Updated on: December 23rd, 2022 9:05 PM

Updated on: December 23rd, 2022 9:05 PM

Enquiry of Challan Status

The Income Tax Department facilitates taxpayers to track the status of their challan deposits through an Enquiry of Challan Status on TIN-NSDL website. Enquiry of challan status enables the taxpayers to verify whether their tax payments have been properly accounted for in their name. These services can be availed by both taxpayer and banks. In this article, we look at the procedure for enquiring Challan status online.Challan Enquiry - Taxpayers

Taxpayers can track the status of their challan deposits in two ways, namely CIN based view and TAN based view:Challan Identification Number

Challan Identification Number (CIN) is a proof of payment of tax, as well as a necessary resource that can be used for making status enquiries. The taxpayer is required to ensure that CIN is stamped on the challan by the bank. If it is not, the assessee may approach the bank requesting the stamp to be affixed. If the bank is unable to handle the issue, the grievance must be intimated to the Bank’s Regional Manager and the Regional Office of Reserve Bank of India. CIN consists of three parts:- Seven digit BSR code of the depository Bank Branch.

- Date of Deposit.

- Serial Number of Challan.

CIN Based View

The taxpayer can view the following details after entering the Challan Identification Number (CIN):- BSR Code

- Date of Deposit

- Challan Serial Number

- Major Head Code With Description

- TAN/PAN

- Name of Tax Payer

- Date of Receipt of TIN

- Confirmation of the correctness of the amount entered if it was specified earlier

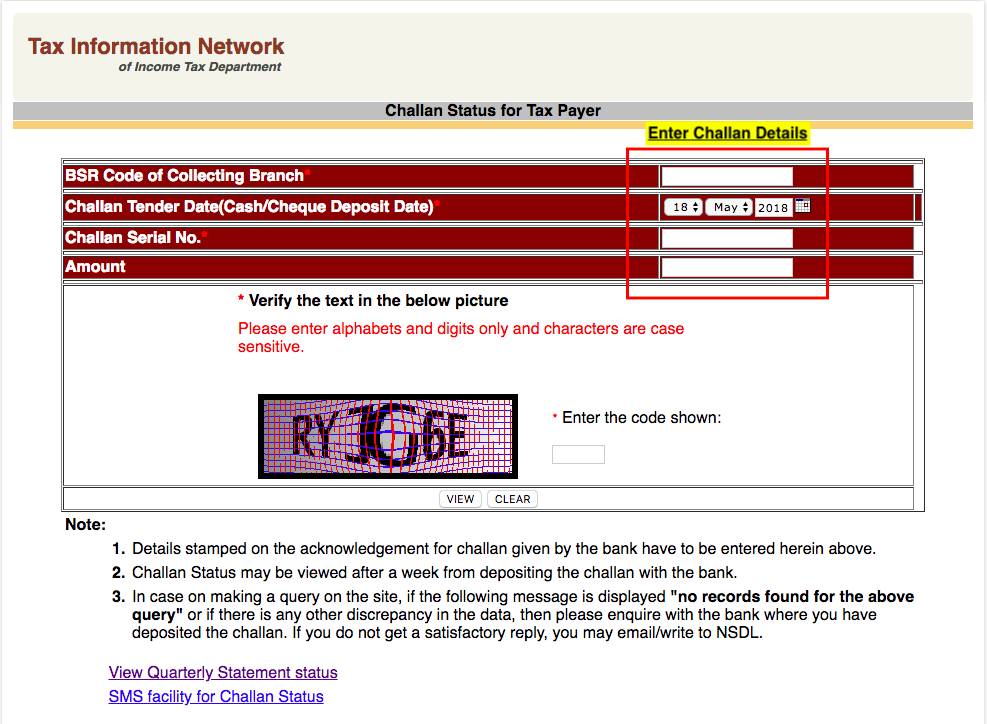

Procedure for Checking Challan - CIN Based

Step 1: Go to Challan Enquiry Page - CIN Based Challan Status Enquiry

Step 2: Enter details of the challan including BSR code of branch, date of deposit and challan serial number. The challan status will be updated only after a week.

Step 3: The system will display the challan status. In case the message displayed is "no records found" and it has been more than 1 week, contact the bank through which Challan was deposited.

Challan Status Enquiry

Step 2: Enter details of the challan including BSR code of branch, date of deposit and challan serial number. The challan status will be updated only after a week.

Step 3: The system will display the challan status. In case the message displayed is "no records found" and it has been more than 1 week, contact the bank through which Challan was deposited.

TAN

Abbreviated as Tax Deduction and Collection Account Number, TAN is a 10 digit number issued on an individual basis for the purpose of deducting or collecting tax on payments remitted by them. Section 203 of the Income Tax Act mandates every taxpayer who is liable to deduct tax at source to quote their TAN number in all their correspondences with the Income Tax Department. TDS Returns and Payments wouldn’t be processed without compliance with the same.TAN Based View

The taxpayer can view the following details after providing TAN and Challan Tender Date range for a specific financial year:- CIN

- Major Head Code with description

- Minor Head Code

- Nature of Payment

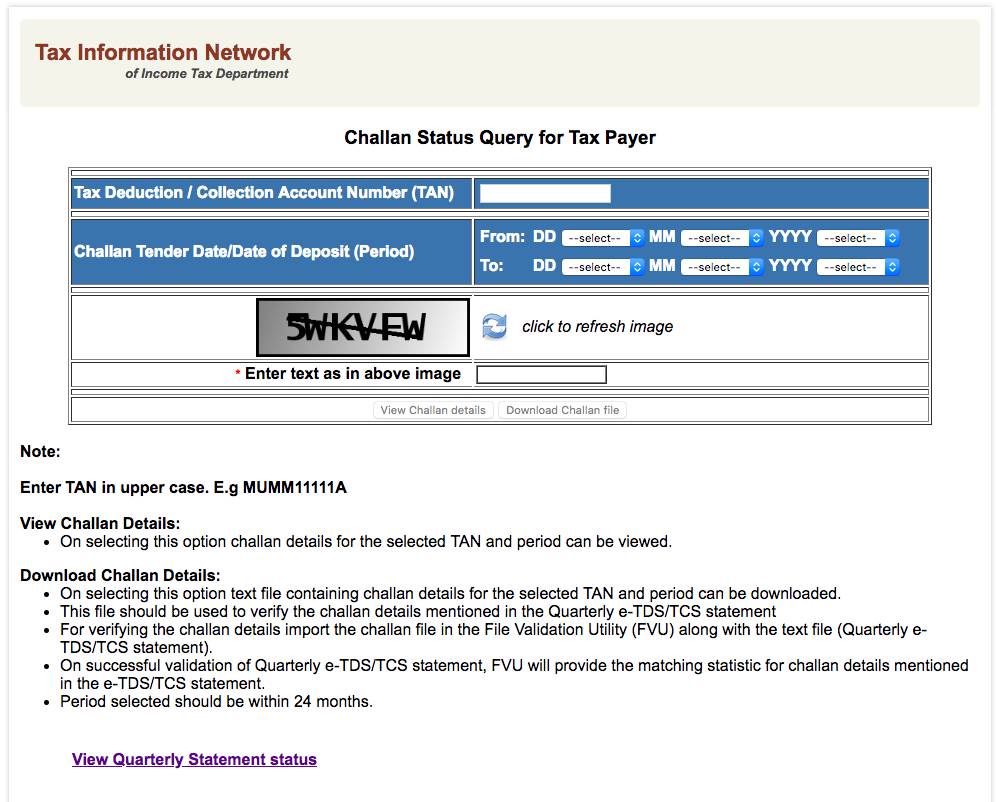

Procedure for Checking Challan - TAN Based

Step 1: Go to Challan Enquiry Page - TAN Based Challan Status - TAN View

Step 2: Enter the date and provide the deposit date in range.

Step 3: The system will display the challan status of all payments made during this time. In case the message displayed is "no records found" and it has been more than 1 week, contact the bank through which Challan was deposited.

Challan Status - TAN View

Step 2: Enter the date and provide the deposit date in range.

Step 3: The system will display the challan status of all payments made during this time. In case the message displayed is "no records found" and it has been more than 1 week, contact the bank through which Challan was deposited.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...