Updated on: January 7th, 2020 12:20 PM

Updated on: January 7th, 2020 12:20 PM

e-Nivaran

The Income Tax department has developed 'e-Nivaran', a Unified Grievance Management System in order to track taxpayer grievances and ensure early redressal of their complaints. Through e-Nivaran taxpayers can submit the grievance in respect to AO, NSDL, UTISL, CPC-ITR, CPC-TDS, E-filing Website team, Directorate of Systems, and SBI-Refund Banker. In this article, we look at the e-Nivaran in detail. Also, read about MCA HelpdeskFeatures of e-Nivaran

The salient features of the e-Nivaran are as follows:- E-Nivaran aims to provide a complete solution to solve all grievances of the taxpayers in a simplified and systematic manner.

- All offline and online complaints are integrated into the central system to avoid duplicity.

- Also, it has a process set up, which will automatically send the problem to the designated department.

- e-Nivaran portal facilitates the taxpayers to track the status of their complaint and also get updates on them.

- To ensure a timely solution for the problems, an assessment officer monitors the complaints that have been registered on the platform.

- The system is well developed and has taken into account most problems of taxpayers.

Procedure for Online Complaint Registration

To register a complaint under the e-Nivaran, follow the steps mentioned below: Step 1: The applicant needs to access the E-Filing website of Income Tax Department. Step 2: Click on "e-Nivaran" tab, which is present on the homepage of the portal. Step 3: Select "Submit Grievance", the following radio buttons are displayed.- PAN or TAN Holder

- Do not have PAN or TAN

e-Nivaran - Image 1

Step 4: Select "PAN or TAN Holder" option, then enter PAN or TAN number in the textbox and click on the "Submit" button.

[caption id="attachment_88294" align="aligncenter" width="983"]

e-Nivaran - Image 1

Step 4: Select "PAN or TAN Holder" option, then enter PAN or TAN number in the textbox and click on the "Submit" button.

[caption id="attachment_88294" align="aligncenter" width="983"] e-Nivaran - Image 2

Note:

e-Nivaran - Image 2

Note:

- If PAN is previously registered in e-filing, it will be redirected to the login page.

- If PAN is not registered, then the following options will be provided:

-

- Register with e-filing and Continue

- No thanks and Continue without registering.

e-Nivaran - Image 3

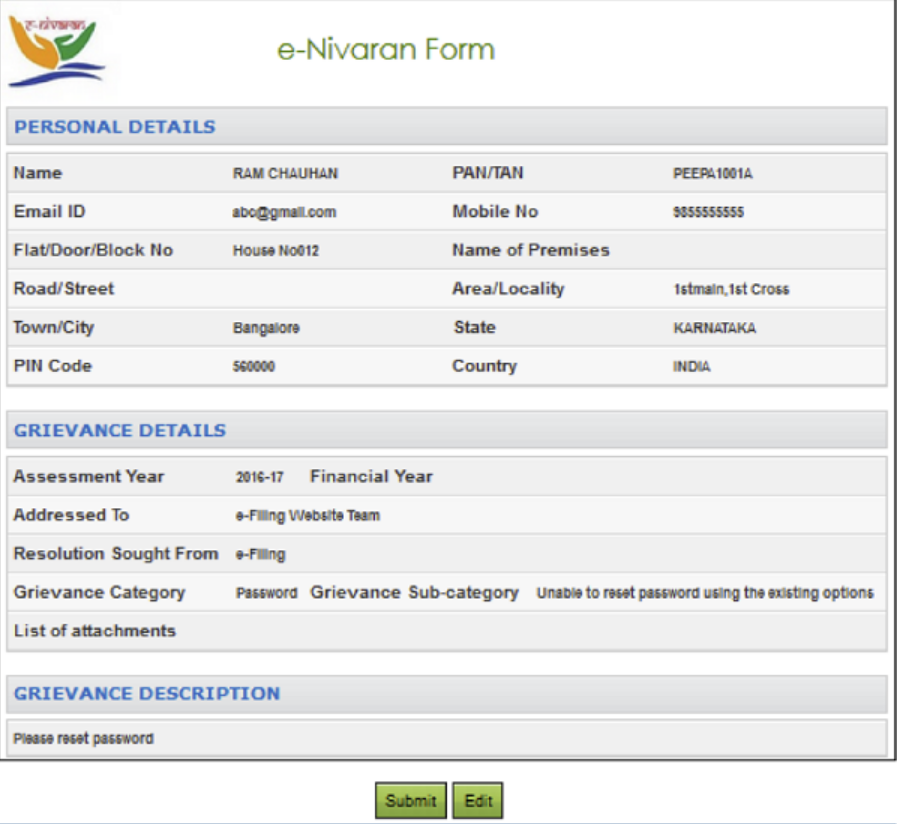

Step 7: The applicant can preview and edit before submitting the grievance request.

[caption id="attachment_88297" align="aligncenter" width="910"]

e-Nivaran - Image 3

Step 7: The applicant can preview and edit before submitting the grievance request.

[caption id="attachment_88297" align="aligncenter" width="910"] e-Nivaran - Image 4

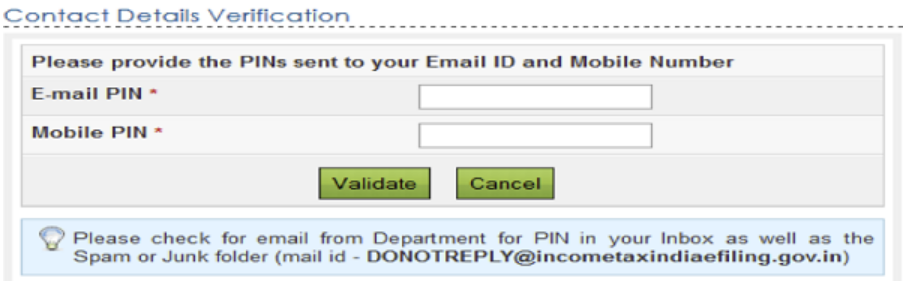

Step 8: Click on the Submit button, the OTP will be sent to registered email id and mobile no provided.

[caption id="attachment_88298" align="aligncenter" width="910"]

e-Nivaran - Image 4

Step 8: Click on the Submit button, the OTP will be sent to registered email id and mobile no provided.

[caption id="attachment_88298" align="aligncenter" width="910"] e-Nivaran - Image 5

Step 9: Click on Validate success message will be displayed along with the option to download pdf.

[caption id="attachment_88299" align="aligncenter" width="920"]

e-Nivaran - Image 5

Step 9: Click on Validate success message will be displayed along with the option to download pdf.

[caption id="attachment_88299" align="aligncenter" width="920"] e-Nivaran - Image 6

Step 10: The website generates an acknowledgement number which can be used for tracking your application further.

Note: The applicant can track the status using that acknowledgement number in the Grievance Status.

e-Nivaran - Image 6

Step 10: The website generates an acknowledgement number which can be used for tracking your application further.

Note: The applicant can track the status using that acknowledgement number in the Grievance Status.

Track Grievance Status

The status of the registered complaint can be tracked by following the below steps: Step 1: To view Grievance Status, the applicant needs to click on "Grievance Status" under the e-Nivaran tab. Step 2: Click on Grievance Status and enter Acknowledgement Number/AY/Status. [caption id="attachment_88300" align="aligncenter" width="996"] e-Nivaran - Image 7

Step 3: After providing the details, the status of the grievance submitted can be viewed.

e-Nivaran - Image 7

Step 3: After providing the details, the status of the grievance submitted can be viewed.

Timelimit for Redressal

The solution will be provided to the registered grievances within 30 days after the complaint has been received.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...