Last updated: August 22nd, 2019 12:28 PM

Last updated: August 22nd, 2019 12:28 PM

eWay Bill Changes

An e-Way Bill is an ‘electronic way’ bill for movement of goods which can be generated on the GST e-Way Bill System Portal. The e-Way bill system ensures that the goods are being transported in line with the GST norms and relevant information is uploaded before the commencement of the transportation of goods. The e-Way bill system has undergone various amendments in the last year. The central Government has come up with specific improvement in the e-Way Bill (EWB) system, and the same is made effective from April 2019. In this article, we will look at the enhancement done in the e-way bill system in detail.Latest Notification on Extension of Effective Date

As per the latest notification, the effective date of e-way bill will be from 21st of November 2019 instead of 21st of August 2019. Please find the notification hereunder: As per the notification from Ministry of Finance, the effective date of applicability of Rule 138E is extended from 21st of June 2019 to 21st of August 2019. The Rule 138E mentions that if a registered dealer has not submitted the GST return for consecutive two tax periods, the dealer would not be able to furnish details with regard to eWay bill in Part A of GST Form EWB-01. This will block the dealer as well as the buyer or whoever part of this particular business. They would not be able to generate on such taxpayers’ behalf. As per notification in April 2019, this was made effective from 21st of June 2019 but the applicability will be from 21st of August 2019 onwards. The notification can be viewed hereunder:Generation of e-Way Bill

As stated above, the GST e-Way bill can be generated through the official website of Goods and Services Tax e-Way Bill System. Once the e-Way bill is created, a unique e-Way bill number (EBN) will be allocated, and it will be available to the supplier, recipient and the transporter. Know more about the procedure to Generate E-Way BillEnhancement in the e-Way Bill System

The improvements done in the e-Way bill system are listed as follows:- Auto calculation of travel distance based on PIN Codes

- Knowing the distance between two PIN codes

- Blocking the generation of multiple e-Way bills on one Invoice

- Extension of e-Way bill in case the consignment is in Transit or Movement

- Report on list of e-Way bills about to expire

Auto calculation of Travel Distance Based on PIN Codes

The e-Way bill system has enhanced with auto distance calculation facility. In previous version, the consignor or consignee has to enter the approximate distance of transport while generating the e-way bill. This would determine the validity of the e-Way bill. From now onwards, the taxpayer/transporters can enter the actual distance, i.e. the user needs to enter the PIN codes of the source and destination.Provide the Actual Distance

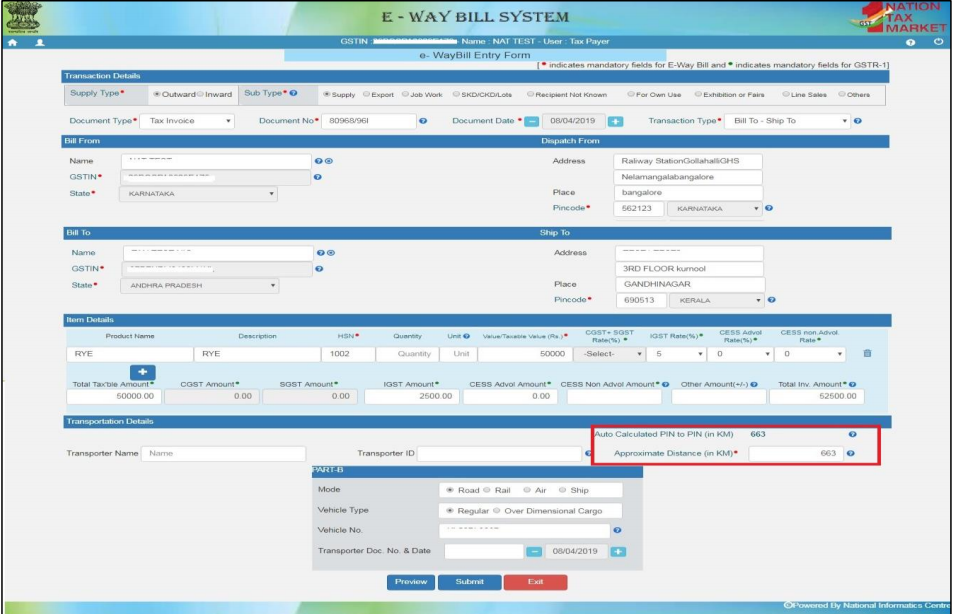

The new e-Way bill system will allow the user to enter the actual distance as per the movement of goods while generating the e-way bill. Although, it will be limited to 10% more than the auto-calculated distance displayed. Image shows enhanced feature in e-Way Bill System

Image shows enhanced feature in e-Way Bill System

For Same PIN Codes

In case, the PIN Code of both the source and destination are same; then the user can provide distance up to a maximum of 100KMs only.For Incorrect PIN Codes

If the PIN Code entered is incorrect, the system will alert the user as INVALID PIN CODE. However, the user can continue entering the distance. Further, the e-way bills having INVALID PIN CODES will be flagged for review by the GST department.Knowing the distance between two PIN codes

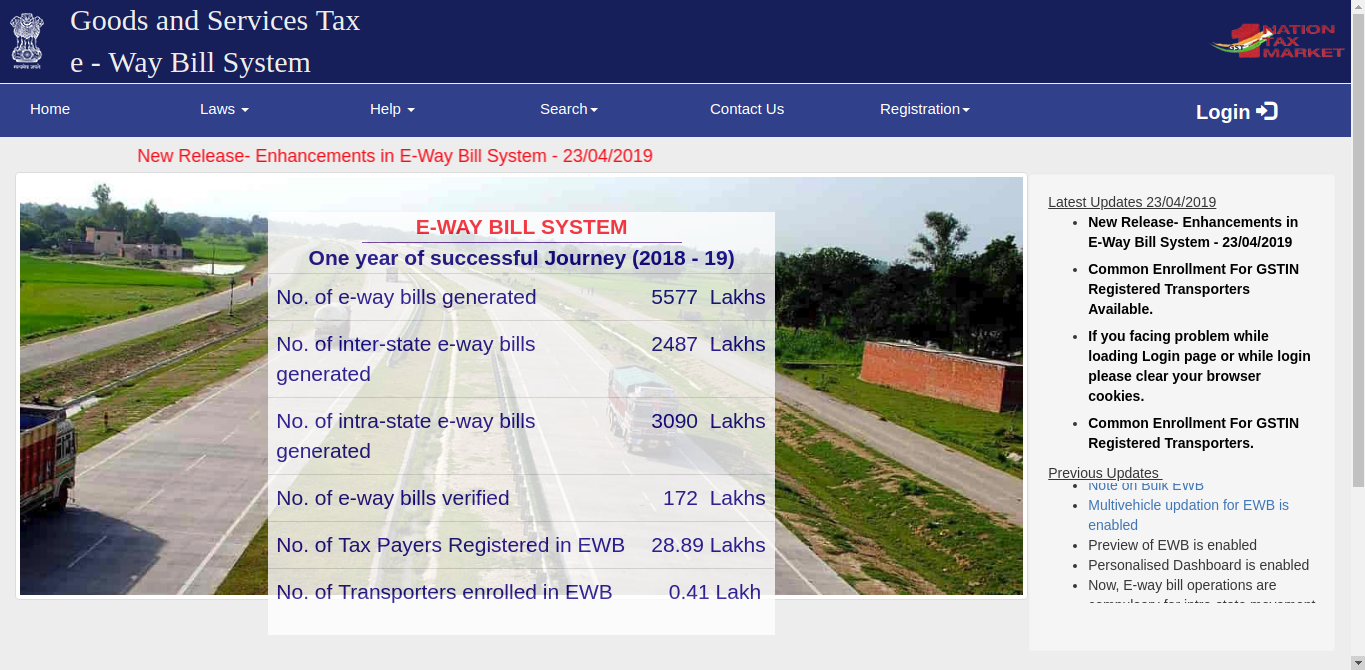

Now the taxpayer can quickly get the travel distance between the source and destination by visiting the home page of e-Way bill system. From the homepage of e-Way bill portal, click on the search option. Select the PIN to PIN distance from the drop-down menu. Image 1 Enhancement in e-Way Bill System

PIN to PIN distance screen will appear, the user needs to enter the “Dispatch From” and “Ship To” Pin codes.

Image 1 Enhancement in e-Way Bill System

PIN to PIN distance screen will appear, the user needs to enter the “Dispatch From” and “Ship To” Pin codes.

Image 2 Enhancement in e-Way Bill System

Image 2 Enhancement in e-Way Bill System

Method of Calculation

- The route distance calculation between the source and destination uses the information from various electronic sources.

- This information employs various attributes such as road class, the direction of travel, average speed and traffic data

- These attributes are picked up from the traffic that is on the national highway, state highway, expressway, district highway as well as main roads inside the cities.

- A proprietary logic is used for approximating the distance between two postal pin codes. The distance thus derived will be provided as the motorable distance at that point of time.

Blocking the Generation of Multiple e-Way Bills on one Invoice

From now, One Invoice, one e-Way bill policy will be followed. The government will not allow the consignor, consignee or transporter for the generation of multiple e-Way bills based on one invoice number.- If the e-Way bill is generated once with a particular invoice number, then none of the parties such as the consignor, consignee or transporter, can generate the e-Way bill with the same invoice number.

- If the same consignor GSTIN is used to create another e-Way bill using the same document number and same document type, the system will not allow the generation and an error message will be displayed.

Extension of e-way Bill in case the Consignment is in Transit or Movement

The e-Way bill system is enhanced to incorporate the provision for extension of the e-Way bill when the goods are in movement/transit. The taxpayer or the transporter have to log in to the e-Way bill portal and then select the e-Way bill module. Image 5 Enhancement in e-Way Bill System

Select the extend validity option and provide the e-Way bill number to fill the form. To avail this option the user has to access the form of extension validity and choose “Yes” for extension in the e-Way Bill.

Image 5 Enhancement in e-Way Bill System

Select the extend validity option and provide the e-Way bill number to fill the form. To avail this option the user has to access the form of extension validity and choose “Yes” for extension in the e-Way Bill.

Image 8 Enhancement in e-Way Bill System

Transportation Details will be displayed in the form where the user needs to select the position of the consignment as In Transit or In Movement.

Image 8 Enhancement in e-Way Bill System

Transportation Details will be displayed in the form where the user needs to select the position of the consignment as In Transit or In Movement.

In Movement

On selection of In Movement option, the system will prompt the user to select the “Mode” and “Vehicle details”. Image 7 Enhancement in e-Way Bill System

Image 7 Enhancement in e-Way Bill System

In Transit

On selection of In Transit, the user has to select the “Transit type,” i.e. On Road, Warehouse or Others. Followed by the Address details of the transit place. Image 8 Enhancement in e-Way Bill System

In both the scenarios, the destination PIN will be considered from the PART-A of the e-Way bill for calculation of travel distance for movement and validity details.

Image 8 Enhancement in e-Way Bill System

In both the scenarios, the destination PIN will be considered from the PART-A of the e-Way bill for calculation of travel distance for movement and validity details.

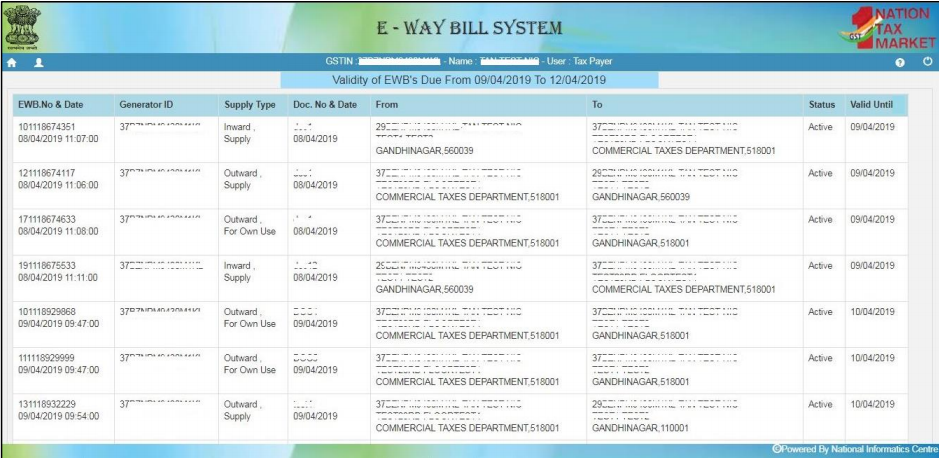

Report on list of e-Way bills about to expire soon

Taxpayers or transporters can now view the list of e-Way Bills about to expire in 4 days.- They can keep track of expiry dates for each of the consignments generated.

- To avail, this option, login to the e-Way Bill system and select the Reports option.

- Click on the My EWB Reports and then select the EWB about to expire option.

- The list presents the validity of e-Way Bills about to expire.

Image 9 Enhancement in e-Way Bill System

Recently, the e-way bill system has been empowered with various fruitful changes. The e-way bill system now would be empowered to auto calculate the route distance based on the PIN code; blocking of generation of multiple e-way bills based on the single invoice; facility to extend e-way bill in case of consignment in transit; for composition dealer, blocking of the interstate transaction. The said changes along with its effect thereon are being explained in the present article.

Image 9 Enhancement in e-Way Bill System

Recently, the e-way bill system has been empowered with various fruitful changes. The e-way bill system now would be empowered to auto calculate the route distance based on the PIN code; blocking of generation of multiple e-way bills based on the single invoice; facility to extend e-way bill in case of consignment in transit; for composition dealer, blocking of the interstate transaction. The said changes along with its effect thereon are being explained in the present article.

- Route distance would be auto-calculated based on the PIN code

- The user is allowed to enter the actual distance as per the movement of goods, however, the difference would be limited to 10% more than the distance displayed by the system;

- In case of same source PIN and destination PIN, the user would be allowed to enter maximum up to 100 KMS;

- In case the PIN entered is incorrect, the e-way bill system would report the same as “INVALID PIN CODE’, however, the user is allowed to continue the same by entering the distance, but the consequence would be that the said e-way bill would be flagged for the review by the department.

- Generation of multiple e-way bills will not be possible for a single invoice

- Facility to extend e-way bill would be made available in case the consignment is in transit

- Relevant changes affecting composition dealer

- Blocking of the inter-state transaction– GST Act doesn’t permit inter-state transaction, in case of composition dealer, and the same shall be blocked in e-way bill system too. Meaning thereby that composition dealer will not be allowed to generate an e-way bill for the inter-state transaction.

- Blocking of taxes CGST and SGST for the intra-state transaction– Under e-way bill system, composition dealer would not be allowed to enter CGST and SGST taxes relevant for the intra-state transaction.

- Blocking of document type ‘tax invoice’– Document type ‘tax invoice’ would not be available for composition dealer.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...