Updated on: November 15th, 2019 1:29 AM

Updated on: November 15th, 2019 1:29 AM

DIN KYC Due Date Extended upto 5th October 2018

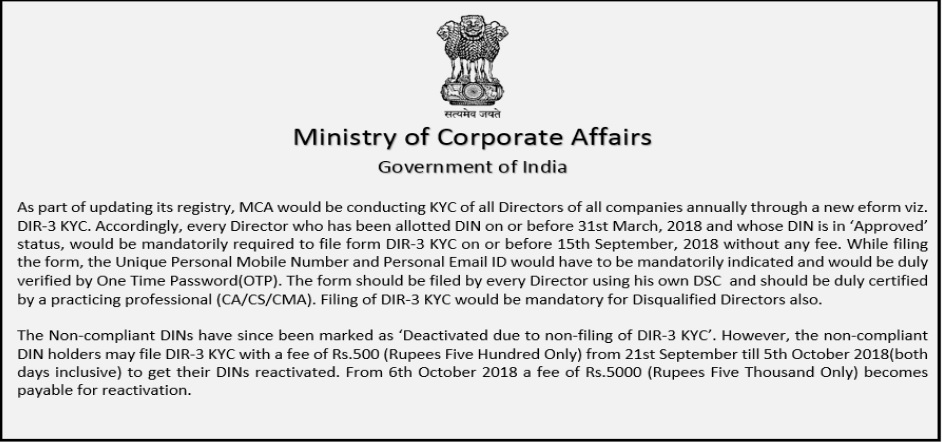

In order to update the Directors database of The Ministry of Corporate Affairs(MCA), MCA had earlier requested all Directors holding a DIN to complete DIN KYC before 15th September 2018. Now the MCA has announced a scheme to regualarise DIN eKYC before 5th October by paying a penalty of Rs.500. To complete DIN KYC, the Director woud be required to file a form known as DIR-3 KYC or DIN eKYC. In this article, we look at MCA notification on DIN KYC due date extension upto 5th October 2018.Latest Update - As on 21st September 2018 - Rs.500 Penalty

The MCA has now allowed for filing of DIN eKYC with a reduced penalty of Rs.500 upto 5th October 2018 as a last chance for defaulting Directors. The respective notification is reproduced below: As you are aware the last date for filing form DIR-3 KYC without fee has expired on 15th September 2018. The process of deactivating the non-compliant DINs has since been completed and their status has been updated as ‘Deactivated due to non-filing of DIR-3 KYC’. However, the non-compliant DIN holders may file DIR-3 KYC with a fee of Rs.500 (Rupees Five Hundred Only) from 21st September till 5th October 2018(both days inclusive) to get their DINs reactivated. From 6th October 2018 onwards, a fee of Rs.5000 (Rupees Five Thousand Only) becomes payable for reactivation. To file your DIN eKYC filing at just Rs.1899 per Director inclusive of Government fee and taxes, contact sales@indiafilings.comDIN eKYC Due Date Extention Notification - Earlier Notification

The MCA has issued a directive stating that the due date has been extended from 31st August 2018 to 15th September 2018. The notification issued by Ministry of Corporate Affairs has been reproduced below:Government of India MINISTRY OF CORPORATE AFFAIRS

Notification

New Delhi, dated 21st August 2018

G.S.R. …… (E).-In exercise of the powers conferred by sections 396,398,399, 403 and 404 read with sub-sections (1) and (2) of section ‘1-69 of the Companies Act, 2013 (18 of 2013), the Central Government hereby makes the following rules further to amend the Companies (Registration Offices and Fees) Rules, 2014, namely:- 1. (1) These rules may be called the Companies (Registration Offices and Fees) Fourth Amendment Rules, 2018. (2) They shall come into force from the date of their publication in the Official Gazette. 2. In the Companies (Registration Offices and Fees) Rules, 2014, in the Annexure, under the head VII, for note below Fee for filing e-form DIR-3 KYC, the following note shall be substituted, namely:- “for the current financial (2018-2019), no fee shall be chargeable till the 15th September 2018 and fee of Rs.5000 shall be payable on or after the 16th September 2018”.[F. No. 01/16/2013 CL-V (Pt-I)]

K.V.R MURTY, JOINT SECRETARY

Purpose of E-form DIR-3 KYC

The chief purpose of eform DIR-3 KYC is to collect the latest information about the directors of all companies. The information to be provided while completing eKYC procedures include Aadhar, PAN, Passport number, address, phone and email. The information submitted must be authenticated by completing a OTP verification and by signing with Digital Signature of Director and a practising Chartered Accountant.Applicability

All directors having a DIN as on 31st March of 2018 must file e-form DIR-3 KYC on or before 15th September of 2018. For all Directors who obtained DIN after 31st March, 2018, DIR eKYC must be filed next year.Documents Required

The following are the documents required to file E-form DIR-3 KYC:- PAN Card for identity proof

- Aadhar Card for address proof

- Recent passport size photographs

- Personal Mobile Number and E-mail ID of director for OTP Verification

- Digital Signature Certificate of the director (DSC) that must be registered on MCA Portal

- Passport (if the person holds a foreign citizenship)

Certifying Authority

The E-form DIR-3 KYC has to be duly certified by the Practicing Chartered Accountant (PCA), Practicing Company Secretary (PCS) or Practicing Cost Accountant.Penalties

If the DIN holders do not file DIR-3, the MCA will mark them as deactivated. If the DIN holder fils e-form DIR-3 KYC after 31st August 2018, a fee of Rs. 5,000 will be charged.Time Limit

All directors to whom DIN has been allocated as of March 2018 must file the e-form DIR-3 KYC by September 15, 2018, without any fee. Originally, the MCA had provided a due date of 31st August which was subsequently changed to 15th September. DIN holders who fail to meet this obligation would have their accounts deactivated. However, these DIN holders may file DIR-3 KYC by remitting a fee of Rs. 500 from 21st September to 5th October, post which the fine amount would be enhanced to Rs. 5,000. The notification pertaining to the same has been produced below: MCA Notification

MCA Notification

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...