Last updated: December 17th, 2019 3:41 PM

Last updated: December 17th, 2019 3:41 PM

Federal Bank Current Account

Current account is a sort of deposit account maintained by individuals or entities who carry out transactions with banks, whose frequency of transactions is significantly higher than others. Current accounts are often linked to liquid deposits and offer a wide array of customized options according to the applicant's financial dealings. These accounts do not provide interests and require a higher minimum balance when compared to a savings account. The striking feature of this account is the fact that account holders can seamlessly avail overdraft facility up to an allowed limit. This article hopes to provide you with a glimpse of the various Current Accounts offered by Federal Bank and the details related to the same.Current Accounts by Federal Bank

Federal Bank aims to provide a comprehensive and flexible current account service that is designed strategically for each of its customers. Current Accounts by Federal Bank offer convenient and efficient business banking that is tailor-made for the Small to Medium Enterprise and Corporate customers. Applicants who are interested in starting a current account with Federal Bank may choose from a broad spectrum of options that best suit their needs. The following are the types of Current Accounts offered by the bank. Necessary details such as Features and Benefits, Eligibility, Balance Requirement, Interest Rates, and Service Charges are mentioned below for your awareness.Eligibility

Most of the Current Accounts offered by Federal Bank have the same Eligibility as mentioned below unless specified otherwise:- Individuals/Sole proprietary concerns

- Firms

- Joint stock companies

- Any other business entity

Freedom Current

Freedom Current is a standardised current account that aims to smoothen the process of business regarding banking. With a monthly average balance commitment of a mere INR 5000, Freedom Current is the type of current account that most people would opt for. The debit card that comes along with this account is the VISA Fast Biz Silver with a cash withdrawal limit and e-commerce transaction limit of INR 50,000.Features and Benefits

- Average Monthly Balance of INR 5000.

- Payable-at-par chequebook at a nominal price.

- Free monthly email statements.

- Internet Banking and Mobile Banking facility available.

- Free E-mail alerts.

- NEFT and RTGS facilities are available.

Current Plus

A Current Plus account is designed to enable its user with ample features and reduce the banking worries that come along with running a business. This account promises a variety of advantages by maintaining a bare minimum of a monthly average balance of just INR 10,000. The debit card provided along with this current account is the VISA Fast Biz Silver with a cash withdrawal limit and e-commerce transaction limit of INR 50,000.Features and Benefits

- Average Monthly Balance of INR 10,000.

- 20 free cheque leaves per half year.

- Free monthly email statements.

- Internet Banking and Mobile Banking facilities available.

- Free E-mail alerts.

- Free Demand Draft, 1 per day.

- NEFT and RTGS transactions are possible.

- 25% concession on service charges for collection of outstation cheques.

Fed Trade

A FedTrade current account helps a user to carry out their business with ease. With the help of a flexible current account such as FedTrade, companies run more efficiently and effectively. As this account is designed for mid-sized businesses with regular and simple cash management needs, an account holder has access to power-packed features such as account transactional alerts in mobile and email, pay bills on the go, manage fiscal spending and a lot more. With an average monthly balance of INR 25,000, the type of debit card that is offered with this account is the VISA Fast Biz Silver with a cash withdrawal and e-commerce transactional limit of INR 50,000.Features and Benefits

- Average Monthly Balance of INR 25000/-.

- Free 20 Cheque leaves per quarter.

- Free monthly email statements.

- Internet Banking and Mobile Banking facilities available.

- Free E-mail alerts.

- Free Mobile Alerts.

- Free Demand Draft, 2 per day.

- NEFT and RTGS facility are available.

- 50% concession on service charges for collection of outstation cheques.

Eligibility

- Individuals/Sole proprietary concerns

- Firms

- Joint stock companies

- Hindu Undivided Families

- Any other business entity

Fed Trade Plus

The FedTrade Plus current account by Federal Bank is a much more sophisticated version of the FedTrade current account. This account offers facilities such as bulk RTGS/ NEFT transactions without extra charges along with free demand drafts and a lot more. Since this current account is designed for higher trades and businesses, the monthly average balance to be maintained is kept at INR 1,00,000. The debit card that can access this specific current account is the Visa Fast Biz Platinum which has a cash withdrawal limit of INR 2 Lakhs and an e-commerce transactional limit of INR 3 Lakhs.Features and Benefits

- An average monthly balance of INR 1 Lakh.

- 50 Free cheque leaves per month.

- Free monthly email statements.

- Debit cards - Visa International Business Debit Card.

- Free Internet Banking.

- Free Mobile Banking.

- Free E-mail Alerts.

- Free Mobile Alerts.

- Free Demand Draft, 15 per day.

- Free NEFT and RTGS facility.

- 75% concession on service charges for collection of outstation cheques.

- 50% concession in Processing Fee/Administration Fee for all Retail Loan Products.

Fed Trade 50

Federal Bank offers the Fed Trade 50 current account with exclusive and exciting features such as high transactional limits and multiple banking channels. This account comes with a debit card of Visa Fast Biz Silver with a cash withdrawal limit if INR 50,000 AND e-Commerce transactional limit of INR 50,000. The monthly average balance that is to be maintained by this account holder is INR 50,000.Features and Benefits

- An average monthly balance of INR 50000.

- 20 Free cheque leaves per month.

- Free monthly email statements.

- Free Internet Banking.

- Free Mobile Banking.

- Free E-mail Alerts.

- Free Mobile Alerts.

- Free Demand Drafts, 5 per day.

- NEFT and RTGS facilities are available.

- 50% concession on service charges for collection of outstation cheques.

Fed Vanijya

The Fed Vanijya Current Account offers account holders many benefits on opening their account. The flexible and comprehensive solutions provided by Federal Bank gives its customers a convenient and efficient banking experience. Opening this current account offers the user with a debit card of Visa Fast Biz Platinum with a cash withdrawal limit if INR 2,00,000 AND e-commerce transactional limit of INR 3,00,000. The monthly average balance that is required to be maintained by the account holder is INR 5,00,000.Features and Benefits

- The average balance of INR 5 Lakhs.

- 150 Free cheque leaves per month.

- Free monthly email statements.

- Free Internet Banking.

- Free Mobile Banking.

- Free E-mail Alerts.

- Free Mobile Alerts.

- Free Demand Draft, 25 per day.

- Free NEFT and RTGS facility.

- Free collection of outstation cheques.

- 50% concession in Processing Fee/ Administration Fee for all Retail Loan Products.

FedVanijya Plus

The Fed Vanijya Plus Current Account offers account holders many benefits exclusively for the business they are into. This current account offers the user exciting features such as high transaction limits, free unlimited cheque leaves and free access to every digital banking channels along with free unlimited demand drafts, NEFT and RTGS facility. Opening this current account provides the user with a debit card of Visa Fast Biz Platinum with a cash withdrawal limit if INR 2,00,000 and e-commerce transactional limit of INR 3,00,000. The monthly average balance that is required to be maintained by the account holder is INR 10,00,000.Features and Benefits

- Maintenance of an average monthly balance of INR 10 Lakhs.

- Free unlimited cheque leaves.

- Free monthly email statements.

- Debit cards - Visa International Business Debit Card.

- Free Internet Banking.

- Free Mobile Banking.

- Free E-mail Alerts.

- Free Mobile Alerts.

- Free Unlimited Demand Drafts.

- Free NEFT and RTGS facility.

- Free collection of outstation cheques.

- 50% concession in Processing Fee/Administration Fee for all Retail Loan Products.

Fed Sahakari

Federal Bank’s Fed Sahakari Current Account has been created specifically for banks and cooperative societies. The features and benefits of this account are prepared by keeping the focus as the financial requirements of the account holder. Fed Sahakari has no average monthly balance that is required to be maintained.Features and Benefits

- Free Unlimited Cheque Leaves.

- Free monthly email statements.

- Free Internet Banking.

- Free Mobile Banking.

- Free E-mail Alerts.

- Free Mobile Alerts.

- Free Unlimited Demand Drafts.

- Free NEFT and RTGS facility.

- Free collection of outstation cheques.

Eligibility

- State, District, Urban, Primary, Service, Scheduled, Non-Scheduled Co-operative Banks.

- Co-operative Credit Societies.

- Any other Co-op Society.

Fed Arogya

Federal Bank provides its clients with a number of opportunities when it comes to choosing a current account for their businesses. The Fed Arogya is one such account that caters solely to those in the healthcare field and provides them with many advantages and privileges that can best aid their practice. This account comes with a debit card of Visa Fast Biz Platinum with a cash withdrawal limit if INR 2,00,000 and e-commerce transactional limit of INR 3,00,000. No monthly average balance is to be maintained by this account holder.Features and Benefits

- Free at par Cheque leaves.

- Free monthly email statements.

- VISA International Business Debit Card.

- Free Internet Banking.

- Free Mobile Banking.

- Free E-mail Alerts.

- Free Mobile Alerts.

- Free Demand Draft.

- Free NEFT and RTGS facility.

- Free collection of outstation cheques.

Eligibility

- Hospitals

- Nursing Homes

- Clinics

- Diagnostic Centers

Fed Chit

Federal Bank presents Fed Chit that is designed exclusively for Chit Fund/Kuri Companies based on their necessities. This account comes with a debit card of VISA Fast Biz Platinum with a cash withdrawal limit if INR 2,00,000 and e-Commerce transactional limit of INR 3,00,000. The monthly average balance that is to be maintained by this account holder is INR 1 Lakh.Features and Benefits

- An average monthly balance of INR 1 Lakh.

- Free unlimited Cheque leaves.

- Free monthly email statements.

- VISA International Business Debit Card.

- Free Internet Banking.

- Free Mobile Banking.

- Free E-mail Alerts.

- Free Mobile Alerts.

- Free Demand Draft.

- Free NEFT and RTGS facility.

- Free collection of outstation cheques.

Eligibility

Chit Fund/Kuri CompaniesESCROW Account

Federal Bank offers the services termed as ESCROW Account to meet the needs and requirements of its customers. Clients who deal with Project Financing, Debt Repayments, IPO collections of listed companies, Liquidations and Mergers and Acquisitions would find that this kind of account would uplift their business. The benefits of an ESCROW Account include safe and secure mode of routing cash flows, hassle-free account opening and dedicated services.RERA Project Account

Federal Bank offers the services Federal Bank offers RERA Project Account as a dedicated project account which enables the account holder to meet the regulatory guidelines under the RERA Act. The benefits of a RERA Project Account include safe and secure mode of routing cash flows, hassle-free account opening and dedicated services.Application Procedure

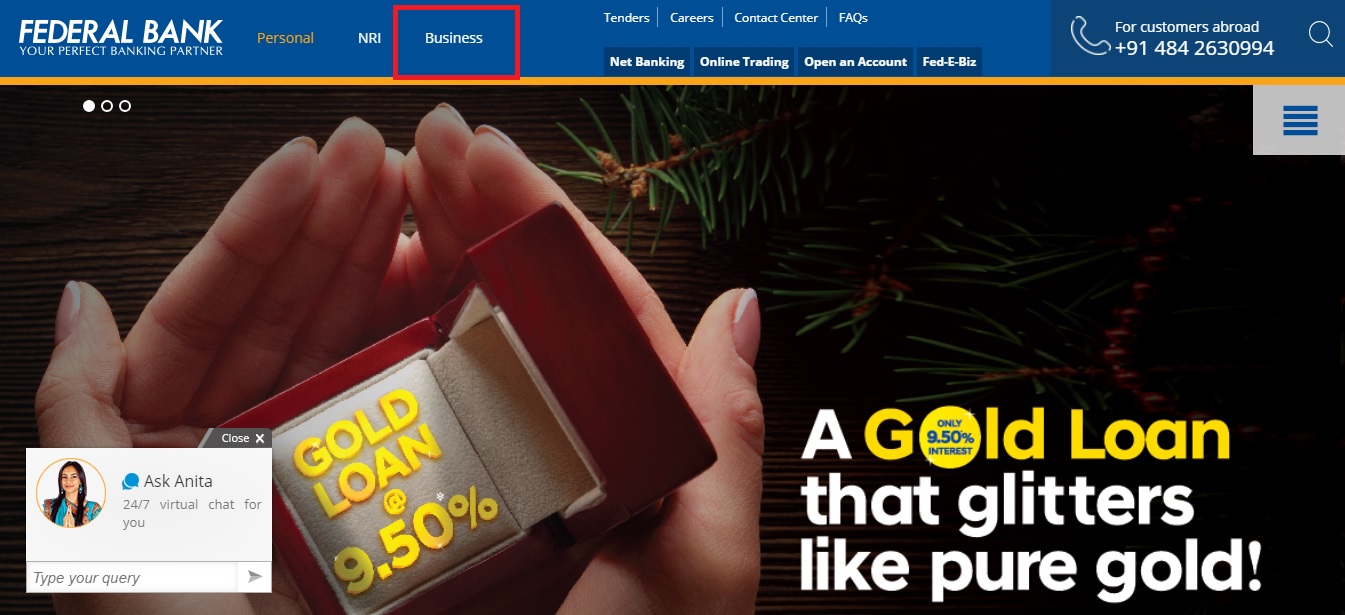

The following steps have to be followed in order to apply for any of the above mentioned current accounts in Federal bank. Step 1: Visit the official site of Federal Bank Step 2: Click on the Business option which can be found on the top part of the site. [caption id="" align="alignnone" width="1345"] Step 2- Federal Bank Current Account

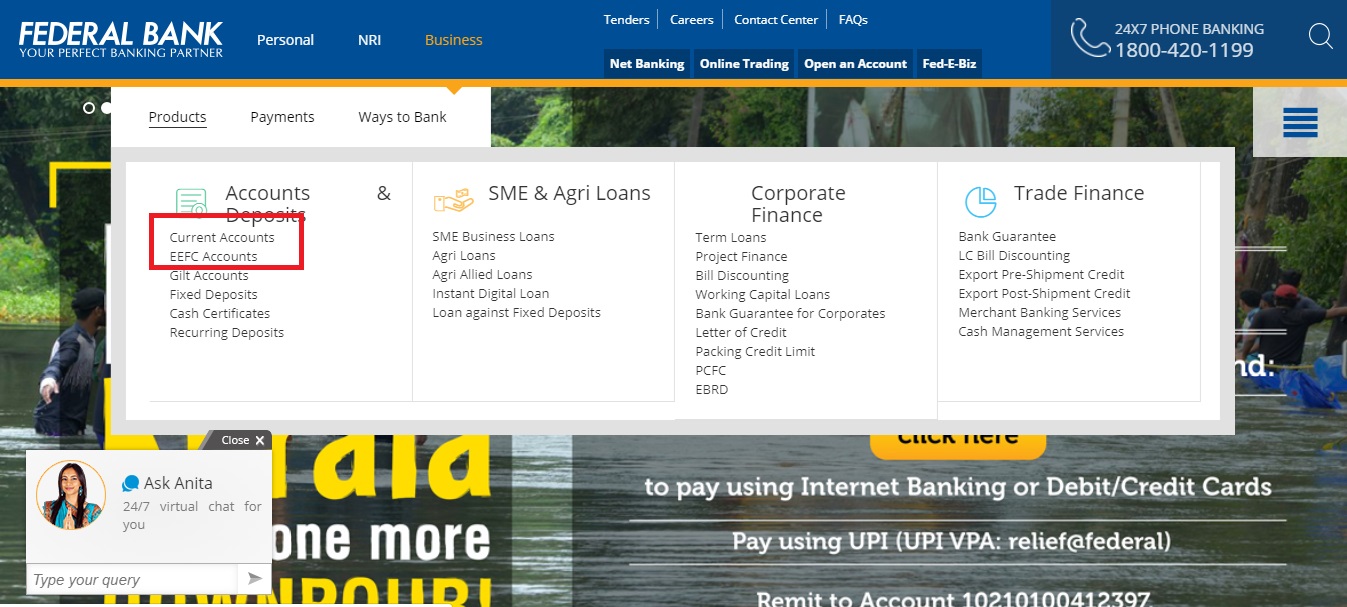

Step 3: Click on the Current Accounts option under the Accounts & Deposits section.

[caption id="" align="alignnone" width="1347"]

Step 2- Federal Bank Current Account

Step 3: Click on the Current Accounts option under the Accounts & Deposits section.

[caption id="" align="alignnone" width="1347"] Step 3- Federal Bank Current Account

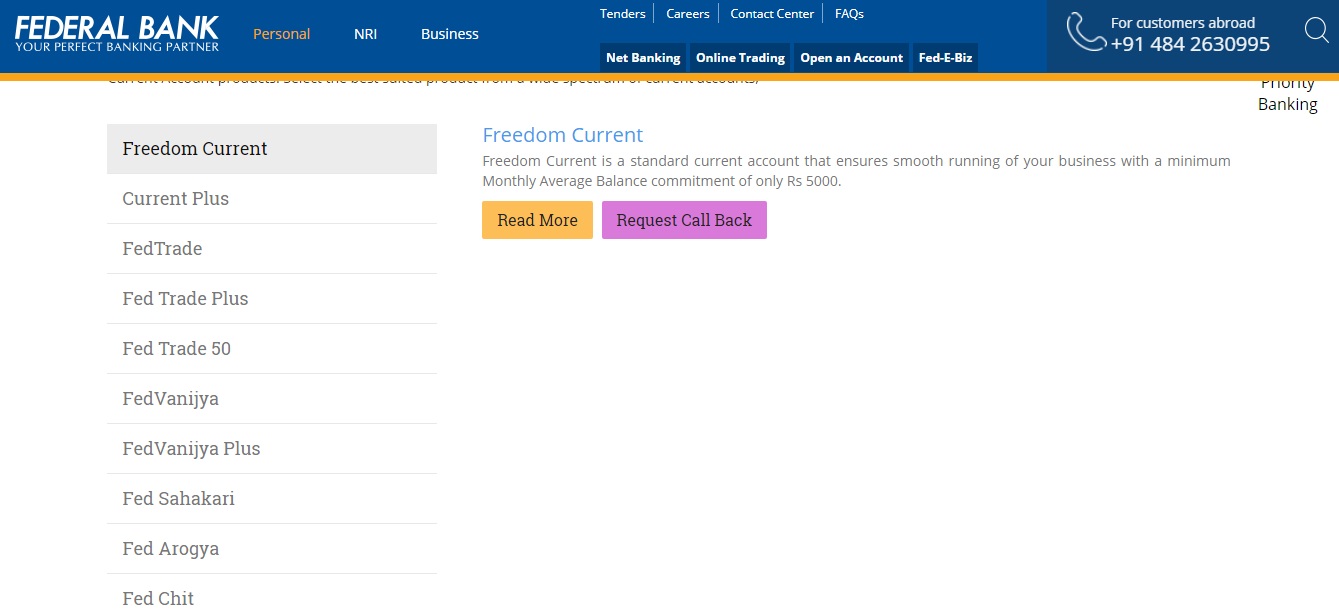

Step 4: Scrolling down, all the current accounts mentioned above can be seen on the side for the user to select.

[caption id="" align="alignnone" width="1339"]

Step 3- Federal Bank Current Account

Step 4: Scrolling down, all the current accounts mentioned above can be seen on the side for the user to select.

[caption id="" align="alignnone" width="1339"] Step 4- Federal Bank Current Account

Step 5: Select the account required, and the option to Request Call Back should be chosen.

[caption id="" align="alignnone" width="1337"]

Step 4- Federal Bank Current Account

Step 5: Select the account required, and the option to Request Call Back should be chosen.

[caption id="" align="alignnone" width="1337"] Step 5- Federal Bank Current Account

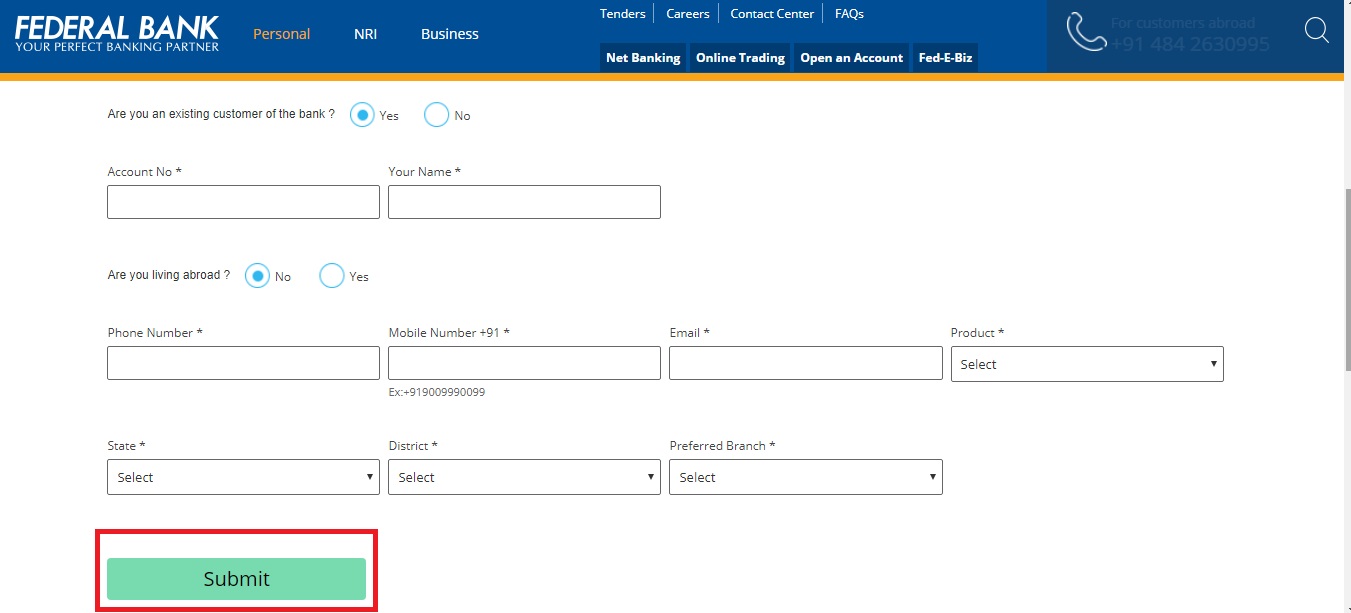

Step 6: Fill in the details such as Name, Number and other appropriate information and click Submit.

[caption id="" align="alignnone" width="1351"]

Step 5- Federal Bank Current Account

Step 6: Fill in the details such as Name, Number and other appropriate information and click Submit.

[caption id="" align="alignnone" width="1351"] Step 6- Federal Bank Current Account

Step 7: After the concerned department reviews the submitted details, a call will be initiated from Federal Bank at a time of your convenience.

Step 6- Federal Bank Current Account

Step 7: After the concerned department reviews the submitted details, a call will be initiated from Federal Bank at a time of your convenience.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...