Last updated: November 22nd, 2024 10:09 AM

Last updated: November 22nd, 2024 10:09 AM

eWay Bill Cancellation

Persons registered with GST eWay Bill portal can cancel the generated E-Way bill for various reasons. As per the GST Act, any supplier or transporter involved in transporting goods or storing the goods for transport must obtain GST eway bill. The registered person can generate the e-way bill through various provisions as provided by the Government of India. However, if the registered person finds it necessary to cancel the generated e-way bill, the person can cancel the generated bill. E-way shall be generated for all interstate movement of goods with a value of more than Rs.50,000. In this article, let us look at the procedure on eway bill cancellation time limit, how to cancel e way bill within 24 hours and after 24 hours to 72 hours. Click here to know on How to generate eWay bills using the PortalWhen can the Registered User Cancel the EWay Bill?

The registered person can cancel the e-way bill if the allotted goods were never transported, major mismatch in the goods allotted or goods were not transported as per the details furnished in the registered e-way bill. Under these circumstances, the registered person can cancel the way. It is important for those registered person to know about how to cancel e way bill.eWay Bill Cancellation Time

If the registered person requires to cancel the bill and having probable cause for cancelling the e-way bill, the person should cancel within 24 hours of eway bill cancellation time from the time the bill generated. When cancelling the bill the person shall enter the e-way bill on the portal and also provide the reason for cancelling the e-way bill. After cancelling the GST bill using the same bill shall apply as illegal and subject to penalty or prison as per the GST Act. Also, since there is no option to rectify or correct an incorrect eWay bill, its best to cancel an e-way bill same as shown above and create a fresh e-way bill in case of a mistake or if the goods are not transported as per the details furnished in the e-way bill. Note: If it is before 24 hours only the consignor can cancel the registered bill and not the consignee.e-Way bill cancel after 24 hours - 72 hours

If the supplier of the said goods in the bill wants to cancel the eway bill, the supplier can cancel within 24 hours. However, if the supplier unable to request for cancelling the bill and crossed the 24-hour time limit, the supplier could request the receiver of the said goods to cancel the eway bill. The receiver can cancel the eway bill if the time limit crossed 24 hours and within 722 hours. Hence, an eway bill cancellation time limit is limited. It cannot be cancelled if it has crossed 72 hours from the time of the bill generation. Click here to read on Integration of e-way Bill and Vahan SystemHow to Cancel e Way Bill via the eWay Bills Portal

Cancellation of an e-way bill can be done due to various reasons like an error in e-way bill generation or non-movement of goods or any other reasons within 24 hours of generation. Ensure to cancel it before the specified e way bill cancel time.Step: 1 - Login

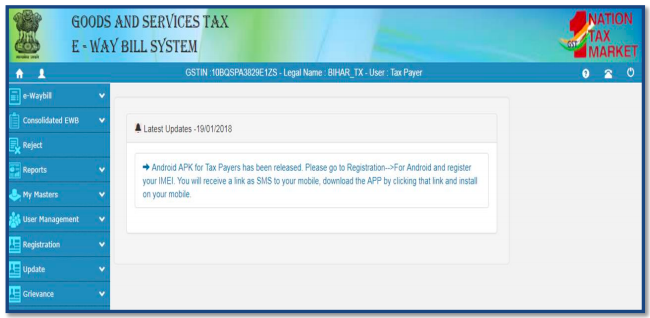

One must log on to the e-way bill system portal to access waybill. E-Way Bill Main Menu

E-Way Bill Main Menu

Step: 2 - Options for cancellation of e way bill

Select Cancel option from the e-way bill tab. Eway bill tab is the 1st option in the left menu bar.Step: 3 - E-Way Bill Number

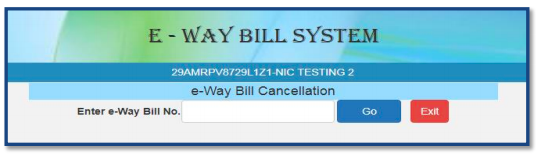

Once the cancellation is selected, a new screen would be displayed prompting the user to enter the eway bill number. Cancel E-way Bill

Cancel E-way Bill

Step: 4 - Entry of E-Way Bill Number

Enter the 12 digits eway bill number and select Go.Step: 5 - Reason

The registered person shall provide the reasons for cancelling the generated eway bill. This is the step-by-step process regarding how to cancel e Way bill within the e way bill cancel time. Click here to register for GST or for GST Return filingPopular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...