Updated on: January 7th, 2020 12:18 PM

Updated on: January 7th, 2020 12:18 PM

How to File GSTR 2 Return Online

GSTR 2 return must be filed by all persons having GST registration before the 15th of each month. GSTR 2 return can be filed after a taxpayer filed GSTR 1 return on the 10th of each month. In GSTR 2 return, the taxpayer provides details of all purchases during the last month. Since, all taxpayers provide details of sales in GSTR 1 on the 1oth of each month, most of GSTR 2 return is auto populated. The taxpayer would only have to verify and provide the following information shown below. This article follows up on the GSTR 2 return filing article which provided details about providing details of purchases. Its recommended that you first read the below-mentioned article before reading this article on submitting information about amendments, nil rated input supplies and more.GSTR 2 Return Filing

How to Prepare GSTR 2 Return

You can easily prepare GSTR 2 return and file it online on the GST Portal using LEDGERS GST Software. You can also prepare the data offline using the following excel sheet and upload it to LEDGER for import of data.GSTR 2 Excel Format

Amendments to Inward Supplies

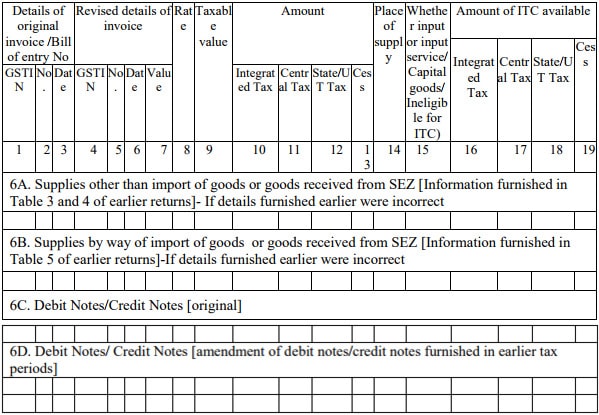

[caption id="attachment_33466" align="aligncenter" width="756"] GSTR 2 Amendments to Purchases

In this table, details of amendments to inward supplies furnished in returns for earlier tax periods must be provided if applicable. Hence, in case of changes to original invoice or Bill of entry, then the details of the old invoice or bill of entry must be provided along with the following details.

GSTR 2 Amendments to Purchases

In this table, details of amendments to inward supplies furnished in returns for earlier tax periods must be provided if applicable. Hence, in case of changes to original invoice or Bill of entry, then the details of the old invoice or bill of entry must be provided along with the following details.

- Revised invoice number

- Revised invoice date

- Revised invoice value

- GSTIN of supplier

- GST rate applicable

- Taxable value

- Amount of IGST applicable

- Amount of CGST applicable

- Amount of SGST applicable

- GST Cess

- Place of supply

- Amount of ITC claim

- IGST

- SGST

- CGST

- GST Cess

- 6A. Supplies other than import of goods or goods received from SEZ [Information furnished in Table 3 and 4 of earlier returns]- If details furnished earlier were incorrect.

- 6B. Supplies by way of import of goods or goods received from SEZ [Information furnished in Table 5 of earlier returns]-If details furnished earlier were incorrect.

- 6C. Debit Notes/Credit Notes [original].

- 6D. Debit Notes/ Credit Notes [amendment of debit notes/credit notes furnished in earlier tax periods].

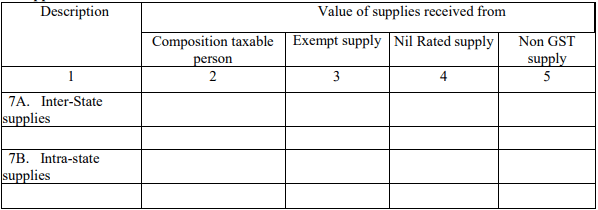

Supplies Received from Composition Taxable Person & NIL Rated Supplies

In the following table, the taxpayer must provide details of supplies received from composition taxable person and other exempt or NIL rated or Non-GST supplies received under the following two categories:- Interstate Supply

- Intrastate Supply

GSTR 2 NIL Rated Inward Supplies

GSTR 2 NIL Rated Inward Supplies

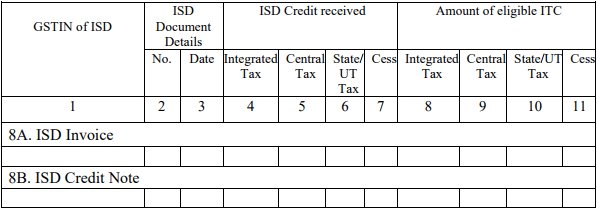

ISD Credit Received

In this table, the taxpayer must provide details of input tax credit received from an Input Service Distributor. Input service distributor can be setup by a taxpayer if the business has more than one branch and some or all of the input services are purchased at one office for operational purposes. In such a case, the input tax credit on account of service can be distributed among the branches. [caption id="attachment_33468" align="aligncenter" width="728"] GSTR 2 ISD Credit Received

In the above table, taxpayers having an Input Service Distributor registration must provide details of input service distributor invoice and credit note issued during the last month and the amount of input tax credit distributed. If a taxpayer does not have an input service distributor registration, then the table would not be applicable.

GSTR 2 ISD Credit Received

In the above table, taxpayers having an Input Service Distributor registration must provide details of input service distributor invoice and credit note issued during the last month and the amount of input tax credit distributed. If a taxpayer does not have an input service distributor registration, then the table would not be applicable.

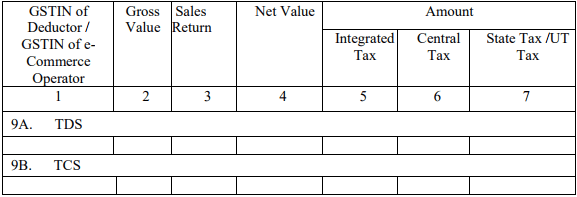

TDS and TCS Credit Received

In this table, the taxpayer must provide detail of TDS and TCS credit received along with the GSTIN of the TDS or TCS deductor. TDS deduction on GST is done by Governmental Agencies and Departments authorised to deduct TDS. TCS is done by e-commerce companies registered to deduct TCS. In case TDS or TCS was deducted during the last month, details of such deductions can be provided to claim credit in GSTR 2 return. [caption id="attachment_33469" align="aligncenter" width="812"] GSTR 2 TDS and TCS Credit Received

GSTR 2 TDS and TCS Credit Received

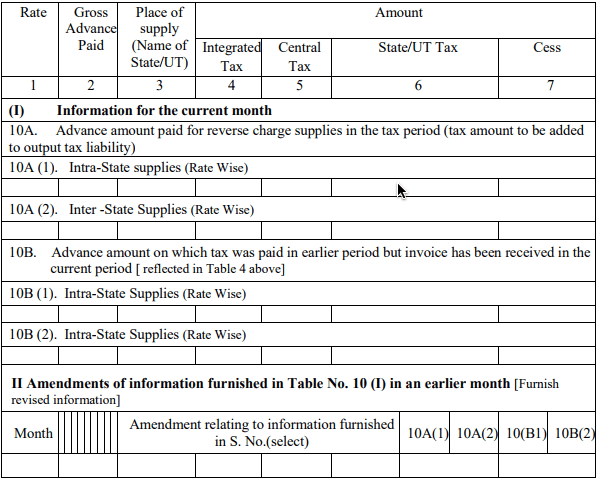

Consolidated Statement of Advances Paid

In this table the taxpayer must declare details of advances paid during the last month. Details of advances paid must be furnished along with the applicable GST rate, gross advance paid, place of supply, amount of IGST or CGST and SGST applicable. [caption id="attachment_33470" align="aligncenter" width="701"] GSTR 2 Statement of Advance Paid

In addition, the data must be provided under the following four categories:

GSTR 2 Statement of Advance Paid

In addition, the data must be provided under the following four categories:

- 10A. Advance amount paid for reverse charge supplies in the tax period (tax amount to be added to output tax liability)

- 10A (1). Intra-State supplies (Rate Wise)

- 10A (2). Inter -State Supplies (Rate Wise)

- 10B. Advance amount on which tax was paid in earlier period but invoice has been received in the current period [ reflected in Table 4 above]

- 10A (1). Intra-State supplies (Rate Wise)

- 10A (2). Inter -State Supplies (Rate Wise)

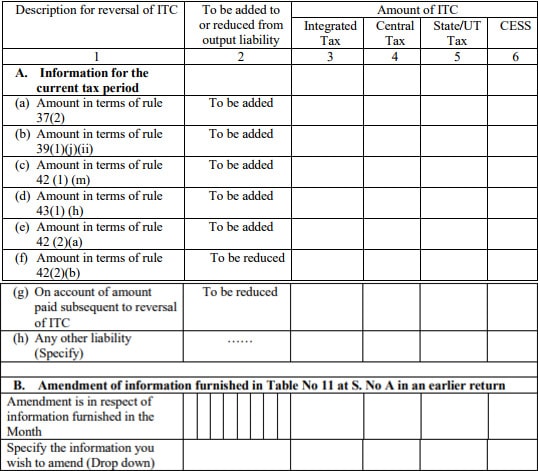

Input Tax Credit Reversal / Reclaim

The input tax credit on all purchases cannot be claimed by a taxpayer. For instance, some types of input tax credit could be ineligible and some types of input tax credit would have to calculated as per Rules 42 and 43 of CGST Rules. Any such deductions to the input tax credit calim must be declared in the below table. [caption id="attachment_33471" align="aligncenter" width="647"] GSTR 2 ITC Reversal

GSTR 2 ITC Reversal

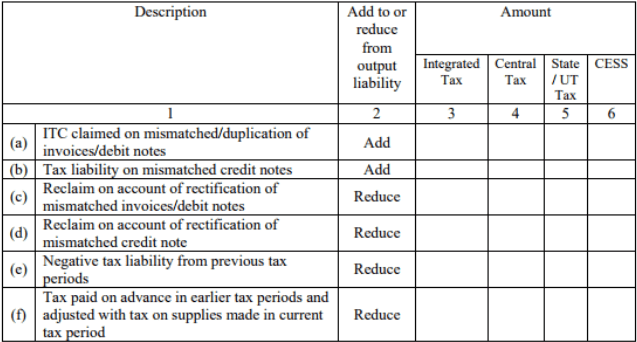

Addition and Reduction of Amount in Output Tax

In the following table, the taxpayer must provide details of addition and reduction of amount in output tax due to the following reasons:- ITC claimed on mismatched/duplication of invoices/debit notes

- Tax liability on mismatched credit notes

- Reclaim on account of rectification of mismatched invoices/debit notes

- Reclaim on account of rectification of mismatched credit note

- Negative tax liability from previous tax periods

- Tax paid on advance in earlier tax periods and adjusted with tax on supplies made in current tax period

GSTR 2 Addition and Reduction of Amount in Output Tax

GSTR 2 Addition and Reduction of Amount in Output Tax

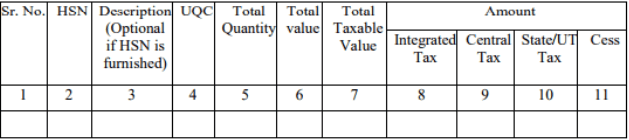

HSN Summary

Similar to the HSN summary in GSRT 1 return, the taxpayer must also provide a HSN summary of all purchases effected during the previous month in the following format. [caption id="attachment_33474" align="aligncenter" width="629"] GSTR 2 HSN Summary

GSTR 2 HSN Summary

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...