Last updated: March 18th, 2020 3:37 PM

Last updated: March 18th, 2020 3:37 PM

Due Date for TDS Extended

The Central Board of Direct Taxes (CBDT) had earlier extended the TDS filing due dates for Odisha. The move was initiated to redress the difficulties faced by the deductors on account of the severe disruption of normal life and breakdown of communication systems caused by Cyclone Fani, which hit the state on 3rd May 2019. On 3rd June, the Government has extended the due date for filing TDS to all deductors.Extension to 30th June for all Deductors

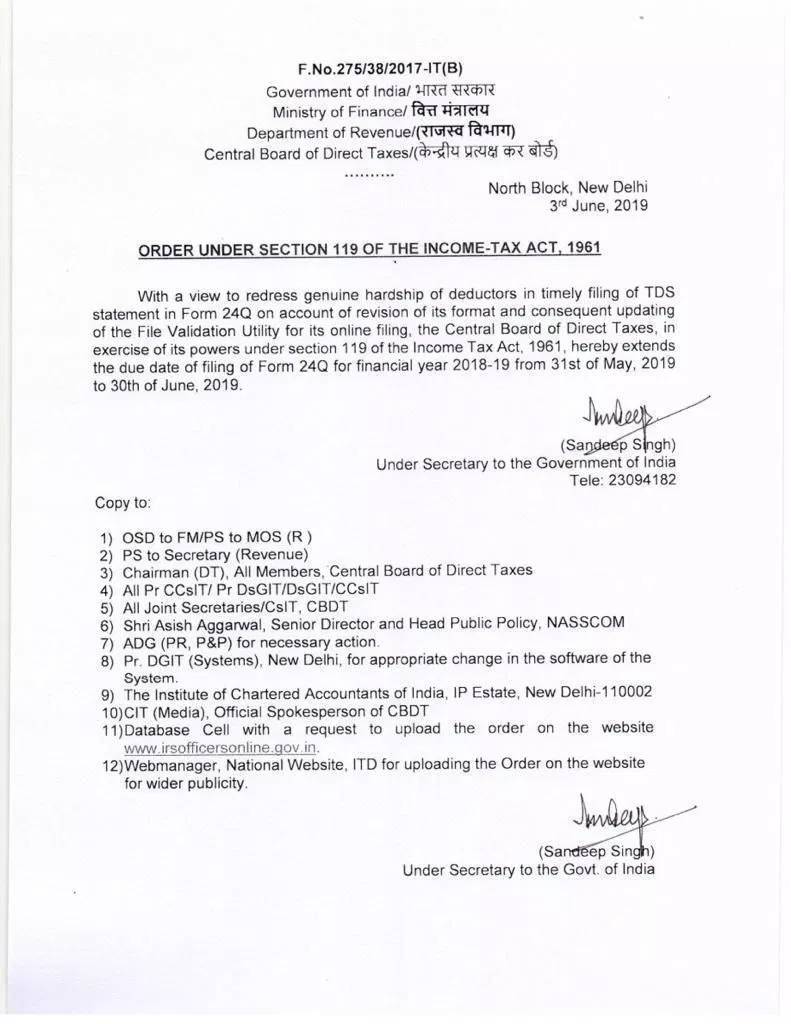

The CBDT has now extended the due date for TDS filing - Form 24Q [i.e. quarterly TDS statement in respect of salaries] for FY 2018-19 from 31st May 2019 to 30th June 2019 for all categories of deductors across India. The report states that the relief measure has been provided in order to address the genuine hardships of deductors in timely filing of TDS statements in Form 24Q, on account of revision of the format and consequent updating of the File Validation Utility for its online filing. A copy of the order released on 3rd June 2019 is given below for reference: TDS Due Date Extension - 30th June 2019

TDS Due Date Extension - 30th June 2019

Deposit of TDS

The due date for depositing Tax Deducted at Source (TDS) for April 2019 has been extended to the 20th May 2019. The date previously stipulated for this purpose was 7th May 2019. The mechanism of TDS prompts a deductor who is required to make payment of specified nature to any other person (who is known as a deductee in this context) to deduct Tax at source. The tax so deducted must be remitted to the Governmental Account. The remittance can be made either physically or electronically. Physical payment can be made by furnishing Challan 281 in the authorized bank branch. The electronic mode of payment is mandatory for:- All corporate taxpayers.

- Others who are covered by a Tax Audit under Section 44AB.

Filing TDS Quarterly Statements

The deadline for filing quarterly statements for the last quarter of the financial year 2018-19 has been extended to 30th June 2019 from the usual due date of 31st May 2019. A quarterly statement refers to a quarterly return to be filed by the deductors of tax. The following details must be included in the statement:- PAN of the deductor and the deductee.

- Sum of tax remitted to the Government.

- Information of TDS challan.

- Other details, if required.

Issuance of TDS Certificates

The due date for issuing TDS certificates in Form 16 and Form 16A has been extended to 15th July 2019 from the previous deadline of 15th June. TDS certificates must be issued by deductors of tax at source. The document enables taxpayers to claim the relevant tax credits, along with the applicable refunds. TDS Certificates are of two types, namely Annual TDS Certificate and Quarterly TDS Certificate. The former document is issued to the employees in Form 16 and relates to TDS on salary. It includes the particulars pertaining to TDS deducted by the employer from salary and the particulars of TDS deposited with the Government. Quarterly TDS Certificates are issued in Form 16A and is meant for the deduction of TDS on income other than salary. It is issued by banks when the TDS is deposited on interest earned by the depositor on fixed deposits. A copy of the official notification has been attached for the convenient reference of taxpayers: [pdf-embedder url="https://www.indiafilings.com/learn/wp-content/uploads/2019/05/Extension-of-Due-Dates.pdf" title="Extension of Due Dates"]Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...