Last updated: July 30th, 2019 5:19 PM

Last updated: July 30th, 2019 5:19 PM

Digital Life Certificate (DLC) - Jeevan Pramaan

Pension is an essential source of income after retirement for many citizens of India. Citizen in India enjoying pension must submit a certificate called Life certificate every year to the concern Pension Disbursing Authorities (PDAs), so that Pensioner can continue to receive their pension. Jeevan Pramaan is a biometric enabled Aadhaar-based Digital Life Certificate. Such Digital Life Certificate will be generated for every pensioner using his/her Aadhaar number and Biometrics to streamline pension disbursement. In this article, we look at Digital Life Certificate in detail.Life Certificate

Life certificate or certificate of existence is a document signed by a responsible person to assure that Pensioner is still alive to receive the pension. Government and pension disbursing agencies need to check periodically that Pensioner have not died in order to avoid overpaying annuities and pensions.Jeevan Pramaan

Digital Life certificate or Jeevan Pramaan scheme was launched by Honorable Prime Minister Shri. Narendra Modi on 10th Nov 2014. Normally, all Pensioners in India are required to submit a Life certificate to Pension Disbursing Authority in November month of every year. Further, in some cases, the pensioner him or herself need to be present personally for receiving the pension. The requirement to produce life certificate by physical presence has caused huge hardship, particularly to the aged pensioners. Jeevan Pramaan is eliminating such hardships by digitizing the whole process. Jeevan Pramaan scheme enables the pensioner to generate a digital life certificate using a software application and secure Aadhaar based Biometric Authentication System. The Digital Life Certificate generated will be stored online in Jeevan Pramaan website. Pensioner & Pension Disbursing Agencies can access the life digital certificate online at any time to confirm the existence of the pensioner.Advantages of Digital Life Certificate (DLCs):

- DLC can be generated from anywhere including home (Only if the Windows/Android based device is having an Internet and STQC certified Bio metric device connected to it is available).

- Auto SMS facility to pensioners regarding DLC.

- Auto transfer of DLC to Pension Disbursing Agency.

- Sending SMS by Pension Disbursing Agency after processing DLC.

Requirement for Digital Life Certificate Generation

Essential things for generating Digital Life certificate are as follows:- Aadhaar number

- Mobile number

- Aadhaar number should registered with PDA ( bank or Post Office etc)

- Biometric device

- PC with Windows 7.0 & above Android Mobile/Tablet 4.0 & above

- Internet Connectivity

How to Generate Digital Life Certificate

Pensioner can generate digital life certificate either by themselves or by visiting nearest centers having facility for digital services such as CSC, Government Offices & Banks.Generate Digital Life Certificate through Digital Service Centres.

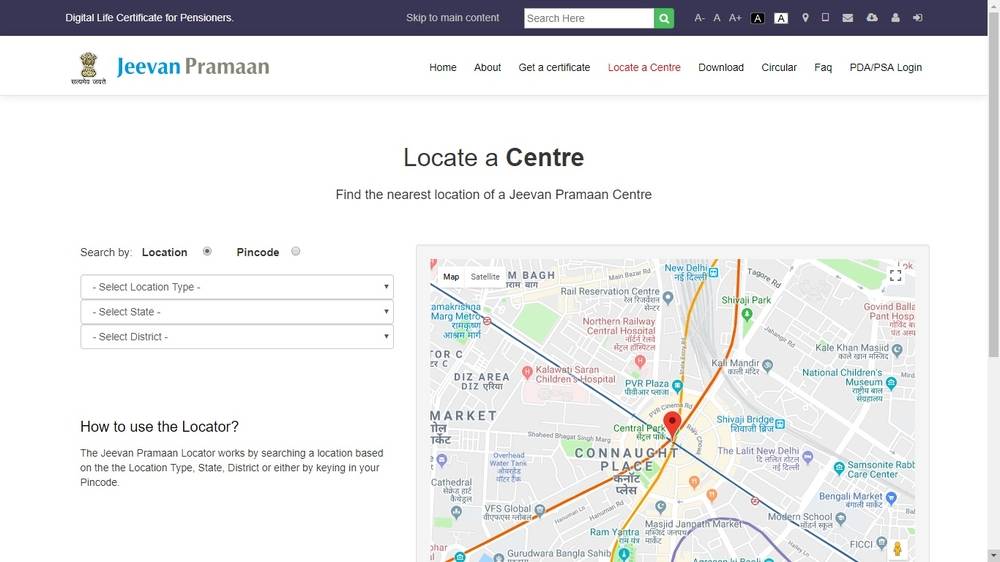

Follow the below mentioned steps to generate your DLC online through service centres. Step 1: Visit nearest Citizen Service Centre, bank or any other Government offices having digital service facility. You can locate centers nearest you by Jeevan Pramaan portal.Locate Centers

To locate CSC you need to visit Jeevan Pramaan webpage. Step 2: Select your location, state & district from drop down menu. Location types available in this portal are given below.- CSC

- NIELIT Centre

- Government offices

- Jammu & Kashmir Bank

Image 1 Jeevan Pramaan

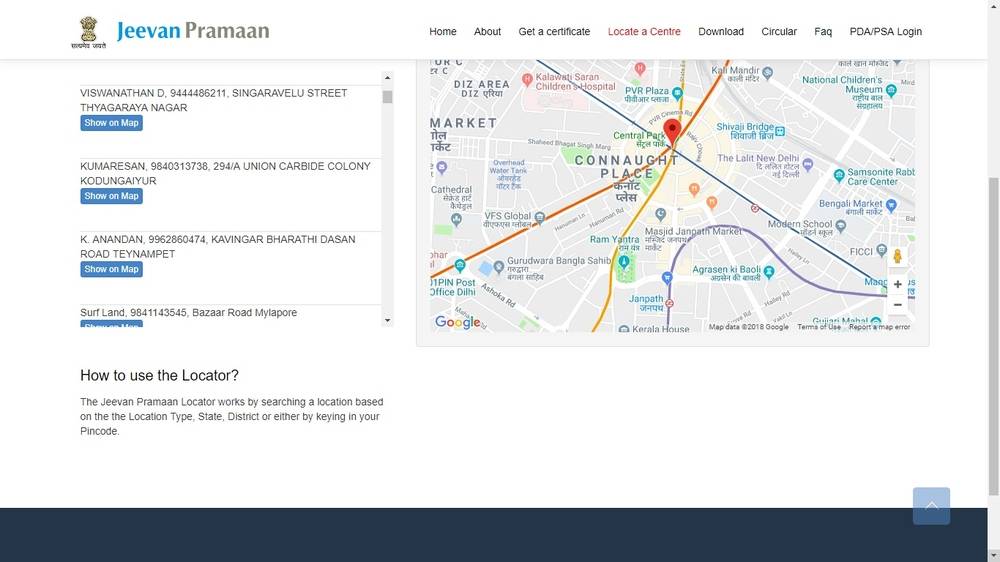

Step 4: Once all details are selected, list of centers in the particular area will be displayed.

Image 1 Jeevan Pramaan

Step 4: Once all details are selected, list of centers in the particular area will be displayed.

Image 2 Jeevan Pramaan

Image 2 Jeevan Pramaan

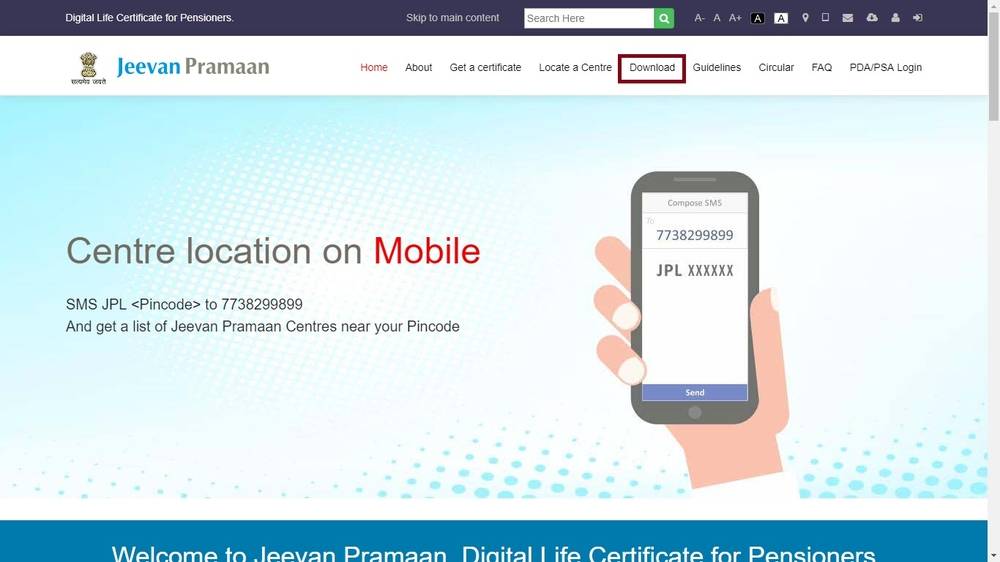

Generate Digital Life Certificate Online

Pensioner who decided to generate Digital Life Certificate online by themselves can follow the steps below: Step 1: Visit home page of Jeevan Pramaan. Step 2: Click on Download option in the menu bar. Image 3 Jeevan Pramaan

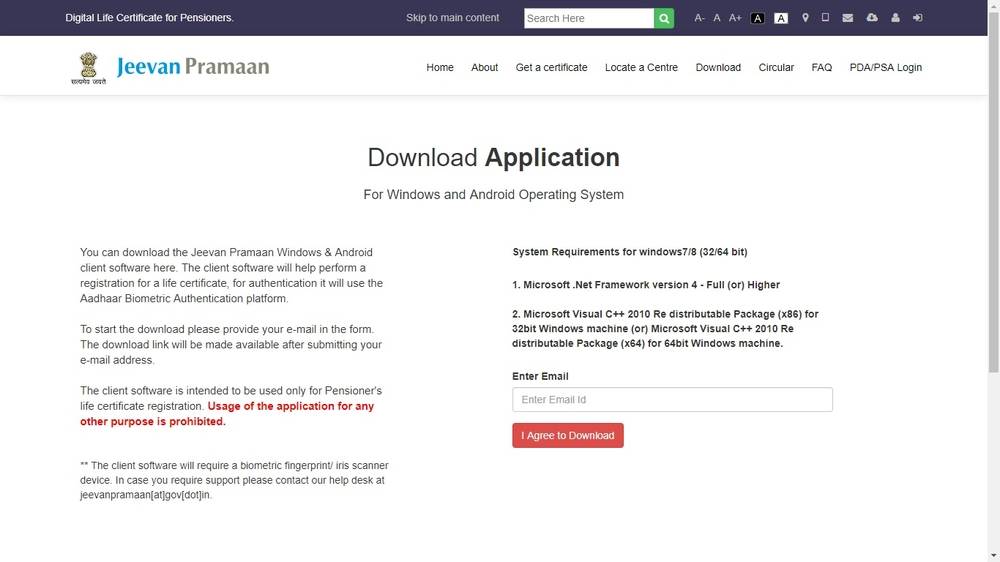

Step 3: Provide your e-mail ID in the space provided click on I agree to download.

Image 3 Jeevan Pramaan

Step 3: Provide your e-mail ID in the space provided click on I agree to download.

Image 4 Jeevan Pramaan

You will get link to download Jeevan Pramaan Windows & Android client software. This can be done with PC/Mobile/Tablet.

Image 4 Jeevan Pramaan

You will get link to download Jeevan Pramaan Windows & Android client software. This can be done with PC/Mobile/Tablet.

| Sl.No | PC app Installer | Mobile App |

| 1 | Jeevan Pramaan 3.0 Installer |

RD(Registered Device) Service & Drivers for Android |

| 2 | Client Installation Document 3.0 | |

| 3 | RD(Registered Device) Service & Drivers for Windows |

Image 5 Jeevan Pramaan

Step 4: After successful installation of client software in your PC/Mobile. You need complete two basic steps, such as User Registration & Certificate Authentication to get Digital Life Certificate.

Image 5 Jeevan Pramaan

Step 4: After successful installation of client software in your PC/Mobile. You need complete two basic steps, such as User Registration & Certificate Authentication to get Digital Life Certificate.

User Registration

Step 5: Authenticate the biometric device with PC/mobile/tab. Note: Registration of biometric is a onetime process. Step 6: Provide Aadhaar Number and a Mobile number and click on Generate OTP. Step 7: You will receive an OTP to the registered mobile number. Step 8: On entering correct OTP, the next screen will be displayed. Provide Name & Email ID and click on Scan Finger Step 9: Scan finger-print on finger-print scanner or scan eye on Iris Scanner connected to PC/mobile/tab. Step 10: After successful authentication of the finger-print/Iris you will get a message in pop-up window as ‘Device Registration successful’. Now Click on OK.Certificate Generation

Step 11: In this screen, enter Pensioner’s Adhaar number and mobile number. Click on Generate OTP. Step 12: The pensioner will receive an OTP in his/her mobile. Enter the same in space provided and click OK. Step 13: In the next screen you need to enter some information listed below.- Pensioner Name

- PPO Number

- Type of pension

- Name of Sanctioning Authority

- Name of Disbursing Agency

- Name of Agency

- Email Id

- Select Remarried options

- Select Re-Employed Options

Download Digital Life Certificate

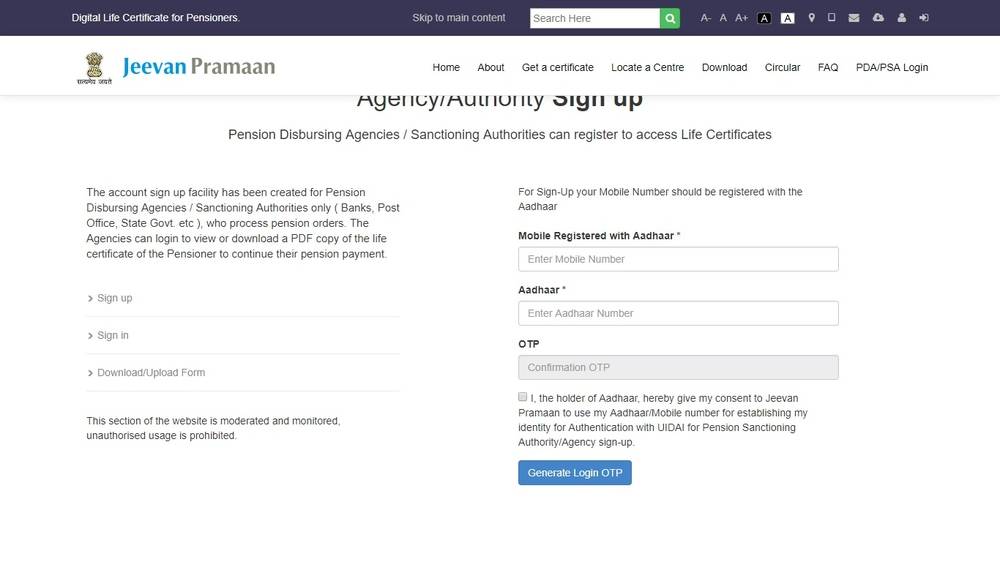

The PDAs can access and view the DLC of a pensioner in the Jeevan Pramaan website at anytime anywhere. The account sign up in Jeevan Pramaan facility has been created for Pension Disbursing Agencies / Sanctioning Authorities only (Banks, Post Office, State Govt. etc ). Registered PDS can view DLC of pensioner by entering registered mobile number, Aadhaar number & OTP. Image 6 Jeevan Pramaan

Image 6 Jeevan Pramaan

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...