Last updated: February 26th, 2020 12:05 PM

Last updated: February 26th, 2020 12:05 PM

Exports - GST Refund

As per the provisions included under IGST law, the exports of goods are considered as zero-rated supply is exempted from GST and are eligible to claim the refund of GST paid. The GST portal has been set up for making GST refund claims efficiently. In this article, we look at the procedure for claiming GST refund on exports.Eligibility Criteria

Every registered taxable person, other than an input service distributor/compounding taxpayer/TDS deductor/TCS Collector, can claim for refund on taxes paid on exports under the following conditions are:- The taxpayer who filed Form GSTR-1, providing export details in Table 6A of GSTR-1 along with Shipping bill details of Integrated Tax paid can claim for their refund.

- The taxpayer who filed Form GSTR-3B is returns of the relevant tax period for which the refund can be claimed.

Refund Process

The taxpayer has to make an application in the form GSTR-1 and provide export details (Table 6A) along with shipping bill details of integrated tax paid. And also the application form of GSTR-3B has to be proposed for the relevant tax period for which refund has to be paid. Then GST portal shares the export data included under form GSTR1 along with a form GSTR3B filed for the appropriate tax period with ICEGATE. The system validates the Form GSTR 01 data with their Shipping Bill and EGM data and initiates the refund process. The taxpayer is not needed to file a separate refund application in this case, and shipping Bill itself will be treated as refund application. Once the refund payment is credited to the account of the taxpayers, the ICEGATE system will provide the payment information with the GST Portal will send the details through SMS and e-mail with the taxpayers.Correction In Form GSTR -1

In case of incomplete or incorrect details of export filed in Form GSTR-1 of existing periods can be corrected through Table 9A (Amended Export Invoices) of Form GSTR 1 of the subsequent period. If an invoice needs to be included in Table 6A of Form GSTR-1 in a particular month, the same can be reported in Table 6A of Form GSTR -1 of the subsequent period.Correction In Form GSTR -3B

Corrections in the filing of return in Form GSTR-3B of a tax period may be adjusted in GSTR-3B of the subsequent month, as per the circular number 26/26/2017 issued by CBEC:- The tax paid on exports which are indicated in table 3.1(a) or table 3.1(c) instead of table 3.1(b), in such case the appropriate corrections can be done in the subsequent month to the extent permitted.

- The tax paid on exports has been mentioned as zero in table 3.1(b), the correct amount can be declared and offset during GSTR -3B filing of the subsequent month.

- The tax paid on exports declared in table 3.1(b) is lesser than the return specified in the invoices filed under table 6A, and Table 6B, of FORM GSTR-1, differential amount of tax can be declared and offset during GSTR 3B filing of the subsequent month.

Concerned Authority

The entire refund process on account of the export is completed by the ICEGATE (Indian Customs Electronic Commerce/Electronic Data Interchange (EC/EDI) Gateway). Hence for more query taxpayer needs to contact corresponding ICEGATE Jurisdictional officials.Time Limit for Refund Process

The entire process of refunding tax paid on exports of goods can be completed in seven days from the date of application submitted.Online Procedure To Claim Refund

To claim for the refund on the export of goods online, follow the steps mentioned below: Step 1: Visit the Official Portal of GST Department.Provide Login Details

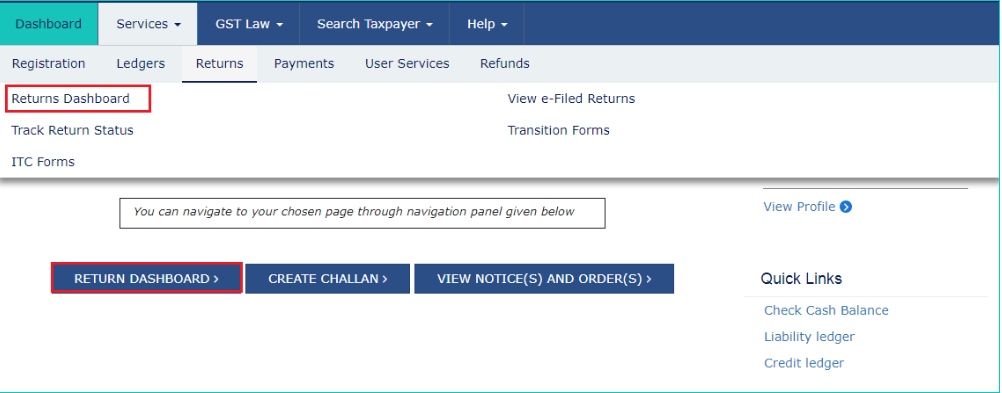

Step 2: Log in to the GST Portal with accurate details like username and password and click on the "Login" button. Step 3: Click the Services and select "Returns Dashboard" command from Returns menu. [caption id="attachment_63943" align="aligncenter" width="648"] Exports-GST-Refund-Select-Services

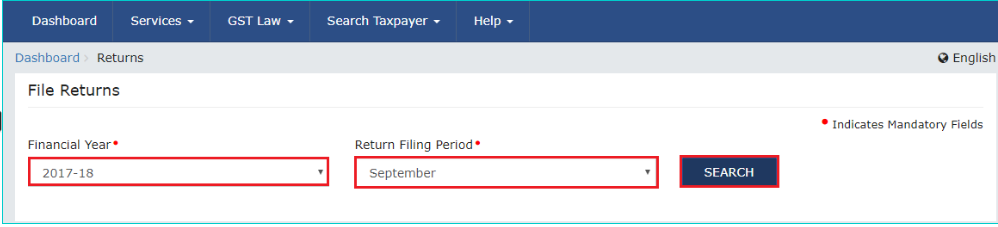

Step 4: On the next page File Returns is visible. Select the Financial Year and Return Filing Period (Month) to file the return from the drop-down list.

Step 5: Click on "Search" button.

[caption id="attachment_63944" align="aligncenter" width="672"]

Exports-GST-Refund-Select-Services

Step 4: On the next page File Returns is visible. Select the Financial Year and Return Filing Period (Month) to file the return from the drop-down list.

Step 5: Click on "Search" button.

[caption id="attachment_63944" align="aligncenter" width="672"] Exports-GST-Refund-Select-File-Return

Step 6: The File Returns page has appeared. This page represents the due date of filing the returns, which the taxpayer has to file using separate tiles.

In the Table 6A of FORM GSTR1 tab, click the "Prepare Online" button to prepare the return by making entries on the GST Portal.

[caption id="attachment_63945" align="aligncenter" width="664"]

Exports-GST-Refund-Select-File-Return

Step 6: The File Returns page has appeared. This page represents the due date of filing the returns, which the taxpayer has to file using separate tiles.

In the Table 6A of FORM GSTR1 tab, click the "Prepare Online" button to prepare the return by making entries on the GST Portal.

[caption id="attachment_63945" align="aligncenter" width="664"] Exports-GST-Refund-Select-File-Return-Details

Exports-GST-Refund-Select-File-Return-Details

Provide Invoice Details

Step 7: Click the "Add Details" button to add a new invoice. [caption id="attachment_63946" align="aligncenter" width="650"] Exports-GST-Refund-Select-Invoice-Details

Step 8: On the next page, Exports- Add Details page displays to enter the appropriate details as shown below.

Exports-GST-Refund-Select-Invoice-Details

Step 8: On the next page, Exports- Add Details page displays to enter the appropriate details as shown below.

- Provide the invoice number in the Invoice Number field.

- Choose the date on which the invoice using the calendar in the Invoice Date field.

- Enter the port code in the Port Code field.

- Enter the shipping bill number or bill of the export number in the Shipping Bill Number or Bill of Export Number field.

- Once entering the shipping bill number or bill of the export number, enables the shipping bill date or Bill of the export date field.

- Select the date on the shipping bill or bill of export using the calendar in the Shipping Bill Date/Bill of Export Date field.

- Enter the total invoice value in the Total Invoice Value field.

- Select whether GST payment is with payment of tax or without payment of tax from the GST Payment drop-down list.

- In the Taxable Value field against the rates, enter the taxable value of the goods or services.

Preview Form GSTR-1

Step 10: On adding invoices, select the "Preview" tab. [caption id="attachment_63947" align="aligncenter" width="602"] Procedure-For-Refund-On-Export-of-Goods-GSTR--1

With the help of the preview tab, download the draft Summary page of Table 6A of FORM GSTR1 for review.

Step 11: The PDF file of Table Form GSTR1 will be generated.

Procedure-For-Refund-On-Export-of-Goods-GSTR--1

With the help of the preview tab, download the draft Summary page of Table 6A of FORM GSTR1 for review.

Step 11: The PDF file of Table Form GSTR1 will be generated.

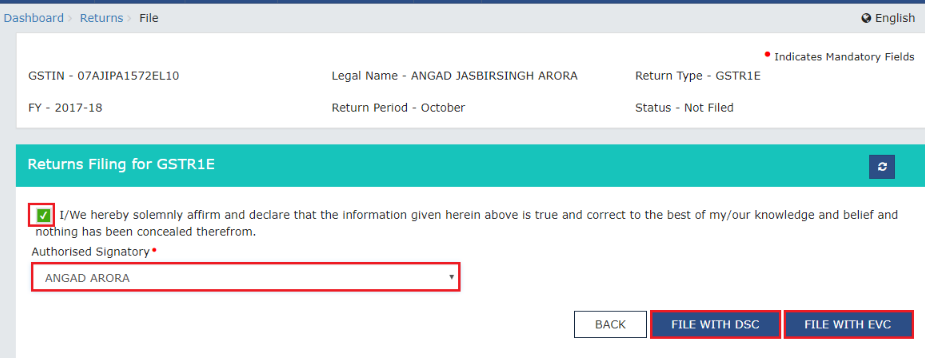

File Return with DSC OR EVC

Step 12: Click the "File Return" button. Step 13: The Returns Filing for the GSTR1E page is visible. Select the Declaration checkbox. Step 14: In the Authorised Signatory scroll-down list, press the authorised signatory. This will allow the two buttons - File With DSC or File With EVC. Step 15: Click the File with DSC or File with EVC button to file Table 6A of FORM GSTR1. [caption id="attachment_63948" align="aligncenter" width="632"] Exports-GST-Refund-Return-Filing

Exports-GST-Refund-Return-Filing

File With DSC- Method

Click the Proceed button and select the certificate and click the Sign button.File With EVC - Method

Enter the OTP sent on email and mobile number of the Authorized Signatory registered at the GST Portal and click the Verify button. Step 16: The success message is displayed. Status of the Table 6A of FORM GSTR-1 returns changes to "Filed".View Status

Step 17: Now, select the Financial Year and Return Filing Period (Month) to view the return from the drop-down list and click the Search button. [caption id="attachment_63949" align="aligncenter" width="577"] Exports-GST-Refund-View-Status

To know about GST return Filing Click Here

Exports-GST-Refund-View-Status

To know about GST return Filing Click Here

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...