Last updated: September 14th, 2021 6:13 PM

Last updated: September 14th, 2021 6:13 PM

Check GST E-way Status & Create an E-way Bill Online Login

E-way bill is used under the GST regime to track the movement of goods across IndiaE-way bill is now mandatory for the transport of goods with a value of more than Rs.50,000. E-way bill can be generated for free from the GST E-way Bill Portal or through SMS facility. However, before generating the e-way bill, the taxpayer must be registered on the e-way bill portal. In this article, we provide a step-by-step guide to obtaining e-way bill registration.

Documents Required E-way Bill Registration

Registration on the e-way bill portal must be completed before generating e-way bills. The following documents are required for registration:- GST registration certificate of the registered taxpayer/transporter.

- A mobile number with a cellphone.

E-way Bill Portal Registration

E-way bill registration and the facility to generate e-way bill can be obtained by the following categories of persons:- Registered suppliers with GST registration.

- Transporters with GST registration

- Transporters not having GST registration.

E-Way Bill Registration for Registered Suppliers

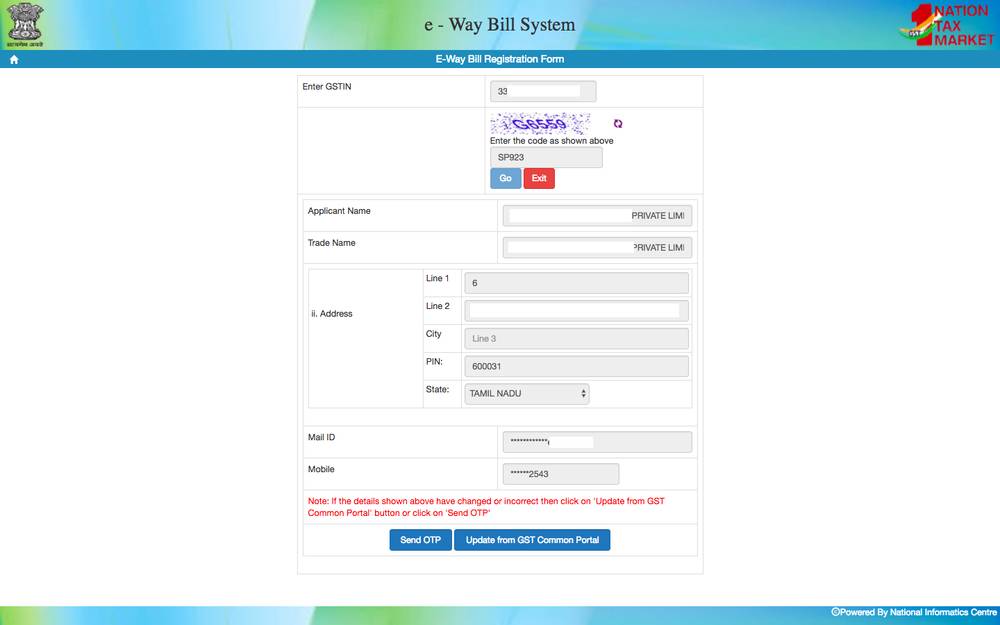

The process for creating an e-way bill portal login for registered suppliers is very simple. On the e-Way Bill portal, a supplier having GST registration can click on the e-way bill Registration link to begin the enrollment process. After selecting e-way bill registration, the taxpayer must enter GSTIN and select GO. The screen shown below with details of the GST registration information will be shown: E-way Bill Registration

Click on Send OTP and complete the OTP authentication. Once, the OTP is authenticated, the user must provide a username that can be used for the account and set up the password. After the portal verifies and approves the username and password, the user can begin to use the e-way bill portal.

Click here to read about the Integration of e-way Bill and Vahan System

E-way Bill Registration

Click on Send OTP and complete the OTP authentication. Once, the OTP is authenticated, the user must provide a username that can be used for the account and set up the password. After the portal verifies and approves the username and password, the user can begin to use the e-way bill portal.

Click here to read about the Integration of e-way Bill and Vahan System

E-Way Bill Registration for Unregistered Transporters

In case of a transporter not having GST registration, he/she can still obtain the facility for issuing and authenticating e-way bills by registering on the e-way bill portal.Steps to Register on the E-way bill - Unregistered Transporters

To obtain e-way bill registration for a transporter not registered under GST, visit the e-way bill portal and select registration -> Enrolment for transporters. To transporter shall provide the following information during registration: [pdf-embedder url="https://www.indiafilings.com/learn/wp-content/uploads/2018/04/E-way-Bill-Registration-for-Unregistered-Transporters.pdf" title="E-way Bill Registration for Unregistered Transporters"] Upload a copy of identity and address proof in the place requested and select a username/password for the account. Once, uploading all the information and documents on the portal select submit. A Transporter ID would then be generated along with e-bill portal access. The transporter can use the credentials for operating the e-way bill portal.E-Way Bill Registration for Taxpayers/Registered Transporters

In case of a transporter having GST registration, the process for obtaining e-way bill portal access is similar to that of a person having GST registration as below.- Step 1: Go to the e-way bill portal.

- Step 2: Go to the Registration tab and click on e-way bill registration.

- Step 3: Generate an OTP and submit the same.

- Step 4: Create the user ID and password

E-way Bill Portal Access for Unregistered Supplier:

If an unregistered provider supplies goods to a person having GST registration, the receiver of the goods should generate the e-way bill on the e-way bill portal on behalf of the unregistered person.To create and manage the e-way bill, signup for LEDGERS GST Software.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...