Last updated: May 26th, 2021 12:55 PM

Last updated: May 26th, 2021 12:55 PM

eGRAS

Online Government Receipts Accounting System is an initiative of the Government of Haryana under the Mission Mode Project category and is part of the Integrated Financial Management System. e-GRAS facilitates the revenue payers to make all revenue due to the government such as sales tax, road tax, taxes and duties including penalties online. In this article, we look at the e-GRAS in detail.Who can avail this Service?

Any user who has to deposit government receipts can use this facility provided in this portal. The user can be a single person, association, entity, government or semi-government units, departments etc.Advantages of e-GRAS

There are some of the advantages to the citizens provided through e-GRAS areas follows:- The e-GRAS offers ease of operation and convenience.

- The e-GRAS facility is available on 24 hours a day.

- One can deposit on behalf of the firm, company and others.

- On-line payment of taxes avoid queues and waiting.

- Online Filling of single challan form minimum fields of the challan need to be filled, and most of the fields are populated automatically.

Online Payment Procedure

The citizens can register through the official portal of e-GRAS to make payment online, follow the steps mentioned below: Provide Login Details Step 1: Firstly, you have to log in through the website for making payment. Step 2: If you are an existing user, you directly login into the portal with the login details. [caption id="attachment_73781" align="aligncenter" width="319"] e-GRAS - Image 1

New User Registration

Step 3: If you are a new user, click on “Sign in” button where you need to fill the personal details and then click on the “Submit” button.

Step 4: After registering as a new user you can log in into the portal with your login credentials.

Purpose of Payment

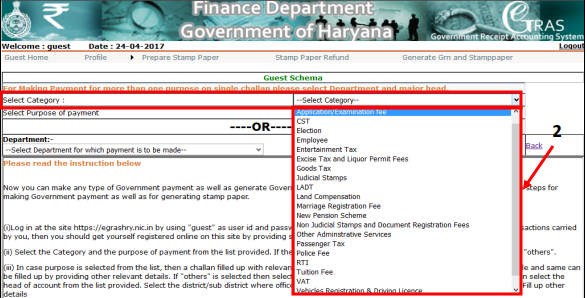

Step 5: Upon login, on the next screen the user needs to select the category and select the purpose of payment for which the user wants to generate the challan.

]

[caption id="attachment_73782" align="aligncenter" width="587"]

e-GRAS - Image 1

New User Registration

Step 3: If you are a new user, click on “Sign in” button where you need to fill the personal details and then click on the “Submit” button.

Step 4: After registering as a new user you can log in into the portal with your login credentials.

Purpose of Payment

Step 5: Upon login, on the next screen the user needs to select the category and select the purpose of payment for which the user wants to generate the challan.

]

[caption id="attachment_73782" align="aligncenter" width="587"] e-GRAS - Image 2

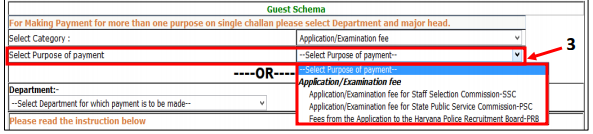

Step 6: Upon selection of “Purpose of Payment”, respective “Department” & “Major Head” will be automatically selected.

[caption id="attachment_73783" align="aligncenter" width="593"]

e-GRAS - Image 2

Step 6: Upon selection of “Purpose of Payment”, respective “Department” & “Major Head” will be automatically selected.

[caption id="attachment_73783" align="aligncenter" width="593"] e-GRAS - Image 3

Select Department

Step 7: The user may also select directly “Department” and “Major Head” instead of selecting “Purpose of Payment”.

[caption id="attachment_73785" align="aligncenter" width="588"]

e-GRAS - Image 3

Select Department

Step 7: The user may also select directly “Department” and “Major Head” instead of selecting “Purpose of Payment”.

[caption id="attachment_73785" align="aligncenter" width="588"] e-GRAS - Image 4

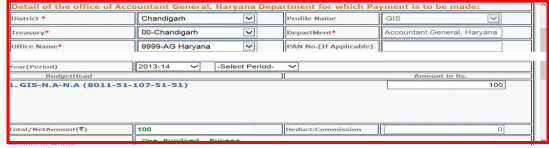

Step 8: After selection, click on the “Submit” Button. Upon clicking, E-Challan Page will be opened. On this page, you need to enter four types of information.

Fill the Department Details

Step 9: Provide the details of the department for which the payment has to be made.

[caption id="attachment_73787" align="aligncenter" width="549"]

e-GRAS - Image 4

Step 8: After selection, click on the “Submit” Button. Upon clicking, E-Challan Page will be opened. On this page, you need to enter four types of information.

Fill the Department Details

Step 9: Provide the details of the department for which the payment has to be made.

[caption id="attachment_73787" align="aligncenter" width="549"] e-GRAS - Image 5

Step 10: Select the district, treasury, office name, PAN number, year and then select the period.

Step 11: Enter the nature of the tax payment, amount, total amount and after entering the amount details, you need to select the “Security question” and then enter “email” and mobile number.

[caption id="attachment_73788" align="aligncenter" width="542"]

e-GRAS - Image 5

Step 10: Select the district, treasury, office name, PAN number, year and then select the period.

Step 11: Enter the nature of the tax payment, amount, total amount and after entering the amount details, you need to select the “Security question” and then enter “email” and mobile number.

[caption id="attachment_73788" align="aligncenter" width="542"] e-GRAS - Image 6

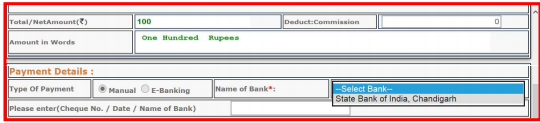

Payment Detail

Step 12: Select manual or e-banking in the type of payment option. If the user selects “manual option” you have to deposit the printout the challan at the selected bank. If the user selects the “e-banking” option, then enter the bank account details and then make payment in Government receipt directly.

[caption id="attachment_73789" align="aligncenter" width="540"]

e-GRAS - Image 6

Payment Detail

Step 12: Select manual or e-banking in the type of payment option. If the user selects “manual option” you have to deposit the printout the challan at the selected bank. If the user selects the “e-banking” option, then enter the bank account details and then make payment in Government receipt directly.

[caption id="attachment_73789" align="aligncenter" width="540"] e-GRAS - Image 7

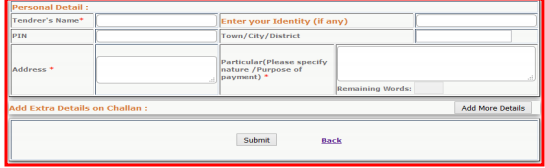

Personal Details

Step 13: Now enter the required details in the column such as tender name, identity, PIN, town/city/district, address and particular (the purpose of payment).

[caption id="attachment_73790" align="aligncenter" width="545"]

e-GRAS - Image 7

Personal Details

Step 13: Now enter the required details in the column such as tender name, identity, PIN, town/city/district, address and particular (the purpose of payment).

[caption id="attachment_73790" align="aligncenter" width="545"] e-GRAS - Image 8

Add Extra Detail on Challan

Step 14: Click on the “Add more detail” button to enter any extra detail with challan.

Step 15: On the next page, click on the “New add detail” button to enter the details and save the same, and this will be added with the challan. Click on the ”Submit” button.

[caption id="attachment_73791" align="aligncenter" width="548"]

e-GRAS - Image 8

Add Extra Detail on Challan

Step 14: Click on the “Add more detail” button to enter any extra detail with challan.

Step 15: On the next page, click on the “New add detail” button to enter the details and save the same, and this will be added with the challan. Click on the ”Submit” button.

[caption id="attachment_73791" align="aligncenter" width="548"] e-GRAS - Image 9

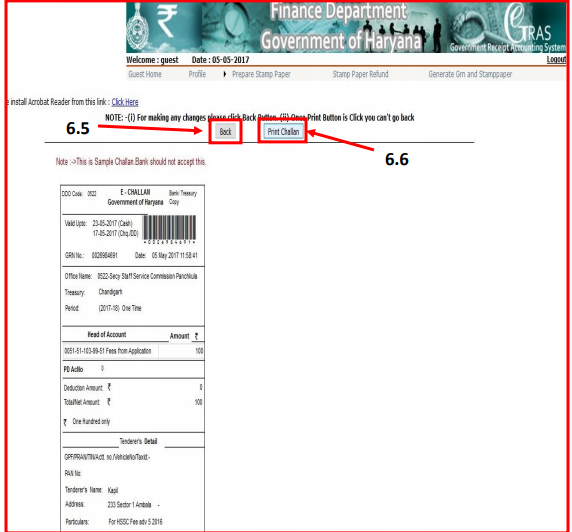

Step 16: Upon clicking the submit button, Challan will be generated.

Step 17: If you add any extra details with the challan, then click on “View Extra Detail” and can take the print of that as well. After this, deposit the amount in the bank mentioned at the printed Challan, and the amount can be deposited directly in the Bank.

[caption id="attachment_73792" align="aligncenter" width="572"]

e-GRAS - Image 9

Step 16: Upon clicking the submit button, Challan will be generated.

Step 17: If you add any extra details with the challan, then click on “View Extra Detail” and can take the print of that as well. After this, deposit the amount in the bank mentioned at the printed Challan, and the amount can be deposited directly in the Bank.

[caption id="attachment_73792" align="aligncenter" width="572"] e-GRAS - Image 10

e-GRAS - Image 10

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...