Last updated: December 17th, 2024 9:56 AM

Last updated: December 17th, 2024 9:56 AM

Due Date for July GST Return

The due date for July GST return has been extended again to provide more time for taxpayers and streamline the GST portal. The new due date for July GST return (GSTR1) is 10th October 2017. If the business has a turnover of more than Rs.100 crores, the due date for filing the GSTR1 return is 3rd October 2017. The GSTR2 return for July will be due on 31st October 2017 and the GSTR3 return for July will be on 10th November 2017. The due date for August and September 2017 GST return will be notified by the GST Council at a later date. Hence, the Ministry yet to set any deadlines for the August and September 2017 GST returns. Any registered taxpayers can avail support for filing GSTR1 through the GST Portal. return filing facility with GST portal API has been made available through LEDGERS GST Software. In case you would like to file GSTR1 return, signup for a LEDGERS GST Software account. [caption id="attachment_32997" align="aligncenter" width="1000"] GST Software

GST Software

GSTR3B Due Date

In the GST Council Meeting held on 9th September, mentioned that all the businesses should file GSTR3B return from July to December. Though the Ministry of Finance extended the due date for filing of GSTR1, GSTR2 and GSTR3 return, the deadline for filing of GSTR3B returns on the 20th of every month shall continue.GSTR4 Due Date

All taxpayers registered under GST Composition Scheme should file GSTR4 returns. The due date for filing GSTR4 is 18th of October for the months of July to September. Hence, the due date remains the same and yet to announce any new due dates for filing GSTR 4 from the Ministry. However, in the GSTR4 return due on 18th September GSTR4A is not required. Hence, the GSTR4 return due on 18th October 2017 is expected to be a simpler return. Learn more: 38th GST Council MeetingGSTR6 Due Date

GSTR6 return must be filed monthly by persons registered as an Input Service Distributor. The Ministry fixed the due date for filing GSTR6 for the month of July on 13th October 2017.GST Council Press Release - 9th September 2017

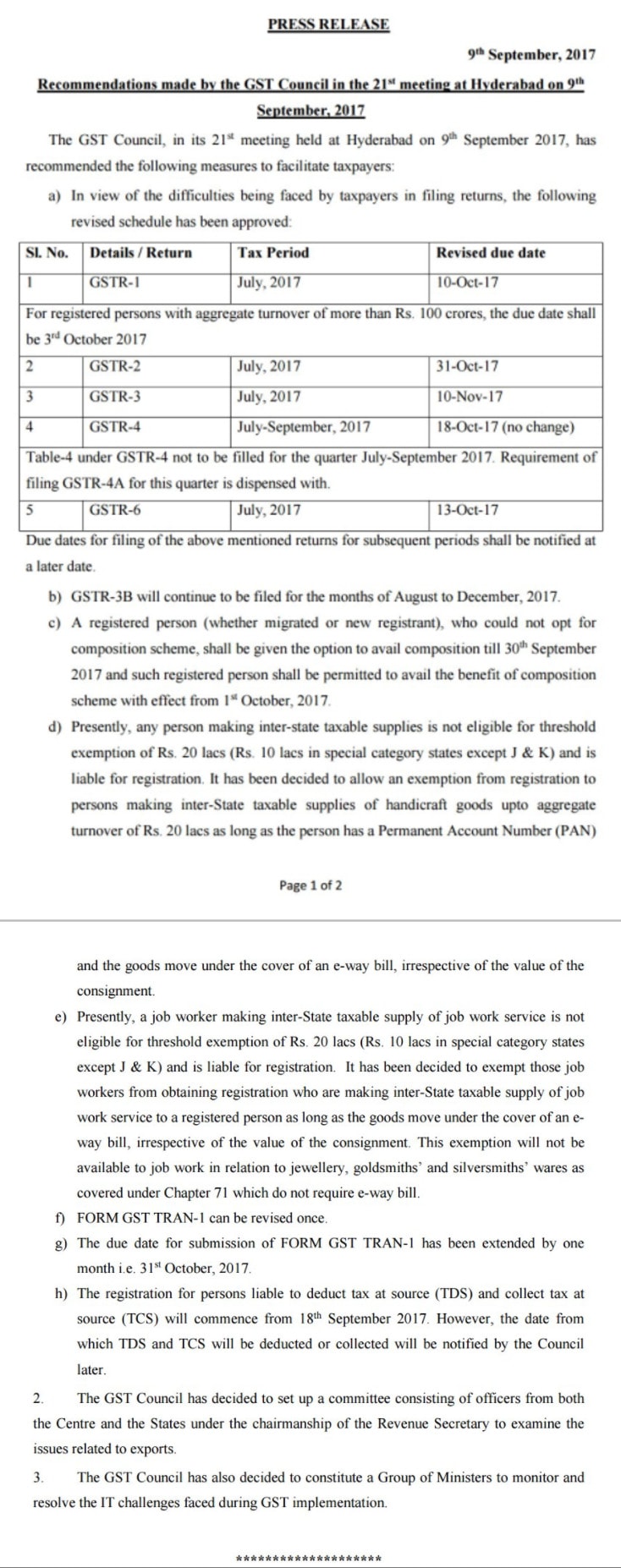

The GST Council mentioned the due date changes to GST return due date in a press release on 9th September 2017. A copy of the GST Council press release is as follows: [caption id="attachment_33615" align="aligncenter" width="734"] GST Council Press Release 9 September 2017

Also read: GST Registration or GST Return Filing

GST Council Press Release 9 September 2017

Also read: GST Registration or GST Return Filing

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...