Last updated: February 2nd, 2023 7:22 PM

Last updated: February 2nd, 2023 7:22 PM

DSC Registration on the New Income Tax Portal

DSC utility is a software used to create a digital signature file for income tax efiling. In this article, we discuss the procedure for creating a digital signature file using DSC utility. When the taxpayer is using a digital signature to authenticate the returns filed, it allows the Income Tax Department to verify that the returns are filed only with the approval of the taxpayer and not by a random person.What is a digital signature file?

A digital signature file is an encrypted document containing the identity details of the verifier. A digital signature file is needed to confirm the authenticity of the source of a file. For instance, a digital signature file is used in income tax efiling to verify the return filed by an assessee and the identity of the income tax return uploader.What is DSC Utility?

DSC stands for Digital Signature Certificate. DSC utility is a Tool to digitally sign government forms such as income tax returns, TDS returns and for verifying PAN online.Types of Digital Signature

There are two types of Digital Signature Certificate.- PFX File

- USB Token

PFX File

PFX File is a Digital Signature Certificate that is in a file format (.pfx format). This type of signature can be easily circulated through e-mail, which makes it easier for users. However, there is a risk of misuse if not handled properly.USB Token

Digital Signature certificate in a USB Token, looks similar to a pen drive, which is attached to the PC for using a digital signature. The main advantage of it is that it safeguards DSC from misuse which is more likely in a pfx file.Generating Signature File for Income Tax EFiling using DSC Utility

Step 1: Download DSC Utility

Download the utility from the link provided above. You can also download the utility through the Income Tax E-Filing portal.Step 2: Extracting the JAR File

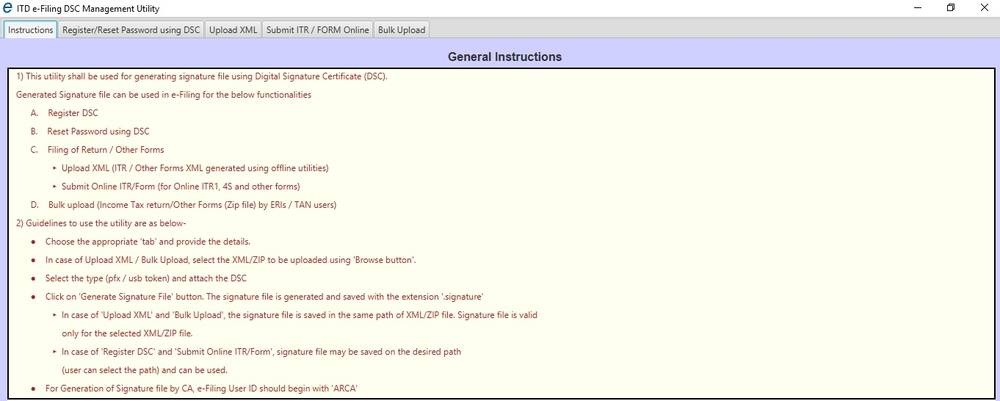

Extract the zip folder and open the utility (DSC_MGMT_UTILITY.jar)Step 3: Read the Instructions

The utility looks as below. Read the instructions that are provided in the Instructions tab. DSC-Utility-for-Filing-Income-Tax-Returns

DSC-Utility-for-Filing-Income-Tax-Returns

Step 4: Uploading File

Click on the 'Bulk Upload Tab'. DSC-Utility-for-Filing-Income-Tax-Returns

Zip your file, click on 'Browse Zip file', select your file and enter the efiling User Id (TAN number) and PAN as registered with DSC and efiling login.

DSC-Utility-for-Filing-Income-Tax-Returns

Zip your file, click on 'Browse Zip file', select your file and enter the efiling User Id (TAN number) and PAN as registered with DSC and efiling login.

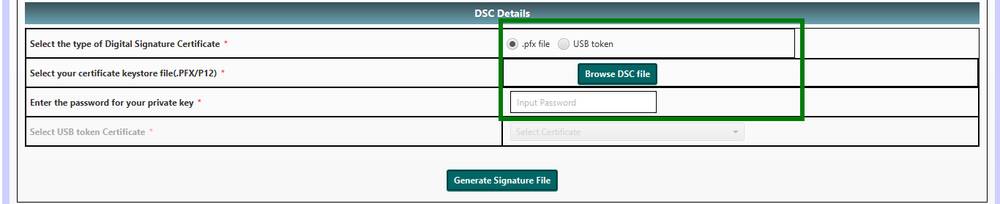

Step 5: Select the Digital Signature Certificate

Select the type of Digital Signature Certificate that you possess. As mentioned earlier in the article, Digital Signature Certificate could either be PFX file or USB Token. USB token digital signatures are now more prevalent. DSC-Utility-for-Filing-Income-Tax-Returns

DSC-Utility-for-Filing-Income-Tax-Returns

If you have your Digital Signature in PFX File :

Select '.pfx file' option, click on ‘Browse DSC File’ button to select a valid ‘.pfx’ file and then enter the password for the file. DSC-Utility-for-Filing-Income-Tax-Returns

Click on ‘Generate Signature file’ button. A success message will be displayed. The generated signature file will be saved at the same location where the return file is stored.

Upload the generated signature file with the return file in the Income Tax eFiling portal to complete filing with DSC.

DSC-Utility-for-Filing-Income-Tax-Returns

Click on ‘Generate Signature file’ button. A success message will be displayed. The generated signature file will be saved at the same location where the return file is stored.

Upload the generated signature file with the return file in the Income Tax eFiling portal to complete filing with DSC.

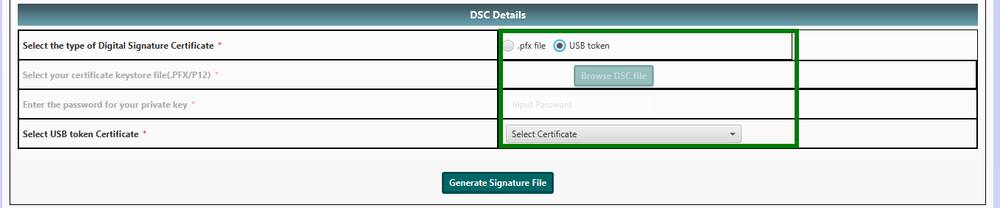

If you have your Digital Signature in USB Token :

Insert the DSC Token in the system, select a valid certificate from the drop-down and enter the PIN of the USB token. DSC-Utility-for-Filing-Income-Tax-Returns

Click on ‘Generate Signature file’ button. A success message will be displayed. The generated signature file will be saved at the same location where the return file is stored.

Upload the generated signature file with the income tax return file in the eFiling portal to complete filing with DSC.

DSC-Utility-for-Filing-Income-Tax-Returns

Click on ‘Generate Signature file’ button. A success message will be displayed. The generated signature file will be saved at the same location where the return file is stored.

Upload the generated signature file with the income tax return file in the eFiling portal to complete filing with DSC.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...