Last updated: December 15th, 2022 3:08 PM

Last updated: December 15th, 2022 3:08 PM

Export and Import Procedure in India

India ranks 19th in terms of overall export of merchandise and 12th in terms of the overall import of merchandise compared to other countries. With more trade liberalization deals to be signed by the pro-business Indian Government, there is plenty of opportunity for establishing a successful import or export business. To undertake an import or export business, the Entrepreneur must have a strong understanding of all import or export transactions documentation. This article covers India's primary export and import procedures and the necessary documentation.

Export and Import Procedure

To begin exporting or importing goods from India, the business or individual must obtain an Import Export Code or IE Code from the Directorate General of Foreign Trade. Obtain the IE Code from the business after obtaining PAN and opening a bank account. IndiaFilings can help you obtain IE Code.Commercial Invoice

The seller issues the commercial invoice to the buyer containing the terms of the transaction, like the date of the transaction, seller details, buyer details, value, shipping terms, and more. Customs duty is levied on the shipment, usually based on the commercial invoice raised by the seller.

[caption id="attachment_3710" align="aligncenter" width="612"] Sample Commercial Invoice

Sample Commercial Invoice

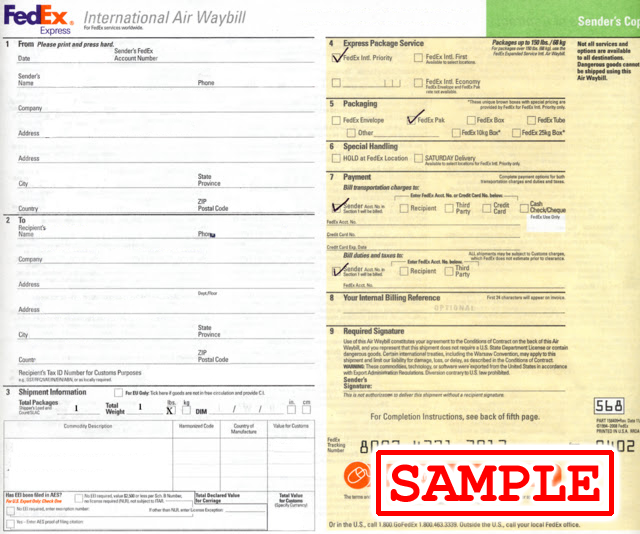

Air Waybills

An airway bill is proof of shipment of goods by air. Air waybills serve as proof of receipt of goods for shipment by the air cargo agent, an invoice for the air shipment, a certificate of insurance, and a guide to the air cargo agent for handling, dispatch, and delivery of the consignment. A typical airway bill contains details about the shipper and the consignee, the departure and destination airports, a description of the goods, sign and seal of the carrier.

[caption id="attachment_3703" align="aligncenter" width="640"] Sample Air Waybill

Sample Air Waybill

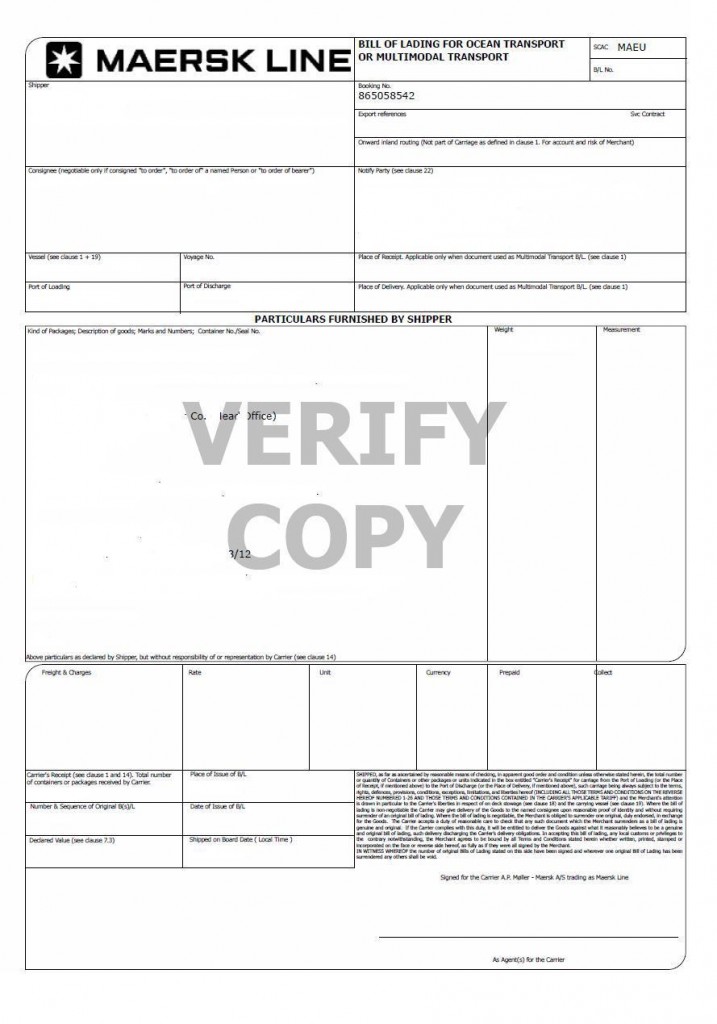

Bill of Lading

The shipping agency provides a Bill of Lading for goods shipped by them. A Bill of lading usually contains information about the shipper, consignee, carrying vessel, ports of loading and discharge, place of receipt and delivery, mode of payment, and name of the carrier.

[caption id="attachment_3704" align="aligncenter" width="717"] Sample Bill of Lading

Sample Bill of Lading

Bill of Exchange

A Bill of exchange is used when an importer agrees to pay the exporter in the future on a date on or before that is mutually agreed upon. A Bill of exchange is an important written document in wholesale trade involving large amounts of money. A Bill of exchange can be classified as a bill of exchange after the date and a bill of exchange after sight. Bill of exchange after the date is when the due date for payment is counted from the date of the drawing. Bill of exchange after sight is when the due date for payment is counted from the date of acceptance of the bill.

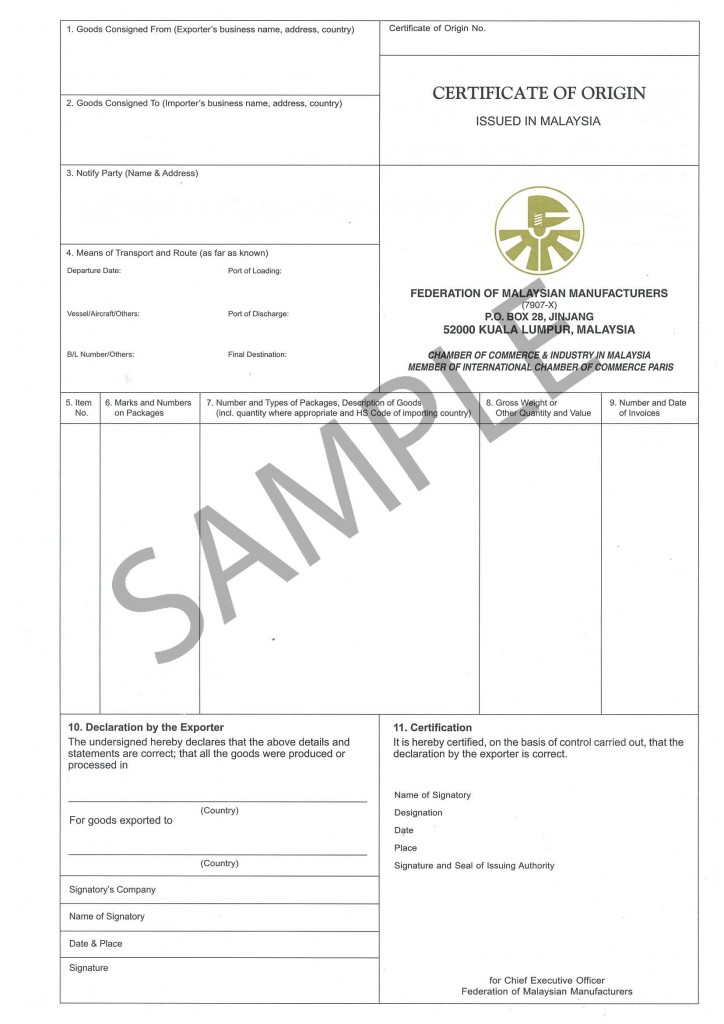

Certificate of Origin

The Customs Authority generally requests the certificate of origin while clearing Customs. A certificate of Origin is used to establish the product's origin and is issued by the Chamber of Commerce of the Exporter's country. Certificate of origin usually contains the name and address of the exporter, details of the goods, package number or shipping marks, and quantity, as applicable.

[caption id="attachment_3707" align="aligncenter" width="724"] Sample Certificate of Origin

Sample Certificate of Origin

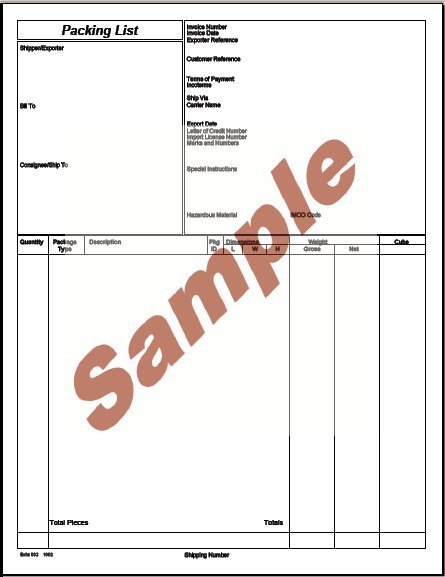

Packing List

The packing list contains detailed information about the shipped goods, quantity, weight, and packing specifications. The packing list must contain a product description and details regarding the shipping marks.

[caption id="attachment_3708" align="aligncenter" width="445"] Sample Export Packing List

Sample Export Packing List

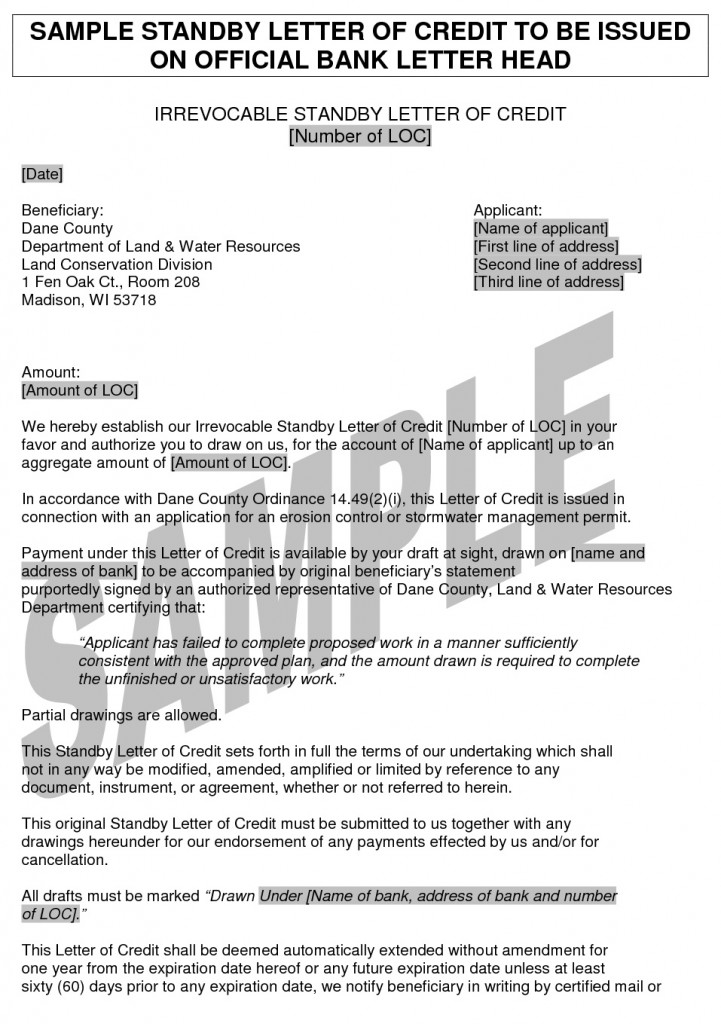

Letter of Credit

A letter of Credit is an arrangement wherein a Bank, on the request of its customer, agrees to make payment to a beneficiary on receipt of documents from a beneficiary as per the terms stipulated in the Letter of Credit. Letter of Credit or LC is used extensively in international and domestic trade transactions.

Click here to learn more about the Letter of Credit (LC).

[caption id="attachment_3709" align="aligncenter" width="721"] Sample Letter of Credit

For more information about export and import procedure in India, talk to an IndiaFilings Business Advisor.

Sample Letter of Credit

For more information about export and import procedure in India, talk to an IndiaFilings Business Advisor.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...