Last updated: September 30th, 2021 2:25 PM

Last updated: September 30th, 2021 2:25 PM

Fetching of Bill of Entry details from ICEGATE Portal

Recently, the Goods and Services Tax Network (i.e., GSTN) has introduced a new feature namely ‘Fetching of Bill of Entry details from ICEGATE Portal’. This self-service functionality has been made available on the GST Portal to help importers of goods, and recipients of supplies from the Special economic zone (SEZ). Vide the feature, the registered taxable person can search Bill of Entry details in GST Portal, and fetch the missing records from ICEGATE. The present article briefly explains the steps to avail the functionality of Fetching of Bill of Entry details from ICEGATE Portal.Synopsis of Notification

The Goods and Services Tax Network (GSTN) has issued an Advisory dated September 17, 2021, for taxpayers regarding the introduction of a new feature ‘on-demand fetching of Bill of Entry details from the ICEGATE Portal’. This self-service functionality has been enabled on GST Portal to search Bill of Entry details which did not auto-populate in GSTR-2A.Benefits of the New Feature

To help importers of goods, and recipients of supplies from SEZ, a self-service functionality has been made available on the GST Portal that can be used to search Bill of Entry records (which did not auto-populate in GSTR-2A) in the GST System, and fetch the missing records from ICEGATE.Important Announcement for Taxpayer

GSTN also announced that it takes 2 days (after the reference date) for Bill of Entry details to get updated on GST Portal from ICEGATE. This functionality should, therefore, be used if data is not available after this period. Note: The reference date would be either Out of charge date, Duty payment date, or amendment date – whichever is later.Procedure for Fetching of Bill of Entry Details from ICEGATE Portal

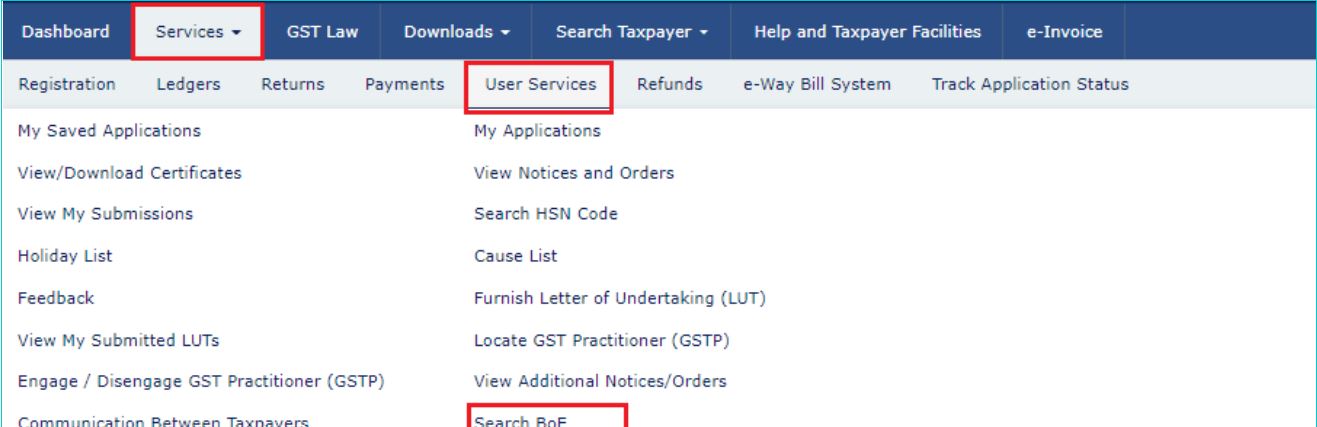

Taxpayers can follow the below-mentioned steps to fetch the requisite details from ICEGATE Portal: The first and foremost step is to log in to GST Portal after login into the portal Navigate to Services and then select user Services. By clicking on the Search BoE option, a small window will be displayed. Fetching of Bill of Entry details from ICEGATE Portal - GST Login

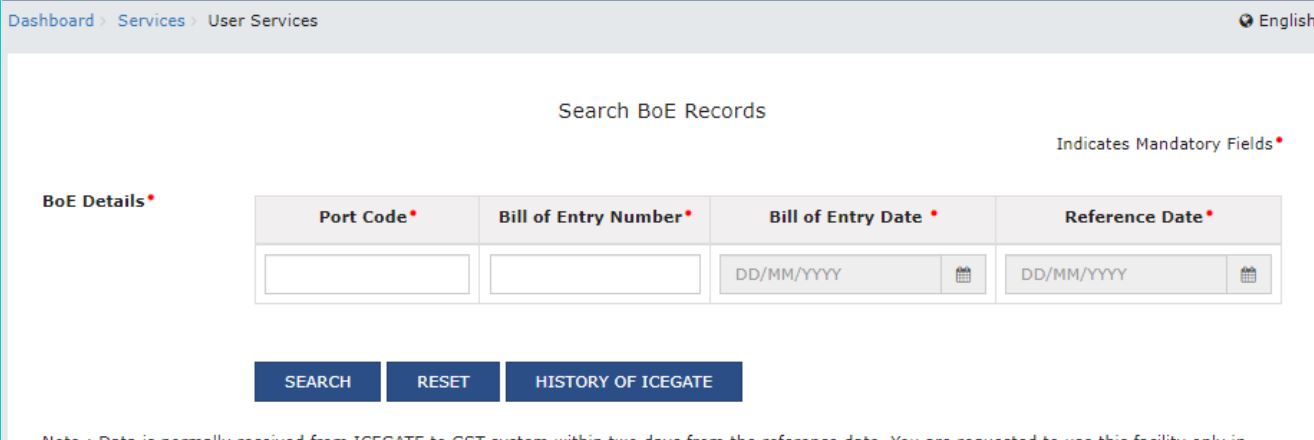

After Furnishing the following details click on the search button

Fetching of Bill of Entry details from ICEGATE Portal - GST Login

After Furnishing the following details click on the search button

- Port Code

- Bill of Entry Number

- Bill of Entry Date

- Reference Date

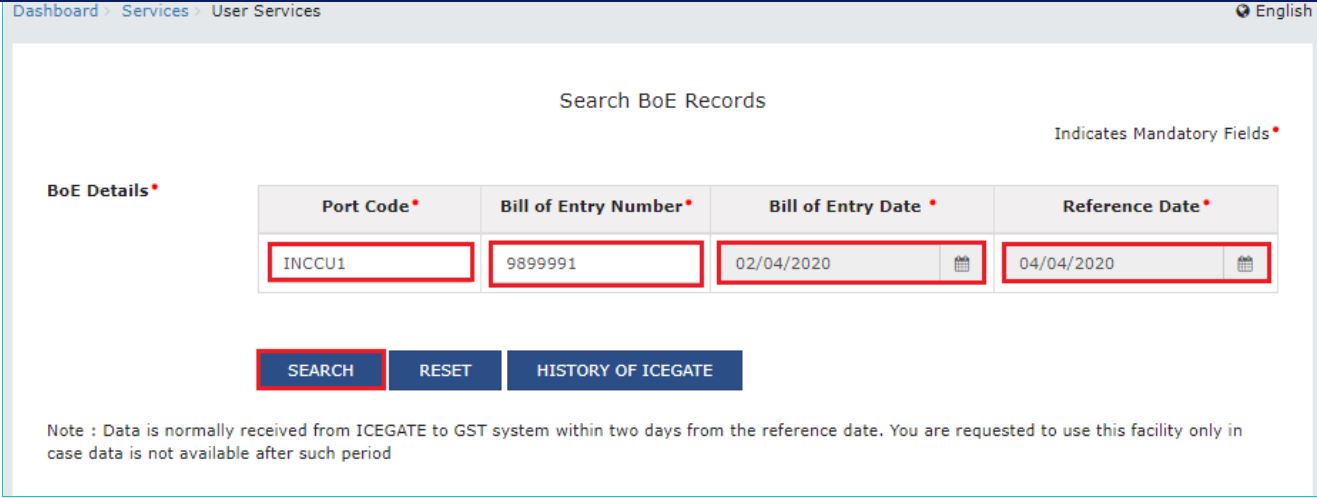

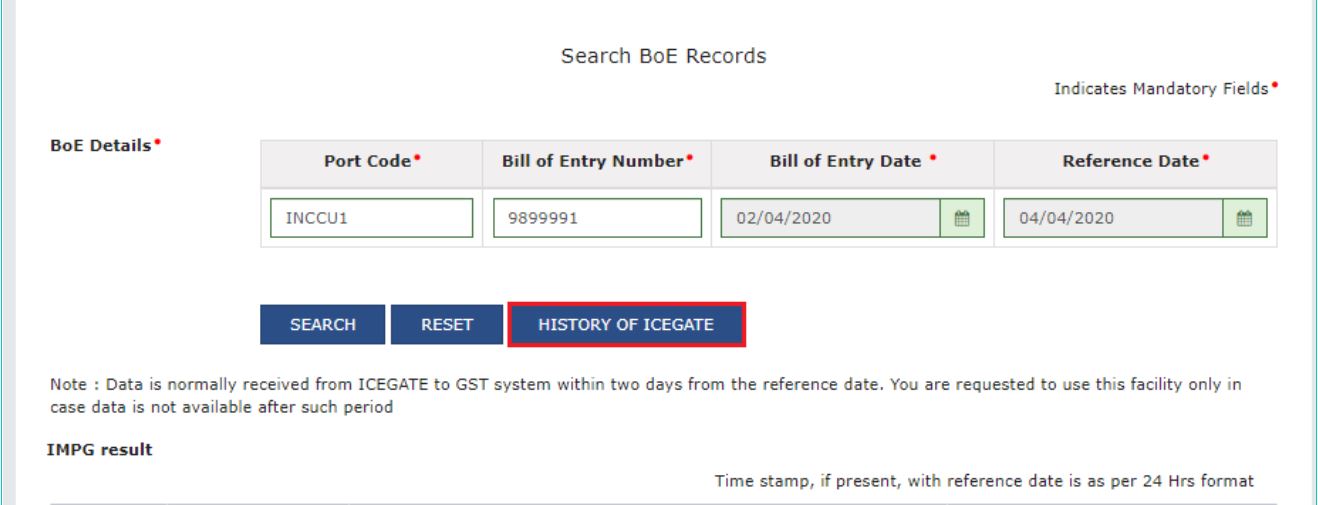

Fetching of Bill of Entry details from ICEGATE Portal - Search BOE

Note: The reference date would be either Out of charge date, Duty payment date, or amendment date – whichever is later.

Fetching of Bill of Entry details from ICEGATE Portal - Search BOE

Note: The reference date would be either Out of charge date, Duty payment date, or amendment date – whichever is later.

Fetching of Bill of Entry details from ICEGATE Portal - Search BOE2

If the BoE details do not appear in the search results, click on the QUERY ICEGATE button, at the bottom of the screen, to trigger a query to ICEGATE.

Fetching of Bill of Entry details from ICEGATE Portal - Search BOE2

If the BoE details do not appear in the search results, click on the QUERY ICEGATE button, at the bottom of the screen, to trigger a query to ICEGATE.

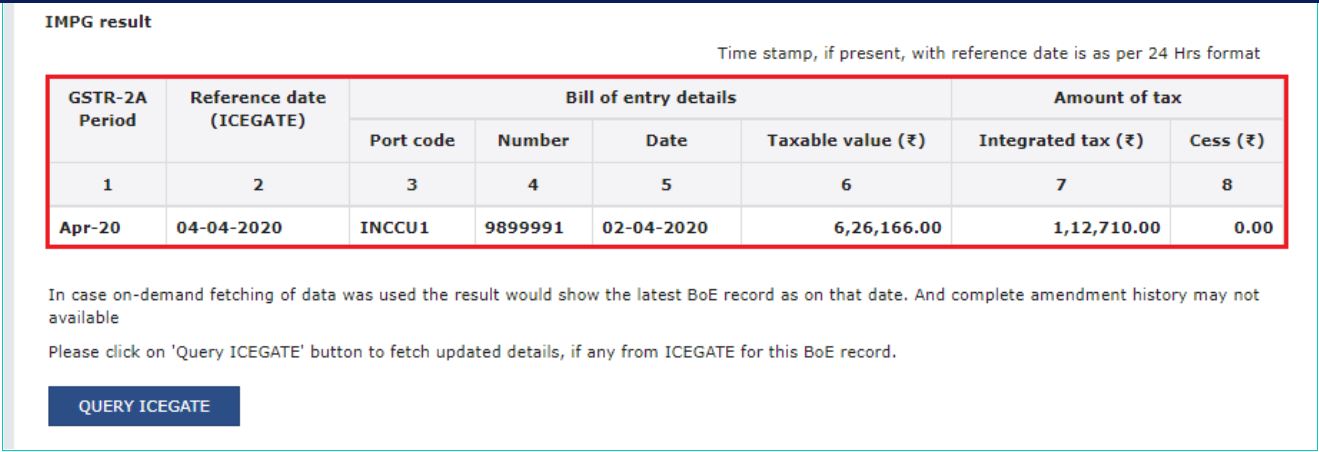

Fetching of Bill of Entry details from ICEGATE Portal - Search BOE3

History of fetched BoE details from ICEGATE along with the status of the query is displayed after 30 minutes from the time of triggering the query.

Fetching of Bill of Entry details from ICEGATE Portal - Search BOE3

History of fetched BoE details from ICEGATE along with the status of the query is displayed after 30 minutes from the time of triggering the query.

Fetching of Bill of Entry details from ICEGATE Portal - ICEGATE History

For records of type IMPG (Import of Goods), details of the following would be displayed:

Fetching of Bill of Entry details from ICEGATE Portal - ICEGATE History

For records of type IMPG (Import of Goods), details of the following would be displayed:

- Period for Form GSTR-2A (system generated Statement of Inward Supplies)

- Reference Date

- Bill of Entry Details - Port Code

- BoE Number

- BoE Date & Taxable Value

- Amount of Tax

- Period for Form GSTR-2A

- Reference Date

- GSTIN of Supplier

- Trade Name of Supplier

- Port Code

- BoE Number

- BoE Date & Taxable Value

- Amount of Tax

Other Announcements

GSTIN also announced that in case of any problem, taxpayers are advised to create a ticket at the GST Helpdesk or GST Self-service portal by including the following details:- Complete details of BE records

-

- GUSTIN

- BE Number

- BE Date

- Port Code

- Reference Date

- Screenshot of ICEGATE portal with BE record

- Any error that they may have encountered while using the “Search BoE” functionality on GST Portal

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...