Updated on: December 16th, 2024 5:54 PM

Updated on: December 16th, 2024 5:54 PM

2020 DIN eKYC - DIR-3 eKYC - Director KYC

Important Update: 2020 Director Identification Number (DIN)

Due to the unfortunate situation of many people affected directly or indirectly to the Corona Virus across the globe, many countries have implemented lock down situation to prevent spreading of the virus. This has ultimately hit the economy for India as well as for other countries. To retain financial stability during this situation the Ministry of Corporate Affairs (MCA) waived off the filing fee of Rs.5000 and Rs.10,000 for the DIN holders who have not filed DIN-3 KYC OR DIN-3 eKYC. The MCA implemented this wave-off through General Circular N0.11 on 24th March 2020 and through General Circular No. 12 on 30th March 2020. This wave-off of filing fee shall apply for the following only if:- The status of the DIN holders marked as 'Deactivated' for non-filing DIN-3 KYC OR DIN-3 eKYC and

- The status of the Companies whose compliance has been marked as 'Active non-compliant' for not filing Active Company Tagging Identifies and Verification (ACTIVE) e-form.

2019 eForm DIR-3 KYC

The Ministry of Corporate Affairs has recently notified that it would be conducting KYC (Know Your Customer) verification for Directors of all companies through a new eForm DIR-3 KYC. By filing DIR-3 eKYC form the Director would have to provide a unique personal mobile number and personal email address which would both be verified with an OTP code. In case you need to complete DIN eKYC filing, please get in touch with an Advisor at sales@indiafilings.com2019 DIN eKYC or Director KYC Process

The MCA has recently announced the DIN eKYC process for the year 2019. Director KYC for 2019 will be due on 30th September 2019. Further, those who had last year submitted the DIN KYC form can complete the process using a simple web form in minutes. The copy of the notification is attached below for reference:Latest Update - 30th September 2019

As per update on 30th September 2019, the Companies (Appointment and Qualification of Directors) Fourth Amendment Rules, 2019 have been notified where the last date for submitting DIR-3 KYC is extended till 14th October 2019. The excerpts from notification is provided below: "Note: For the financial year ending on 31st March,2019, the individual shall submit e-form DIR-3 KYC or web form DIR-3 KYC-WEB, as the case may be, on or before the 14th October, 2019." The exact notification from MCA is provided below: Also, there is another notification called "Companies (Registration Offices and Fees) Fifth Amendment Rules, 2019" mentions that there is no shall be payable till 14th October 2019 for the financial year ended on 31st March 2019. The excerpts from notification is provided below: *Note: For the financial year ended on 31st March, 2019, no fee shall be payable in respect of e-form DIR-3 KYC or DIR-3 KYC-WEB through web service till 14th October, 2019." The exact notification from MCA can be accessed below:Update on 26th July 2019

As per update on 26th July 2019, the Companies (Appointment and Qualification of Directors) Third Amendment Rules, 2019 have been notified with effective from 25th July 2019. The exact notification from MCA is provided below: As per the said notification: i) eForm DIR-3 KYC is to be filed by an individual who holds DIN and is filing his KYC details for the first time or by the DIN holder who has already filed his KYC once in eform DIR-3 KYC but wants to update his details. ii) Web service DIR-3-KYC-WEB is to be used by the DIN holder who has submitted DIR-3 KYC eform in the previous financial year and no update is required in his details. Stakeholders may plan accordingly.Update on 21st September 2018

The MCA has now allowed for filing of DIN eKYC with a reduced penalty of Rs.500 upto 5th October 2018 as a last chance for defaulting Directors. The respective notification is reproduced below: As you are aware the last date for filing form DIR-3 KYC without fee has expired on 15th September 2018. The process of deactivating the non-compliant DINs has since been completed and their status has been updated as ‘Deactivated due to non-filing of DIR-3 KYC’. However, the non-compliant DIN holders may file DIR-3 KYC with a fee of Rs.500 (Rupees Five Hundred Only) from 21st September till 5th October 2018(both days inclusive) to get their DINs reactivated. From 6th October 2018 onwards, a fee of Rs.5000 (Rupees Five Thousand Only) becomes payable for reactivation.MCA Notification

The MCA notification with respect to the implemention of DIR-3 eKYC form is reproduced below for reference:"As part of updating its registry, MCA would be conducting KYC of all Directors of all companies annually through a new eform viz. DIR-3 KYC to be notified and deployed shortly. Accordingly, every Director who has been allotted DIN on or before 31st March, 2018 and whose DIN is in ‘Approved’ status, would be mandatorily required to file form DIR-3 KYC on or before 31st August, 2018. While filing the form, the Unique Personal Mobile Number and Personal Email ID would have to be mandatorily indicated and would be duly verified by One Time Password (OTP). The form should be filed by every Director using his own DSC and should be duly certified by a practising professional (CA/CS/CMA). Filing of DIR-3 KYC would be mandatory for Disqualified Directors also. After expiry of the due date by which the KYC form is to be filed, the MCA21 system will mark all approved DINs (allotted on or before 31st March 2018) against which DIR-3 KYC form has not been filed as ‘Deactivated’ with reason as ‘Non-filing of DIR-3 KYC’. After the due date filing of DIR-3 KYC in respect of such deactivated DINs shall be allowed upon payment of a specified fee only, without prejudice to any other action that may be taken."

DIR-3 eKYC Filing

DIR-3 eKYC form would have to be filed by all Directors who have been allotted a DIN on or before 31st March 2018. The date for allotment of DIN can be ascertained from the DIN allotment letter. The DIN eKYC form must be filed using the Directors own DSC (Digital Signature) and should be certified by a practising Professional like Chartered Accountant, Company Secretary or Cost Accountant.Due Date for DIR-3 eKYC or DIN eKYC

The Ministry of Corporate Affairs has fixed 15th September 2018 as the due date for filing DIR-3 eKYC form. If DIN eKYC is not completed on or before the due date, the MCA system will automatically deactivate those DINs for which the form is not filed. In such cases, the system will show the message that DIN was deactivated for ‘Non-filing of DIR-3 KYC’. If a DIN is deactivated for non-filing of DIN eKYC form, it can be reactivated by paying a penalty (to be announced) and by filing DIR-3 eKYC form. Note: The due date for filing DIN eKYC was changed from 31st August to 15th September by the Government. Know more.Penalty for Not Filing DIN eKYC Form

Directors of companies that have continuously not filed company annual return for 3 years have recently been disqualified by the MCA. The MCA has provided an opportunity for reactivating such companies through the Condonation of Delay scheme. Even such Directors who have been disqualified by the MCA are required to file DIN eKYC to update their email and phone number on MCA record. Failure to file DIR-3 eKYC form by disqualified Directors will also lead to an additional penalty of Rs.5000.DIR-3 Form vs DIR-3 eKYC Form

Form DIR-3 and DIR-3 eKYC will be separate forms:DIR-3

The main purpose of the DIR-3 form is to apply for obtaining Director Identification Number. Any individual who is an existing director or intending to be appointed as the Director of an existing company would be required to file DIR-3 form to obtain DIN. One person can have only one DIN. Recent changes to the company incorporation process has made DIR-3 form not applicable for obtaining DIN during new company incorporation, as DIN is automatically issued under SPICe Form.DIR-3 eKYC

DIR-3 eKYC form will be a new form that is different from the DIR-3 form. While the DIR-3 form is used to generate DIN, DIR-3 eKYC form would be used to complete eKYC procedure each year. Further, it can be ascertained from the MCA notification that DIR-3 eKYC form would have to be filed every year as the notification states "MCA would be conducting KYC of all Directors of all companies annually through a new eform viz. DIR-3 KYC to be notified and deployed shortly."DIR-3 eKYC Forms

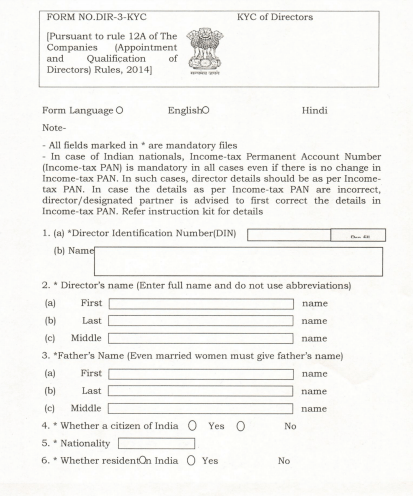

DIR-3 eKYC Form - Page 1

DIR-3 eKYC Form - Page 1

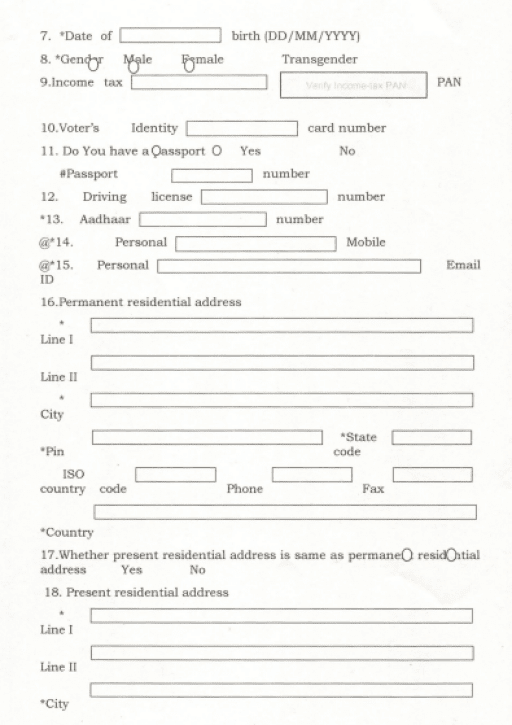

DIR-3 eKYC Form - Page 2

DIR-3 eKYC Form - Page 2

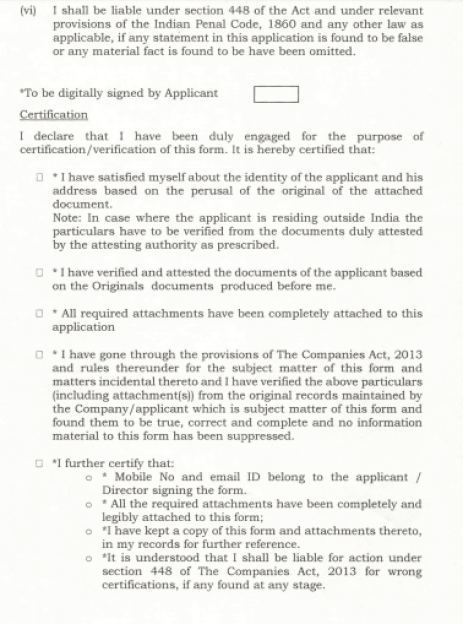

DIR-3 eKYC Form - Page 3

DIR-3 eKYC Form - Page 3

DIR-3 eKYC Form - Page 4

DIR-3 eKYC Form - Page 4

DIR-3 eKYC Form - Page 5

DIR-3 eKYC Form - Page 5

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...