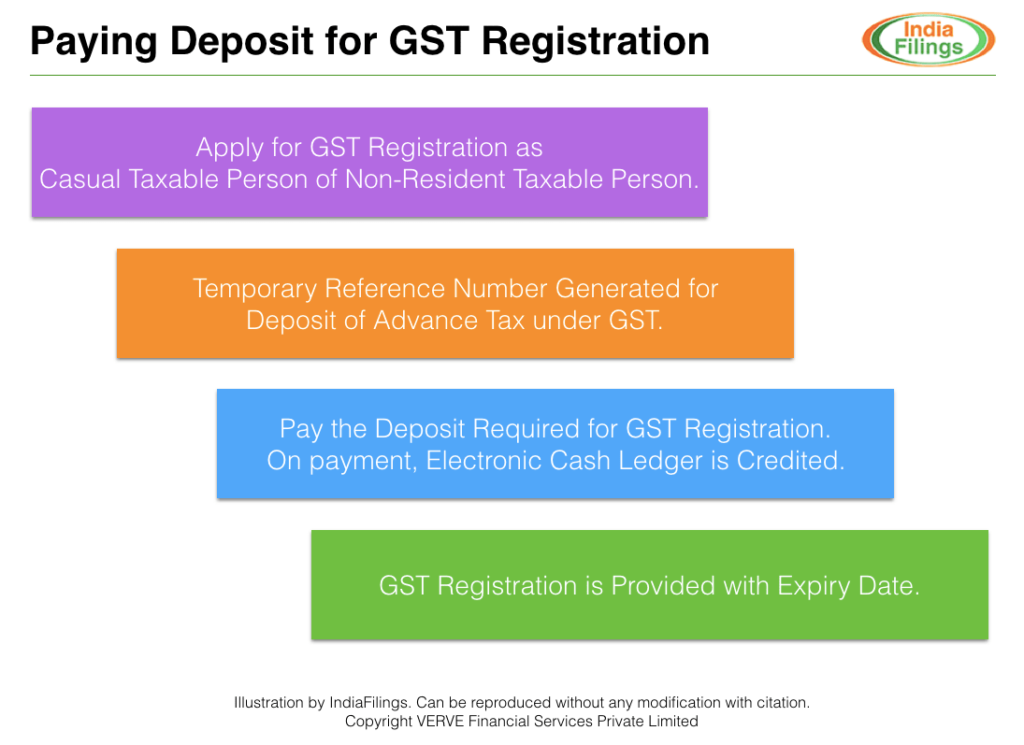

Paying Deposit for GST Registration

Casual Taxable Persons under GST

A casual taxable person under GST means a person who occasionally undertakes transactions involving the supply of goods or services or both in the course or furtherance of business, whether as principal, agent or in any other capacity, in a State or a Union territory where he has no fixed place of business. An example of a casual taxable person under GST; firework shops set up during Diwali times or shops set up in temporary exhibitions.

Non-Resident Taxable Persons under GST

Non-resident taxable person means any person who occasionally undertakes transactions involving the supply of goods or services or both, whether as principal or agent or in any other capacity, but who has no fixed place of business or residence in India.Regular Taxpayers

As per GST rules, no regular taxpayers shall pay any deposit for the advanced tax while applying for GST registration. However, after obtaining GST registration, all regular taxpayers would be required to file monthly GST returns regularly or pay the penalty as per the GST Act. Penalty for late filing of GST returns is Rs.100 per day, with a maximum penalty of Rs.5000, per each instance of default.Procedure for Paying Deposit for GST Registration

Upon filing a GST registration application for a casual taxable person or non-resident taxable person, the system generates a temporary reference number for making an advance deposit of tax into the electronic cash ledger. After the completion of the process for the advance tax payment, the portal shall generate an acknowledgement for the payment made. After the acknowledgement, the completes the GST registration. India Filings can help to obtain GST Registration, talk to an India Filings Business Advisor today.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...