Last updated: January 10th, 2023 6:22 PM

Last updated: January 10th, 2023 6:22 PM

Export Bond for GST & Letter of Undertaking

Entities involved in the export of goods having GST registration are allowed to export goods without payment of IGST by furnishing an export bond or Letter of Undertaking (LUT) in Form GST RFD-11. In this article, we look at this procedure in detail.Letter of Undertaking (LUT) for Exports under GST

According to the Central Goods and Services Tax Rules, 2017, any registered person exporting goods without payment of integrated tax must mandatorily furnish a bond or a Letter of Undertaking (LUT) in FORM GST RFD-11. The following types of persons registered under GST will be allowed to submit a letter of undertaking and undertake export transactions.- Status holder as specified in the Foreign Trade Policy; or

- Entities that have received the due foreign inward remittances amounting to a minimum of 10% of the export turnover, which should not be less than one crore rupees, in the preceding financial year, and he has not been prosecuted for any offence under the Central Goods and Services Tax Act, 2017 (12 of 2017) or under any of the existing laws in case where the amount of tax evaded exceeds two hundred and fifty lakh rupees.

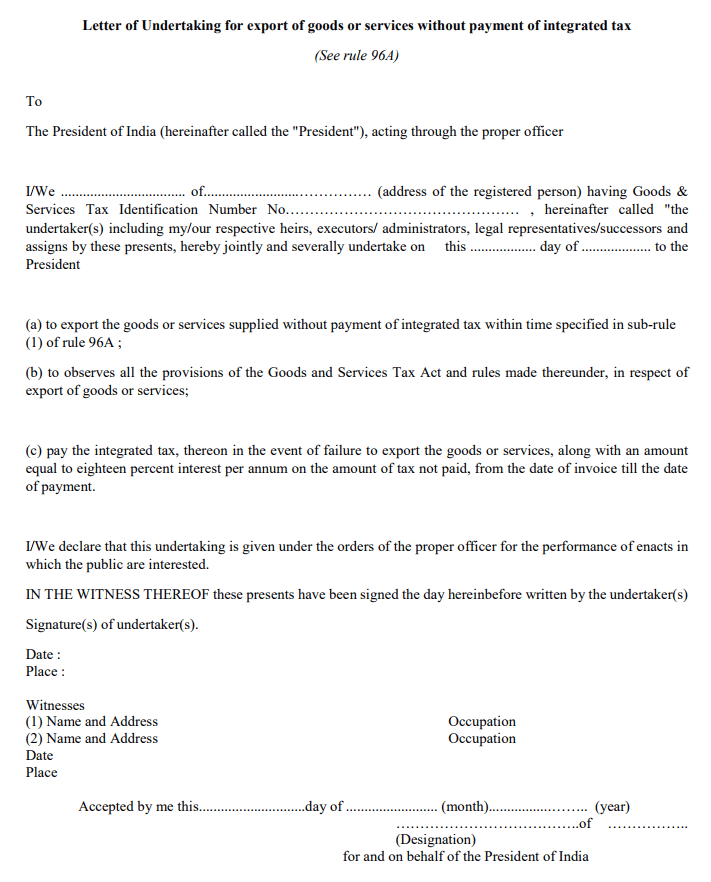

GST Letter of Undertaking Format

The following letter of undertaking format can be adopted by exporters under GST: [caption id="attachment_33019" align="aligncenter" width="711"] GST Letter of Undertaking Format

GST Letter of Undertaking Format

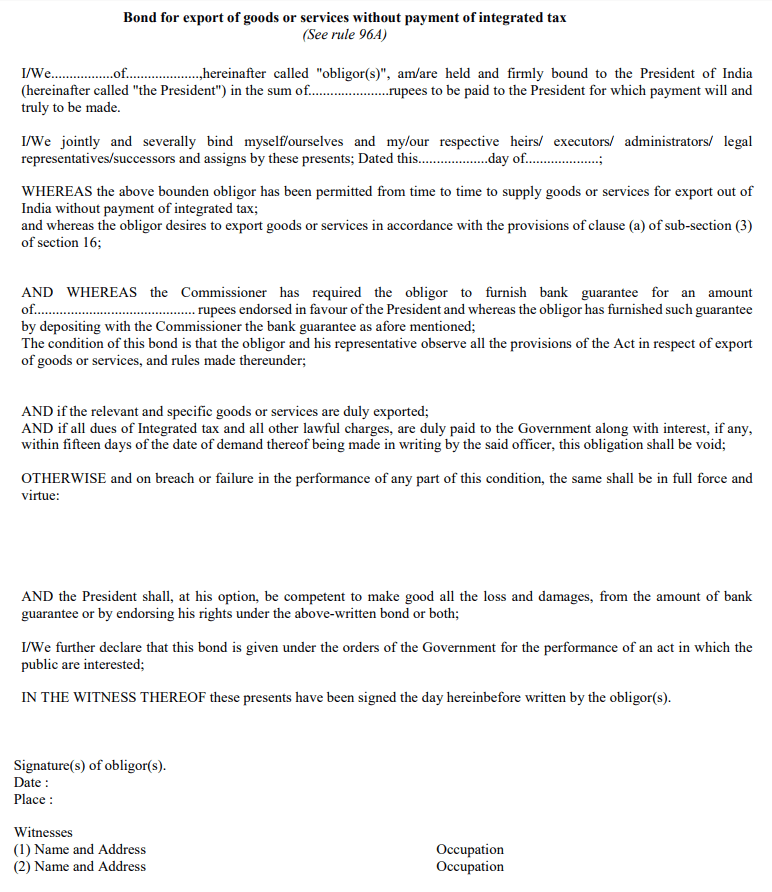

Export Bond for GST

Entities not eligible to submit Letter as per the conditions mentioned above would have to furnish an export bond along with bank guarantee. The bond should cover the amount of tax involved in the export based on estimated tax liability as assessed by the exporter himself. The concerned individual shall furnish the Export bond on a non-judicial stamp paper with the value as indicated in the State. Also, exporters can furnish a running bond, so that export bond need not be executed for each and every export transaction. However, if the outstanding tax liability on exports exceeds the bond amount at any time, then the exporter must furnish a fresh bond to cover the additional liability. The individual shall submit the Export bonds and letter to the jurisdictional Deputy Commissioner or Assistant Commissioner of the concerned jurisdiction. However, after uploading the FORM RFD-11 on the GST Portal, the individual shall proceed to submit the document online.GST Export Bond Format

[caption id="attachment_33020" align="aligncenter" width="772"] GST Export Bond Format

GST Export Bond Format

Bank Guarantee for Export Bond

Along with the export bond, the individual shall include a bank guarantee. The value of the bank guarantee should normally not exceed 15% of the bond amount. However, based on the track record of the exporter, the jurisdictional GST Commissioner may wave off the bank guarantee as required along with the export bond.Import Export Code

The Import Export Code is a primary document necessary for commencing Import-export activities. The IE code is to be obtained for exporting or importing goods or services. IEC has numerous benefits for the growth of the business. Indeed, you cannot ignore the necessity of IE code registration, as it is mandatory. You can apply for an Import Export code through IndiaFilings and obtain it within 6 to 7 daysPopular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...